We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Lump sum when on benefits

Comments

-

QrizB said:saintscouple said:Yes, it is a defined benefit scheme.

No the £8650 is the total pension pot.There is no "pot" with a Defined Benefit scheme.Exactly what does it say next to the £8650 number? And what pension is is offering to pay, how many ££ per year?QrizB said:saintscouple said:Yes, it is a defined benefit scheme.

No the £8650 is the total pension pot.There is no "pot" with a Defined Benefit scheme.Exactly what does it say next to the £8650 number? And what pension is is offering to pay, how many ££ per year?

Perhaps this helpsDRS1 said:Defined benefit schemes don't have a pot as such. It might be a transfer value I suppose.

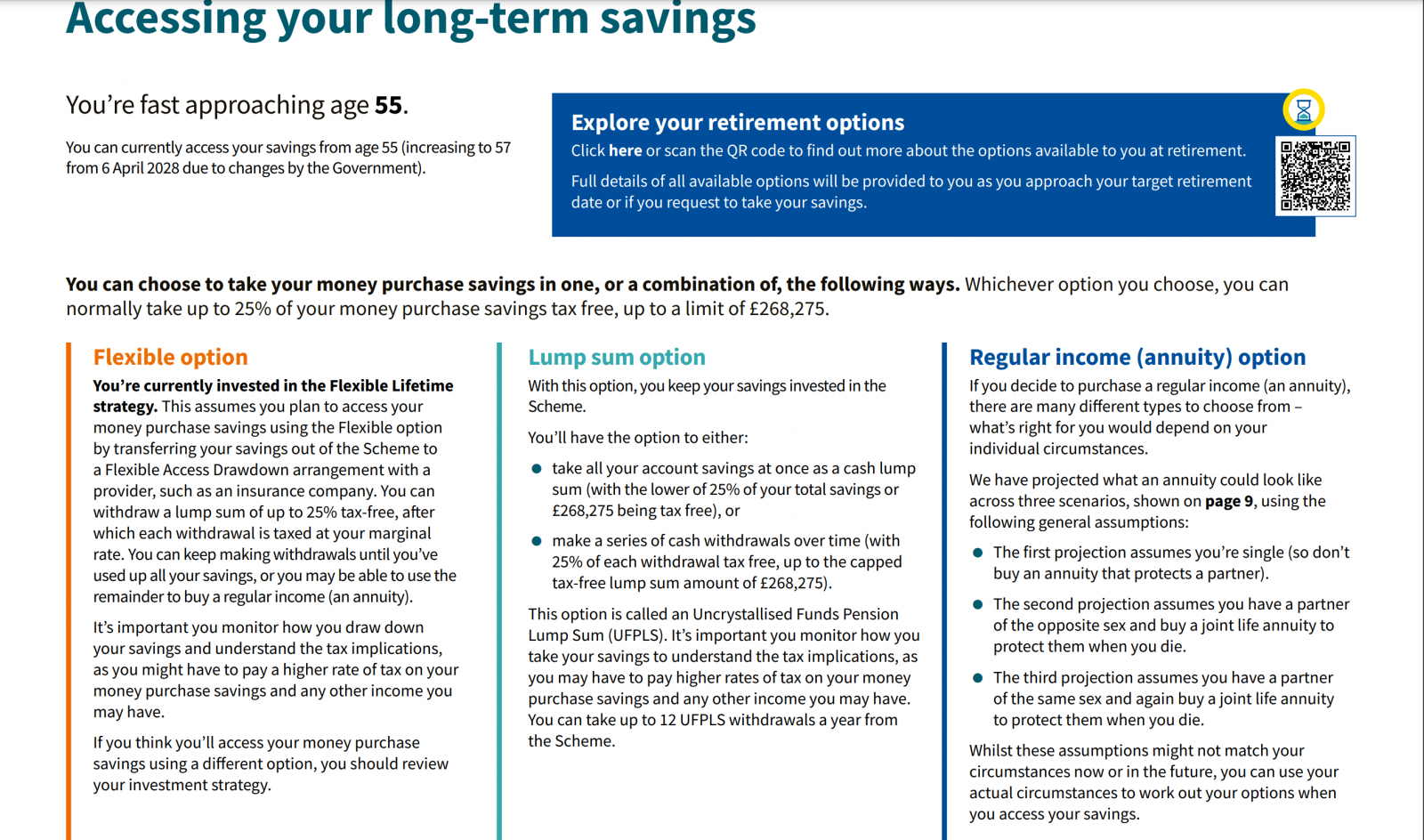

55 would be young for a "normal retirement age" which would usually be 60/65/67 - 55 is typically the youngest age from which you can take early retirement but early retirement usually requires consent from the trustees or the employer.

I raised the point because with some benefits if you can take a pension as of right from a certain age then the benefit requires you to do so (or you are treated as if you have done so). If that age really is 55 you may want to dig a bit deeper and perhaps look at taking the benefits from the Aviva Scheme (in whatever way will least affect your benefits).

I confess I am wondering if the Aviva Scheme really is defined benefits rather than defined contribution given the way you describe those options - they are not what you'd expect from a defined benefits scheme (which is basically a lump sum at retirement plus a pension for life (with spouse's or dependants' pension after you die)). The problem with taking all £6k from the Aviva Scheme is that a large chunk of that would be taxable - check but I imagine only 25% of the £8650 pot can be taken tax free.

Sorry I seem to be making this more complicated. Ignore me and just do what SVaz said as it is far simpler but maybe have a read around the benefits you are on to see if there is any mention of pensions.

I really am out of my depth with understanding these things, and really appreciate all the advice given.

If i take the lump sum option from the Aviva pension wouldn´t that mean only aprox £2k would be tax free, the rest will be taxed?0 -

To clarify, my wife and I are on a joint Universal Credit benefit.

I understand the rules that a pension lump sum is treated as savings, and with UC you can have a maximum of £6k in savings before it affects your benefit.

Hence only wanting a lump sum at this time.0 -

Don´t know if my maths is correct, but if the Aviva balance is £8k i would get £2k tax free, the other £6k is taxed at 20%, meaning £1.2k is lost, the amount received would be £6.8k.

UC will then deduct £4.35 for every £250 in savings over the £6k - thus it would be wise to spend that £800 quick, on things like appliances.

0 -

saintscouple said:Don´t know if my maths is correct, but if the Aviva balance is £8k i would get £2k tax free, the other £6k is taxed at 20%, meaning £1.2k is lost, the amount received would be £6.8k.

UC will then deduct £4.35 for every £250 in savings over the £6k - thus it would be wise to spend that £800 quick, and things like appliances.- For each £250 above £6,000, your UC is reduced by £4.35 a month

Life in the slow lane1 -

It reduces until you cannot get universal credits by the time you reach £16k. Have you considered having more savings, perhaps?saintscouple said:Don´t know if my maths is correct, but if the Aviva balance is £8k i would get £2k tax free, the other £6k is taxed at 20%, meaning £1.2k is lost, the amount received would be £6.8k.

UC will then deduct £4.35 for every £250 in savings over the £6k - thus it would be wise to spend that £800 quick, on things like appliances.1 -

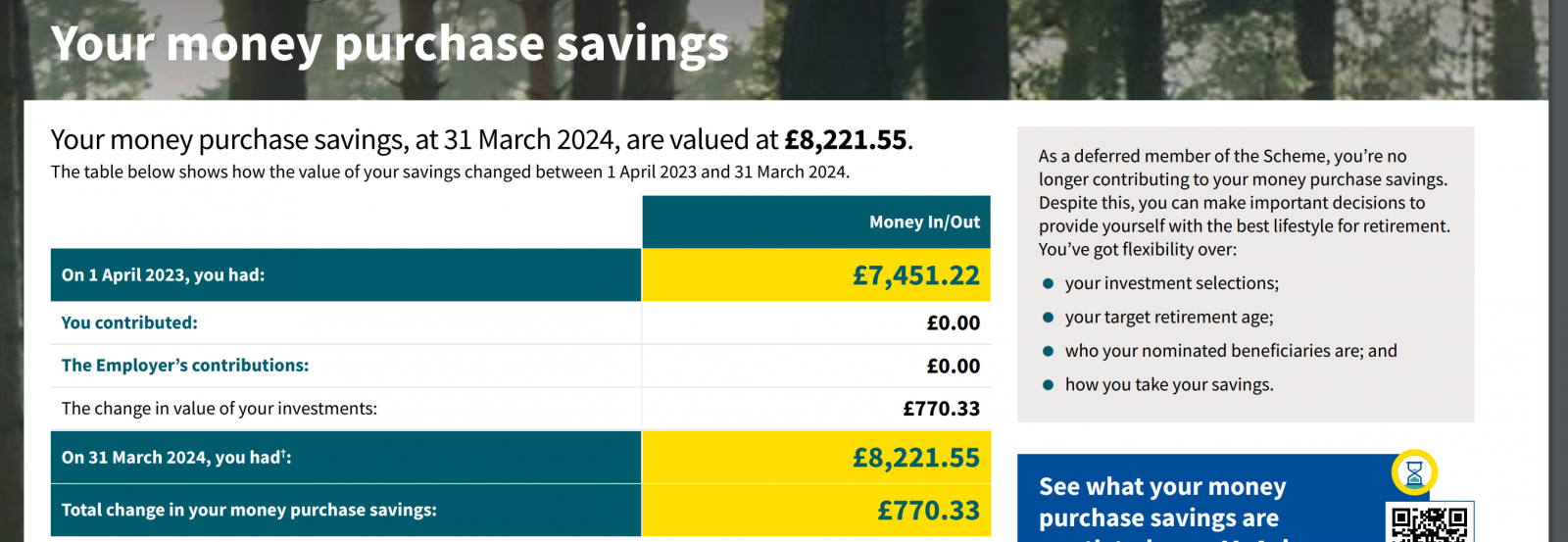

Thank you, and yes it does. It's a money purchase (ie. Defined Contribution) scheme. It does have a pot and that pot was valued at £8211.55 in March last year.saintscouple said:Perhaps this helps

Yes, 25% of it will be paid tax-free, the rest is taxable. Whether you actually have to pay any tax on it, or not, will depend on your taxable income for the year. And as may have already been mentioned, the pension company might charge tax at first and you'll get a refund later.saintscouple said:I really am out of my depth with understanding these things, and really appreciate all the advice given.

If i take the lump sum option from the Aviva pension wouldn´t that mean only aprox £2k would be tax free, the rest will be taxed?

If you've used your tax-free Personal Allowance and the £6k is taxed at 20%, yes, eventually. But if you've got unused Personal Allowance , you'll pay less tax than that; some of it might be taken as tax to begin with, then refunded later.saintscouple said:Don´t know if my maths is correct, but if the Aviva balance is £8k i would get £2k tax free, the other £6k is taxed at 20%, meaning £1.2k is lost, the amount received would be £6.8k.

I don't know the UC rules - they get debated on the Benefits board by cleverer people than me - but yes, spent on things like that.saintscouple said:UC will then deduct £4.35 for every £250 in savings over the £6k - thus it would be wise to spend that £800 quick, on things like appliances.N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.1 -

Do you actually need to take the £6k at 55? Might it be better to leave it in the pension(s) until SPA if you are not going to spend it?

I know nothing about Universal Credit but the little I have read suggests that anything in the pension can be ignored. See below

Pension freedoms and DWP benefits - GOV.UK1 -

This pdf is more up-to-date although not government website,

https://www.ageuk.org.uk/siteassets/documents/factsheets/fs91-pension-freedom-and-benefits.pdf

And more importantly, there are case studies in this pdf that may help the OP understand the potential impacts..1 -

Thank you, this confirms the £6k capital, and rules above that limitJoeCrystal said:This pdf is more up-to-date although not government website,

https://www.ageuk.org.uk/siteassets/documents/factsheets/fs91-pension-freedom-and-benefits.pdf

And more importantly, there are case studies in this pdf that may help the OP understand the potential impacts..

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards