We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

HMRC Debt

Comments

-

The OP has stated they have several pensions other than the SP.Qyburn said:

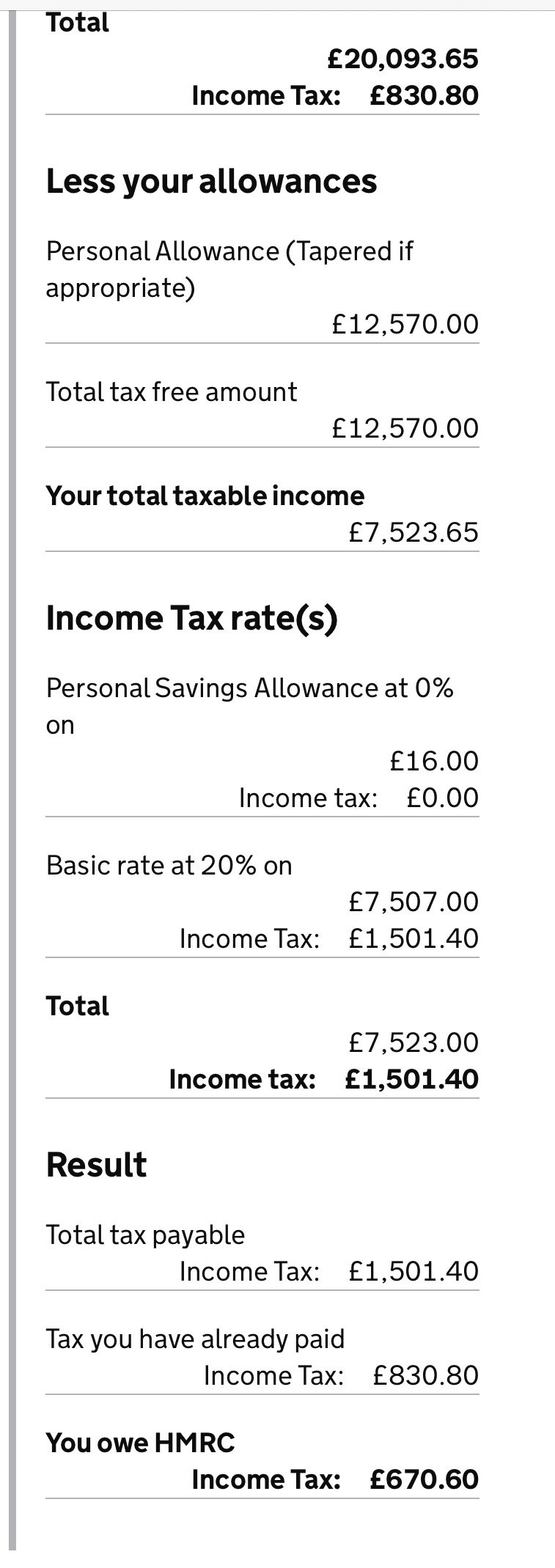

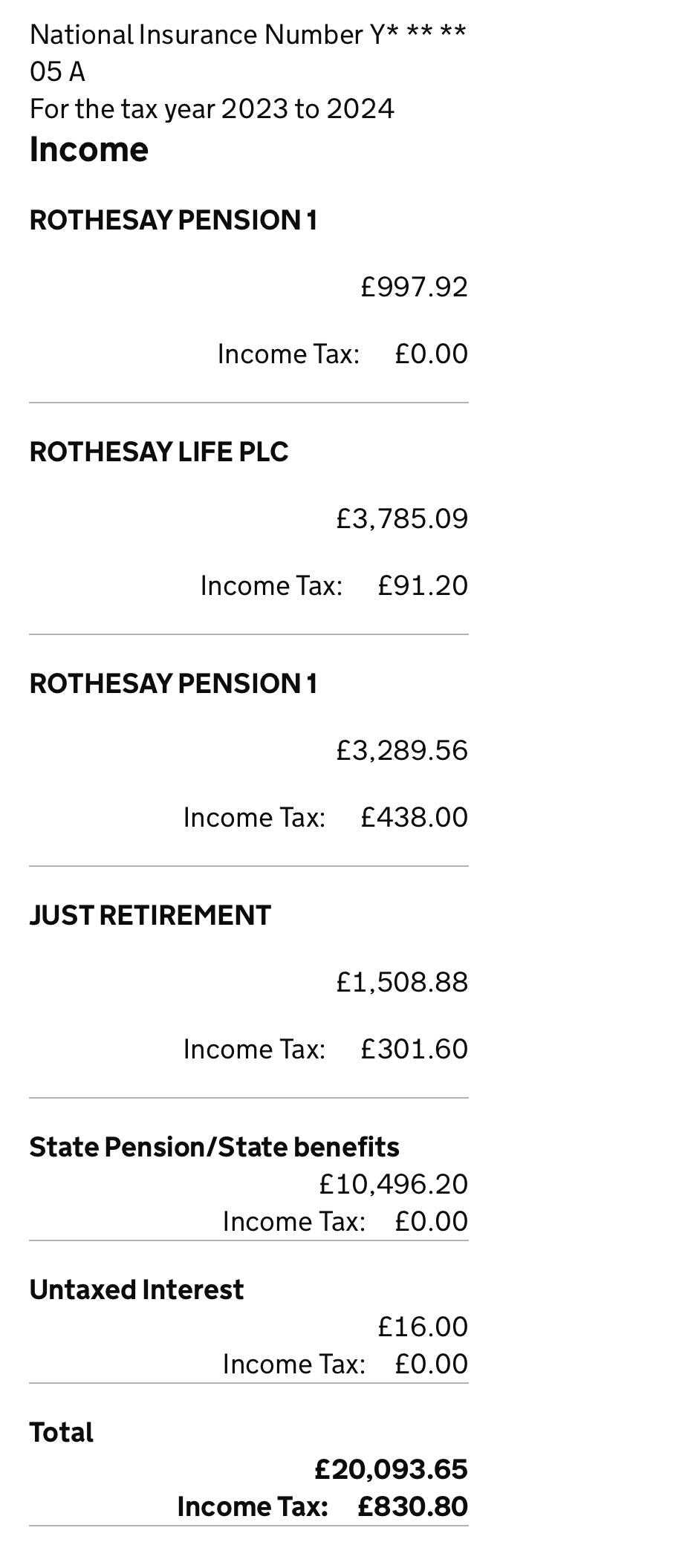

Do you have just the one pension, the State Pension? How much was it, roughly, for each of those two years?rogertb said:I do not understand, I am 74 and have not had to think about tax on my pensions for years figuring that HMRC and the Pension Service were handling it. However I have now been asked for £670 for each of the last two tax years ie £1,340.In an attempt to keep this brief and after several conversations with HMRC the only explanation is that my pension has increased but my tax-free allowance has not.

Tax of £670 suggests income of around £15,900 per year, or £306 per week. High but not impossible if there was a lot of SERPS accrued. But I would have expected that weekly figure to have increased from 2022/23 to 2023/24.

Thanks D&C and Dizzycap I have state pension and several small company pensions totalling (£1,350 net/month)0 -

So if you’re all not too bored with this I have looked more carefully at the HMRC site and found actual calculations, they seem to suggest that their representative gave me incorrect information when he said I owed circa £1,300 … it seems a little like the Post Office “Horizon” scandal ! Whilst I feel it’s a poor way of treating pensioners I will pay the amount but it “sucks” .

0

0 -

First page

0

0 -

I do wonder if taxing pensioners small(ish) amounts is actually cost effective for HMRC? My mother has been sent a tax bill for £267 all off her state pension income- no private pensions. I think personally that HMRC will have to create some method of collecting the sums via deduction as more get dragged into the fiscal drag. Not every pensioner is in the position to fork out several hundred pounds.CRV1963- Light bulb moment Sept 15- Planning the great escape- aka retirement!3

-

they will certainly need warning in advance that they may get a bill. Tax codes can be applied to other pensions am sure they could do the same for state pensionscrv1963 said:I do wonder if taxing pensioners small(ish) amounts is actually cost effective for HMRC? My mother has been sent a tax bill for £267 all off her state pension income- no private pensions. I think personally that HMRC will have to create some method of collecting the sums via deduction as more get dragged into the fiscal drag. Not every pensioner is in the position to fork out several hundred pounds.1 -

But at what cost for the computer system to do it ? (Both to the national purse and the sanity of the "customers")Flugelhorn said:

they will certainly need warning in advance that they may get a bill. Tax codes can be applied to other pensions am sure they could do the same for state pensionscrv1963 said:I do wonder if taxing pensioners small(ish) amounts is actually cost effective for HMRC? My mother has been sent a tax bill for £267 all off her state pension income- no private pensions. I think personally that HMRC will have to create some method of collecting the sums via deduction as more get dragged into the fiscal drag. Not every pensioner is in the position to fork out several hundred pounds.

1 -

agree! bound to turn a relatively straightforward matter into utter chaos. My SP started late last year and my code for my NHS pension changed within 4 days so something works fairly quickly when it wants tomolerat said:

But at what cost for the computer system to do it ? (Both to the national purse and the sanity of the "customers")Flugelhorn said:

they will certainly need warning in advance that they may get a bill. Tax codes can be applied to other pensions am sure they could do the same for state pensionscrv1963 said:I do wonder if taxing pensioners small(ish) amounts is actually cost effective for HMRC? My mother has been sent a tax bill for £267 all off her state pension income- no private pensions. I think personally that HMRC will have to create some method of collecting the sums via deduction as more get dragged into the fiscal drag. Not every pensioner is in the position to fork out several hundred pounds.0 -

And as it would be DWP implementing the new system what cost for sorting the issues that would inevitably arise!molerat said:

But at what cost for the computer system to do it ?Flugelhorn said:

they will certainly need warning in advance that they may get a bill. Tax codes can be applied to other pensions am sure they could do the same for state pensionscrv1963 said:I do wonder if taxing pensioners small(ish) amounts is actually cost effective for HMRC? My mother has been sent a tax bill for £267 all off her state pension income- no private pensions. I think personally that HMRC will have to create some method of collecting the sums via deduction as more get dragged into the fiscal drag. Not every pensioner is in the position to fork out several hundred pounds.

Ensuring each pensioner gets the letter each year detailing the new award and adding some prominent tax information to forewarn people there could be tax to pay direct to HMRC would be a much cheaper option than creating a system for DWP to deduct tax at source.1 -

So if you’re all not too bored with this I have looked more carefully at the HMRC site and found actual calculations,

Which is another thing - if you don't regularly use the HMRC site, finding specific information through the links is difficult if you start by choosing the wrong section. Added to which, even if you are used to it, the tax account isn't updated particularly quickly to show any payments made (certainly not in days as the site implies IME).

It's where people really do need knowledgable help on the enquiry lines.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards