We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

HMRC Tax Code changes are on their way

Comments

-

Actually the tax owed from an earlier can relate to 2024-25.eskbanker said:

The £4,600 untaxed interest will presumably relate to 2025/26 if that's the year the code refers to.GalacticaActual said:Just received my tax code in the post for the new tax year, starting 6 April 2025.

Untaxed Interest - this is an estimate of the interest you will receive during the year. Doesn’t specify which tax year but they’ve put in a figure of £4,600.

Tax you owe (earlier year) - I still owe £111 from an earlier tax year, apparently (must be 2024/25 tax year as per K tax code issued 1st Jan 2025). Adjustment made to tax code for 2025/26 to accommodate owed tax.

Tax code will be 733L from 6 April 2025.

The tax owed from an earlier tax year must be 2023/24, as they can't have calculated tax owed for 2024/25 yet, even if they've used an estimate of interest to adjust your 2024/25 coding (a separate issue from what you're seeing in this coding notice) - it's normal for collection of underpaid tax to skip a year, i.e. any deficit from 2023/24 will be collected in 2025/26, not 2024/25.

Although HMRC normally include estimated underpayments in the tax code of the tax year they arise, once it gets closer to the end of the tax year the time available to collect the (estimated) tax owed means the adjustment needed to collect the tax over 2-3 months can be huge.

So instead of including the tax owed in the new code for that year they move it into the following year. So a new code issued on 1 January 2025 which estimated tax owed of £111 could well result in an adjustment in the 2025-26 code, not the 2024-25 code (as far as the £111 was concerned).

However LITRG mention a specific date of 5 January in relation to this so maybe @GalacticaActual's situation was different?

https://www.litrg.org.uk/tax-nic/how-tax-collected/pay-you-earn-paye/paye-codes#81 -

Thanks for the feedback everyone.

I mentioned on page 2 of this thread:

“Anyway, I’ve already had a chunk of tax deducted on 2nd January relating to December’s wages. The tax code letter says I owe £570 to HMRC, so they will collect £458 in equal instalments from my wages by 5 April 2025. Then the remaining amount of £112 will be collected from 6 April 2025, in equal instalments.”

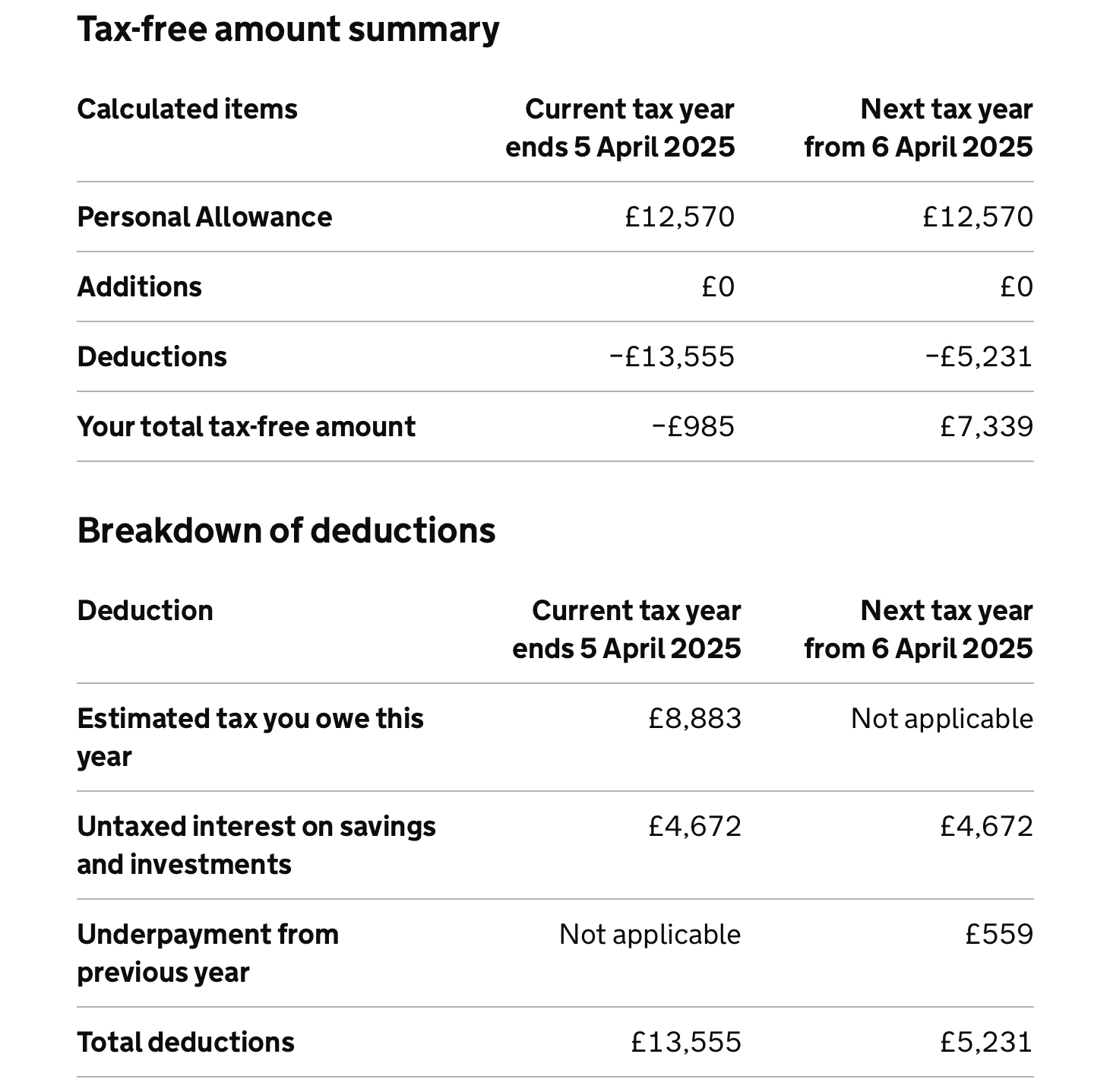

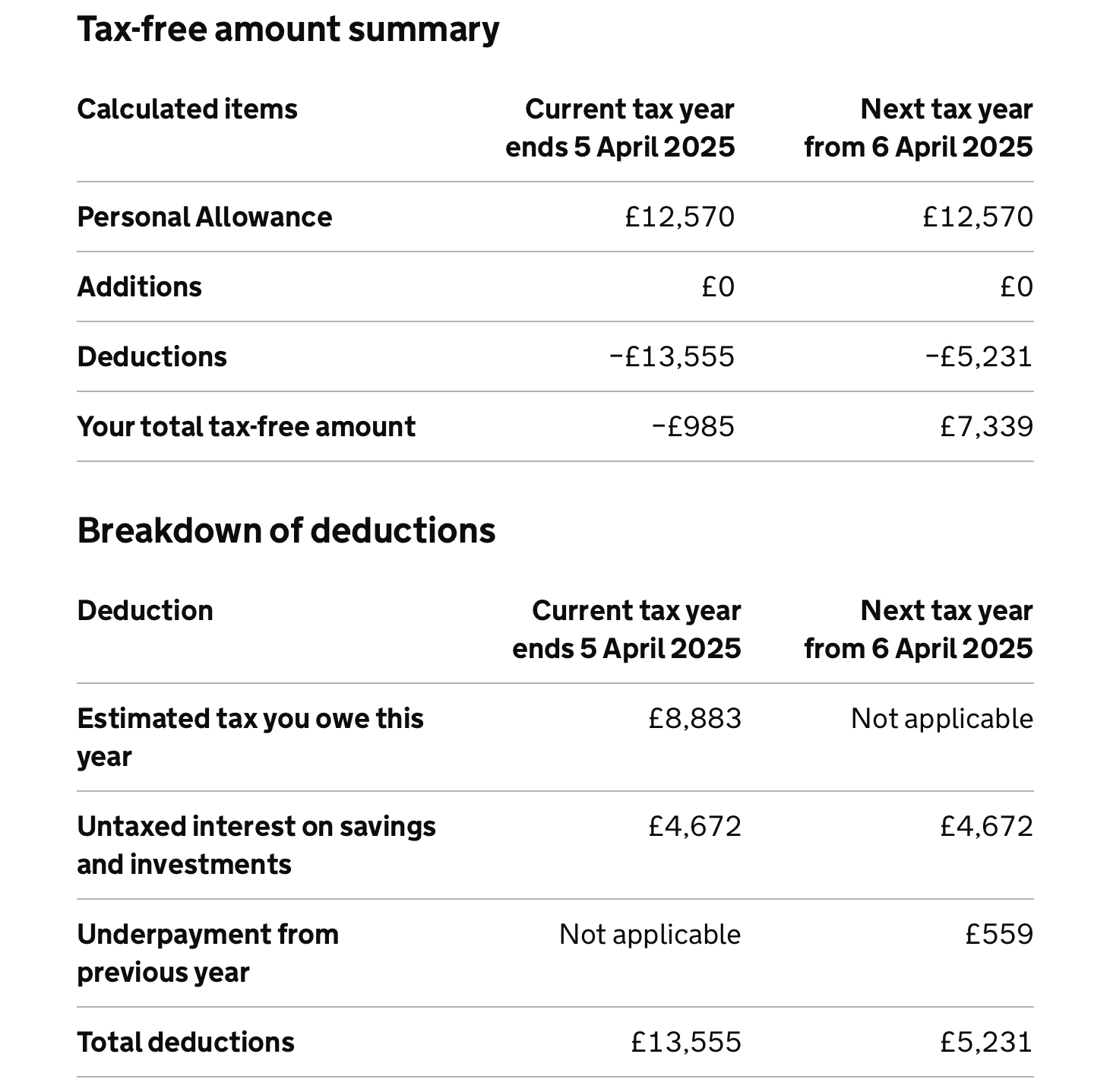

I’ve just checked my online tax record and it’s showing this for the current and new tax years:

0 -

So as that £559 will be in place for the whole year it is expected to collect £111.80 from a basic rate payer (559 x 20%).GalacticaActual said:Thanks for the feedback everyone.

I mentioned on page 2 of this thread:

“Anyway, I’ve already had a chunk of tax deducted on 2nd January relating to December’s wages. The tax code letter says I owe £570 to HMRC, so they will collect £458 in equal instalments from my wages by 5 April 2025. Then the remaining amount of £112 will be collected from 6 April 2025, in equal instalments.”

I’ve just checked my online tax record and it’s showing this for the current and new tax years:

There's nothing you can do to directly alter that but if the untaxed interest estimate (£5,672?) is more than you expect to receive for 2024-25 then you can ask HMRC to use your figures instead. And that might in turn impact the estimated tax owed and have a knock on impact to the estimated tax owed.2 -

Thanks @Dazed_and_C0nfusedDazed_and_C0nfused said:GalacticaActual said:Thanks for the feedback everyone.

There's nothing you can do to directly alter that but if the untaxed interest estimate (£5,672?) is more than you expect to receive for 2024-25 then you can ask HMRC to use your figures instead. And that might in turn impact the estimated tax owed and have a knock on impact to the estimated tax owed.

The HMRC estimate is about right, as of today, although I am expecting interest from Yorkshire Building Society (31st March) and NS&I (by 5th April).

This may result in an additional £200-£300 interest but hopefully HMRC will adjust my tax code again when they receive the necessary interest figures later this year from the various financial institutions.0 -

Is interest paid at the end of a tax year or a year from when the account was opened? I opened YBS and NS&I summer 2024.0

-

It will depend on the terms of each account.sarah_25 said:Is interest paid at the end of a tax year or a year from when the account was opened? I opened YBS and NS&I summer 2024.

Could by 31 March. Or 5 April. Or anniversary of the opening date. Or a fixed date near the anniversary. Or any other option you can think of to be honest. Each bank will have its own rules/reasons for when they pay interest.0 -

Thanks, it's a watch and wait then unless I can be bothered to sit around on a phone line waiting for them to answer.

0 -

Do you not have the details (an email?) with the terms from when you opened each account?sarah_25 said:Thanks, it's a watch and wait then unless I can be bothered to sit around on a phone line waiting for them to answer.

1 -

Why not just visit the two websites to view the product terms, if you didn't retain copies of useful information when opening? Interest payment schedules are normally prominently displayed in summary boxes rather than buried within small print, so it should take no more than a couple of minutes to find answers to your questions....sarah_25 said:Thanks, it's a watch and wait then unless I can be bothered to sit around on a phone line waiting for them to answer.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards