We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

So did I. Did you see this though?, kindly posted earlier by #CricketLadyjameseonline said:

I already sawPowerSavingMode said:

Monmouthshirejameseonline said:I've got 2 transactions for my Monmouthshire 7%, 1 shows + £1000 CR the other + - £1000 CR, both dated 2025-12-01 (they really should be using UK date format) is that normal or has something gone wrong?There have been a fair number of posts on this today (2nd December), but this should help:ChewyyBacca said:Update on Monmouth BS Reg Saver credit reversals

I just rang them, the nice lady was apologetic for the inconvenience & following is the gist.

This should save many their time & also not clog the Monmouth lines

1. They are aware of the issue. It is building society wide problem, their IT is looking into it. They do not have a time line for resolution, but they are trying to get it done today.

2. The money isnt sent to source account, its sat in their (Monmouth) account

3. There wont be any interest loss, once resolved, the interest will be backdated to 1 Dec if they received money on 1 Dec.

4. If they resolve it today before EOD, it wont be reflected in the app/online, until tomorrow.

Re Monmouthshire - 9.33am, just had a reply!

"Thank you for your online enquiry, we are aware of this issue regarding standing orders from yesterday showing as reversed and our team are working on rectifying this as soon as possible. Please be reassured no funds will be returned and they will be backdated and recredited to the account to ensure no loss of interest."

This was by email within ten minutes of my message via their app.

xxx1 -

I go through all the replies to this thread asap hence why I've just replied to several messages from the point I got upto yesterdayMiddle_of_the_Road said:

So did I. Did you see this though?, kindly posted earlier by #CricketLadyjameseonline said:

I already sawPowerSavingMode said:

Monmouthshirejameseonline said:I've got 2 transactions for my Monmouthshire 7%, 1 shows + £1000 CR the other + - £1000 CR, both dated 2025-12-01 (they really should be using UK date format) is that normal or has something gone wrong?There have been a fair number of posts on this today (2nd December), but this should help:ChewyyBacca said:Update on Monmouth BS Reg Saver credit reversals

I just rang them, the nice lady was apologetic for the inconvenience & following is the gist.

This should save many their time & also not clog the Monmouth lines

1. They are aware of the issue. It is building society wide problem, their IT is looking into it. They do not have a time line for resolution, but they are trying to get it done today.

2. The money isnt sent to source account, its sat in their (Monmouth) account

3. There wont be any interest loss, once resolved, the interest will be backdated to 1 Dec if they received money on 1 Dec.

4. If they resolve it today before EOD, it wont be reflected in the app/online, until tomorrow.

Re Monmouthshire - 9.33am, just had a reply!

"Thank you for your online enquiry, we are aware of this issue regarding standing orders from yesterday showing as reversed and our team are working on rectifying this as soon as possible. Please be reassured no funds will be returned and they will be backdated and recredited to the account to ensure no loss of interest."

This was by email within ten minutes of my message via their app.

xxx

I don't even do standing orders, only bank transfers/faster payments however you want to call it0 -

Working hours is the leading theory presently. Certainly the ones I've been rejected for have all been submitted during working hours.jameseonline said:

The system has been letting me up until the other day but clearly something has now triggered manual intervention, as for overpayments, never funded a regular principality with more than the stated £1200Dizzycap said:jameseonline said:

I said this the other day but: option 2, transfer bulk to virgin & reinvest £200 to "new" issue 4 (converted issue 3).Hattie627 said:

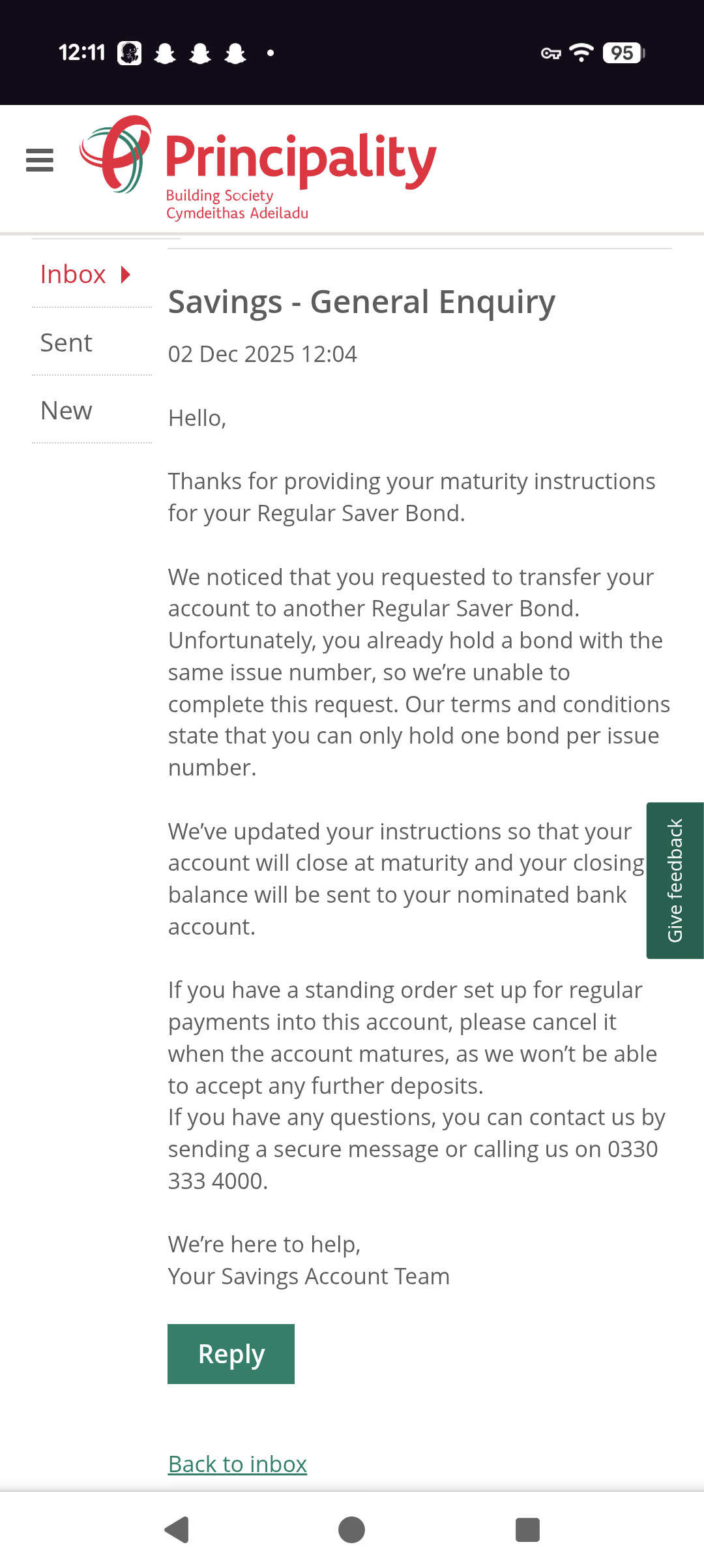

Oh dear. Can you talk us through how you entered the instructions which led to this. Did your instructions generate a "sent" secure message? Where did you instruct the funds coming out at maturity to go to (internal or external account?)jameseonline said:Bad news (for me at least) So guessing Principality are fixing loopholes & probably manually?, it's ok though still got my others & still got Monmouthshire & could still get a a First Direct if desperate.

So guessing Principality are fixing loopholes & probably manually?, it's ok though still got my others & still got Monmouthshire & could still get a a First Direct if desperate.

I'm wondering if Principality are checking when you reach a certain amount of accounts or something, there must be a trigger right?, maybe this site is the trigger, hmm 🤔

I'm defo on their watchlist now, wonder if it's because I submitted instructions during the day.

Hope Dylan doesn't hate me.

The screenshot is the secure message, the only thing I can really think of I did different was I submitted instructions during the day and not after hours but there's no way to be sure this is what triggered it, Principality might be checking accounts anyway.I've personally entered maturity option details both day & night online and as yet, haven't had a rejection to open a new account of anything that's been available at maturity. It would be very strange for Principality not to complete a maturity instruction if a product was showing available as a maturity option because the system would know you already hold another 6 month bond, Christmas saver etc etc.I'm assuming that you haven't made any over payments to the maximum permitted in the t&c's of the savings product that is about to mature i.e 7th payment to a 6 month bond etc?

There was a suggestion upthread that you do it after COB the last working day before maturity always works, and we've stuck to that since (including one last night). Obviously not ideal as eventually I'll forget, but it does work.4 -

Just seen your reply.jameseonline said:

I go through all the replies to this thread asap hence why I've just replied to several messages from the point I got upto yesterdayMiddle_of_the_Road said:

So did I. Did you see this though?, kindly posted earlier by #CricketLadyjameseonline said:

I already sawPowerSavingMode said:

Monmouthshirejameseonline said:I've got 2 transactions for my Monmouthshire 7%, 1 shows + £1000 CR the other + - £1000 CR, both dated 2025-12-01 (they really should be using UK date format) is that normal or has something gone wrong?There have been a fair number of posts on this today (2nd December), but this should help:ChewyyBacca said:Update on Monmouth BS Reg Saver credit reversals

I just rang them, the nice lady was apologetic for the inconvenience & following is the gist.

This should save many their time & also not clog the Monmouth lines

1. They are aware of the issue. It is building society wide problem, their IT is looking into it. They do not have a time line for resolution, but they are trying to get it done today.

2. The money isnt sent to source account, its sat in their (Monmouth) account

3. There wont be any interest loss, once resolved, the interest will be backdated to 1 Dec if they received money on 1 Dec.

4. If they resolve it today before EOD, it wont be reflected in the app/online, until tomorrow.

Re Monmouthshire - 9.33am, just had a reply!

"Thank you for your online enquiry, we are aware of this issue regarding standing orders from yesterday showing as reversed and our team are working on rectifying this as soon as possible. Please be reassured no funds will be returned and they will be backdated and recredited to the account to ensure no loss of interest."

This was by email within ten minutes of my message via their app.

xxx

I don't even do standing orders, only bank transfers/faster payments however you want to call it

Same here, generally.

Awaiting further developments.0 -

Mon BS

For what it's worth, just looked at my accounts via the app and two out of three are now showing the correct amounts. One still not showing payment.

edit: just to add, if I look via online, all three accounts are still showing the wrong amounts.I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.2 -

For anyone looking for some non-MonBS content, here's something:

Anyone so minded as to try for the postcode-restricted Chorley BS Regional Flexible Saver, and you aren't in the postcode area, for me this failed even with a branch visit and being a customer since 1999.

They were polite but adamant. (I was polite but "expressed my disappointment" ) 4

) 4 -

All the SO's I sent to all my Monmouth RS were credited and reversed, but my SOsent on the 1st to my Monbs Instant Access account arrived in full on the 2nd and wasn't reversed. I can only assume that it's a Monbs RS glitch rather than a Monbs account wide glitch.dealyboy said:

... noting that it was not only SOs. It was presumably any payment in by whatever method, in my case by FP transfer from external account to the HSBC holding account.CricketLady said:Re Monmouthshire - 9.33am, just had a reply!

"Thank you for your online enquiry, we are aware of this issue regarding standing orders from yesterday showing as reversed and our team are working on rectifying this as soon as possible. Please be reassured no funds will be returned and they will be backdated and recredited to the account to ensure no loss of interest."

This was by email within ten minutes of my message via their app.

xxx# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £60+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)2 -

This is posted on the Monmouthshire blog-trickydicky14 said:Mon BS

For what it's worth, just looked at my accounts via the app and two out of three are now showing the correct amounts. One still not showing payment.

edit: just to add, if I look via online, all three accounts are still showing the wrong amounts.

In the app, select "more" and then "blog"8 -

In their blog?Middle_of_the_Road said:

This is posted on the Monmouthshire blog-trickydicky14 said:Mon BS

For what it's worth, just looked at my accounts via the app and two out of three are now showing the correct amounts. One still not showing payment.

edit: just to add, if I look via online, all three accounts are still showing the wrong amounts.

In the app, select "more" and then "blog"

So not an email, not a banner on their homepage or on the app?

I know their tech resource is probably a little stretched at the moment but even so....7 -

even online, the applications are manually checked - it took a couple of days for them to open mine (as a new customer).happybagger said:For anyone looking for some non-MonBS content, here's something:

Anyone so minded as to try for the postcode-restricted Chorley BS Regional Flexible Saver, and you aren't in the postcode area, for me this failed even with a branch visit and being a customer since 1999.

They were polite but adamant. (I was polite but "expressed my disappointment" )

)

while i'm here, @bridlington1 - the special conditions for the the standard and regional Chorley RS on page 1 states "Only one Regular Saver and one Seasonal Saver can be held in any 12 month rolling period."

it should really be...

"Only one Regular Saver, one Seasonal Saver and one Regional 2 Year Flexible Saver can be held in any 12 month rolling period."5

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards