We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Surely for a 6 month account, those opened on August 29, 30 or 31 will mature on March 1,2 & 3 (although 1st is a Sunday)kermchem said:I have a Principality 1 year regular saver bond due to mature tomorrow, and already set up to roll to a new 6 month regular saver (because the online form offered that as an option). This would have been my third issue 3 6 month saver. Presumably tomorrow I am going to get an issue 4. And if I open an issue 4 this afternoon?

I do hope that Principality can cope in 6 months with all those accounts opened on August 28, 29, 30 and 31 maturing on February 28th.1 -

Can somebody please remind me about issue 3. I've got £1200 in it, can I make an additional payment on 1st September, account due to mature on 30th, or will it bounce back? If so, I need to cancel a standing order.Make £2026 in 2026

Prolific £156.37, TCB £8.24, Everup £12.17

Total £176.78 8.7%Make £2025 in 2025 Total £2241.23/£2025 110.7%

Prolific £1062.50, Octopoints £6.64, TCB £492.05, Tesco Clubcard challenges £89.90, Misc Sales £321, Airtime £70, Shopmium £53.06, Everup £106.08, Zopa CB £30, Misc survey £10

Make £2024 in 2024 Total £1410/£2024 70%Make £2023 in 2023 Total: £2606.33/£2023 128.8%0 -

Thanks for this nifty little hack. Annoyingly unlike some building societies the transfer of funds from the EA to the RS doesn't show instantly but hopefully quicker than awaiting COP.janusdesign said:Digital_Payback said:

Just funded £1 to the new Principality 6 month reg. saver, until COP is recognised.Aidanmc said:

Think it takes up to 24hrs in some cases. I continued with the transaction from Halifax even though the reference wasn't recognised. Triple checked it though!Digital_Payback said:

Managed to open the issue 4 easily enough, but now, wanting to fund it, Starling won’t recognise my account reference as valid.clairec666 said:

Hah, you beat me to it. If you edit the product code you can access accounts which aren't advertised on the website yet.surreysaver said:homestraight said:

HiBridlington1 said:

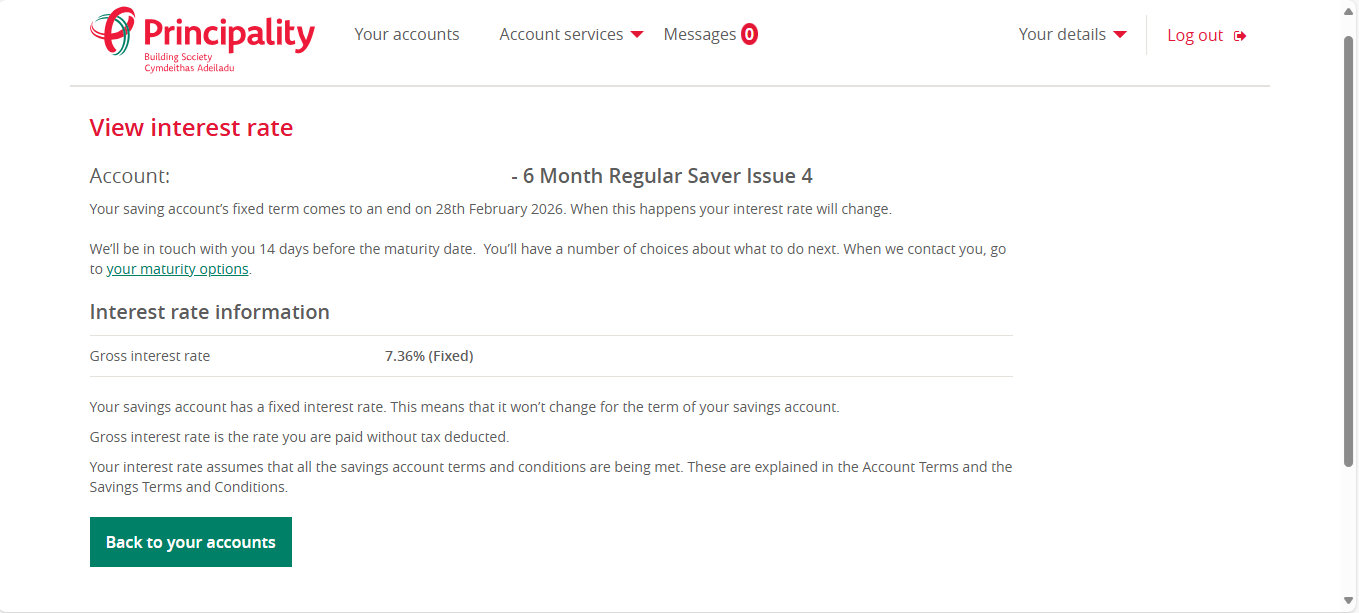

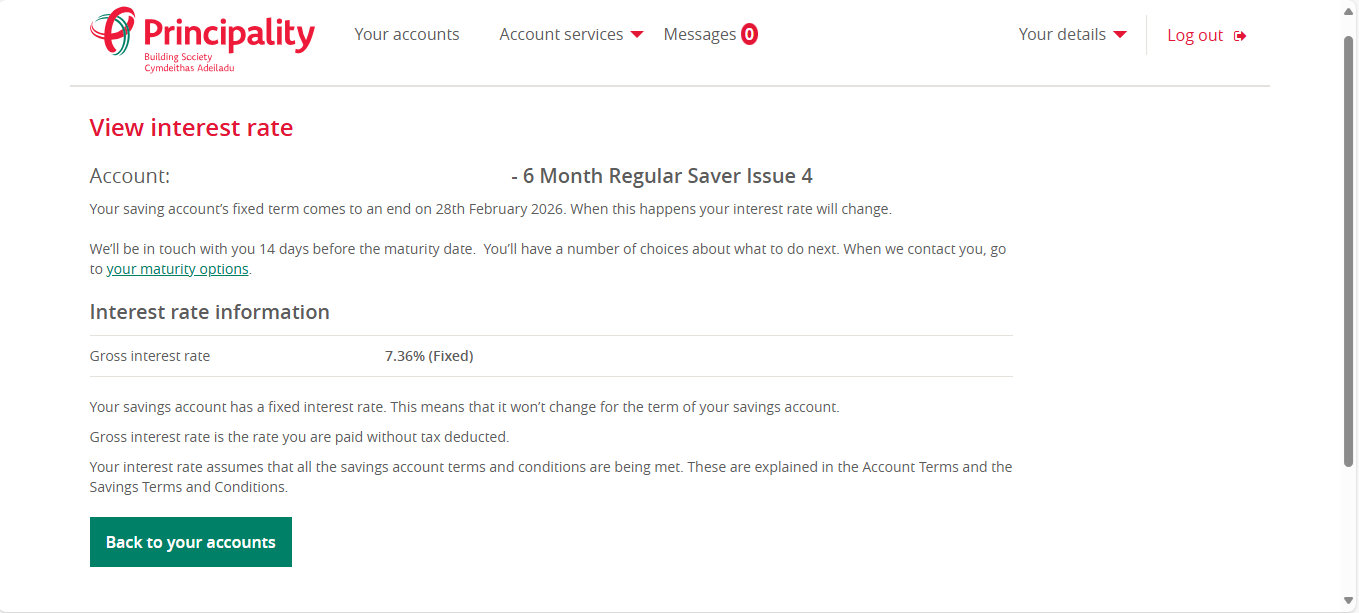

It's fixed, I opened and fully funded it shortly after midnight and this shows in online bankingclairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate.

Do you have a direct link please? I'm still getting issue 3 showing when I try to apply and an application is refused

Thanks

https://online.principality.co.uk/OriginationsUI/Step1?ProductCode=6086&ProductType=RegularSaver

Just went to the application for the Issue 3 and changed the 6084 to 6086 in the address barMaybe I just need to wait!I find it easier to keep an EA account (with £1 balance) with them for these purposes - I can move £200 to it now, wait for it to appear in the EA account and then internally move it to the new RS later today... and then come Monday when I do the RS deposits, the new account should pass CoP.I did toy with waiting until my next RS3 matures on the 13th and using this RS4 as the upgrade path - but easier to bite the bullet and open a new account... worst case, I only end up with this one account... best case, the other 3 x RS3 can be matured into 3 x RS4 (member of staff permitting).0 -

We don't know if Principality have closed the maturity loophole that permits multiple 6 month from being opened but in theory you might be able to hold multiple issues 4's same as issue 3's etc, but yea apply normally for an issue 4 1st then try maturity options.kermchem said:I have a Principality 1 year regular saver bond due to mature tomorrow, and already set up to roll to a new 6 month regular saver (because the online form offered that as an option). This would have been my third issue 3 6 month saver. Presumably tomorrow I am going to get an issue 4. And if I open an issue 4 this afternoon?

I do hope that Principality can cope in 6 months with all those accounts opened on August 28, 29, 30 and 31 maturing on February 28th.

If you applied for an Issue 3 via maturity I'm guessing they have to honour it, you'll know more tomorrow I guess, have you tried applying for an issue 4 today?0 -

Internal transfers i.e.EA to RS do show immediately. A payment from any bank to Principality EA takes a few hours to appear.s71hj said:

Thanks for this nifty little hack. Annoyingly unlike some building societies the transfer of funds from the EA to the RS doesn't show instantly but hopefully quicker than awaiting COP.janusdesign said:Digital_Payback said:

Just funded £1 to the new Principality 6 month reg. saver, until COP is recognised.Aidanmc said:

Think it takes up to 24hrs in some cases. I continued with the transaction from Halifax even though the reference wasn't recognised. Triple checked it though!Digital_Payback said:

Managed to open the issue 4 easily enough, but now, wanting to fund it, Starling won’t recognise my account reference as valid.clairec666 said:

Hah, you beat me to it. If you edit the product code you can access accounts which aren't advertised on the website yet.surreysaver said:homestraight said:

HiBridlington1 said:

It's fixed, I opened and fully funded it shortly after midnight and this shows in online bankingclairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate.

Do you have a direct link please? I'm still getting issue 3 showing when I try to apply and an application is refused

Thanks

https://online.principality.co.uk/OriginationsUI/Step1?ProductCode=6086&ProductType=RegularSaver

Just went to the application for the Issue 3 and changed the 6084 to 6086 in the address barMaybe I just need to wait!I find it easier to keep an EA account (with £1 balance) with them for these purposes - I can move £200 to it now, wait for it to appear in the EA account and then internally move it to the new RS later today... and then come Monday when I do the RS deposits, the new account should pass CoP.I did toy with waiting until my next RS3 matures on the 13th and using this RS4 as the upgrade path - but easier to bite the bullet and open a new account... worst case, I only end up with this one account... best case, the other 3 x RS3 can be matured into 3 x RS4 (member of staff permitting).2 -

I believe Principality have a max deposit balance in place so no extra paymentsSlinky said:Can somebody please remind me about issue 3. I've got £1200 in it, can I make an additional payment on 1st September, account due to mature on 30th, or will it bounce back? If so, I need to cancel a standing order.1 -

Correct, max is £1200jameseonline said:

I believe Principality have a max deposit balance in place so no extra paymentsSlinky said:Can somebody please remind me about issue 3. I've got £1200 in it, can I make an additional payment on 1st September, account due to mature on 30th, or will it bounce back? If so, I need to cancel a standing order.3 -

Mine didn't nt seem to I'll check back now.jameseonline said:

I believe Principality have a max deposit balance in place so no extra paymentsSlinky said:Can somebody please remind me about issue 3. I've got £1200 in it, can I make an additional payment on 1st September, account due to mature on 30th, or will it bounce back? If so, I need to cancel a standing order.0 -

It's in the Summary Sheet for Issue 3 & 4, just below the para stating that you can't have more than one account of the same issue.......s71hj said:

Mine didn't nt seem to I'll check back now.jameseonline said:

I believe Principality have a max deposit balance in place so no extra paymentsSlinky said:Can somebody please remind me about issue 3. I've got £1200 in it, can I make an additional payment on 1st September, account due to mature on 30th, or will it bounce back? If so, I need to cancel a standing order.0 -

Principality 13th Paymentflaneurs_lobster said:

It's in the Summary Sheet for Issue 3 & 4, just below the para stating that you can't have more than one account of the same issue.......s71hj said:

Mine didn't nt seem to I'll check back now.jameseonline said:

I believe Principality have a max deposit balance in place so no extra paymentsSlinky said:Can somebody please remind me about issue 3. I've got £1200 in it, can I make an additional payment on 1st September, account due to mature on 30th, or will it bounce back? If so, I need to cancel a standing order.

I managed it last time after hearing some people had managed it but I know others have had payment returned

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards