We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

CSH2 query

valiant24

Posts: 479 Forumite

I bought some CSH2 on Friday (Lyxor Smart Overnight Return Money market fund).

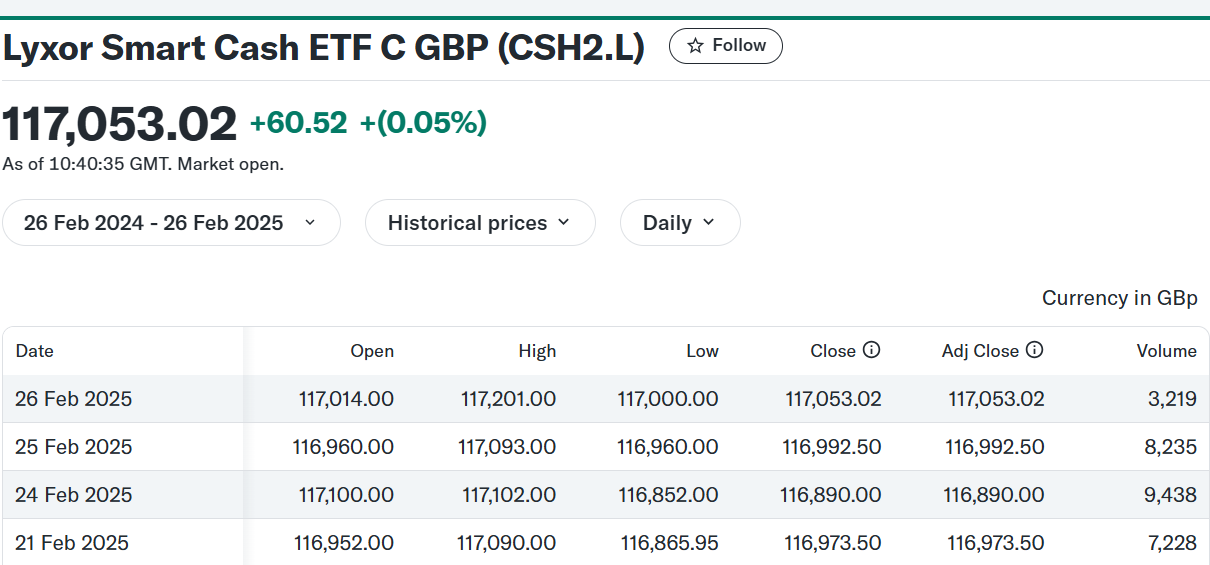

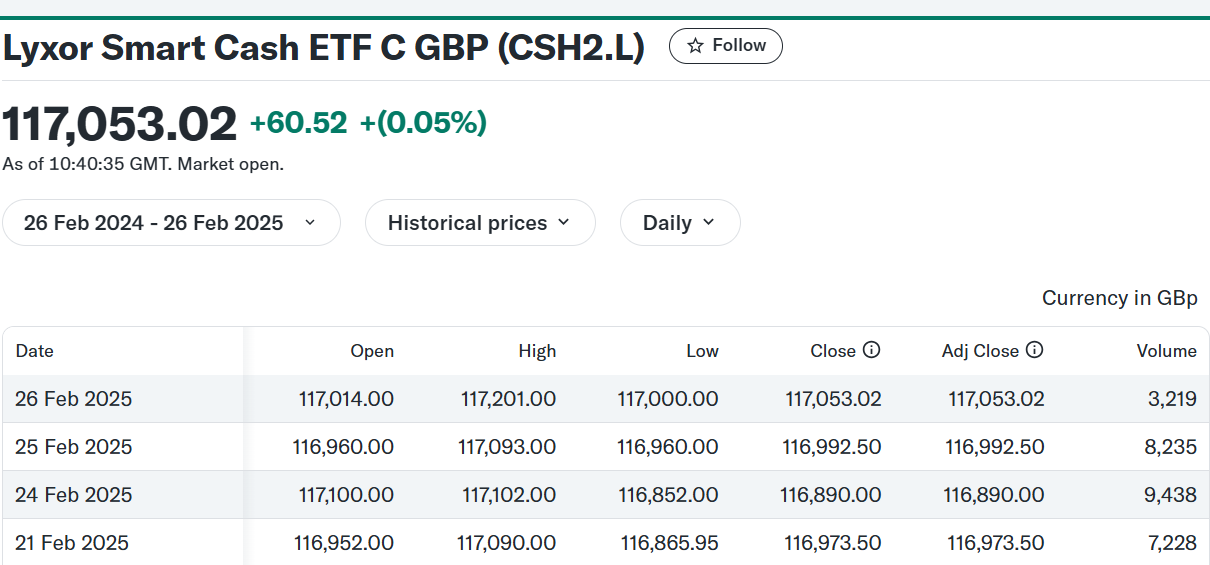

I looked at the portal yesterday and saw that I had made a small loss. And indeed, in Mon 24th the fund did close lower than it opened (see below). My "buy" price on 21st Feb was 117,087.

I'm not too bothered but am just interested, for my education, on how a cash fund like this can ever drop, even for a day.

Could someone complete my education please?

I looked at the portal yesterday and saw that I had made a small loss. And indeed, in Mon 24th the fund did close lower than it opened (see below). My "buy" price on 21st Feb was 117,087.

I'm not too bothered but am just interested, for my education, on how a cash fund like this can ever drop, even for a day.

Could someone complete my education please?

0

Comments

-

It may be 'cash like' but it is still a pot of holdings which act to reflect the 'index' it tracks, and it rarely (ever?) trades at its NAV. Plus there will always be a bid/offer spread.Personal Responsibility - Sad but True

Sometimes.... I am like a dog with a bone2 -

There are lots of reasons. In this case, the opening price was about 0.1% less than the previous opening price. ETFs can trade at a premium of discount to the net asset value of the fund. There is a mechanism to stop discounts and premiums from getting too large, but it is not perfect. Bond ETFs can sometimes trade at huge discounts when that mechanism fails completely. It is generally a good idea not to trade at opening, and wait for the market to settle down. The ETF price can also fall if the net asset value falls. CSH2 is not really a cash fund. It aims to behave as though it was by using swaps. If you look at historical prices, you will find that some money market funds have been better than others at trading through crises.

2 -

RLSTMM - if that's the one you mean is an OIEC, so no bid-offer spread and trades once a day. Also AFAIU CSH2 invests rather differently to the Royal London fund.

0 -

The RL fund actually invests in ultra-short bonds and the like. It could also go down slightly from one day to the next, but for the usual reasons.0

-

I decided that the Royal London fund was the best of the bunch, but it depends on what you want. It is important to understand that none of these funds are cash deposits. You have to do your own research.1

-

The Royal London fund largely holds cash or equivalents with different institutions whereas CSH2 tracks the euro short-term rate ("€STR") via the use of swap (derivative) contracts with different counterparties.

Very different method although both achieve similar performance outcomes.0 -

Do you have more information about this mechanism?GeoffTF said:There are lots of reasons. In this case, the opening price was about 0.1% less than the previous opening price. ETFs can trade at a premium of discount to the net asset value of the fund. There is a mechanism to stop discounts and premiums from getting too large, but it is not perfect. Bond ETFs can sometimes trade at huge discounts when that mechanism fails completely. It is generally a good idea not to trade at opening, and wait for the market to settle down. The ETF price can also fall if the net asset value falls. CSH2 is not really a cash fund. It aims to behave as though it was by using swaps. If you look at historical prices, you will find that some money market funds have been better than others at trading through crises.

Thanks in advance.0 -

leosayer said:

Do you have more information about this mechanism?GeoffTF said:There are lots of reasons. In this case, the opening price was about 0.1% less than the previous opening price. ETFs can trade at a premium of discount to the net asset value of the fund. There is a mechanism to stop discounts and premiums from getting too large, but it is not perfect. Bond ETFs can sometimes trade at huge discounts when that mechanism fails completely. It is generally a good idea not to trade at opening, and wait for the market to settle down. The ETF price can also fall if the net asset value falls. CSH2 is not really a cash fund. It aims to behave as though it was by using swaps. If you look at historical prices, you will find that some money market funds have been better than others at trading through crises.Here is a good account:1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards