We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

10_66 said:

If you're successful at closing this account please post here. I rang to ask if this could be done earlier today but, unsurprisingly (as in KPI), they said no.orange-juice said:Progressive 7%No joy for me as I have a rainy day saver 3 (5.5%) opened. Have requested closure and hopefully try again.

i only have a pound in my account.No luck, like yourself and others on here. Funnily enough I'm sure I managed to open this current rainy day saver (5.5% reduced from 6%), while I still had the older, 7% rainy day saver so maybe they've tightened up their systems since.1 -

The difference between MBS & Scottish BS though is that the MBS Ts&Cs didn't rule out holding both the branch version and the app version.allegro120 said:

Scottish BSBridlington1 said:

They've also said they're planning to launch the online version at some point late this week/early next week.BestSeagull said:

I agree with you about passbooks. They are just clutter! I particularly dislike having to send one in at the end of the term so I asked Scottish BS that question and they said once it's opened it can be managed online, including withdrawal at maturity.where_are_we said:Sorry - "The Quaker" - I do not get sentimental with passbooks. I have a number of passbook RS`s including this one and they only add to admin. At least Scottish BS do online so ,after initial postal baloney, their RS can be managed easily. Lets hope the Maturity process doesn`t require posting in the passbook.

I'm still waiting for the application pack for the account to arrive so shall probably hold out till the online version emerges, if it gets pulled I can always send off a postal application the day it goes NLA and backdate everything so I don't lose out.

I've sent mine yesterday, didn't want to wait for something that might or might not happen. Also there could be a chance that they will allow to have both (like MonBS recently did). I'm not holding my breath, but you never now

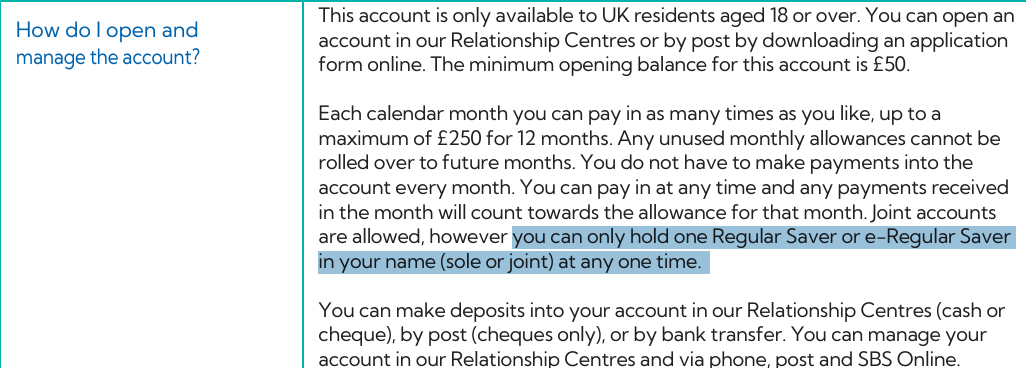

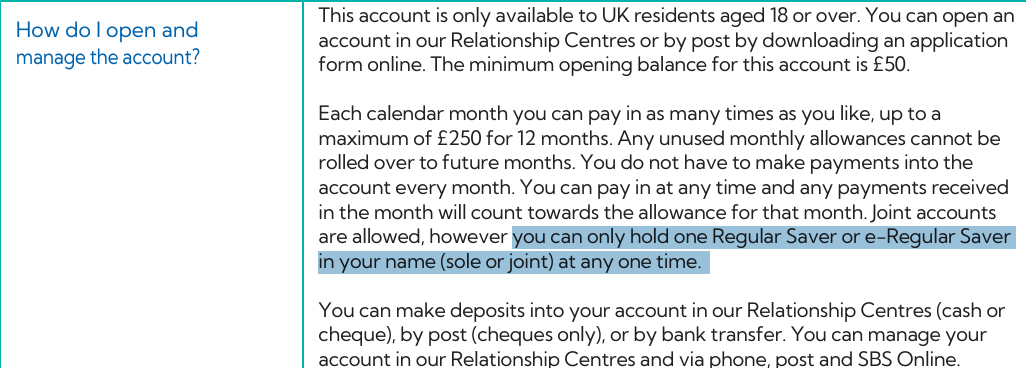

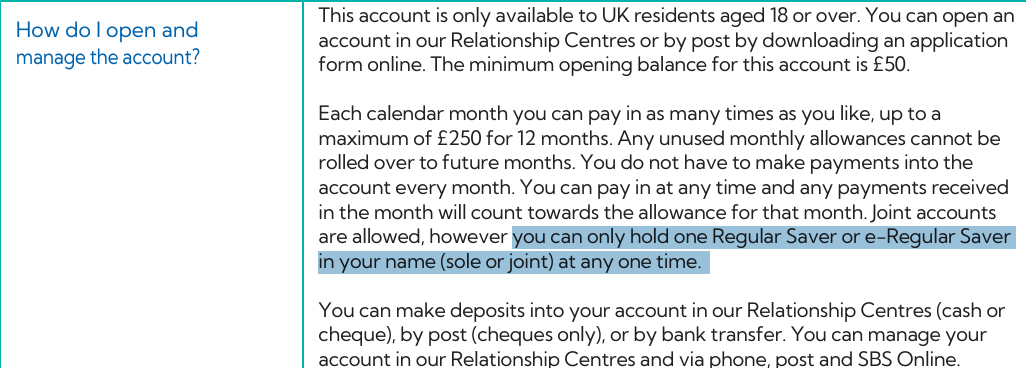

The Scottish BS RS includes this term though:

Scottish BS have also confirmed that the terms of the online version will be identical to the branch/post version barring the fact that it can't be opened in branch/post. Interest rate, max pay ins etc are to be identical to the branch/post account.

This would suggest to me that it'll be more like YBS's regular savers, where they offer a branch/post version and an online version with identical Ts&Cs, in which case holding one version excludes you from holding the other.

If given the choice I'd rather apply online a bit later in the month than apply by post earlier in the month so I'll hold on for the time being.9 -

Nominated account doesn't have a cheque bookhappybagger said:Fair play to Scottish BS, they called me to say I hadn't completed the nominated account details on the form. They said they'd take it off the cheque I had sent if that's what I wanted. Easy as that.

I went to the application form to check why I missed it - it's next to the section "how do you want interest paid", I ticked "add to this account" and thought (wrongly) that the boxes were for when interest was paid away.

Good on you SBS for not making more of it than necessary.0 -

Is that definitely how that sentence is to be understood. Could it not mean you can't hold 2 regular savers and similarly you can't hold 2 esavers.Bridlington1 said:

The difference between MBS & Scottish BS though is that the MBS Ts&Cs didn't rule out holding both the branch version and the app version.allegro120 said:

Scottish BSBridlington1 said:

They've also said they're planning to launch the online version at some point late this week/early next week.BestSeagull said:

I agree with you about passbooks. They are just clutter! I particularly dislike having to send one in at the end of the term so I asked Scottish BS that question and they said once it's opened it can be managed online, including withdrawal at maturity.where_are_we said:Sorry - "The Quaker" - I do not get sentimental with passbooks. I have a number of passbook RS`s including this one and they only add to admin. At least Scottish BS do online so ,after initial postal baloney, their RS can be managed easily. Lets hope the Maturity process doesn`t require posting in the passbook.

I'm still waiting for the application pack for the account to arrive so shall probably hold out till the online version emerges, if it gets pulled I can always send off a postal application the day it goes NLA and backdate everything so I don't lose out.

I've sent mine yesterday, didn't want to wait for something that might or might not happen. Also there could be a chance that they will allow to have both (like MonBS recently did). I'm not holding my breath, but you never now

The Scottish BS RS includes this term though:

Scottish BS have also confirmed that the terms of the online version will be identical to the branch/post version barring the fact that it can't be opened in branch/post. Interest rate, max pay ins etc are to be identical to the branch/post account.

This would suggest to me that it'll be more like YBS's regular savers, where they offer a branch/post version and an online version with identical Ts&Cs, in which case holding one version excludes you from holding the other.

If given the choice I'd rather apply online a bit later in the month than apply by post earlier in the month so I'll hold on for the time being.0 -

If they meant that they would surely say ‘you can only hold one Regular Saver and e-Regular Saver…’s71hj said:

Is that definitely how that sentence is to be understood. Could it not mean you can't hold 2 regular savers and similarly you can't hold 2 esavers.Bridlington1 said:

The difference between MBS & Scottish BS though is that the MBS Ts&Cs didn't rule out holding both the branch version and the app version.allegro120 said:

Scottish BSBridlington1 said:

They've also said they're planning to launch the online version at some point late this week/early next week.BestSeagull said:

I agree with you about passbooks. They are just clutter! I particularly dislike having to send one in at the end of the term so I asked Scottish BS that question and they said once it's opened it can be managed online, including withdrawal at maturity.where_are_we said:Sorry - "The Quaker" - I do not get sentimental with passbooks. I have a number of passbook RS`s including this one and they only add to admin. At least Scottish BS do online so ,after initial postal baloney, their RS can be managed easily. Lets hope the Maturity process doesn`t require posting in the passbook.

I'm still waiting for the application pack for the account to arrive so shall probably hold out till the online version emerges, if it gets pulled I can always send off a postal application the day it goes NLA and backdate everything so I don't lose out.

I've sent mine yesterday, didn't want to wait for something that might or might not happen. Also there could be a chance that they will allow to have both (like MonBS recently did). I'm not holding my breath, but you never now

The Scottish BS RS includes this term though:

Scottish BS have also confirmed that the terms of the online version will be identical to the branch/post version barring the fact that it can't be opened in branch/post. Interest rate, max pay ins etc are to be identical to the branch/post account.

This would suggest to me that it'll be more like YBS's regular savers, where they offer a branch/post version and an online version with identical Ts&Cs, in which case holding one version excludes you from holding the other.

If given the choice I'd rather apply online a bit later in the month than apply by post earlier in the month so I'll hold on for the time being.

0 -

Pleasant surprise to immediately be offered a 7.1% RS from Zopa when my 7.5% matured today.16 Panel (250W JASolar) 4kWp, facing 170 degrees, 40 degree slope, Solis Inverter. Installed 29/9/2015 - £4700 (Norfolk Solar Together Scheme); 9.6kWh US2000C Pylontech batteries + Solis Inverter installed 12/4/2022 Year target (PVGIS-CMSAF) = 3880kWh - Installer estimate 3452 kWh:Average over 6 years = 4400 :j8

-

The 7.1% RS has been on offer to everyone ever since the current account became "Biscuit" - unfortunately it's not fixed rate like the original 7.5% account was, but the rate has remained the same for a few months now.Rheumatoid said:Pleasant surprise to immediately be offered a 7.1% RS from Zopa when my 7.5% matured today.

Good to hear that you can open a new one straight away after maturity. Presumably this means that your deposit date each month doesn't need to change? (Zopa operates a "monthiversary" kind of thing, instead of resetting each calendar month.)2 -

not sure about deposits as I had cancelled the autosave into the 7.5% earlier this month and had to set up a new autosave for the 7.1% account.clairec666 said:

The 7.1% RS has been on offer to everyone ever since the current account became "Biscuit" - unfortunately it's not fixed rate like the original 7.5% account was, but the rate has remained the same for a few months now.Rheumatoid said:Pleasant surprise to immediately be offered a 7.1% RS from Zopa when my 7.5% matured today.

Good to hear that you can open a new one straight away after maturity. Presumably this means that your deposit date each month doesn't need to change? (Zopa operates a "monthiversary" kind of thing, instead of resetting each calendar month.)16 Panel (250W JASolar) 4kWp, facing 170 degrees, 40 degree slope, Solis Inverter. Installed 29/9/2015 - £4700 (Norfolk Solar Together Scheme); 9.6kWh US2000C Pylontech batteries + Solis Inverter installed 12/4/2022 Year target (PVGIS-CMSAF) = 3880kWh - Installer estimate 3452 kWh:Average over 6 years = 4400 :j1 -

Yes I can login and see the account - listed asflaneurs_lobster said:

Do you have online access to WestBrom? They do seem to distinguish between online and branch versions of the same product so do you know what type of EA you have?liamcov said:West Brom Reglar Saver issue 7

Maturity letter just says it will convert to a EA. Says can get passbook updated in branch. How is best to access the money (avoiding going to a branch)Fixed Rate Regular Saver (Issue 7)

0 -

I seem to remember that a withdrawal from the NW digital regular saver resulted in a loss of interest for that month. I presume I'm getting it mixed up with another account seeing as people seem to just cream off anything over 5k every month.16 Panel (250W JASolar) 4kWp, facing 170 degrees, 40 degree slope, Solis Inverter. Installed 29/9/2015 - £4700 (Norfolk Solar Together Scheme); 9.6kWh US2000C Pylontech batteries + Solis Inverter installed 12/4/2022 Year target (PVGIS-CMSAF) = 3880kWh - Installer estimate 3452 kWh:Average over 6 years = 4400 :j0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards