We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

State Pension forecast anomaly

Comments

-

"Additional State Pension" is not "new State Pension" though, is it? Or are you saying that those that had accrued significant Addtl SP before 2016 had that accrual somehow converted into NI year credits that were offset against the 35 year requirement? Never heard of such. Do note however that the guy in the HMRC Community example was saying he very soon would qualify for the maxiumum nSP of £221.20pw. If Addtl SP would take him over that, then I might begin to follow, but it doesn't does it? In any event, that link you gave seems only to apply to oldies (older than me!).Dazed_and_C0nfused said:

If you were a high earner and had never been contracted out you could have accrued plenty of State Pension when the rules changed.1957DfurdPensionist said:

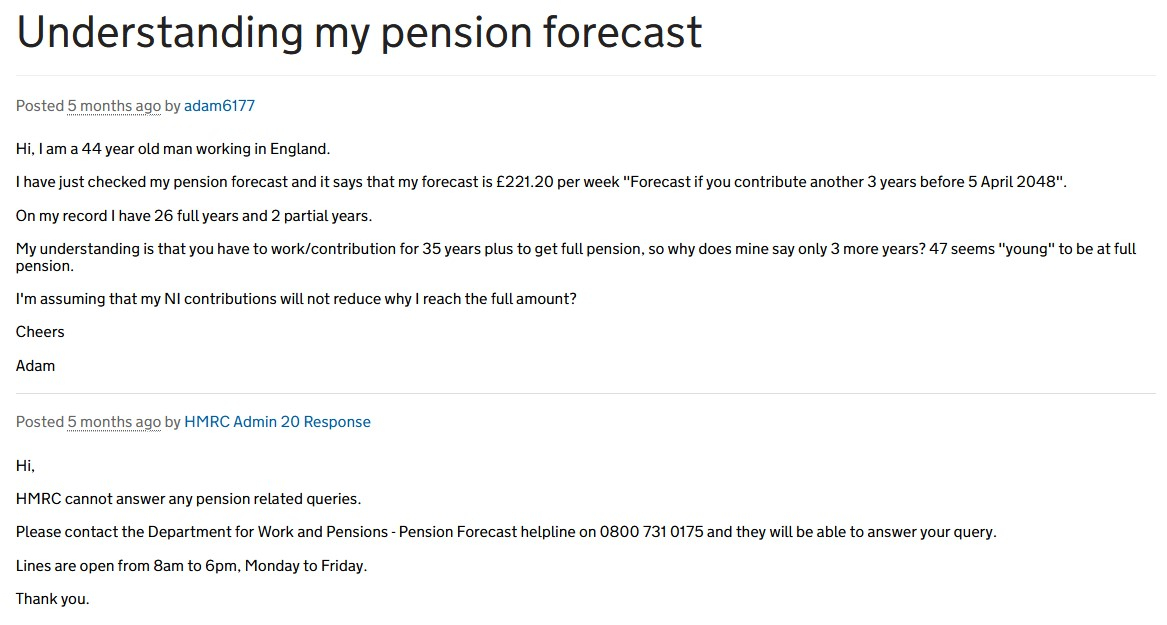

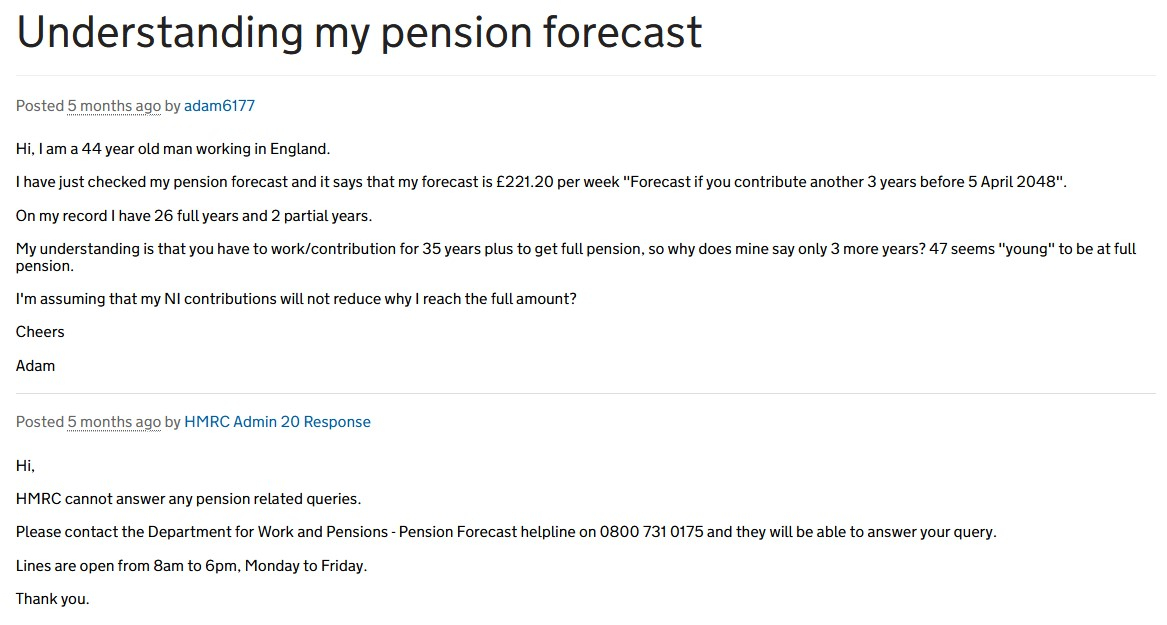

Agreed that it is not similar to M4rtyman's case, but I am confused as hell about the pictured HMRC community example, aren't you, @jem16? How can anyone currently aged 44 who has already worked in 26 + 2 of them only need 3 more for a full new state pension, i.e. presumably with a total of only 29 years as the +2 are partial years? You say there is "completely the wrong understanding of needing 35 years" - can you enlighten us on what would be a completely proper understanding, please? As someone with 36 years contributions who has recently paid for 7 more and still can't quite get to a current £221.30 pw, I honestly don't for a moment believe there is any logic in the rules and calculations, so will you do thousands of us a favour and try to reassure us with what you know?jem16 said:

It doesn’t appear to mirror your own query. That person still requires another 3 years and has completely the wrong understanding of needing 35 years.M4rtyman said:I've just seen the post below on the HMRC forums, which kind of mirrors my own query

You have no need to worry. Your pension is at the maximum and cannot be improved. Nor can it decrease.

https://www.gov.uk/additional-state-pension

Meaning you need minimum post 2016 years to reach the standard new State Pension (currently £221.20/week).

It could be argued this person is a loser under the new system. Where as you are generally considered a winner.

I am not daft or dim, just possibly a bit thick in my old age, but I still don't get it! And please don't keep telling me I'm a winner - I've had too many discussions with old-stagers at DWP to believe that nonsense. One told me that with the old deferred claiming rules with near double the current interest additions for deferral, the largest lump sum of deferred pension they'd ever seen paid out to a deferred claimant was around £140,000! Now that was a real winner! 0

- I've had too many discussions with old-stagers at DWP to believe that nonsense. One told me that with the old deferred claiming rules with near double the current interest additions for deferral, the largest lump sum of deferred pension they'd ever seen paid out to a deferred claimant was around £140,000! Now that was a real winner! 0 -

but I still don't get it!

https://assets.publishing.service.gov.uk/media/5a7a21fd40f0b66a2fc00201/single-tier-pension-fact-sheet.pdf

6/4/16 saw the introduction of NSP and the end of contracting out for DB schemes - it had ended for DC schemes some four years earlier.

It also saw the end of additional state pension.

For those under State Pension Age, a calculation was done (at 6/4/16) to establish each individual's personal starting amount for NSP.

The starting amount for each individual was the higher of his entitlement under

Old Rules

NI qualifying years/30 x Full Basic SP (£119.30) + ( Grad/SERPS/S2P - (if applicable) Deduction for Contracting Out).

New Rules

[NIQY/35 x Full NSP (£155.65)} - (if applicable) Contracted Out Pension Equivalent.

If we take a person who had worked in a well paid job for a number of years and who had never contracted out, the accrued additional state pension (SERPS/S2P, possibly some graduated pension) could be substantial (up to something over £160 a week in 2015/16).

https://en.wikipedia.org/wiki/State_Earnings-Related_Pension_Scheme

https://en.wikipedia.org/wiki/State_Second_Pension

Thus you might have had a person in his mid forties with a starting amount well over a full NSP, despite having only (say) thirty qualifying years)

In that case, £119.65 of his starting amount would revalue under the triple lock while the balance, (the protected payment) would revalue by CPI.

Though it would not improve his state pension, if employed and earning the relevant amount, he would still pay NI up to state pension age.

AT SPA he would receive the full revalued NSP plus his revalued protected payment.

Let's say he had a friend the same age who had the same number of qualifying years but who had always been a member of a contracted out pension scheme.

He and his employer paid a lower rate of NI but in return for the concession, the employer offered a defined benefit pension scheme.

Thus his starting amount was under a full NSP.

His NI qualifying years from 6/4/16 to the last full year before SPA could improve his starting amount up to (but not in excess of) a full new state pension.

Once that point was reached, he would still have to pay NI up to SPA if employed and earning the relevant amount.

However, he would have his DB pension in addition to a full NSP.

With regard to state pension deferral, the old scheme was much more generous.

https://www.litrg.org.uk/pensions/state-pension/tax-state-pension/putting-deferring-claiming-state-pension

3 -

No, Additional State Pension isn't New State Pension but if you accrued a lot of Additional State Pension prior to the rules changing then that would form part of your starting amount calculation.1957DfurdPensionist said:

"Additional State Pension" is not "new State Pension" though, is it? Or are you saying that those that had accrued significant Addtl SP before 2016 had that accrual somehow converted into NI year credits that were offset against the 35 year requirement? Never heard of such. Do note however that the guy in the HMRC Community example was saying he very soon would qualify for the maxiumum nSP of £221.20pw. If Addtl SP would take him over that, then I might begin to follow, but it doesn't does it? In any event, that link you gave seems only to apply to oldies (older than me!).Dazed_and_C0nfused said:

If you were a high earner and had never been contracted out you could have accrued plenty of State Pension when the rules changed.1957DfurdPensionist said:

Agreed that it is not similar to M4rtyman's case, but I am confused as hell about the pictured HMRC community example, aren't you, @jem16? How can anyone currently aged 44 who has already worked in 26 + 2 of them only need 3 more for a full new state pension, i.e. presumably with a total of only 29 years as the +2 are partial years? You say there is "completely the wrong understanding of needing 35 years" - can you enlighten us on what would be a completely proper understanding, please? As someone with 36 years contributions who has recently paid for 7 more and still can't quite get to a current £221.30 pw, I honestly don't for a moment believe there is any logic in the rules and calculations, so will you do thousands of us a favour and try to reassure us with what you know?jem16 said:

It doesn’t appear to mirror your own query. That person still requires another 3 years and has completely the wrong understanding of needing 35 years.M4rtyman said:I've just seen the post below on the HMRC forums, which kind of mirrors my own query

You have no need to worry. Your pension is at the maximum and cannot be improved. Nor can it decrease.

https://www.gov.uk/additional-state-pension

Meaning you need minimum post 2016 years to reach the standard new State Pension (currently £221.20/week).

It could be argued this person is a loser under the new system. Where as you are generally considered a winner.

I am not daft or dim, just possibly a bit thick in my old age, but I still don't get it! And please don't keep telling me I'm a winner - I've had too many discussions with old-stagers at DWP to believe that nonsense. One told me that with the old deferred claiming rules with near double the current interest additions for deferral, the largest lump sum of deferred pension they'd ever seen paid out to a deferred claimant was around £140,000! Now that was a real winner!

- I've had too many discussions with old-stagers at DWP to believe that nonsense. One told me that with the old deferred claiming rules with near double the current interest additions for deferral, the largest lump sum of deferred pension they'd ever seen paid out to a deferred claimant was around £140,000! Now that was a real winner!

Which means you could have a high starting amount, for the number of qualifying years you had. And then post 2016 years would take you from that starting amount to the standard new State Pension. I think the fewest years needed, to get the standard new State Pension, we have seen on here is either 28 or 29.

And yes, it could take you over £221.20. If you had accrued more than the standard new State Pension when your starting amount was calculated then you got to keep that higher amount. But you couldn't increase it with post 2016 qualifying years. And the amount above the standard amount doesn't get triple lock protection.2 -

This poster recently said they were just completing a 27th year but had achieved full NSP by end 2024 i.e after 26 years. https://forums.moneysavingexpert.com/discussion/6595529/state-pension-forecast-and-missing-years-should-i-pay-the-shortfallDazed_and_C0nfused said:

I think the fewest years needed, to get the standard new State Pension, we have seen on here is either 28 or 29.Fashion on the Ration

2024 - 43/66 coupons used, carry forward 23

2025 - 62/891

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards