We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Self Assessment - payments on account...

Comments

-

Still two hours left - plenty of time! Over 3 million outstanding at 8am this morning!Dazed_and_C0nfused said:

Typical 31 January panic I suspect 😂[Deleted User] said:

Yes - £1151.80 is clearly 2022/23 liability. Very confusing and, like you, not convinced July POA remains unpaid.Dazed_and_C0nfused said:

I don't know how you have suddenly changed your liability from £1151.80 to £1421.00 but this higher figure makes far more sense.mmunro2013 said:

Wow! I am confused. I paid the £575.90 back in January 2024. 2023-4 tax return and payments complete. Now, tax return 2024-25 (which I submitted yesterday), The last page of my calculation looks something like this:[Deleted User] said:

You totally misunderstood the process.mmunro2013 said:Last year after completing and submitting my tax return on-line I was instructed (by my 'tax calculation') to pay monies into my account:

1st payment on account for 2023-24 due 31 January 2024 of £575.90

This year I had similar, however different amounts:

1st payment on account for 2024-25 due 31 January 2025 of £710.50

2nd payment on account for 2024-25 due 31 July 2025

My question is: what happens to these monies 'on account'? I don't seem to see them credited to my account anywhere? Am I misunderstanding this process?The calculation is a final reckoning of your bill for 2023/24. Nothing else - like a final invoice. Presumably this is £1421.00?

Now, what have you paid towards this?Answer - the two payments on account that you made in January and July 2024. Deduct these from your calculation. You owe £269.20.Add this to your first payment on account for 2024/25 and pay the total today!!!The second payment on account remains payable in July.

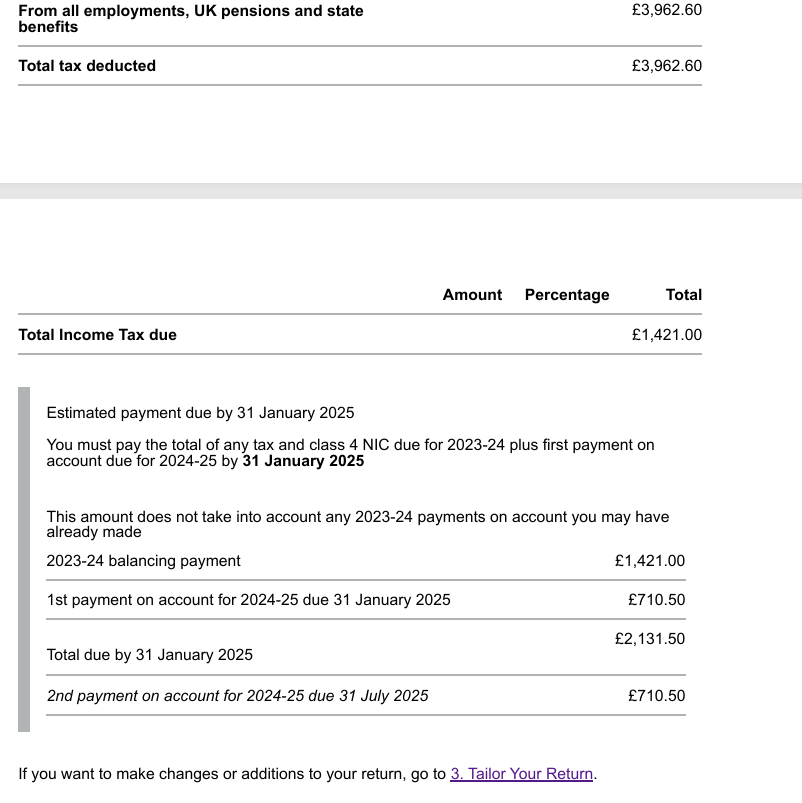

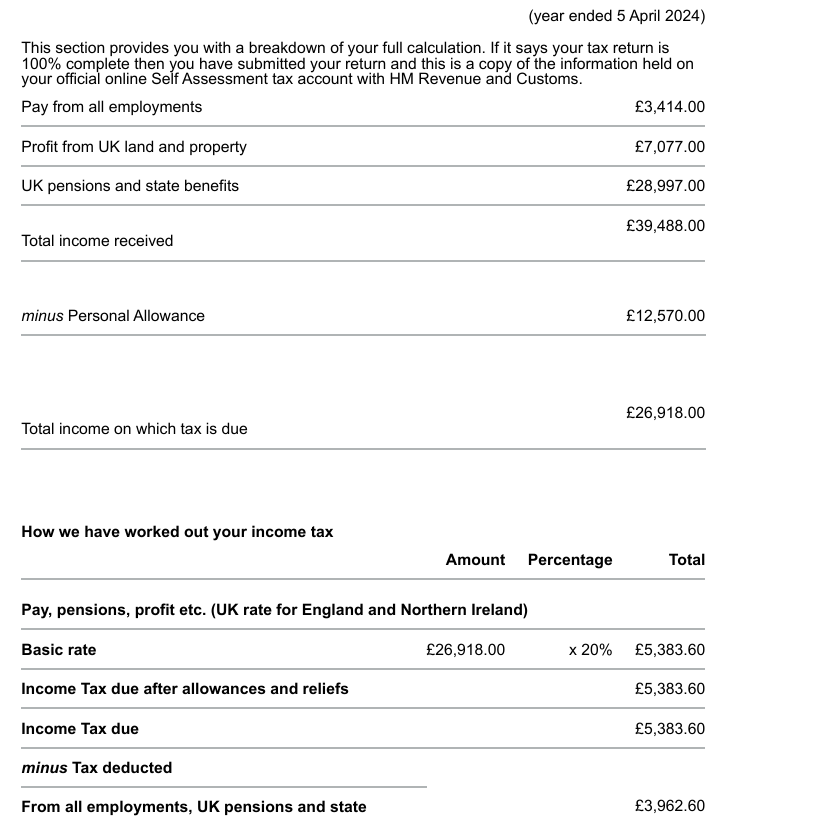

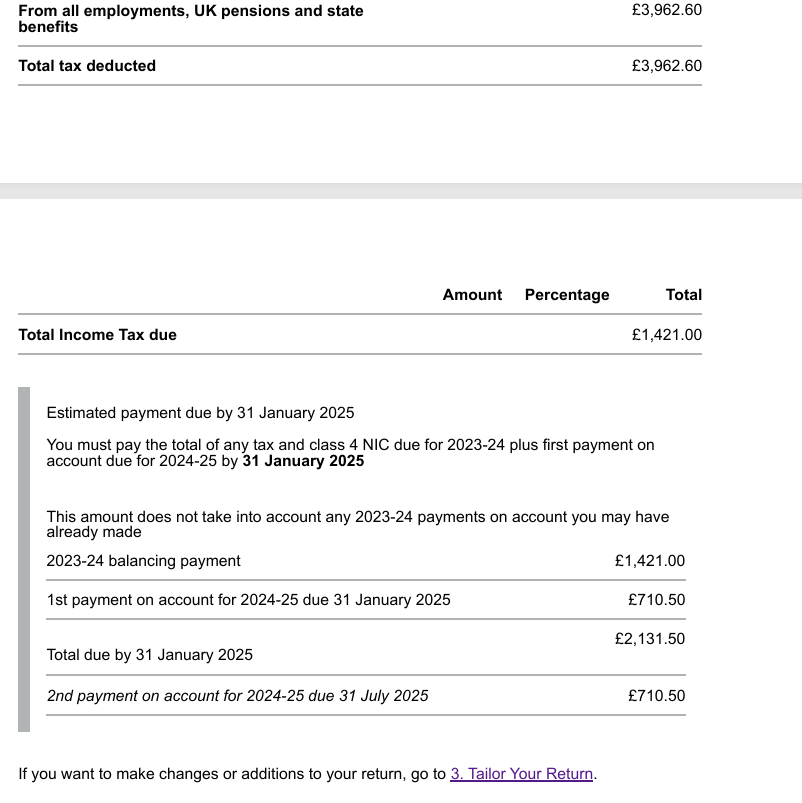

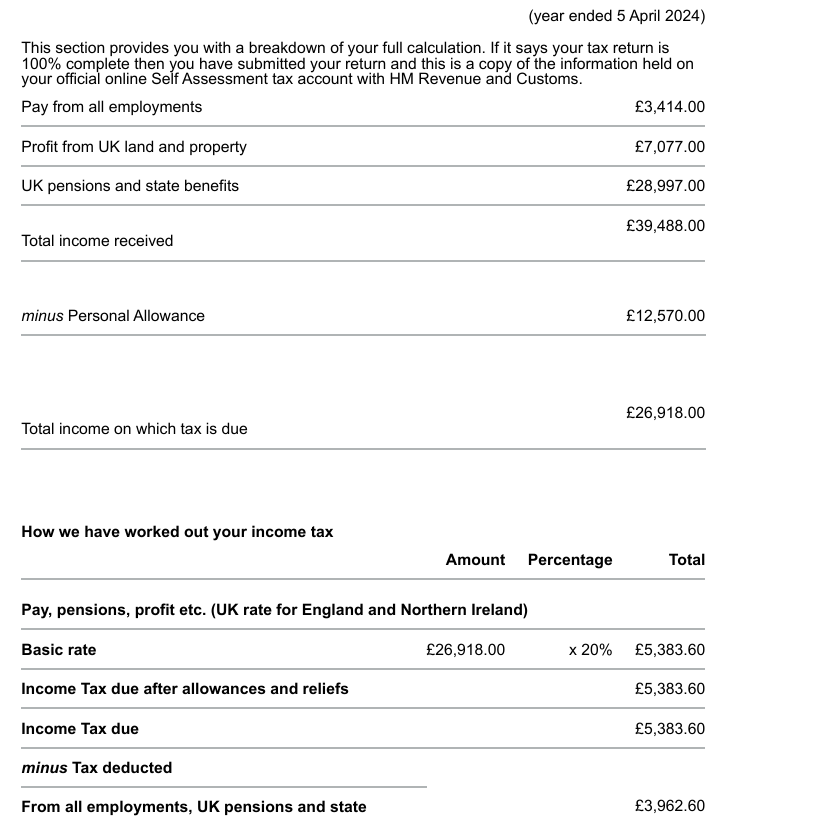

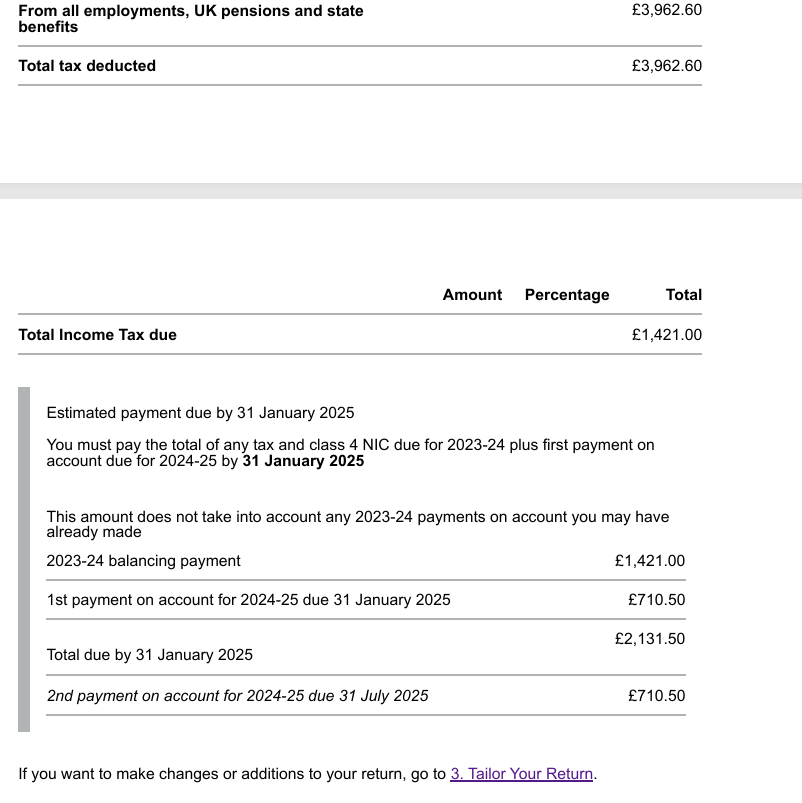

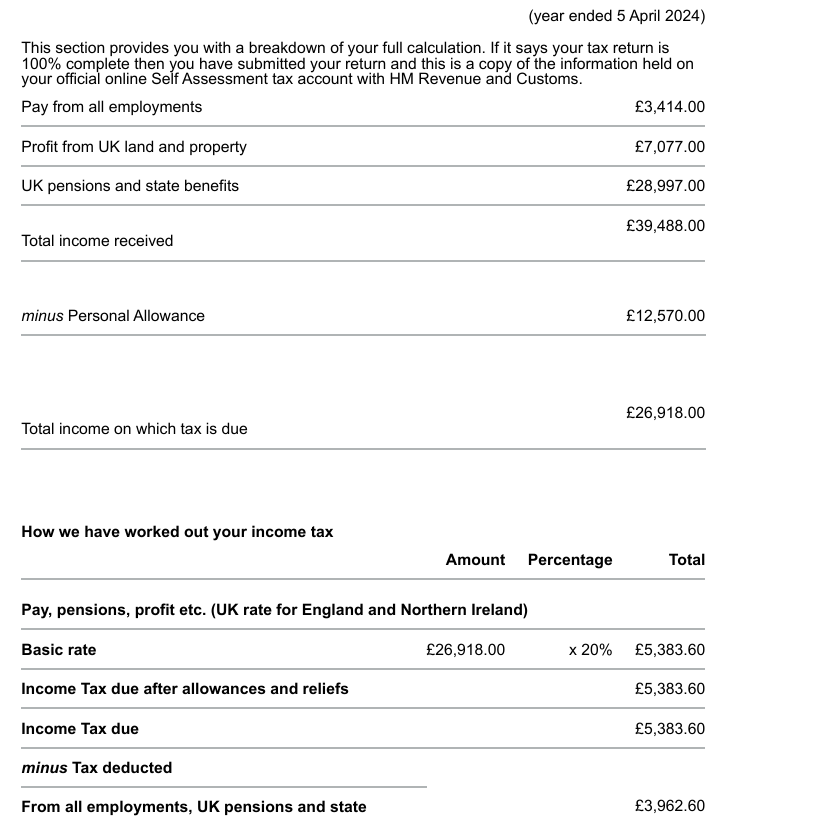

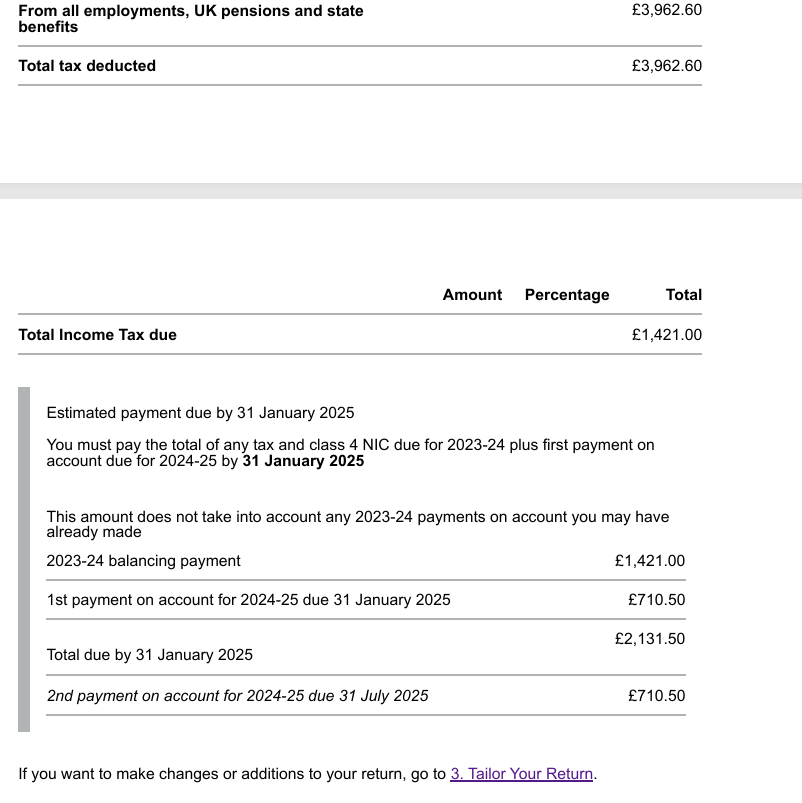

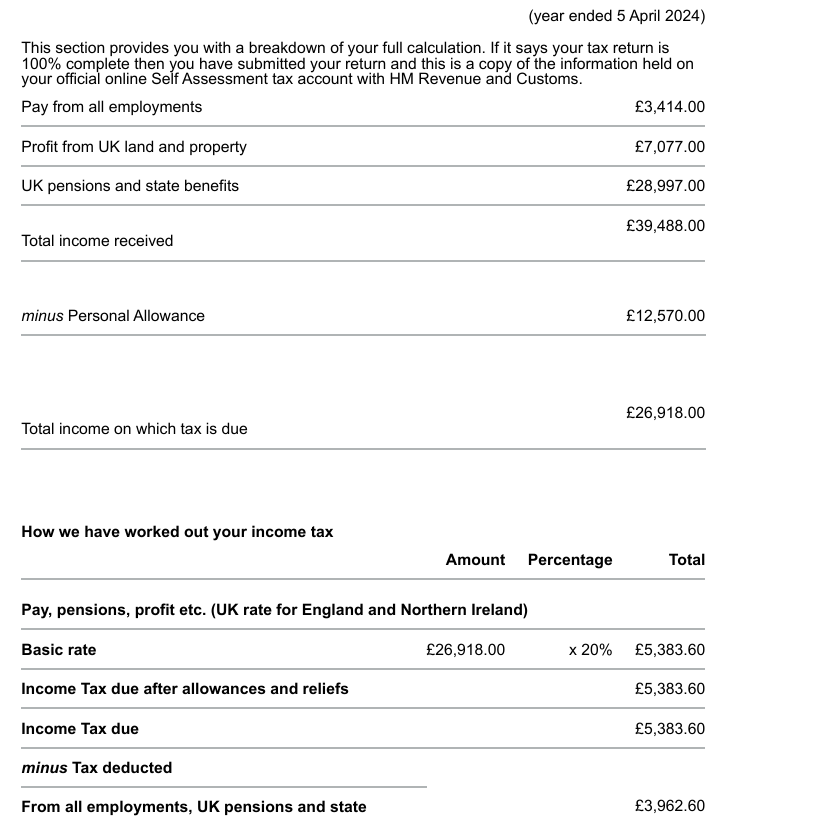

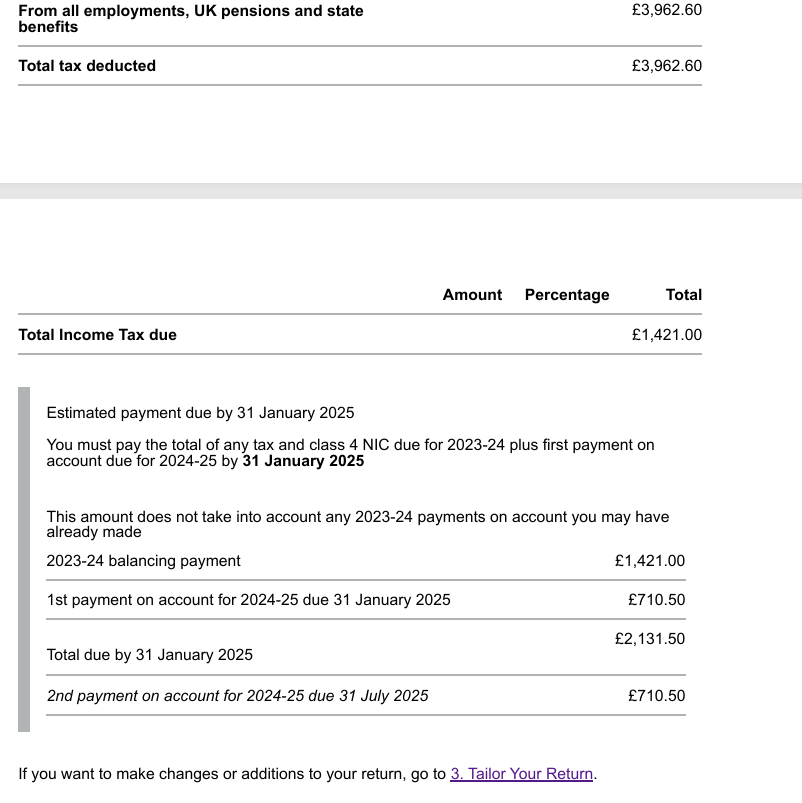

...'Total Income Tax due £1,421.00

Estimated payment due by 31 January 2025

You must pay the total of any tax and class 4 NIC due for 2023-24 plus first payment on account due for 2024-25 by 31 January 2025

This amount does not take into account any 2023-24 payments on account you may have already made

2023-24 balancing payment £1,421.00

1st payment on account for 2024-25 due 31 January 2025 £710.50

Total due by 31 January 2025 £2,131.50

2nd payment on account for 2024-25 due 31 July 2025 £710.50'...

If you have only made a single POA of £575.90 towards 2023-24 then you have £845.10 left to pay for 2023-24.

Plus £710.50 as your first POA for 2024-25.

So £1,555.60 in total to be paid today. You will be charged late payment interest on the £575.90 you should have paid in July 2024 so you might want add a bit extra towards this.

To be clear the £575.90 you owe from July 2024 is a part of the £1,555.60, not in addition to that.

What isn't clear is why you haven't had a debt collector knocking on your door!

Tomorrow it will be - my payments won’t clear my bank until Monday. Will I get a fine/penalty/bailiffs calling, 1000 lashes?0 -

You might also want to redact your name and UTR from your posts2

-

Sensible for have paid something, far better than prevaricating.mmunro2013 said:

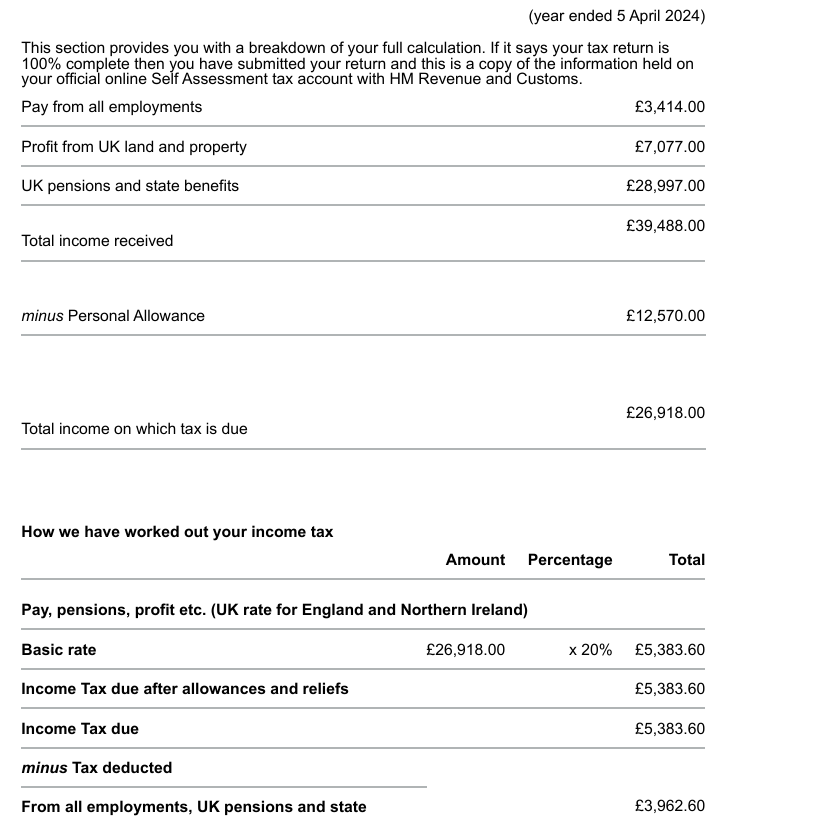

JFYI I paid £2131.50 yesterday...mmunro2013 said:Sorry for all the confusion... I attach here snapshots of my 2023-24 final tax calculation... not sure if this helps?

But given what is in the screenshot above I have no idea how you decided that was what you should have paid 😭0 -

OP - you have now paid £575.90 too much! See Dazed post at 9.35.Personally, I would leave it sitting and deduct that from the second payment on account due in July, given your confusion now!

Are you absolutely certain you made no payment in July 2024?

Wait a few days and check your STATEMENT to see where you are.0 -

So you paid the £1,421 + the 1st payment on accountmmunro2013 said:

JFYI I paid £2131.50 yesterday...

As it says the £1,421 does not take into account the payments on account you made

You have now overpaid by whatever payments on account you made (January 2024 ...£575.90?)

0 -

Exactly this!Caz3121 said:

So you paid the £1,421 + the 1st payment on accountmmunro2013 said:

JFYI I paid £2131.50 yesterday...

As it says the £1,421 does not take into account the payments on account you made

You have now overpaid by whatever payments on account you made (January 2024 ...£575.90?)0 -

He paid the total liability for 2023/24 plus the POA for 2024/25, ignoring any POA made for 2023/24.Dazed_and_C0nfused said:

Sensible for have paid something, far better than prevaricating.mmunro2013 said:

JFYI I paid £2131.50 yesterday...mmunro2013 said:Sorry for all the confusion... I attach here snapshots of my 2023-24 final tax calculation... not sure if this helps?

But given what is in the screenshot above I have no idea how you decided that was what you should have paid 😭OP - delete your two posts with the screenshot - your name is included.0 -

I do understand that. I just don't understand how the op can possibly have though that was the correct thing to pay given he has made a point of telling us he had paid the first POA for 2023-24.[Deleted User] said:

He paid the total liability for 2023/24 plus the POA for 2024/25, ignoring any POA made for 2023/24.Dazed_and_C0nfused said:

Sensible for have paid something, far better than prevaricating.mmunro2013 said:

JFYI I paid £2131.50 yesterday...mmunro2013 said:Sorry for all the confusion... I attach here snapshots of my 2023-24 final tax calculation... not sure if this helps?

But given what is in the screenshot above I have no idea how you decided that was what you should have paid 😭

You have to sympathise with HMRC sometimes, they have a good explanation for this and still people just don't get it!0 -

And the UTR 😳[Deleted User] said:

He paid the total liability for 2023/24 plus the POA for 2024/25, ignoring any POA made for 2023/24.Dazed_and_C0nfused said:

Sensible for have paid something, far better than prevaricating.mmunro2013 said:

JFYI I paid £2131.50 yesterday...mmunro2013 said:Sorry for all the confusion... I attach here snapshots of my 2023-24 final tax calculation... not sure if this helps?

But given what is in the screenshot above I have no idea how you decided that was what you should have paid 😭OP - delete your two posts with the screenshot - your name is included.0 -

Yes - understood!Dazed_and_C0nfused said:

I do understand that. I just don't understand how the op can possibly have though that was the correct thing to pay given he has made a point of telling us he had paid the first POA for 2023-24.[Deleted User] said:

He paid the total liability for 2023/24 plus the POA for 2024/25, ignoring any POA made for 2023/24.Dazed_and_C0nfused said:

Sensible for have paid something, far better than prevaricating.mmunro2013 said:

JFYI I paid £2131.50 yesterday...mmunro2013 said:Sorry for all the confusion... I attach here snapshots of my 2023-24 final tax calculation... not sure if this helps?

But given what is in the screenshot above I have no idea how you decided that was what you should have paid 😭

You have to sympathise with HMRC sometimes, they have a good explanation for this and still people just don't get it!0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards