We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Think I’ll be giving the YBS 5% variable a miss. I currently have a monthly RS outlay of £3,850 with the lowest rate being 6%. As they mature i will open/fund the 5.25%-5.75% regular savers that are currently on offer (e.g. Skipton, Halifax, Lloyds etc).Still have Santander Edge at 6% and 3x Cahoot Sunny Day Savers at 5% also.2

-

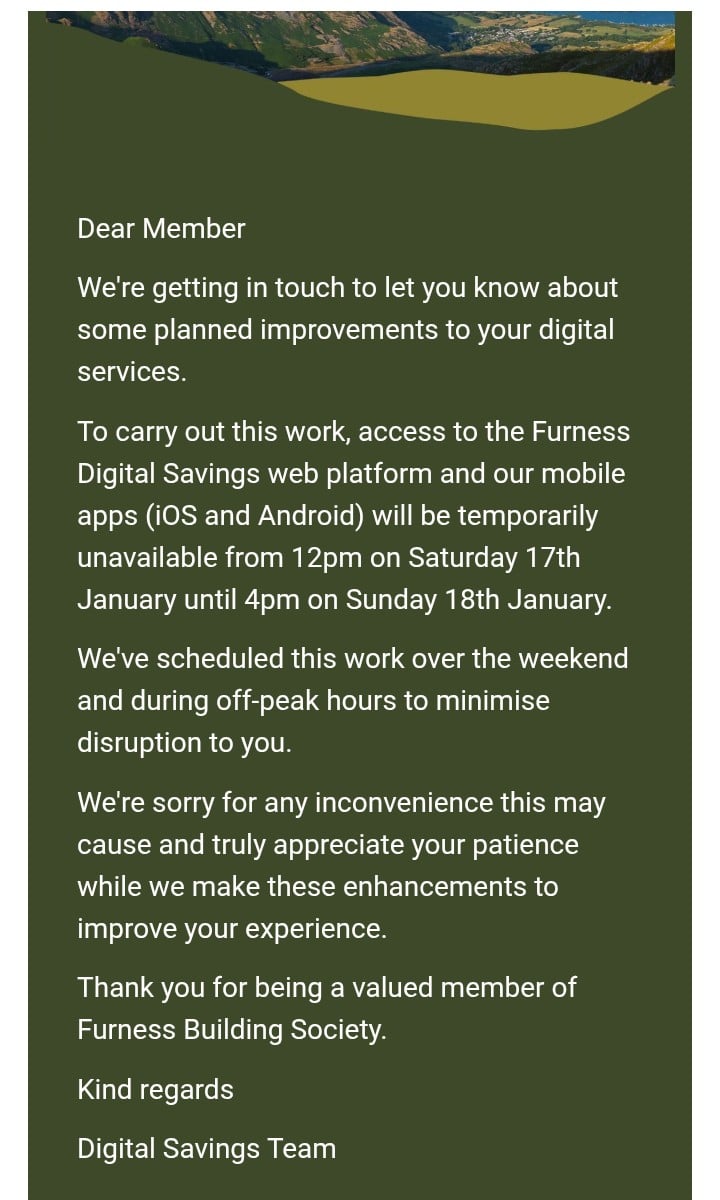

Looks as though they are prepping for this new editionsurreysaver said:

Assuming the website doesn't crash!clairec666 said:

Sounds like they've got a limit on the total number of accounts. If there hasn't been a massive take-up before the 20th, then I imagine there will be a bit of a rush once online applications open. How soon it takes for them to pull the account remains to be seen, depends whether they have an in-built counter or whether it has to be removed manually from the website.friolento said:Kim_13 said:

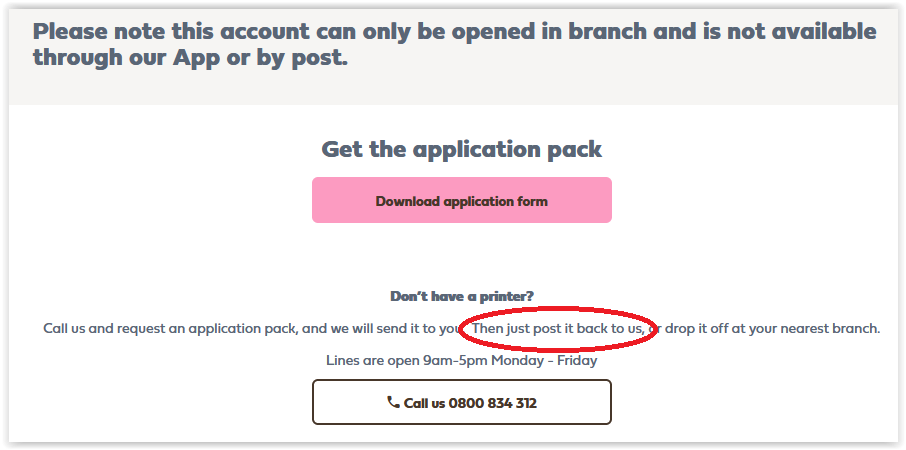

Hopefully the information Furness gave the poster re: accepting online applications from the 20th is accurate, as the download application form button sends you in a loop rather than giving you a form.friolento said:I'll wait for the 20th but if you are desperate, you can send your Furness application by post, apparently

I had also been on the phone to them, and they told me that I can post the application form or that I can wait until the 20th, when it will go online provided it hasn't sold out by then. I am going to take the risk and wait. 1

1 -

Yorkshire BS

Anyone else unable to log in?0 -

chris_the_bee said:Yorkshire BS

Anyone else unable to log in?

Logged into the app just now, no issues1 -

Any rate above the rate of inflation is good. There will be plenty going for YBS @5% including myself.GetRichOrDieSaving said:Think I’ll be giving the YBS 5% variable a miss. I currently have a monthly RS outlay of £3,850 with the lowest rate being 6%. As they mature i will open/fund the 5.25%-5.75% regular savers that are currently on offer (e.g. Skipton, Halifax, Lloyds etc).Still have Santander Edge at 6% and 3x Cahoot Sunny Day Savers at 5% also.1 -

Yorkshirefriolento said:chris_the_bee said:Yorkshire BS

Anyone else unable to log in?

Logged into the app just now, no issues

I just get "Invalid path was requested" using desktop.

Worked OK earlier as I opened an X-mas eSaver OK.0 -

I have all of them so not really in need of 5% RSs, but still opened YBS 5%. I might need it at some point, you never know. It took about 3 minutes to open and make £1 deposit. I wouldn't have bothered if the opening required any more effort than this. It's a healthy addition to my £1 accounts collection, most of them pay significantly lower ratesGetRichOrDieSaving said:Think I’ll be giving the YBS 5% variable a miss. I currently have a monthly RS outlay of £3,850 with the lowest rate being 6%. As they mature i will open/fund the 5.25%-5.75% regular savers that are currently on offer (e.g. Skipton, Halifax, Lloyds etc).Still have Santander Edge at 6% and 3x Cahoot Sunny Day Savers at 5% also. 2

2 -

It's one of those I'll likely retain as a ``dripping tray" account. I doubt the rate'll ever end up high enough for me to fund actively but if I've got a surplus of funds and need to dump it somewhere for a few days it might come in useful. I've got a few accounts like this for the same reason.allegro120 said:

I have all of them so not really in need of 5% RSs, but still opened YBS 5%. I might need it at some point, you never know. It took about 3 minutes to open and make £1 deposit. I wouldn't have bothered if the opening required any more effort than this. It's a healthy addition to my £1 accounts collection, most of them pay significantly lower ratesGetRichOrDieSaving said:Think I’ll be giving the YBS 5% variable a miss. I currently have a monthly RS outlay of £3,850 with the lowest rate being 6%. As they mature i will open/fund the 5.25%-5.75% regular savers that are currently on offer (e.g. Skipton, Halifax, Lloyds etc).Still have Santander Edge at 6% and 3x Cahoot Sunny Day Savers at 5% also. 2

2 -

I don't think they will be inundated, purely because the majority (outside of loyal/high street customers) will only want it as an overflow account - and for that it's of limited use given you have to close to move funds to a higher paying account more than once.alfred64 said:

Any rate above the rate of inflation is good. There will be plenty going for YBS @5% including myself.GetRichOrDieSaving said:Think I’ll be giving the YBS 5% variable a miss. I currently have a monthly RS outlay of £3,850 with the lowest rate being 6%. As they mature i will open/fund the 5.25%-5.75% regular savers that are currently on offer (e.g. Skipton, Halifax, Lloyds etc).Still have Santander Edge at 6% and 3x Cahoot Sunny Day Savers at 5% also.

It should be a simple open it with £1 and close later, but YBS have a habit of throwing up Mitek checks and forumites report it is sometimes a job to get them to accept their valid ID. 5% isn't worth the effort for me given that risk. I will only open 5% if the account has the kind of favourable conditions defined in this thread. Also notable is that deposits by debit card can't be made in app and you have to log in online to pay in that way.

3 -

But you are only allowed one withdrawal beforeBridlington1 said:

It's one of those I'll likely retain as a ``dripping tray" account. I doubt the rate'll ever end up high enough for me to fund actively but if I've got a surplus of funds and need to dump it somewhere for a few days it might come in useful. I've got a few accounts like this for the same reason.allegro120 said:

I have all of them so not really in need of 5% RSs, but still opened YBS 5%. I might need it at some point, you never know. It took about 3 minutes to open and make £1 deposit. I wouldn't have bothered if the opening required any more effort than this. It's a healthy addition to my £1 accounts collection, most of them pay significantly lower ratesGetRichOrDieSaving said:Think I’ll be giving the YBS 5% variable a miss. I currently have a monthly RS outlay of £3,850 with the lowest rate being 6%. As they mature i will open/fund the 5.25%-5.75% regular savers that are currently on offer (e.g. Skipton, Halifax, Lloyds etc).Still have Santander Edge at 6% and 3x Cahoot Sunny Day Savers at 5% also.

closure. So this ‘drip tray’ approach will only

work on one occasion if you plan on taking that money back out. Another reason this account doesn’t appeal to me, along with the low deposit limit which is another…

I’ve not doubt customers will appreciate and snap up this low rate, low deposit, restricted account but as indicated by myself and others it just ain’t worth the hassle.Each to their own 3

3

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards