We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Mortgage: Tracker vs Fixed Rate Predictions

houmie

Posts: 224 Forumite

Hello,

I currently have a tracker mortgage with HSBC at 5.04%, which ends in February.

I'm considering my options and wondering about interest rate predictions for the next 2 years. Will rates continue to decrease? Should I stay on a tracker or switch to a fixed rate?

My options are:

Tracker: 4.89% for 2 years (£999 fees)

Fixed: 4.20% for 2 years (£999 fees)

Fixed: 4.44% for 2 years (£0 fees)

The last option seems to be the best, as it results in the lowest total cost over 2 years compared to the other plans. However, I'm considering whether I should take the risk with a tracker mortgage in hopes of benefiting from lower interest rates.

What would you do? And do you know if there are any Bank of England announcements expected in the next 2 weeks?

Many thanks

0

Comments

-

Banks' fixed rates are based on their own predictions, made by experts whose only job is to predict.

Do you want to beat them?

For you it's just a gamble. Chose the option that suits you best - depending on your risk attitude.

Both fixed options are likely to cost you in total about the same over 2 years.

>> Are we expecting BOE to remain at 4.75% on 8th February 2025?houmie said:...And do you know if there are any Bank of England announcements expected in the next 2 weeks?1 -

What is your overall intent? Pay the lowest monthly, the lowest over the period of the fix, assured liability? These will influence the selection differently?houmie said:Hello,I currently have a tracker mortgage with HSBC at 5.04%, which ends in February.I'm considering my options and wondering about interest rate predictions for the next 2 years. Will rates continue to decrease? Should I stay on a tracker or switch to a fixed rate?My options are:Tracker: 4.89% for 2 years (£999 fees)Fixed: 4.20% for 2 years (£999 fees)Fixed: 4.44% for 2 years (£0 fees)The last option seems to be the best, as it results in the lowest total cost over 2 years compared to the other plans. However, I'm considering whether I should take the risk with a tracker mortgage in hopes of benefiting from lower interest rates.What would you do? And do you know if there are any Bank of England announcements expected in the next 2 weeks?Many thanks

Why only 2 years?

What options are available for 5 yr or longer fixes?

How much outstanding and how long left?

Any intent to overpay and pay off early?

There is the purely mathematical calculation of cost but there is also the less tangible aspect of peace of mind. Your question over simplifies the issue.1 -

Why 2 years only?

There are other factors behind the rates that banks offer on their products. Not entirely linked to base rate. Given there's still options at beneath the current BOE base rate of 4.75%. Normality will have finally returned once lending rates are higher than base rate. There's still a long way to go yet.0 -

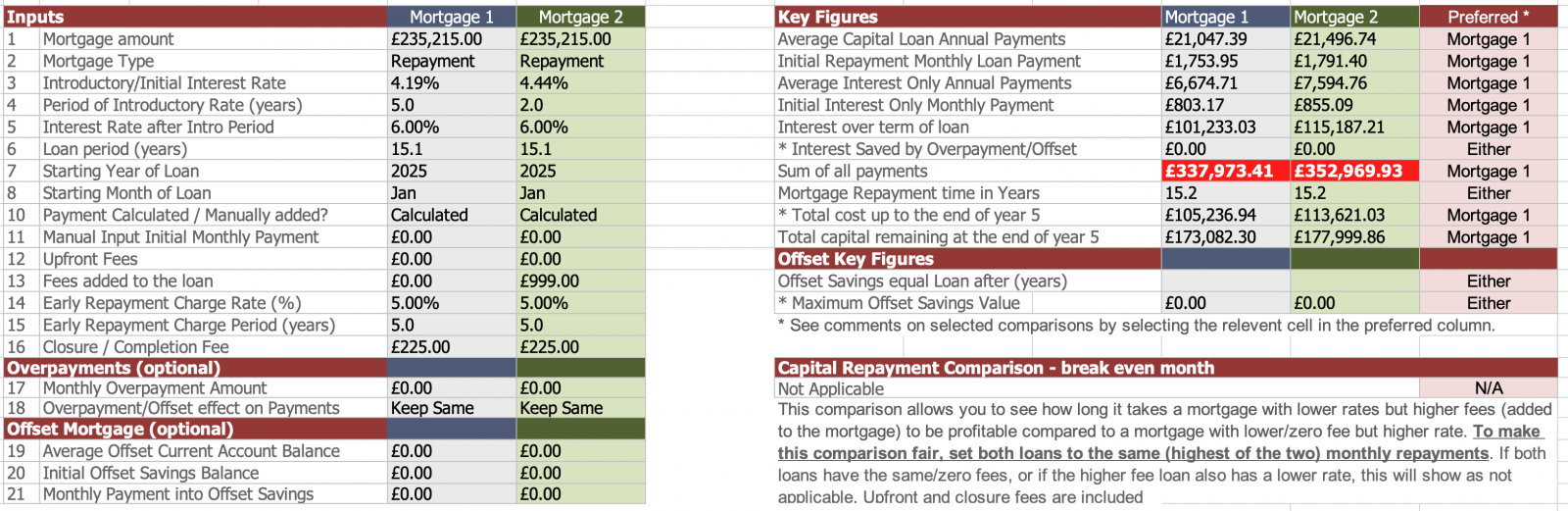

Thanks everyone for your replies. Sorry, I should have provided more details. I'm not in a great place job-wise, hence I can't remortgage outside my bank, HSBC.My current situation:- £235,215 mortgage left to pay- 15 years and 1 month leftAvailable Fixed deals:2-year fixed:- 4.20% (£999 fees)- 4.44% (£0 fees)3-year fixed:- 4.13% (£999 fees)- 4.40% (£0 fees)5-year fixed:- 4.03% (£999 fees)- 4.19% (£0 fees)10-year fixed:- 4.59% (£999 fees)- 4.74% (£0 fees)The 10-year option seems too long, as I expect the economy will improve once the war in Ukraine is over. The 2, 3 or 5-year options might be more suitable.While having lower monthly payments would be helpful in my current situation, I've also been considering the total mortgage debt over time. For example, with the 2-year fixed rate:- £0 fees option: debt after 2 years = £212,120- £999 fees option: debt after 2 years = £212,613The £0 fees option would reduce the debt by £493 more, but I'm unsure if this is the right way to analyse it. Perhaps lower monthly payments should be my priority given my current circumstances.

If my business improves, I would like to make overpayments to clear the mortgage sooner.Thanks for helping me think this through.0 -

How do intend to pay the £999 fee ?houmie said:The £0 fees option would reduce the debt by £493 more, but I'm unsure if this is the right way to analyse it. Perhaps lower monthly payments should be my priority given my current circumstances.

Important to compare the monthly outgoing not just the balance left at the end of the fixed term.

In the example you've given. By not paying a fee and instead overpaying the mortgage by £999 over two years. You'd owe considerably less.0 -

With 15 years left I would pitch in for 5 years fixed without fee:

SVR follow on rate @6% after 2 years - might be more might be less- increase payments to £1907 on 5 year fix and £1960ish on 2 year fix.

With this illustration and figures approx £40 per month cheaper, cheaper by year 5 by over 8K, overall just shy of £15k cheaper.

I would also check what options you have for overpaying as some lenders, especially Halifax, are reticent to allow borrowers the flexibility to maximise interest savings by sustaining the same monthly payments and paying off the mortgage early. This inhibits your potential savings.0 -

Yes, the 5 years seem cheaper because the other option is calculated with 6% after year 2. Unless I'm misunderstanding this.0

-

Yes. I made that absolutely clear, it was that bit in bold!

Can be reworked as you see fit but then that's the crux of the problem isn't it 🤷🏼

The maths provide the answer but the answer doesn't accommodate the expectations or the reality and only hindsight will tell 🫣

You can try and assert that one thing is more likely than another but at the end of the day that will be biased according to your perspective or desire, as people will frequently skew reality to support the decision they have already made.

You want what's best for you, only you know what you can tolerate and you should be prepared to put the leg work in. So play away to your hearts content. https://www.locostfireblade.co.uk/spreadsheet/Index.html and see where the break points are, what would it "cost" if the SVR stayed at 4ish % or fell to 3.5%, 2.5% and then see where you can put the realism into that occurring. As that's the flip of the coin.

ETA Please ensure you compare after the longest fixed rate eg 5 years as at this point you are free to remortgage so both models should only be trusted to run to this point.

You can then rinse and repeat to see what suits best for the next period.

Otherwise it's 4319mm2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards