We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

A bit confused about my national insurance.

Comments

-

Does your forecast say that you need that year?gillyzulu said:For the year 2023/24 my weekly wages fell between the lower earnings threshold 123 pounds and the the primary threshold 242, with 2 exceptions one week below and 1 week above. I have not received NI credits, but told to pay just over 800 pounds to have the year added for my state pension. Is this right?I’m a Senior Forum Ambassador and I support the Forum Team on the Pensions, Annuities & Retirement Planning, Loans

& Credit Cards boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com.

All views are my own and not the official line of MoneySavingExpert.0 -

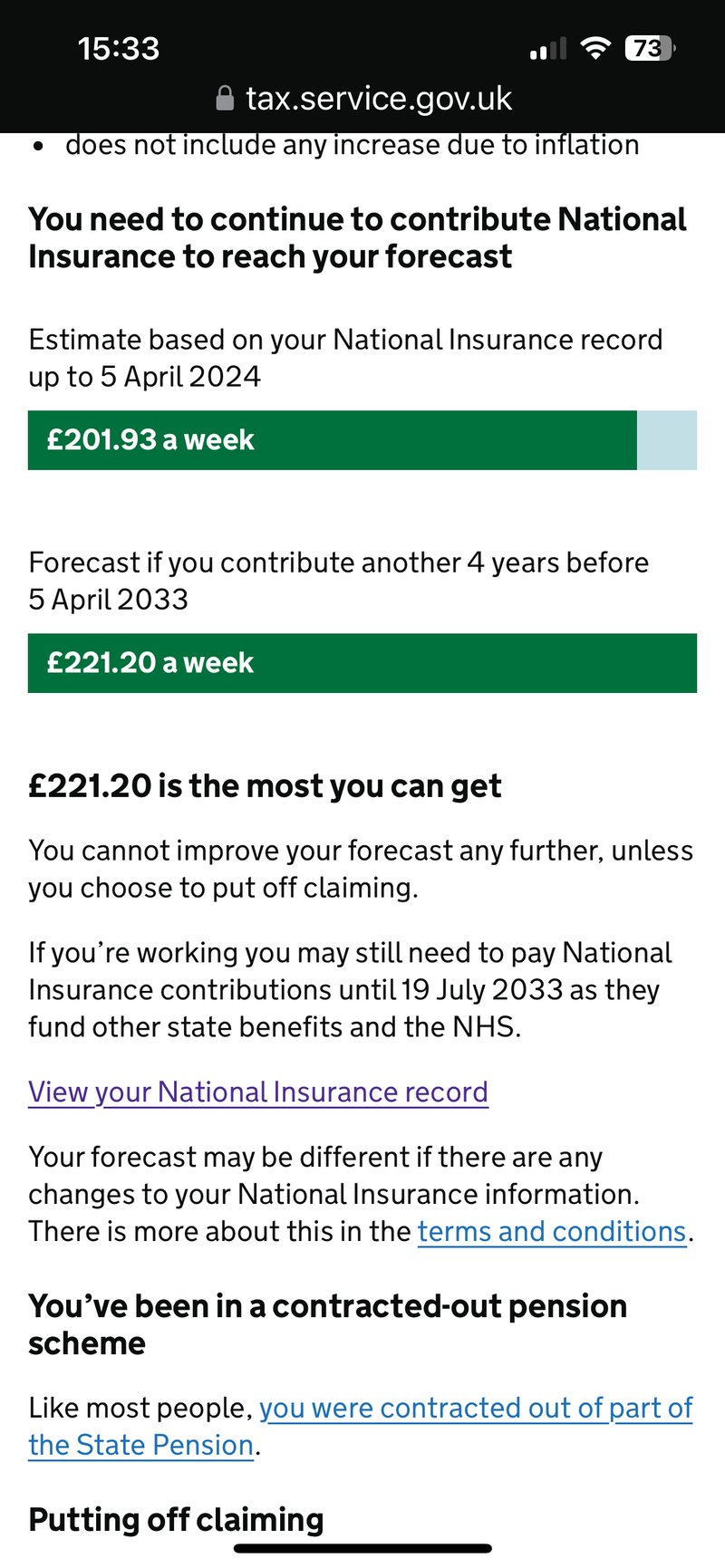

ctrainor said:I thought you had to have only 35 years contributions to get the full pension. Am I wrong?Yes you're wrong.

You're going to need more years.ctrainor said:Obviously no NI since I left work Dec 22 which shows on my NI records.

Thoughts would be appreciated

It should say how many more years you need in the bit below the green box - the bit Sarahspangles is asking for.Something like this, but with different numbers: N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.1 -

That year should be costing considerably less or maybe even full. You would need to speak to HMRC as with earnings above £123 you should have some weeks although those will not be visible as a credit of any sort but will just reduce what you need to pay for the year.gillyzulu said:For the year 2023/24 my weekly wages fell between the lower earnings threshold 123 pounds and the the primary threshold 242, with 2 exceptions one week below and 1 week above. I have not received NI credits, but told to pay just over 800 pounds to have the year added for my state pension. Is this right?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards