We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Telegraph annuity figures. Unbelievable?

Comments

-

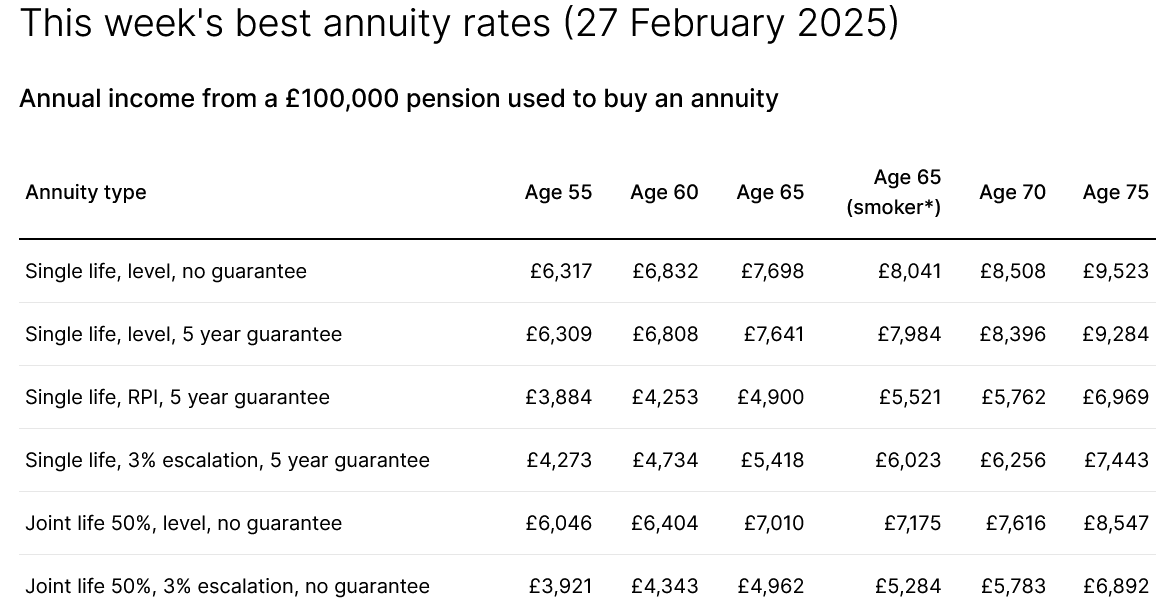

There was a time when I admired a lot of the writing in the Telegraph, but this is a seriously misleading comparison between annuities and DC invested drawdown. The annuity payout rate is NOT a yield and includes return of capital as well as a mortality credit. Most people will probably be better off with DC drawdown. Where annuities win out is that they eliminate the risk of DC drawdown, but financially for funding retirement they will almost always be worse than DC drawdown in purely financial terms.QrizB said:This article?At today’s top rates, £100,000 buys a 75-year-old £9,500 a year of income, according to broker Hub Financial.

That’s a 9.5pc yield – pretty punchy when you consider the FTSE 100 is currently yielding 3.5pc. It also beats the total return (dividend and capital gains) of London’s blue-chip index over the past 20 years (6.3pc).

Now let’s say you want the annuity to pay out 50pc to your wife or husband and to increase with inflation every year. Even with these conditions, your £100,000 will provide £7,750 annually (increasing every year).

And so we beat on, boats against the current, borne back ceaselessly into the past.4 -

Taking up smoking isn't financial fraud as such, however the about provider will follow up with questions about how long you have smoked for, how many you smoke a day etc, and giving false answers to those would be fraud.Albermarle said:

I have asked a similar question before, and the answer was that is would be financial fraud and you could end up with a criminal record.E_zroda said:

Is there a link to this, or do you need an account to get that quote?QrizB said:This article?At today’s top rates, £100,000 buys a 75-year-old £9,500 a year of income, according to broker Hub Financial.

That’s a 9.5pc yield – pretty punchy when you consider the FTSE 100 is currently yielding 3.5pc. It also beats the total return (dividend and capital gains) of London’s blue-chip index over the past 20 years (6.3pc).

Now let’s say you want the annuity to pay out 50pc to your wife or husband and to increase with inflation every year. Even with these conditions, your £100,000 will provide £7,750 annually (increasing every year).

Hargreaves Lansdown is quoting this as their best buys: That matches his £9500 level single-life but the RPI joint-life will be nowhere close.Maybe you need to ask Hub Financial?

That matches his £9500 level single-life but the RPI joint-life will be nowhere close.Maybe you need to ask Hub Financial?

Do I read correctly that smokers can get more money? If so - what prevent people taking up smoking prior to buying an annuity?

So you can't just have a quick puff on a cigarette before you fill in the application form and (legally) get the same enhancement as someone who has smoked 40 a day since their teenage years.1 -

Oh yes thank you. . I’ve missed an obvious fact. I’m younger at 65 years old. It willHappyHarry said:Was the client in the article a different age to you?

obviously be different. Thank you forum.1 -

Yes, mine is well under control. Didn’t seem to move the needle on the quoteAlbermarle said:

I think half the population over 50 probably has a slight BP thing.pterri said:Can’t remember where but I think HL have a calculator where you can plug in any health issues. I’ve got a slight BP thing, although I’ll not look at an annuity for some years if at all.

In any case it is normally very easy to reduce with drugs.2 -

FWIW, Hub Financial says "HUB Financial Solutions is a subsidiary of Just Group plc". Just is an annuity provider that sometimes/often comes out top when asking for quotes.

1 -

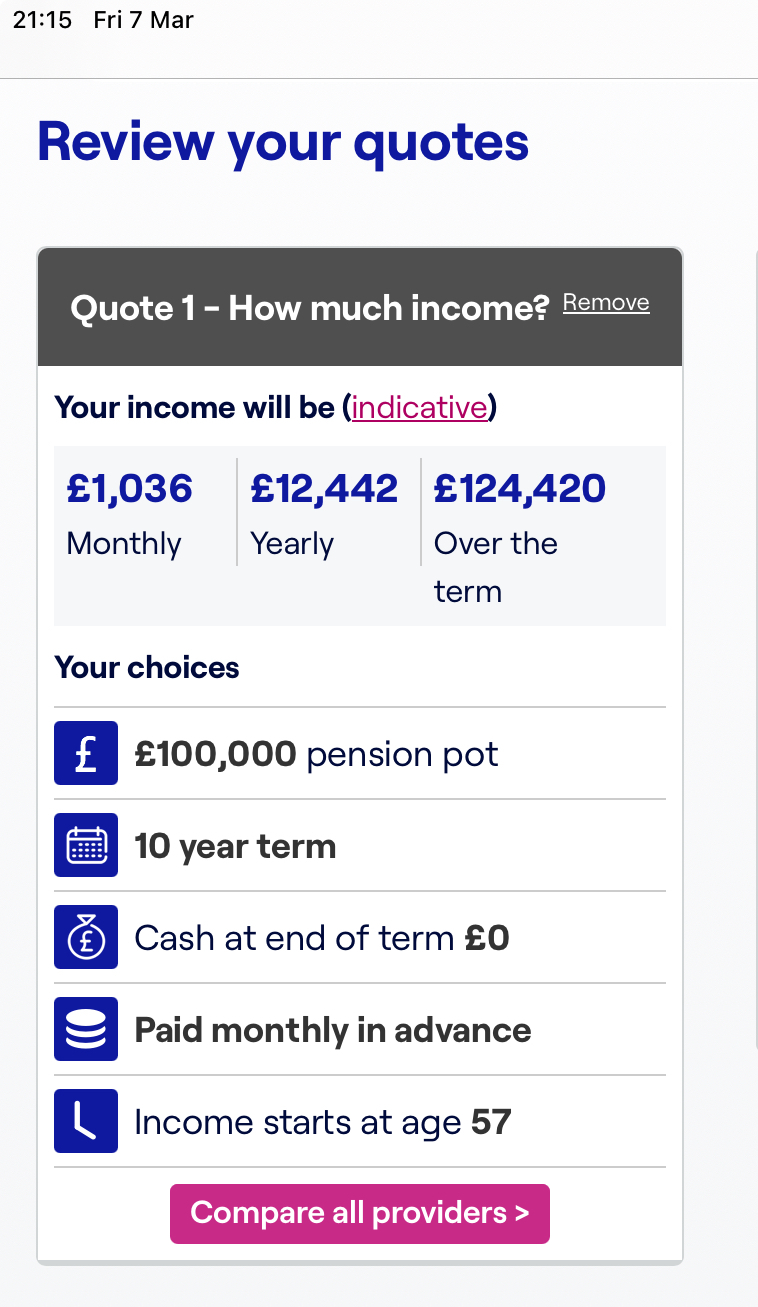

I was looking at fixed term annuities to cover the gap between retirement and SP and was quite surprised. According to MoneyHelper £100k would buy £12.5k for a 10yr term. So spending £300k of my current £600k plus my DB pension would get me to SP age with an income of about £50k and still £300k left in the pot for growth. Seems quite an attractive option but the other part of my brain says that if they are willing to offer this then there must be some reasonable confidence of growth over the next 10 yrs so sticking with investments might be better?

I'm currently Confused.com as to what to do for the best

I'm currently Confused.com as to what to do for the best

0

0 -

I think they are pricing in inflation rather than asset price real growthGenX0212 said:I was looking at fixed term annuities to cover the gap between retirement and SP and was quite surprised. According to MoneyHelper £100k would buy £12.5k for a 10yr term. So spending £300k of my current £600k plus my DB pension would get me to SP age with an income of about £50k and still £300k left in the pot for growth. Seems quite an attractive option but the other part of my brain says that if they are willing to offer this then there must be some reasonable confidence of growth over the next 10 yrs so sticking with investments might be better? I'm currently Confused.com as to what to do for the best

I'm currently Confused.com as to what to do for the best

I think....0

I think....0 -

Annuities are pooled risk based on acturial life expectancy tables. Everbody is ultimately a winner as it's a guranteed income for life. No restless nghts wondering when the next mad person is going to grab control of the steering wheel and throw global trade into turmoil.GenX0212 said:Seems quite an attractive option but the other part of my brain says that if they are willing to offer this then there must be some reasonable confidence of growth over the next 10 yrs so sticking with investments might be better?1 -

It might sometimes be easy to get medicated for it, but it depends what is actually causing it, that's the difficult part to get formally documented, especially for women coping with all manner of other gender related upsets each possibly being simultaneously medicated. The interactions between multiple drugs can then create an almost unravelable potentially life-shortening connundrum, one that has to be managed extremely carefully in the undoing.Albermarle said:

I think half the population over 50 probably has a slight BP thing.pterri said:Can’t remember where but I think HL have a calculator where you can plug in any health issues. I’ve got a slight BP thing, although I’ll not look at an annuity for some years if at all.

In any case it is normally very easy to reduce with drugs.

Atrial Fibrillation is perhaps one of the now very common conditions that can get you (men and women) an enhanced annuity quote. I read somewhere that AF is now one of the top ten overall most expensive illnesses the NHS finds itself treating, and growing all the time with an almost exponential growth in public awareness from the use of smartwatches and other wearable fitness monitors. These things are in many cases now sufficiently accurate to warn of irregularities that once upon a time could only be diagnosed via medially supervised multi-lead ECG examinations that happened to coincide with an episode of AF.

Many of us otherwise don't have noticeable symptoms. If you have a form of AF, and are not already on a control medication of some sort, particularly a preventative blood thinner (often for the remainder of your life), there is otherwise a definite enhanced risk of a sudden stroke.

So rather than reaching for the fags, if this post has you worried, I'd recommend learning how to feel variations in your own pulse i.e. easy to feel strong regular steady versus sometimes not so easy to find weak, "lumpy" and if it doesn't feel right go get an ECG done at your GP in the first instance, and ask for a further ECG next time your pulse is irregular if you think Sod's Law meant that the AF had gone away again before they did an ECG that found nothing. There's a word for that kind of now you see it, then you don't AF - it's paroxysmal AF and ultimately it accounts for a lot of AF diagnoses.

The rogue blood clot / stoke risk in this is caused because an incorrect heartbeat can mean the heart is no longer a consistently efficient pump (="heart failure") and that in turn can mean some blood ends up in "too quiet / undisturbed" areas inside the heart. If blood collects in this way, it may then too easily form stationary clots, and if they then move, it can cause a world of grief.

For the sake of just having sticky electrode patches stuck to your chest and ankles and those pop-fixed to wires for 5 minutes while you relax on the table, do get checked out, and then get your annuity quote armed with your very own doctor's doomsday prediction without the need to start smoking!

Incidentally, I understood there were only about six providers that offer enhanced annuities? Aviva, Scottish Widows, Standard Life, L&G, Just Retirement and Canada Life.

Obviously a normal average life expectancy annuity offered to a 75 year old is going to offer a significantly increased "yield" for want of a better word than that offered to an average life expectancy annuity offered to a 66 year old. The 75 year old on average might only have ten more years to live dependent on postcode

And that last quip might offer a further clue to getting the best quote - would it be fraud to deliberately move to Glasgow before getting the quote? 1

1 -

I would only ever buy a lifetime annuity because it gives longevity insurance. If you have a fixed term gap of 10 years to fill I'd just put the 300k into a ladder of saving accounts and short term gilts.GenX0212 said:I was looking at fixed term annuities to cover the gap between retirement and SP and was quite surprised. According to MoneyHelper £100k would buy £12.5k for a 10yr term. So spending £300k of my current £600k plus my DB pension would get me to SP age with an income of about £50k and still £300k left in the pot for growth. Seems quite an attractive option but the other part of my brain says that if they are willing to offer this then there must be some reasonable confidence of growth over the next 10 yrs so sticking with investments might be better? I'm currently Confused.com as to what to do for the best

I'm currently Confused.com as to what to do for the best

And so we beat on, boats against the current, borne back ceaselessly into the past.0

And so we beat on, boats against the current, borne back ceaselessly into the past.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards