We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

General Investment Account record keeping

Comments

-

dllive said:Can I ask - what would the Income equivalents of Invesco FTSE All-World (Acc) and SPDR S&P 500 UCITS ETF (Acc) be?

For example, Ive searched on T212 for "Invesco FTSE All-World" and theres quite a few! Presumably I should get FTWG because its on the London Stock Exchange? What about SPDR S&P 500 UCITS ETF?They are ETFs not funds/OEICs so my descriptions above aren't applicable as stated. With ETFs you can throw ERI (Excess Reportable Income) into the mix but remove equalisationFor Distributing shares you need to report dividends and ERI as income. Just to add to the fun factor ERI will probably not be on you annual CTC and you'll have to dig it out on the fund house's web site and as a Brucie bonus the reporting period is different to dividends. Quite do-able but additional hassleAcc shares are (conversely) a bit simpler as everything is ERI, no dividends as such, but you'll still need to tease out the real gain for CGTPersonally I have always steered clear of unwrapped ETFs, life is too shortOn a positive note one thing you might look at is finding an OEIC version of the ETF from another vendor for the same index so performance should be pretty much the same barring OCF (though perhaps not your platform charges)1 -

Hmm, T212 only offers ETFs.

So - for minimal hassle - I should choose perhaps Vanguard's LifeStrategy 100% Equity Fund - Income class? If so, Ill forget about T212 and just use Vanguards platform.0 -

So - for minimal hassle - I should choose perhaps Vanguard's LifeStrategy 100% Equity Fund - Income class? If so, Ill forget about T212 and just use Vanguards platform.VLS100 would mean moving from a market cap fund to a managed weightings fund (home bias in particular) and its higher cost than a global tracker. Obviously, there are many different global trackers that follow different benchmarks. So, you could argue each different benchmark is effectively a managed decision but you need to decide how you want to invest first. Then look at solutions.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

OP has Acc and IncGeoffTF said:

Equalisation does not apply to accumulation units.ColdIron said:One position I wouldn't like to be in is having to deal with both equalisation and retained dividends dllive said:I read that - for reporting tax etc - its far easier to invest in income classes of funds. Which is what Ive done. However, recently I invested in their accumulation versions by mistake.1

dllive said:I read that - for reporting tax etc - its far easier to invest in income classes of funds. Which is what Ive done. However, recently I invested in their accumulation versions by mistake.1 -

Sorry to hijack this but I will be in similar position possibly soon and I have no idea what to report. What do you mean switch funds to reset CGT ?dllive said:

Thats a good idea about resetting CGT!kempiejon said:If you never sell you are potentially accumulating a tax event in the future. In my GIA I switch between funds every few years to reset capital gains. The capital gains allowance should be used, £3k per year profit compared to dividend income tax allowance of just £500. I heard about buying the income fund to make record keeping easier but subsequently learnt that some income versions have excess reportable income too.

Yes, Ive read about excess reportable income, although I believe thats not the case with funds traded in sterling. (again, I may be completely wrong!)0 -

Because there's an annual 'use it or lose it' CGT allowance of £3K, those with significant unwrapped holdings can utilise this by selling enough to realise £3K of gains and then purchasing something else with the proceeds, to avoid more substantial taxable gains from building up over time.flopsy1973 said:

Sorry to hijack this but I will be in similar position possibly soon and I have no idea what to report. What do you mean switch funds to reset CGT ?dllive said:

Thats a good idea about resetting CGT!kempiejon said:If you never sell you are potentially accumulating a tax event in the future. In my GIA I switch between funds every few years to reset capital gains. The capital gains allowance should be used, £3k per year profit compared to dividend income tax allowance of just £500. I heard about buying the income fund to make record keeping easier but subsequently learnt that some income versions have excess reportable income too.

Yes, Ive read about excess reportable income, although I believe thats not the case with funds traded in sterling. (again, I may be completely wrong!)2 -

iWeb might be worth considering to break out of the Vanguard stable, but if you were previously looking at a FTSE All World ETF, you could consider Vanguards Global All Cap Index fund, which is closer than VLS100 and which many would consider preferable to FTSE All World.dllive said:Hmm, T212 only offers ETFs.

So - for minimal hassle - I should choose perhaps Vanguard's LifeStrategy 100% Equity Fund - Income class? If so, Ill forget about T212 and just use Vanguards platform.1 -

GeoffTF said:

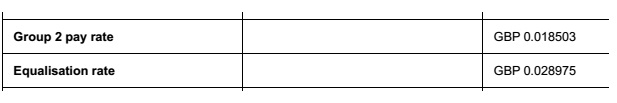

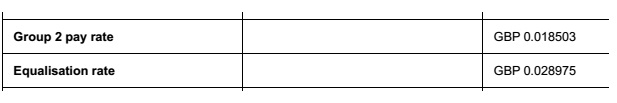

Equalisation does not apply to accumulation units.ColdIron said:One position I wouldn't like to be in is having to deal with both equalisation and retained dividends I have a small holding of Fidelity Index World Acc on AJ Bell. There is equalisation

I have a small holding of Fidelity Index World Acc on AJ Bell. There is equalisation Came to a few pounds on last year's statement.0

Came to a few pounds on last year's statement.0 -

I have purchased many acc funds where there is equalisation and have had to factor both accrued income and equalisation into my CGT calculations. Or maybe I have been doing it wrong!LHW99 said:GeoffTF said:

Equalisation does not apply to accumulation units.ColdIron said:One position I wouldn't like to be in is having to deal with both equalisation and retained dividends I have a small holding of Fidelity Index World Acc on AJ Bell. There is equalisation

I have a small holding of Fidelity Index World Acc on AJ Bell. There is equalisation Came to a few pounds on last year's statement.0

Came to a few pounds on last year's statement.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards