We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Mis-sold bond?

Comments

-

Doesn't make it mis sold. They have multiple options available to lots of people for different reasonsdhuggybear said:

Money took out of an ISA and then put in a bond which would be subject to tax. Can't think of any reason why this would have been offered as an option and had a quick look and Isa rates were 5+% in 2023 makes no sensedunstonh said:You explained the scenario but nothing about why you think it was missold. So, why do you think it was missold?

What is on the market will suit some and not others. This sounds like an error on your dad's part rather than the bank. As difficult as that may be to accept for them. They would also have received statements with the product written on them over the last two years1 -

Well if you can find any paperwork from the bank suggesting a non-ISA account as a potentially suitable home for maturing ISA funds, then that would be of some interest, as I've never seen such a thing.dhuggybear said:

Money took out of an ISA and then put in a bond which would be subject to tax. Can't think of any reason why this would have been offered as an option and had a quick look and Isa rates were 5+% in 2023 makes no sensedunstonh said:You explained the scenario but nothing about why you think it was missold. So, why do you think it was missold?

Or if you can somehow prove that this move was a 'default' action in the absence of specific instructions at maturity, that would be of even greater interest.

But if not then you're just speculating on the motives behind an action that one of your parents took themselves.1 -

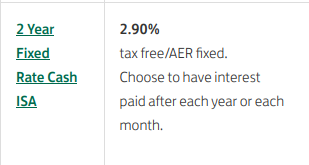

I'll stand corrected I just did a Google search and the 5% was what popped up on resultsmasonic said:dhuggybear said:

Money took out of an ISA and then put in a bond which would be subject to tax. Can't think of any reason why this would have been offered as an option and had a quick look and Isa rates were 5+% in 2023 makes no sensedunstonh said:You explained the scenario but nothing about why you think it was missold. So, why do you think it was missold?According to the wayback machine, the best rate Lloyds were offering on an ISA was their 2 Year Fixed Rate Cash ISA at 2.90% (equivalent to 3.63% taxed at basic rate), so a taxable bond at 4% would be the better option as long as only basic rate tax applied. Some of the interest probably would have been tax free. Their Cash ISA Saver at the time paid just 0.65%!Looks like a sensible choice for someone wishing to continue to save with Lloyds. It is the choice to stick with Lloyds that was unwise, but you cannot reasonably expect Lloyds to recommend he go elsewhere. Choice of provider is 100% his responsibility.Also, top ISAs 2 years ago can be found in the MSE weekly tips: https://www.moneysavingexpert.com/tips/2023/03/08/Quite a bit below 5%. The Lloyds bond is not a best buy, but it is by no means derisory compared with the likes of SmartSave or Atom Bank at ~4.4%. The Virgin or Shawbrook 2 year fixed ISA might have been a better shout, but would he have wanted this hassle?0

Their Cash ISA Saver at the time paid just 0.65%!Looks like a sensible choice for someone wishing to continue to save with Lloyds. It is the choice to stick with Lloyds that was unwise, but you cannot reasonably expect Lloyds to recommend he go elsewhere. Choice of provider is 100% his responsibility.Also, top ISAs 2 years ago can be found in the MSE weekly tips: https://www.moneysavingexpert.com/tips/2023/03/08/Quite a bit below 5%. The Lloyds bond is not a best buy, but it is by no means derisory compared with the likes of SmartSave or Atom Bank at ~4.4%. The Virgin or Shawbrook 2 year fixed ISA might have been a better shout, but would he have wanted this hassle?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards