We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Stumped by council tax question (migrating to universal credit from ESA)

cfsarah

Posts: 2 Newbie

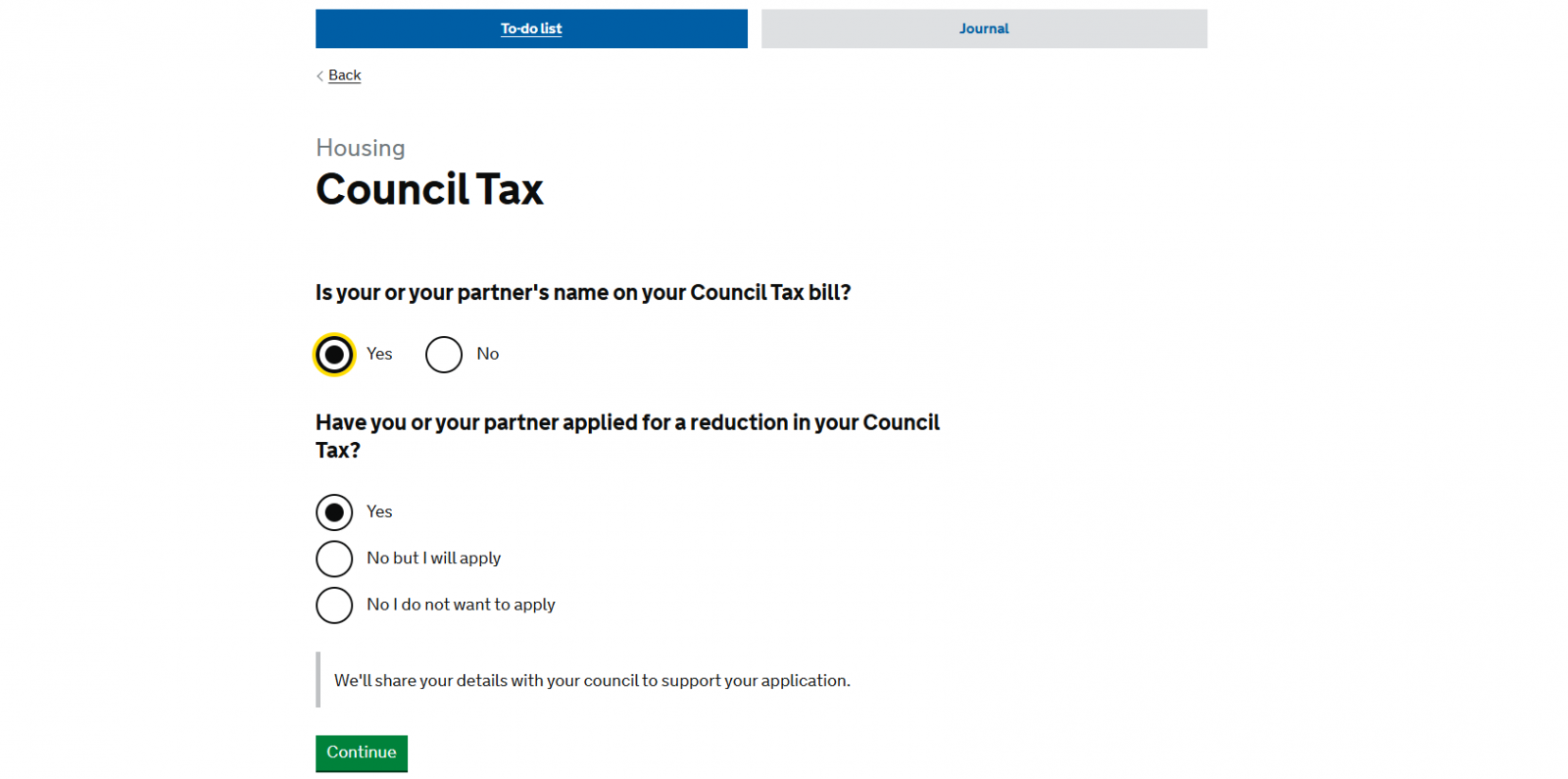

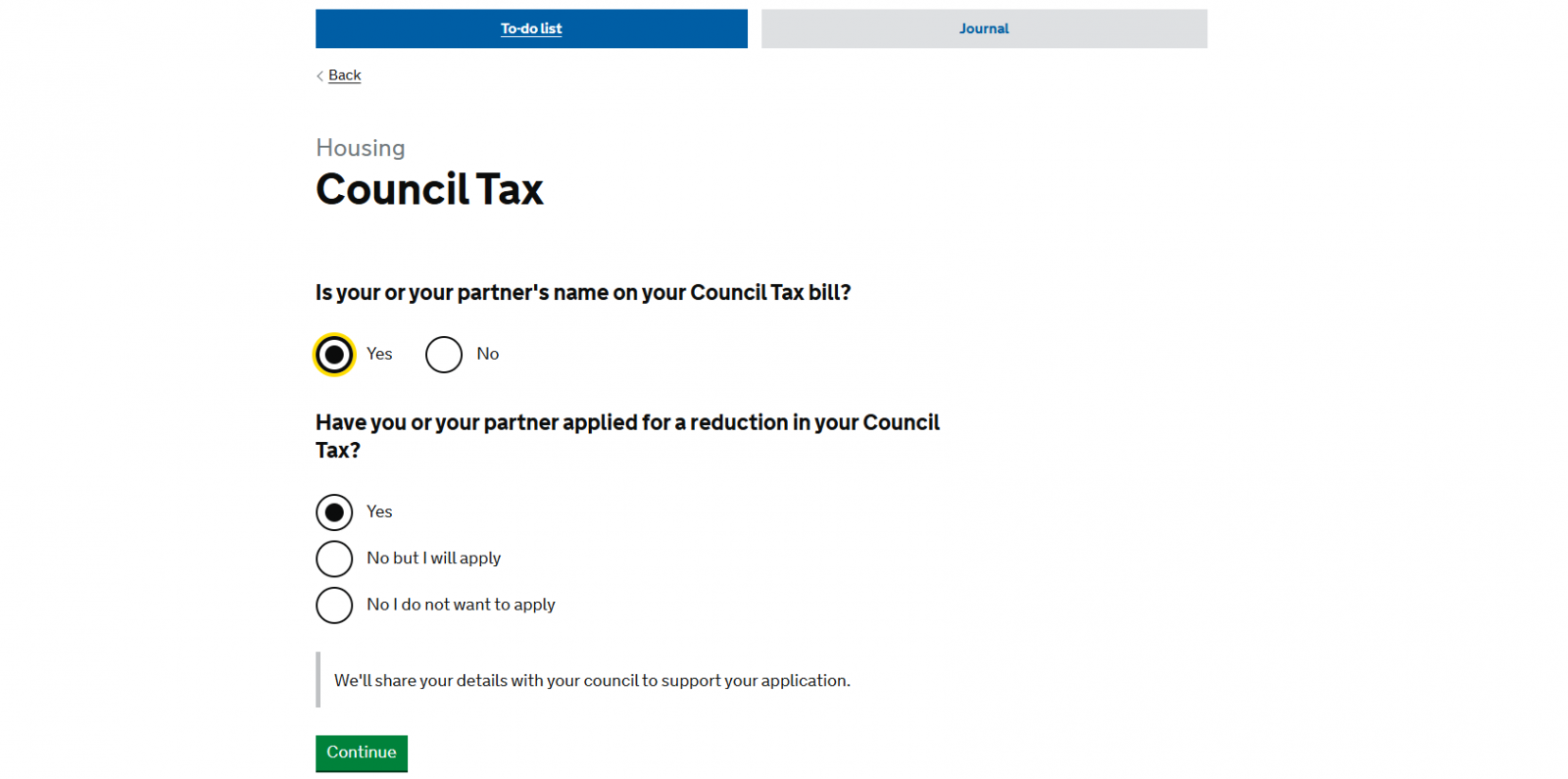

My name is on the bill but being on ESA (support group if that matters) and housing benefit the bill amounts to zero, I'm not sure how to answer because I never applied for the reduction, it's just automatic. Do I have to apply for this separately now? Or do I say I already applied because it was already reduced? Thank you

0

Comments

-

You answer yes because it's something you already get.3

-

cfsarah said:My name is on the bill but being on ESA (support group if that matters) and housing benefit the bill amounts to zero, I'm not sure how to answer because I never applied for the reduction, it's just automatic. Do I have to apply for this separately now? Or do I say I already applied because it was already reduced? Thank youA bit more information about what happens with Council Tax and Council Tax Relief when you migrate to UC.Council Tax stays seperate to UC, and so Council Tax Relief also stays seperate. (It isn't something that could migrate because it isn't something you get paid, it's a reduction in what you have to pay to the council).How your Council Tax Relief is awarded becomes different once you migrate to UC.CTR is no longer automatically 'passported' to 100% by your having IR ESA; instead the council have to do a calculation like they do for everyone else. (That's basically because working people can claim UC so they do the same calculation for everybody).You should note that some people have found that once they migrate to UC from ESA then they do become liable to pay some Council Tax, however usually it isn't much, just a few quid.

Most though will still qualify for 100% CTR.It all depends on your particular council, what their particular CTR rules are, and what their CTR calculation is like - some councils are stingier/greedier than others.It says on your screenshot above that UC will "share your details with your council".If you want to play it safe though then once you have made your UC claim you could also inform your Council Tax department yourself that you are now claiming UC. Your choice.PS. I was actually looking just the other day at what happened with my Council Tax when I migrated from ESA and HB to UC back in 2021. The council were informed by UC that I was now claiming UC and they automatically picked up and recalculated my CTR, then sent me a letter about it and if I now needed to pay anything. (In my case I still get 100% CTR and nothing to pay).

3 -

Thanks so much for your detailed answer! The migration letter didn't mention council tax whatsoever so this threw me for a loop, it would be nice if they explained this to everyone ehNewcad said:cfsarah said:My name is on the bill but being on ESA (support group if that matters) and housing benefit the bill amounts to zero, I'm not sure how to answer because I never applied for the reduction, it's just automatic. Do I have to apply for this separately now? Or do I say I already applied because it was already reduced? Thank youA bit more information about what happens with Council Tax and Council Tax Relief when you migrate to UC.Council Tax stays seperate to UC, and so Council Tax Relief also stays seperate. (It isn't something that could migrate because it isn't something you get paid, it's a reduction in what you have to pay to the council).How your Council Tax Relief is awarded becomes different once you migrate to UC.CTR is no longer automatically 'passported' to 100% by your having IR ESA; instead the council have to do a calculation like they do for everyone else. (That's basically because working people can claim UC so they do the same calculation for everybody).You should note that some people have found that once they migrate to UC from ESA then they do become liable to pay some Council Tax, however usually it isn't much, just a few quid.

Most though will still qualify for 100% CTR.It all depends on your particular council, what their particular CTR rules are, and what their CTR calculation is like - some councils are stingier/greedier than others.It says on your screenshot above that UC will "share your details with your council".If you want to play it safe though then once you have made your UC claim you could also inform your Council Tax department yourself that you are now claiming UC. Your choice.PS. I was actually looking just the other day at what happened with my Council Tax when I migrated from ESA and HB to UC back in 2021. The council were informed by UC that I was now claiming UC and they automatically picked up and recalculated my CTR, then sent me a letter about it and if I now needed to pay anything. (In my case I still get 100% CTR and nothing to pay). 0

0 -

A bit different to my friend's council. Once they claimed UC the council then sent bill for rest of CT year. They had to send off their 1st UC statement to to a adjusted bill.Newcad said:PS. I was actually looking just the other day at what happened with my Council Tax when I migrated from ESA and HB to UC back in 2021. The council were informed by UC that I was now claiming UC and they automatically picked up and recalculated my CTR, then sent me a letter about it and if I now needed to pay anything. (In my case I still get 100% CTR and nothing to pay).

Let's Be Careful Out There0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards