We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

My principality 6 month matured today so I went online and opened a new 6 month reg saver, the opening deposit coming from the expired reg saver. Thanks for Chorley tip just opened.0

-

There was a later post of mine - it seems you can select maturing accounts if logged in to your accounts dashboard first rather than use their maturing saver URL.Dizzycap said:

Ouch!PloughmansLunch said:Principality appear to have closed down the duplicate saver loophole for maturing products now. Offered RS maturity products are now the standard 1 year RS bond, or the Christmas 2025 saver, and once logged in I’m prevented from opening another of the latter as I already hold one.EDIT: I was sent the T&Cs for the 6 month saver as a choice in the post, but that had been removed from maturity options by the time I checked online

Looks like I just manage to set my maturity option for another 6 month regular saver for a maturing product on the 6th January, before it was pulled. Nothing appears to have changed in my Principality account regarding the maturity option I have selected. We shall see what happens on Monday.......Further to this, I had a letter arrive this morning saying they will transfer the funds into my current account on the 9th, so I’ll have to wait and see if my 2nd 6 month saver is opened too as it was accepted online a few days ago but not mentioned at all in the letter.2

Looks like I just manage to set my maturity option for another 6 month regular saver for a maturing product on the 6th January, before it was pulled. Nothing appears to have changed in my Principality account regarding the maturity option I have selected. We shall see what happens on Monday.......Further to this, I had a letter arrive this morning saying they will transfer the funds into my current account on the 9th, so I’ll have to wait and see if my 2nd 6 month saver is opened too as it was accepted online a few days ago but not mentioned at all in the letter.2 -

PloughmansLunch said:

There was a later post of mine - it seems you can select maturing accounts if logged in to your accounts dashboard first rather than use their maturing saver URL.Dizzycap said:

Ouch!PloughmansLunch said:Principality appear to have closed down the duplicate saver loophole for maturing products now. Offered RS maturity products are now the standard 1 year RS bond, or the Christmas 2025 saver, and once logged in I’m prevented from opening another of the latter as I already hold one.EDIT: I was sent the T&Cs for the 6 month saver as a choice in the post, but that had been removed from maturity options by the time I checked online

Looks like I just manage to set my maturity option for another 6 month regular saver for a maturing product on the 6th January, before it was pulled. Nothing appears to have changed in my Principality account regarding the maturity option I have selected. We shall see what happens on Monday.......Further to this, I had a letter arrive this morning saying they will transfer the funds into my current account on the 9th, so I’ll have to wait and see if my 2nd 6 month saver is opened too as it was accepted online a few days ago but not mentioned at all in the letter.I initially logging in to my account but there were no maturity options available. After receiving the maturity letter with the useless URL, I checked again and still no maturity options available online when logged in. I ended up calling Principality and initially asking for the full amount to be repaid because there were no maturity options showing in my account and the URL didn't work. Then Principality had a maintenace night and when I logged in the day after, I had several maturity options available, so I took another 6 month RS.I then made another phone call to Principality to confirm that my maturity options had been received and yes, they confirmed a second 6 month RS Issue 2 was set to go with the remaining balance to be repaid on Monday.# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £60+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)1

Looks like I just manage to set my maturity option for another 6 month regular saver for a maturing product on the 6th January, before it was pulled. Nothing appears to have changed in my Principality account regarding the maturity option I have selected. We shall see what happens on Monday.......Further to this, I had a letter arrive this morning saying they will transfer the funds into my current account on the 9th, so I’ll have to wait and see if my 2nd 6 month saver is opened too as it was accepted online a few days ago but not mentioned at all in the letter.I initially logging in to my account but there were no maturity options available. After receiving the maturity letter with the useless URL, I checked again and still no maturity options available online when logged in. I ended up calling Principality and initially asking for the full amount to be repaid because there were no maturity options showing in my account and the URL didn't work. Then Principality had a maintenace night and when I logged in the day after, I had several maturity options available, so I took another 6 month RS.I then made another phone call to Principality to confirm that my maturity options had been received and yes, they confirmed a second 6 month RS Issue 2 was set to go with the remaining balance to be repaid on Monday.# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £60+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)1 -

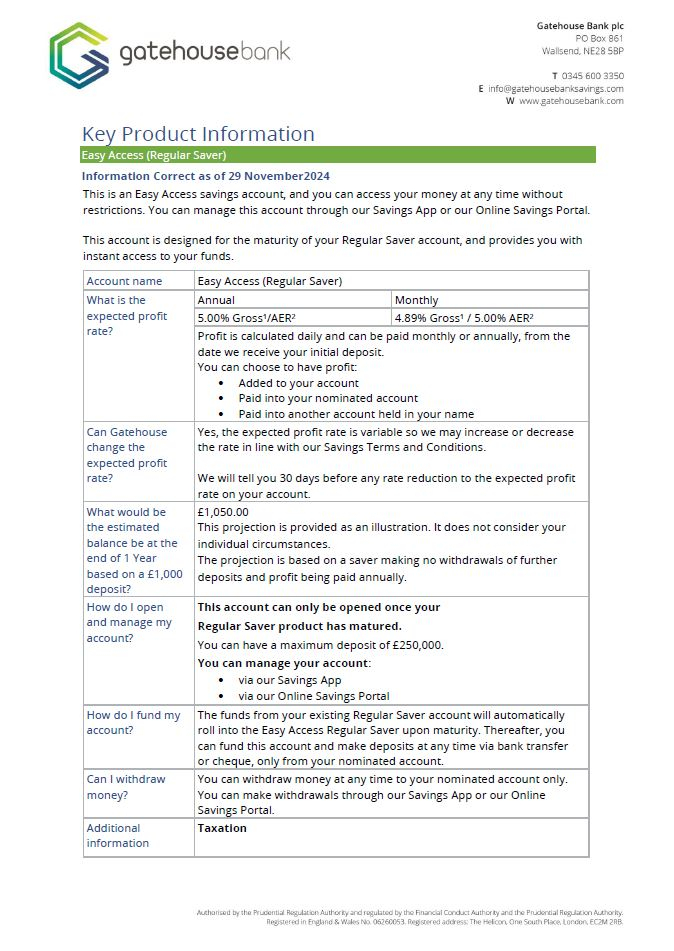

Gatehouse Bank - Regular Saver Matured Easy Access Product

(Apologies in advance if this has already been posted / is very off topic for this thread, but given the only holders of this account will have opened a regular saver it seems more appropriate here then elsewhere).

I've been emailed the T&Cs / KPI sheet for the above account. I can forward the PDF if someone wants a copy.

And of course with the account rate reducing to 4.75% on the 30th January 2025 at least they gave the correct notification period...!10 -

Hinckley and Rugby Regular Saver 30 day maturity options. Has anyone managed to persuade them to pay maturing balance by faster payments? A large cheque in the post means waiting for delivery, trip to bank, time for cheque to clear resulting in no interest for several days.They are able to pay the maturity interest by faster payments to a nominated account but not the balance.2

-

Yes please for PDF and/or please add to archived list of T's&C's1

-

Yes, my balance was transferred to my nominated bank account by FP (I did keep the account open with £1).where_are_we said:Hinckley and Rugby Regular Saver 30 day maturity options. Has anyone managed to persuade them to pay maturing balance by faster payments? A large cheque in the post means waiting for delivery, trip to bank, time for cheque to clear resulting in no interest for several days.They are able to pay the maturity interest by faster payments to a nominated account but not the balance.3 -

dcs34 said:Gatehouse Bank - Regular Saver Matured Easy Access Product

(Apologies in advance if this has already been posted / is very off topic for this thread, but given the only holders of this account will have opened a regular saver it seems more appropriate here then elsewhere).

I've been emailed the T&Cs / KPI sheet for the above account. I can forward the PDF if someone wants a copy.

...............................

And of course with the account rate reducing to 4.75% on the 30th January 2025 at least they gave the correct notification period...!

I love the bit about having "always paid our customers the expected profit rate"! Well, since it's a variable EP rate account, they can always reduce the rate to a point that they know they can pay it! And it seems that is exactly what they are doing!

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

I don't understand your point. The expected profit up to 29th Jan is 5% and then it's 4.75%. I've saved in numerous accounts operated under sharia principles and never once received less than the expected rate.Bobblehat said:dcs34 said:Gatehouse Bank - Regular Saver Matured Easy Access Product

(Apologies in advance if this has already been posted / is very off topic for this thread, but given the only holders of this account will have opened a regular saver it seems more appropriate here then elsewhere).

I've been emailed the T&Cs / KPI sheet for the above account. I can forward the PDF if someone wants a copy.

...............................

And of course with the account rate reducing to 4.75% on the 30th January 2025 at least they gave the correct notification period...!

I love the bit about having "always paid our customers the expected profit rate"! Well, since it's a variable EP rate account, they can always reduce the rate to a point that they know they can pay it! And it seems that is exactly what they are doing!2 -

They have to maintain the uncertainty, as it is a requirement of Sharia compliance. Hypothetically, they could without notice reduce the rate. They cannot guarantee you'll earn the EPR beyond today.Bobblehat said:dcs34 said:Gatehouse Bank - Regular Saver Matured Easy Access Product

(Apologies in advance if this has already been posted / is very off topic for this thread, but given the only holders of this account will have opened a regular saver it seems more appropriate here then elsewhere).

I've been emailed the T&Cs / KPI sheet for the above account. I can forward the PDF if someone wants a copy.

...............................

And of course with the account rate reducing to 4.75% on the 30th January 2025 at least they gave the correct notification period...!

I love the bit about having "always paid our customers the expected profit rate"! Well, since it's a variable EP rate account, they can always reduce the rate to a point that they know they can pay it! And it seems that is exactly what they are doing!

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards