We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

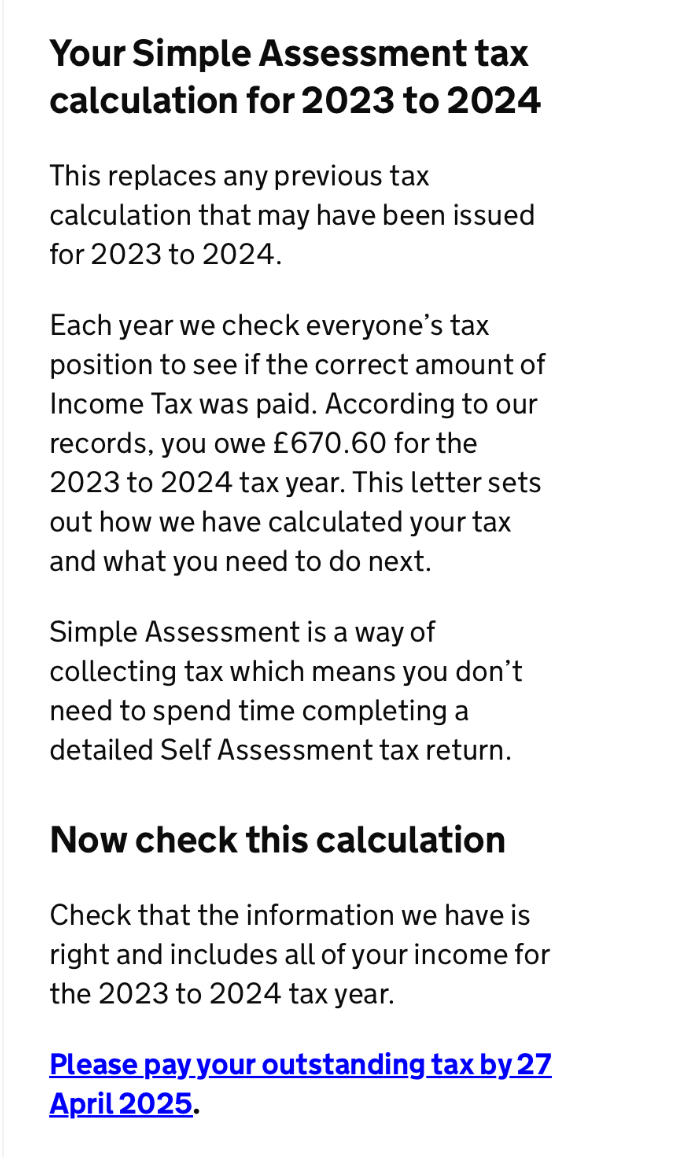

HMRC Debt

Comments

-

molerat said:

But at what cost for the computer system to do it ? (Both to the national purse and the sanity of the "customers")Flugelhorn said:

they will certainly need warning in advance that they may get a bill. Tax codes can be applied to other pensions am sure they could do the same for state pensionscrv1963 said:I do wonder if taxing pensioners small(ish) amounts is actually cost effective for HMRC? My mother has been sent a tax bill for £267 all off her state pension income- no private pensions. I think personally that HMRC will have to create some method of collecting the sums via deduction as more get dragged into the fiscal drag. Not every pensioner is in the position to fork out several hundred pounds.One might suggest that DWP move to paying benefits via a commercial payroll system, like Oracle etc. offer to large employers.Then one might reflect on the regular reports in the IT press of government Oracle etc. rollouts going badly awry, over budget and under delivery, and possibly decide it's all too much trouble ....Here's an example.

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.0 -

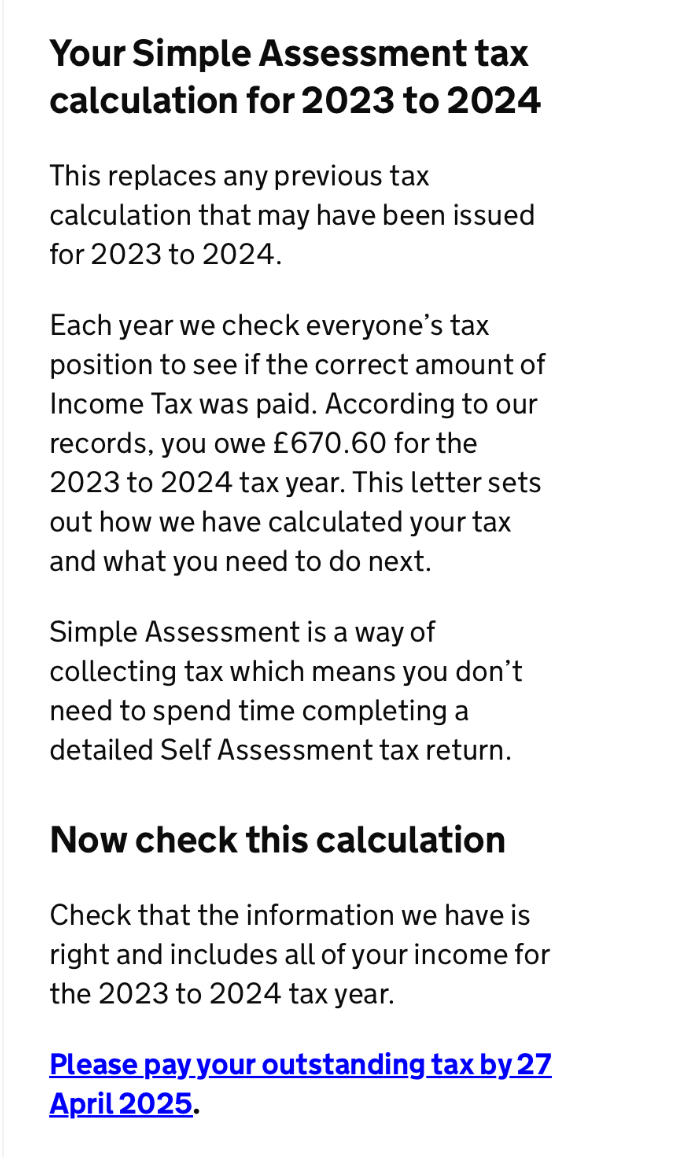

This must have been considered, but instead they’ve implemented Simple Assessment. As this gives pensioners 10 months to pay, it doesn’t seem to me to disadvantage them.crv1963 said:I do wonder if taxing pensioners small(ish) amounts is actually cost effective for HMRC? My mother has been sent a tax bill for £267 all off her state pension income- no private pensions. I think personally that HMRC will have to create some method of collecting the sums via deduction as more get dragged into the fiscal drag. Not every pensioner is in the position to fork out several hundred pounds.

https://www.litrg.org.uk/tax-nic/how-tax-collected/simple-assessment

Fashion on the Ration

2024 - 43/66 coupons used, carry forward 23

2025 - 62/892 -

It really isn't anything like that at all - even if there was an error by a customer service agent, it's hardly comparable to the systematic persecution of sub-postmasters over many years, leading to false imprisonments, suicides, etc, so such hyperbole is pretty tasteless IMHO.bullinn1 said:So if you’re all not too bored with this I have looked more carefully at the HMRC site and found actual calculations, they seem to suggest that their representative gave me incorrect information when he said I owed circa £1,300 … it seems a little like the Post Office “Horizon” scandal ! Whilst I feel it’s a poor way of treating pensioners I will pay the amount but it “sucks” .

In any case, we're obviously not privy to the conversation(s) you had, but presumably if you underpaid tax by £670 in 2023/24, then chances are it'll be the same again in 2024/25, although they'll have the opportunity (but not the obligation) to adjust some tax codings to collect that before April.2 -

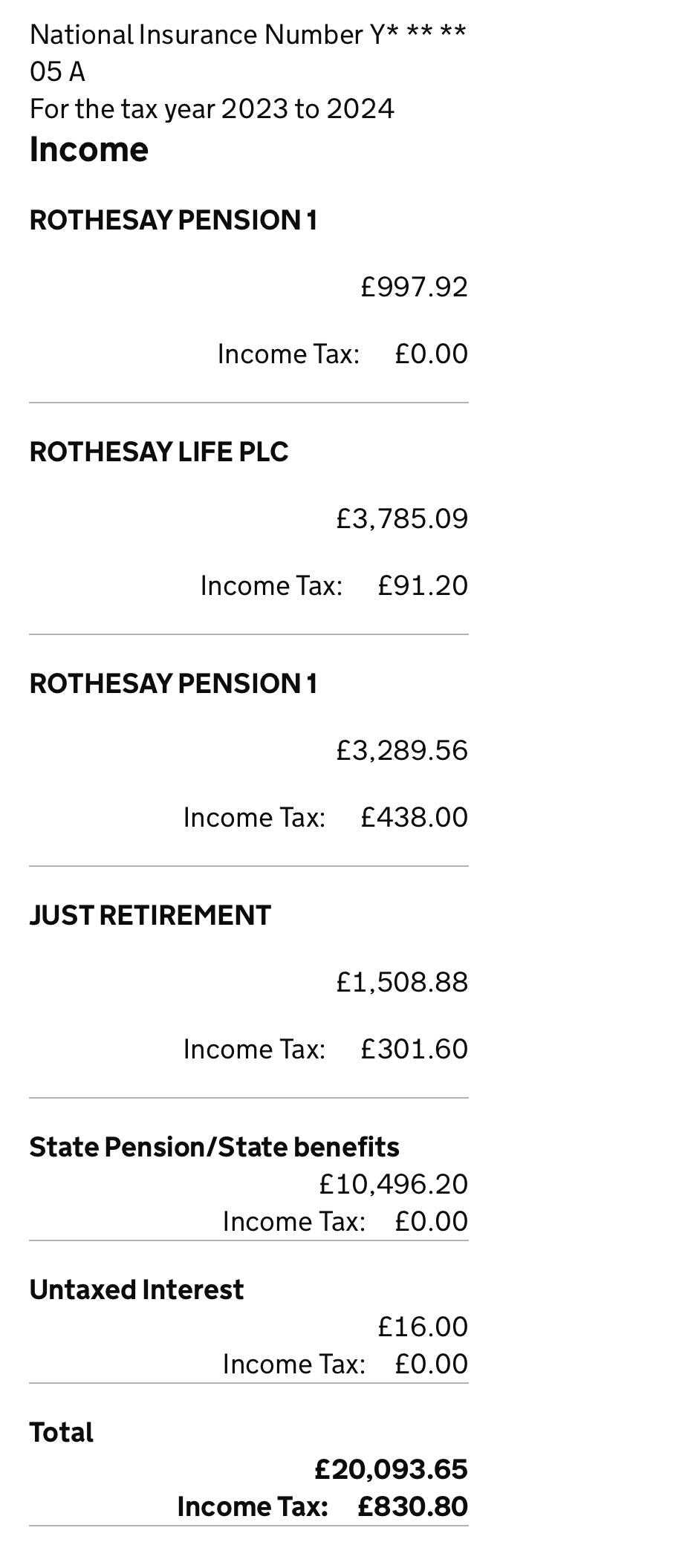

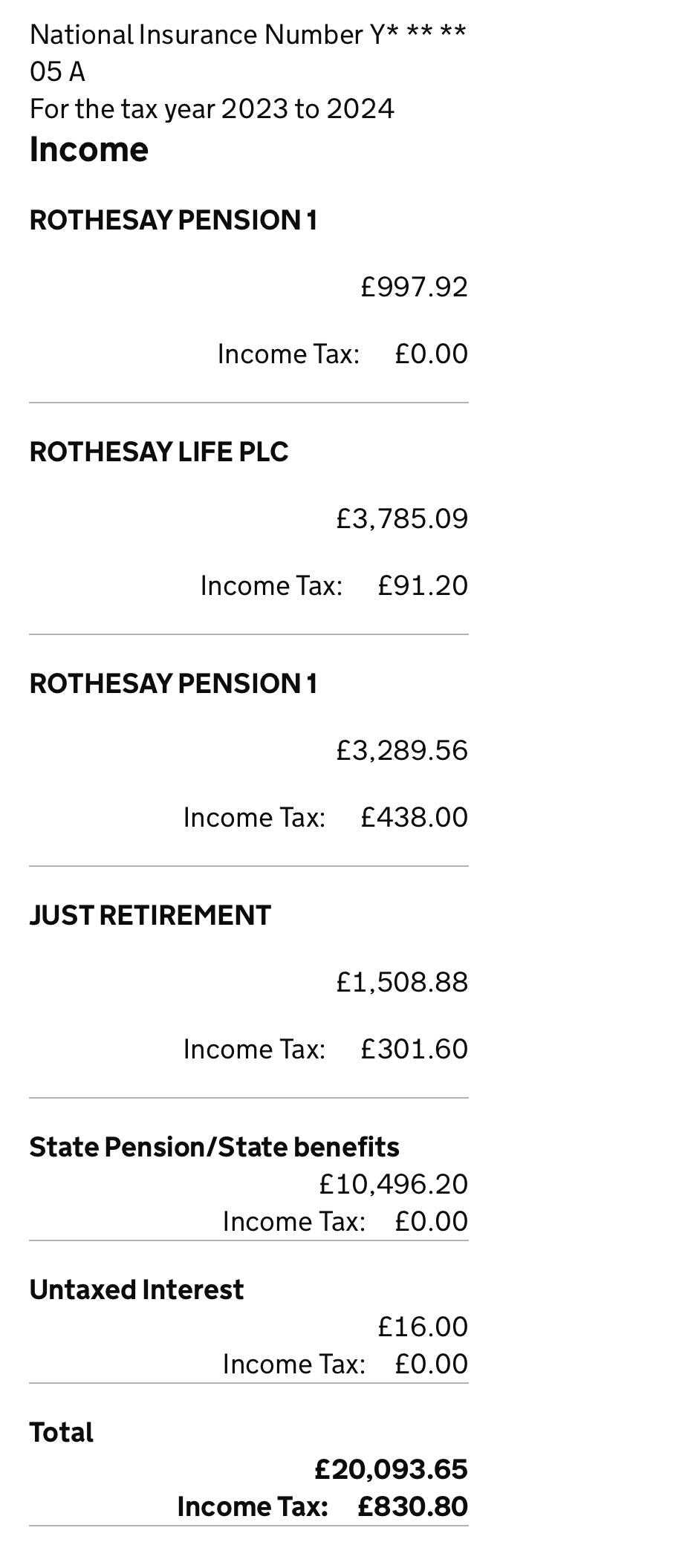

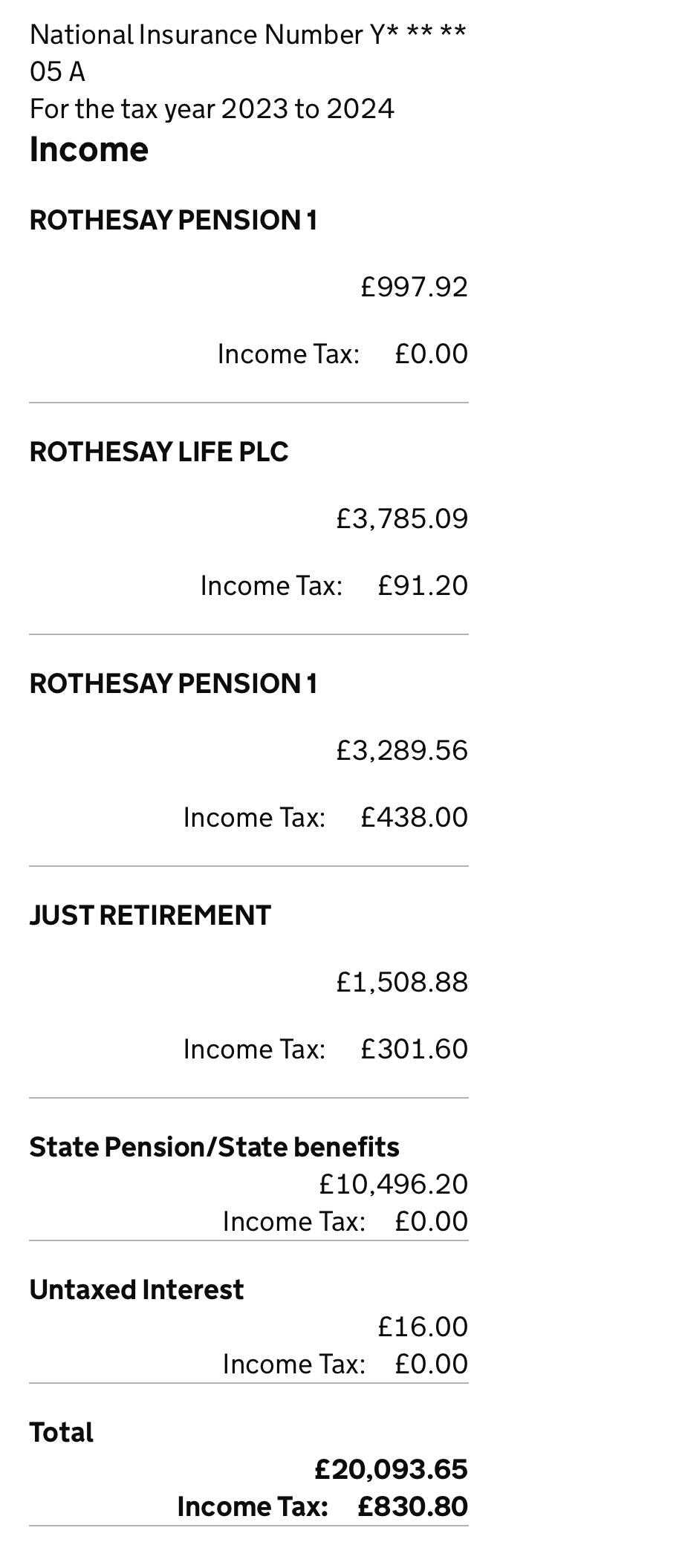

Thank you jem16 Is it the responsibility of the pension provider to ensure my tax codes are correct … I know absolutely nothing about tax coding and during an hour long conversation they offered little advice basically saying “pay up and expect a demand every year because we can’t code it out”.jem16 said:

What tax does are applied to each of your pensions? One of them isn’t being taxed at all which won’t help. Sounds like you need to speak to HMRC and get your tax codes worked out better to avoid this.bullinn1 said:First Paget 0

0 -

I think it is best to keep a close eye on the amounts yourself then the bill doesn't come as a surprise. I've just sent them 3K but I expected to do that and it was in my bank account. You can use sites like https://www.thesalarycalculator.co.uk/salary.php (remember to tick the "I don't pay NI button" ) to get some idea of the total amount payable in any one year. Have a go for this current tax year as soon as you get sight of your P60s in May / Junebullinn1 said:

Thank you jem16 Is it the responsibility of the pension provider to ensure my tax codes are correct … I know absolutely nothing about tax coding and during an hour long conversation they offered little advice basically saying “pay up and expect a demand every year because we can’t code it out”.jem16 said:

What tax does are applied to each of your pensions? One of them isn’t being taxed at all which won’t help. Sounds like you need to speak to HMRC and get your tax codes worked out better to avoid this.bullinn1 said:First Paget

I find tax codes are gobbledygook to me - I had 4 jobs and 3 codes at one point and it was only by adding the whole lot up and putting it into calculators that I could see how much tax I was likely to pay - HMRC tried to take as near as poss but it was always a bit adrift1 -

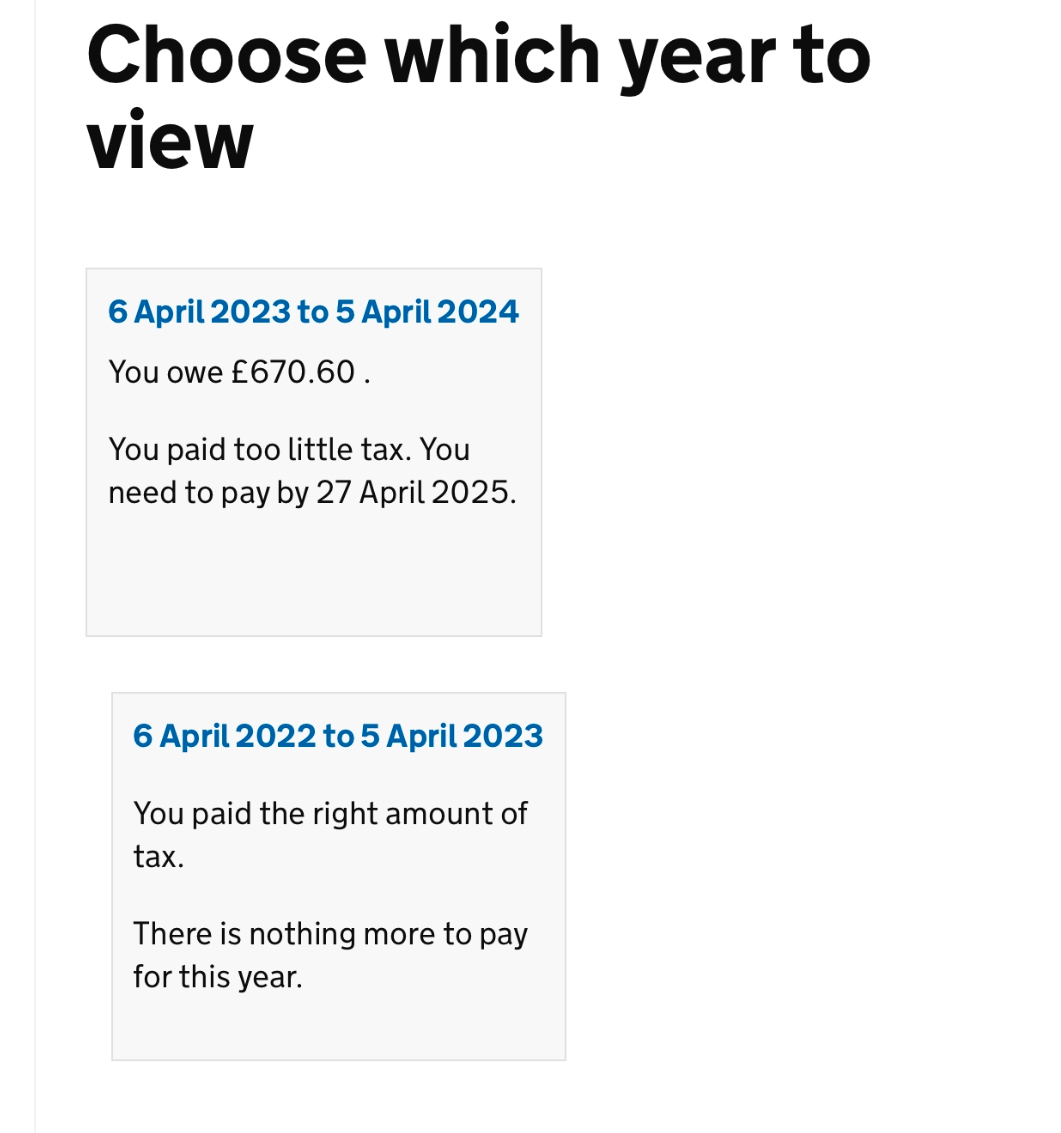

I very rarely look at the HMRC site, there’s never been a need to, I always, foolishly, figured they were handling things until I get a demand for £670. Also searching the site as I have I cannot find where the £670 comes from … if it’s on one or more of the several persons, what % on what ie what happened between ‘22/‘23 and ‘23/‘24.LHW99 said:So if you’re all not too bored with this I have looked more carefully at the HMRC site and found actual calculations,Which is another thing - if you don't regularly use the HMRC site, finding specific information through the links is difficult if you start by choosing the wrong section. Added to which, even if you are used to it, the tax account isn't updated particularly quickly to show any payments made (certainly not in days as the site implies IME).

It's where people really do need knowledgable help on the enquiry lines.

0 -

I was suggesting a computer error and not trivialising the incident.eskbanker said:

It really isn't anything like that at all - even if there was an error by a customer service agent, it's hardly comparable to the systematic persecution of sub-postmasters over many years, leading to false imprisonments, suicides, etc, so such hyperbole is pretty tasteless IMHO.bullinn1 said:So if you’re all not too bored with this I have looked more carefully at the HMRC site and found actual calculations, they seem to suggest that their representative gave me incorrect information when he said I owed circa £1,300 … it seems a little like the Post Office “Horizon” scandal ! Whilst I feel it’s a poor way of treating pensioners I will pay the amount but it “sucks” .

In any case, we're obviously not privy to the conversation(s) you had, but presumably if you underpaid tax by £670 in 2023/24, then chances are it'll be the same again in 2024/25, although they'll have the opportunity (but not the obligation) to adjust some tax codings to collect that before April.0 -

I don’t seem to have an option of 10 months to pay.Sarahspangles said:

This must have been considered, but instead they’ve implemented Simple Assessment. As this gives pensioners 10 months to pay, it doesn’t seem to me to disadvantage them.crv1963 said:I do wonder if taxing pensioners small(ish) amounts is actually cost effective for HMRC? My mother has been sent a tax bill for £267 all off her state pension income- no private pensions. I think personally that HMRC will have to create some method of collecting the sums via deduction as more get dragged into the fiscal drag. Not every pensioner is in the position to fork out several hundred pounds.

https://www.litrg.org.uk/tax-nic/how-tax-collected/simple-assessment 0

0 -

The 10 months reference relates to the tax being payable roughly 10 months after the end of the tax year.bullinn1 said:

I don’t seem to have an option of 10 months to pay.Sarahspangles said:

This must have been considered, but instead they’ve implemented Simple Assessment. As this gives pensioners 10 months to pay, it doesn’t seem to me to disadvantage them.crv1963 said:I do wonder if taxing pensioners small(ish) amounts is actually cost effective for HMRC? My mother has been sent a tax bill for £267 all off her state pension income- no private pensions. I think personally that HMRC will have to create some method of collecting the sums via deduction as more get dragged into the fiscal drag. Not every pensioner is in the position to fork out several hundred pounds.

https://www.litrg.org.uk/tax-nic/how-tax-collected/simple-assessment

In your case it is payable nearly 13 months after the end of the tax year the tax is owed for.3 -

No it’s not the pension provider’s responsibility. They will use the codes that HMRC gives them. It’s really between you and HMRC.bullinn1 said:

Thank you jem16 Is it the responsibility of the pension provider to ensure my tax codes are correct … I know absolutely nothing about tax coding and during an hour long conversation they offered little advice basically saying “pay up and expect a demand every year because we can’t code it out”.jem16 said:

What tax does are applied to each of your pensions? One of them isn’t being taxed at all which won’t help. Sounds like you need to speak to HMRC and get your tax codes worked out better to avoid this.bullinn1 said:First Paget 2

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards