We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Tax on savings

Comments

-

Your tax code will not only reflect paying back the tax on interest from last year but an estimate to collect this years probably assuming you are going to receive a similar amount0

-

Where does the £251 come from? 20% of £148 is £29.60, and 20% of £1148 is £229.60. 40% of £648 (1148 - 500) is £259.0

-

Have you looked at something described as your detailed income tax estimate?Pingu1 said:Where does the £251 come from? 20% of £148 is £29.60, and 20% of £1148 is £229.60. 40% of £648 (1148 - 500) is £259.

That shows the total interest figure HMRC have used for the current tax year.

You will get more help if you provide the breakdown of your tax code as well as the total (estimated) figure HMRC have for the current tax year.0 -

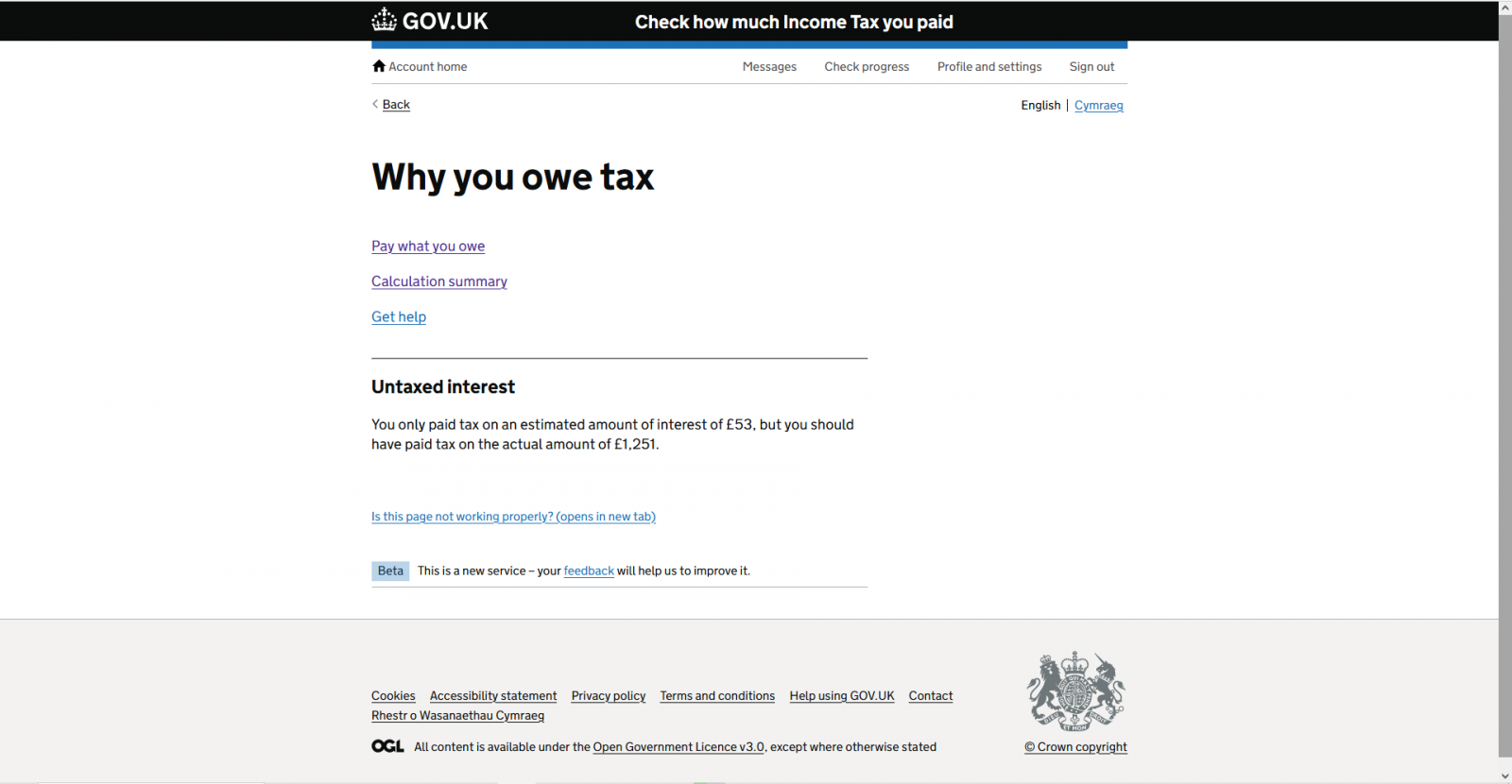

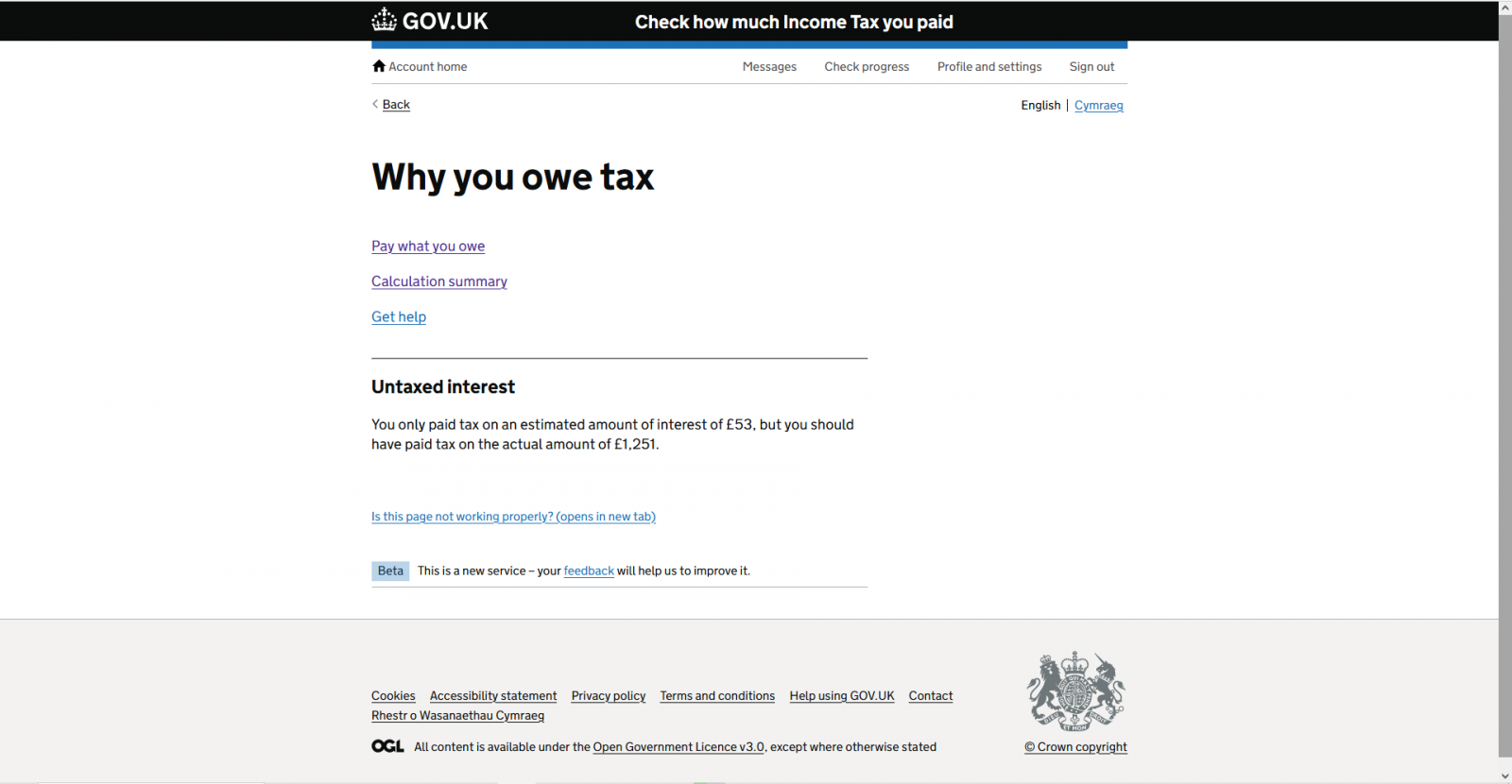

I have found the following page. I went onto my internet banking to double check my calculations and discovered a page summarising the interest accured for 2023/2024. I'm with Nationwide and forgot to include the £100 fairer share payment. I also missed out a savings account entirely as I wasn't looking at the right page. £1251 is correct, so I do indeed owe £53 in tax. Interestingly, the letter they sent was incorrect. There doesn't seem to be a detailed income tax estimate on HRMC, at least none that I can see. If I pay the £52 up front, will my tax code revert back to 1257L?

0

0 -

Thanks for all the help and advice.0

-

If you find your current year tax code and click on all the links available one is called Detailed Income Tax Estimate. But from what you have posted that is likely to show you the £1,251 you are expecting (as an estimate).Pingu1 said:I have found the following page. I went onto my internet banking to double check my calculations and discovered a page summarising the interest accured for 2023/2024. I'm with Nationwide and forgot to include the £100 fairer share payment. I also missed out a savings account entirely as I wasn't looking at the right page. £1251 is correct, so I do indeed owe £53 in tax. Interestingly, the letter they sent was incorrect. There doesn't seem to be a detailed income tax estimate on HRMC, at least none that I can see. If I pay the £52 up front, will my tax code revert back to 1257L?

And I don't think so no, paying the tax owed will remove that element but won't impact any estimate HMRC are using for your untaxed interest.

So it might be a slightly lower code than 1257L still from April.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards