We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

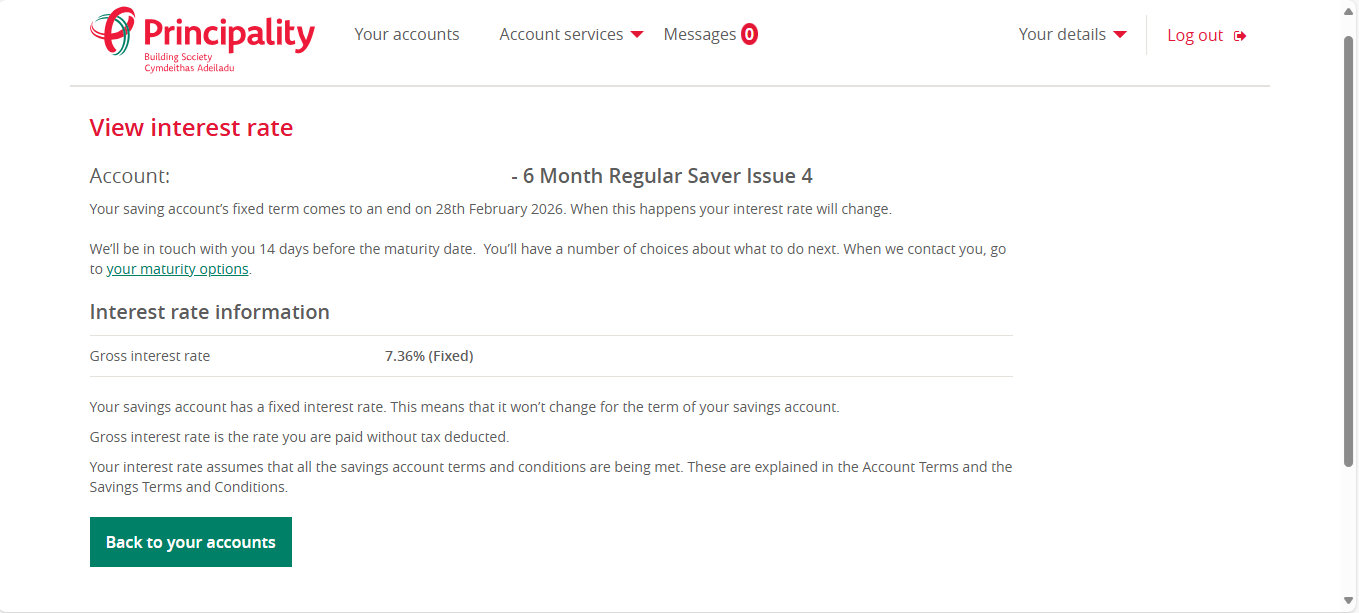

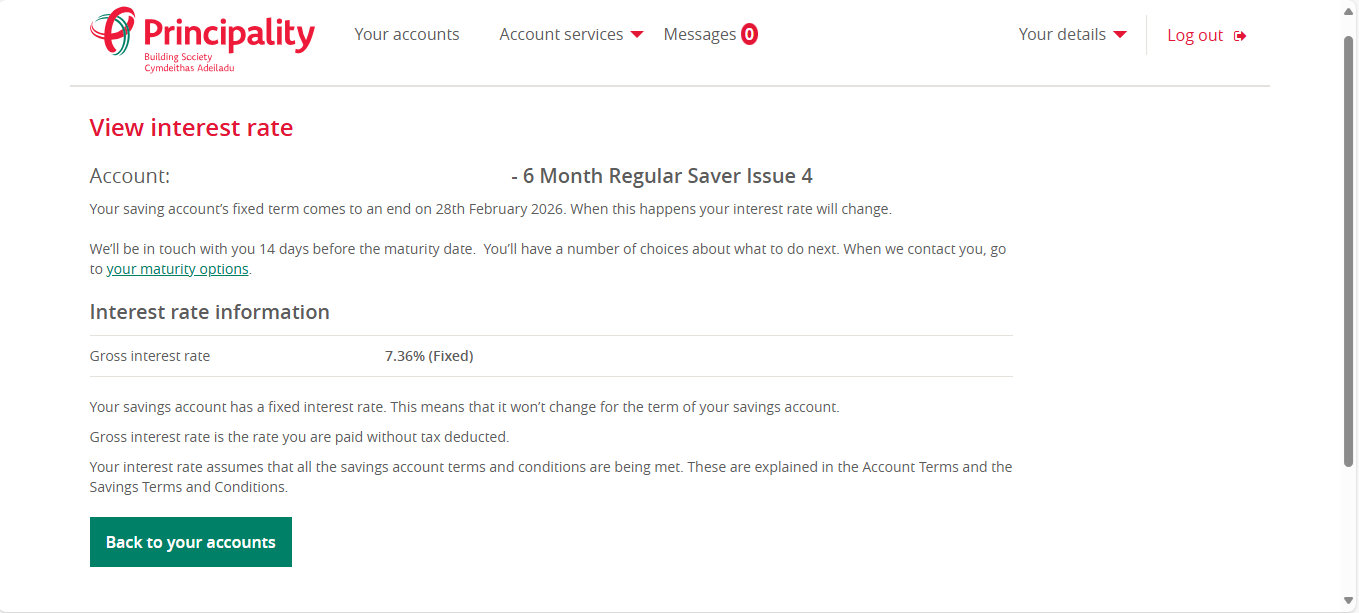

Yes, fixed rate. Link below.clairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate.

https://www.principality.co.uk/home/savings/savings-accounts/6-month-regular-saver

0 -

Digital_Payback said:

Just funded £1 to the new Principality 6 month reg. saver, until COP is recognised.Aidanmc said:

Think it takes up to 24hrs in some cases. I continued with the transaction from Halifax even though the reference wasn't recognised. Triple checked it though!Digital_Payback said:

Managed to open the issue 4 easily enough, but now, wanting to fund it, Starling won’t recognise my account reference as valid.clairec666 said:

Hah, you beat me to it. If you edit the product code you can access accounts which aren't advertised on the website yet.surreysaver said:homestraight said:

HiBridlington1 said:

It's fixed, I opened and fully funded it shortly after midnight and this shows in online bankingclairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate.

Do you have a direct link please? I'm still getting issue 3 showing when I try to apply and an application is refused

Thanks

https://online.principality.co.uk/OriginationsUI/Step1?ProductCode=6086&ProductType=RegularSaver

Just went to the application for the Issue 3 and changed the 6084 to 6086 in the address barMaybe I just need to wait!I find it easier to keep an EA account (with £1 balance) with them for these purposes - I can move £200 to it now, wait for it to appear in the EA account and then internally move it to the new RS later today... and then come Monday when I do the RS deposits, the new account should pass CoP.I did toy with waiting until my next RS3 matures on the 13th and using this RS4 as the upgrade path - but easier to bite the bullet and open a new account... worst case, I only end up with this one account... best case, the other 3 x RS3 can be matured into 3 x RS4 (member of staff permitting).2 -

surreysaver said:

I've opened up the Maturity Winter Saver. My one matured nearly a year ago, shows as paying 6.25% once funded!clairec666 said:Not wishing to stir up trouble for Principality, but....

If you edit the value for ProductCode in the link, you can access earlier accounts which are no longer available. Looks like 6080 is issue 1 and 6083 is issue 2. Anyone bold enough to see if they can open one?

I wonder how much of this could be deemed as taking the mickey? There's nothing saying you cannot do this. I like Principality, so wouldn't want to abuse them, but if they're not going to keep their IT tidy...

I'd been doing this for a while, but a few months' ago they caught on and closed all the off-sale ones I'd opened and returned funds. I hadn't been in touch with them over anything, it just came out of the blue.7 -

You have to be kidding me, Just opened and funded a Principality issue 3 today from maturing account.Now opened an issue 4, the monmouthshire reg 8 I think it is, plus the App exclusive issue 1 at 1K a month.Its like an addiction.7

-

I've ignored CoP, sent £200 at 11:45, money arrived before 12:30. Can't go wrong if copy/paste the account and reference number.janusdesign said:Digital_Payback said:

Just funded £1 to the new Principality 6 month reg. saver, until COP is recognised.Aidanmc said:

Think it takes up to 24hrs in some cases. I continued with the transaction from Halifax even though the reference wasn't recognised. Triple checked it though!Digital_Payback said:

Managed to open the issue 4 easily enough, but now, wanting to fund it, Starling won’t recognise my account reference as valid.clairec666 said:

Hah, you beat me to it. If you edit the product code you can access accounts which aren't advertised on the website yet.surreysaver said:homestraight said:

HiBridlington1 said:

It's fixed, I opened and fully funded it shortly after midnight and this shows in online bankingclairec666 said:

Nice on Principality - I was expecting them to cut the rate. I'm assuming it's still fixed rate? Moneyfactscompare doesn't say, and Principality's website is still showing the issue 3.Bridlington1 said:Principality BS 6 Month Regular Saver (Issue 3) at 7.5% to go NLA within hours.

Replaced by Issue 4 at the same rate.

Do you have a direct link please? I'm still getting issue 3 showing when I try to apply and an application is refused

Thanks

https://online.principality.co.uk/OriginationsUI/Step1?ProductCode=6086&ProductType=RegularSaver

Just went to the application for the Issue 3 and changed the 6084 to 6086 in the address barMaybe I just need to wait!I find it easier to keep an EA account (with £1 balance) with them for these purposes - I can move £200 to it now, wait for it to appear in the EA account and then internally move it to the new RS later today... and then come Monday when I do the RS deposits, the new account should pass CoP.I did toy with waiting until my next RS3 matures on the 13th and using this RS4 as the upgrade path - but easier to bite the bullet and open a new account... worst case, I only end up with this one account... best case, the other 3 x RS3 can be matured into 3 x RS4 (member of staff permitting).

I agree - no point waiting for maturity of another account. It's better to maximise chances for multiple issue 4 and also get £200 working at @7.5% sooner rather than later. My nearest Principality maturity is on 13th Sept, so in theory I should be able to apply for the second issue 4 tomorrow or Saturday (can't remember if it's 14 or 15 days prior to maturity).0 -

This is probably me being simple but with both Principality and Monmouthshire I have set up two different regular savers but when I try to fund the second one through my Natwest account it refers back to my first account as it is in my saved payee's and tells me I have to delete the first one to fund the second one ? Is there a way to have both set up with the different reference numbers ?0

-

Are you allowing for the fact that the final digit of the account number is likely to be what's called a 'check digit'? If you are not allowing for that, then I imagine a more realistic figure would be 202 new accounts opened in ten minutes.chris_the_bee said:Principality 6 month RS

Assuming account numbers are allocated sequentially, 2021 accounts were opened in 10 minutes. £404,200 per month, £2,425,200 per 6 months.....and counting!6 -

With NatWest/RBS - no.gambleruk said:This is probably me being simple but with both Principality and Monmouthshire I have set up two different regular savers but when I try to fund the second one through my Natwest account it refers back to my first account as it is in my saved payee's and tells me I have to delete the first one to fund the second one ? Is there a way to have both set up with the different reference numbers ?

Do you have another current account you can use (if not, why not)?

I use FirstDirect and Chase to fund these multiple same account/different reference savers, I'm sure other accounts allow it too.2 -

unfortunately not if using only Natwest (or indeed RBS) as their accounts will only allow one payee with the same account number and sort code regardless if the reference number differs. I would set up a standing order from an alternative current account if you have one.gambleruk said:This is probably me being simple but with both Principality and Monmouthshire I have set up two different regular savers but when I try to fund the second one through my Natwest account it refers back to my first account as it is in my saved payee's and tells me I have to delete the first one to fund the second one ? Is there a way to have both set up with the different reference numbers ?MFW#105 - 2015 Overpaid £8095 / 2016 Overpaid £6983.24 / 2017 Overpaid £3583.12 / 2018 Overpaid £2583.12 / 2019 Overpaid £2583.12 / 2020 Overpaid £2583.12/ 2021 overpaid £1506.82 /2022 Overpaid £2975.28 / 2023 Overpaid £2677.30 / 2024 Overpaid £2173.61 Total OP since mortgage started in 2015 = £37,286.86 2025 MFW target £1700, payments to date at April 2025 - £1712.07..1 -

Trying to print a copy of the application form via the one link that has been posted so far is beyond my technical capabilities. Do you have a normal straightforward link? I'm not too bothered about getting a first deposit in this month. TIAHattie627 said:

Posted mine today with second class stamp. Didn't realise there was a Freepost address. Mine will probably not reach Newport until next week, takes a snail a long time to crawl from Scotland to Wales. Hope I'm not too late. I put a cheque in with the application form, on the basis that it might be tougher for MonBS to reject an application with a cheque than one without (clutching at straws, I know!)WillPS said:2 x MonBS Branch Saver applications submitted, in hope. Popped a first class label on in an attempt to get ahead of the masses of Freepost envelopes winging their way to Newport...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards