We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Join the MSE Forum

Get the Free MoneySavingExpert Money Tips E-mail

To report inappropriate posts: click the report button

Flag a news story: news@moneysavingexpert.com10 -

Re Principality, 1 Year Triple Access Regular Saver (Online).Interest on maturity ie 18/04/25 for me and others.No interest was paid.I made a call to Principality today and a call back after some clarification.With this account interest is paid once a year on the 01/01/2025.Unlike most reg saver accounts where the rest of the interest is paid on maturity this moves to an easy accessand retains the annual interest payment.Closing the easy access generates the interest owed at that point.SO on the 01/01/25 £10.77 interest & £9.18 interest today. Total of £19.95.Hope this saves a few calls to Principality and a lot of time wasted on hold.Thanks to Harriet at Principality for all your help.

12 -

Just had a quick search and couldn't find this one listed.

https://www.coventrybuildingsociety.co.uk/member/product/savings/regular_saver/loyalty-regular-saver-3.html

12 month term, 5% variable

Must have joined Coventry before 1 Jan 25.

30 days notice

4 -

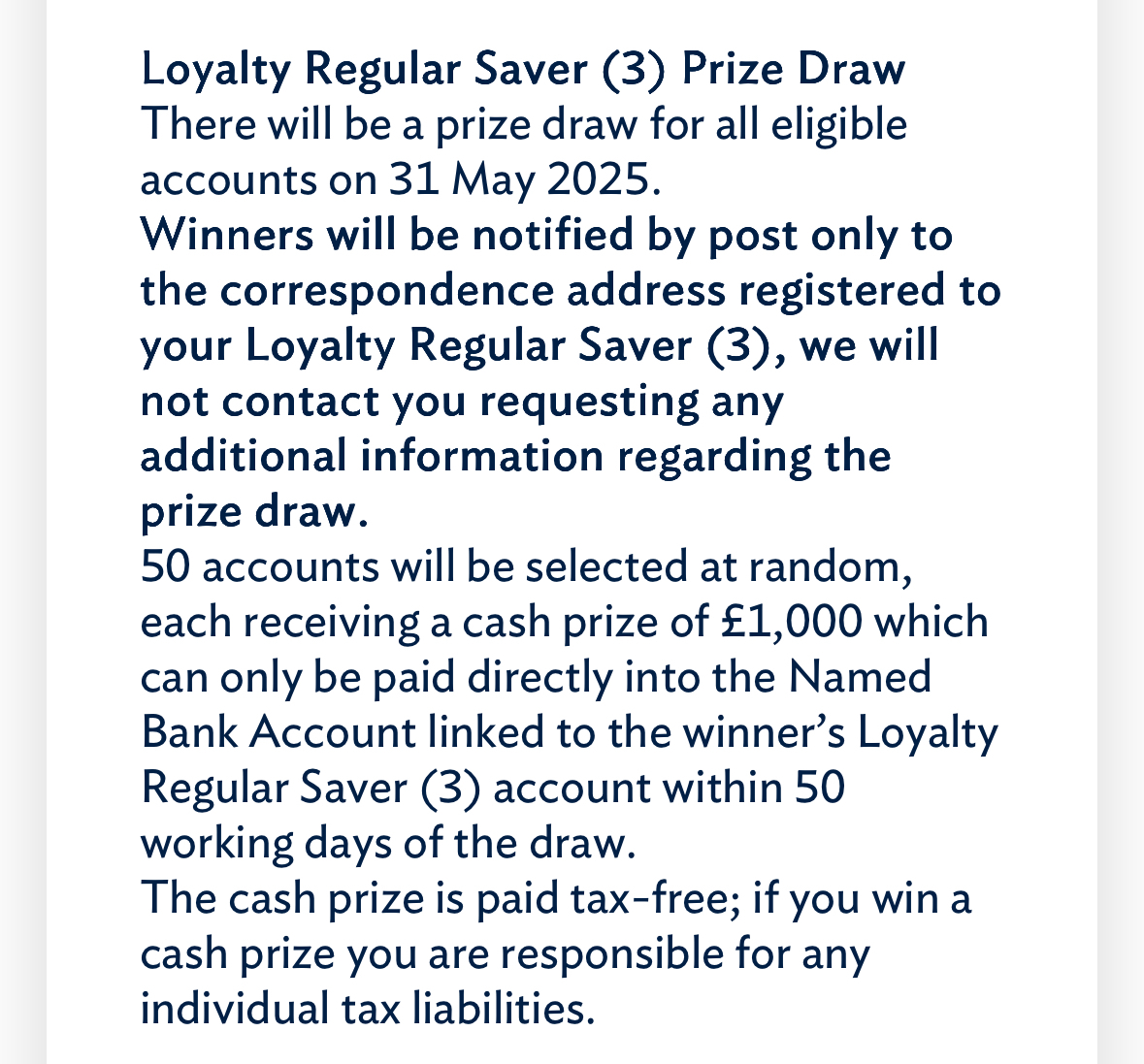

Also a prize draw!gt94sss2 said:Just had a quick search and couldn't find this one listed.

https://www.coventrybuildingsociety.co.uk/member/product/savings/regular_saver/loyalty-regular-saver-3.html

12 month term, 5% variable

Must have joined Coventry before 1 Jan 25.

30 days notice 3

3 -

Loughborough Super SaverDizzycap said:

Yes, that's what I did. Downloaded, completed, scanned & sent with usual ID doc scans via email. I should hear something tomorrow morning either waymasonic said:Kim_13 said:

I didn’t see anything to suggest that email applications were accepted this time whereas it was clearly stated before.allegro120 said:

Yes, I suspect the advice I was given was incorrect. However, given the circumstances it should be quicker for me to open in branch. I have no working printer and forthcoming 4 days of Easter break could delay the process. Luckily I'm only 8 miles away from the branch.Dizzycap said:

That's very strange, as there's a downloadable print off form available on the Loughborough website for the BS 1 Year Super Saver (local) @ 6% (var) to send through the post? 🤔I printed it off directly this morning with no problems. Will have to wait and see if there's any opening issues via postal application, but I doubt it!allegro120 said:

It says on the website that you can open them in branch or by post. I called my nearest branch and has been told that you can only open it in branch, so I've made an appointment for next Tuesday.Bridlington1 said:Loughborough BS have launched two regular savers:

Loughborough BS 1 Year Super Saver Account (Local) at 6% (var), £1k min monthly deposit, £2k max monthly deposit.

Loughborough BS 2 Year Super Saver Account (Local) at 5%, £500 min monthly deposit, £1k max monthly deposit.

Both accounts allow 1 withdrawal per account year (1st April-31st March) plus closure, are branch/post only and available only to new and existing customers residing in the postcodes LE, DE, NG.

Judging by the way they appear on moneyfacts they seem to have been launched before today so I'm listing them as being launched on 14/4/25 for now.

Last time (Holiday Monthly Saver 5.6%) I've asked them to send me the form, scanned it and sent by e-mail together with pictures of ID - that worked, took only 6 days (incl. weekend) for the account to be opened. I'm not sure if e-mail application would work for 1 Year Super Saver, but this could be the quickest way.This is what I see on the "How to Apply" tab:

How did it go, how long did it take for your account to be opened? I've made branch appointment on 15th April for today, account is now opened. Just wondering if I could've get it opened quicker if I used e-mail option.0 -

New Coventry Loyalty RS (3) @5% variable. Withdrawals are penalised so only useful as a RS fixed term savings account. You are able to have one of these RS (3) alongside other Coventry Loyalty RS`s of a different issue. The question is - if they reduce the variable interest rate are you able to close the account without loss of interest?Remember that this is not a monthly calendar RS like most RS`s but a monthly anniversary RS so only 12 monthly payments on the anniversary of opening the account.If you have filled all the better paying RS`s, then it is worth considering provided you are not locked in if they reduce the rate.

0 -

The question is - answered in this post from yesterday on this threadwhere_are_we said:The question is - if they reduce the variable interest rate are you able to close the account without loss of interest?

https://forums.moneysavingexpert.com/discussion/comment/81413172/#Comment_814131725 -

I've lobbed £100 into a new Coventry Loyalty Regular Saver (3), purely to gain entry to the prize draw. Only has to sit there for less than two months with it being a one-off draw, and seems worth losing a minuscule amount of interest to be in with a chance. I was lucky just before Christmas in their Sunny Day Saver draw, so am hoping lightning may strike twice. Thanks to whoever first mentioned the Regular Saver (3) here.3

-

Going to do the same and probably close it as soon as the draw finishes. Even if they charge you the 30 days penalty, it's only 41p to withdraw the £100.HHUK said:I've lobbed £100 into a new Coventry Loyalty Regular Saver (3), purely to gain entry to the prize draw. Only has to sit there for less than two months with it being a one-off draw, and seems worth losing a minuscule amount of interest to be in with a chance. I was lucky just before Christmas in their Sunny Day Saver draw, so am hoping lighting may strike twice. Thanks to whoever first mentioned the Regular Saver (3) here.4 -

Nottingham BS Branch Regular Saver 2 at 4.75% is now NLA.

3

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards