We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

S & P 500 investment in wive's name

Comments

-

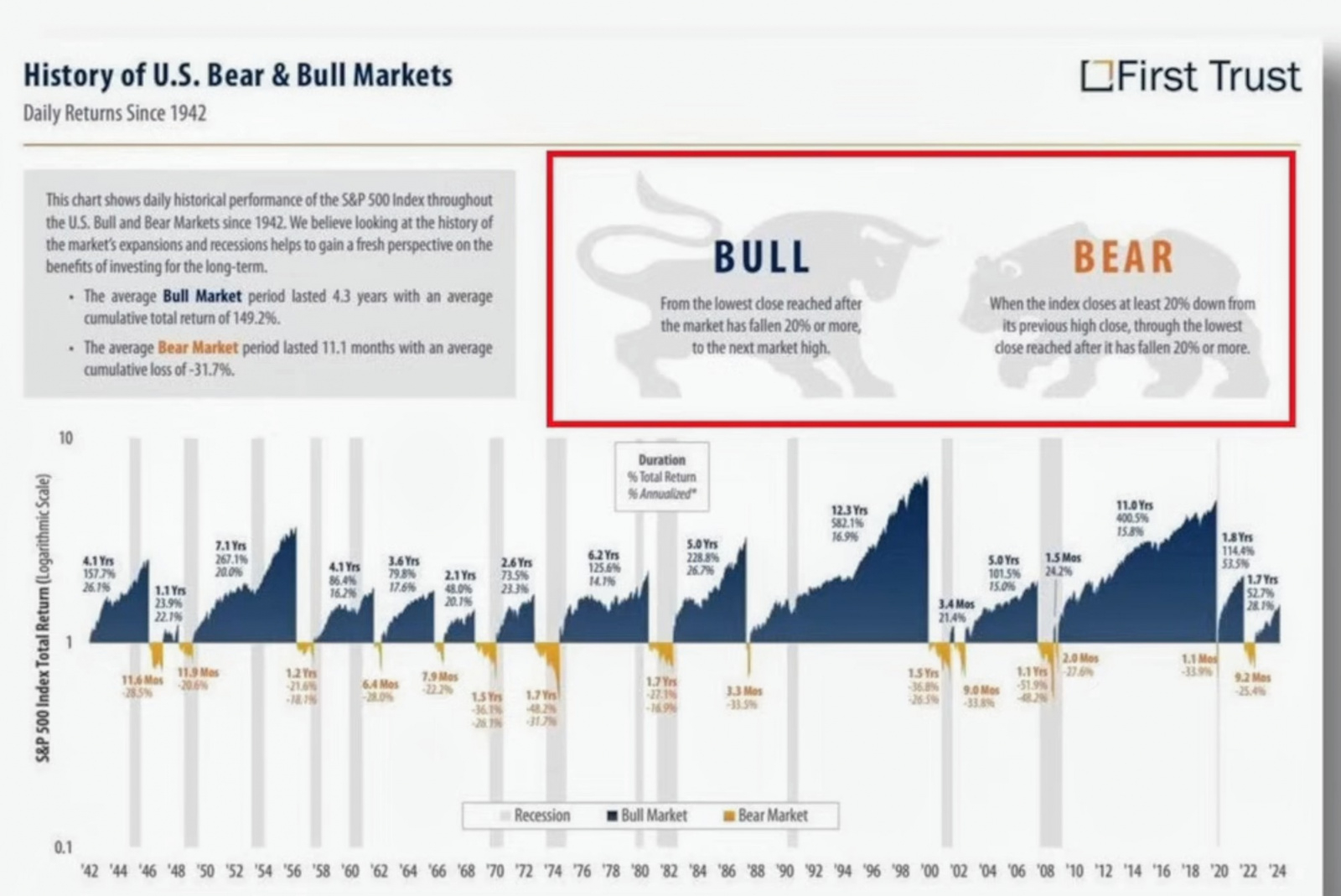

This ⬇️ is the history of S&P500 , but the historical performance is not guarantee for the future returns. Anyone who says the US market is about to crash or will make another few great years of return is just guessing.

Most of the time people talk bad and scary stories, when they are negatively affected , by the fact, that they have missed the very good performance of something in the past.

1 -

For me, that wouldn't be anything like well enough diversified, but as I've already said, I'm recently retired (at 60) and acutely aware of the need to minimise a sequence of returns risk.The_Palmist said:Thanks folks, I have opened a S&S Vanguard account in wife's (basic rate) name and made a small investment 50:50 between S &P 500 and FTSE All world. I have also opened a cash saver with Santander paying just over 5%, this is a bonus rate for 12 month and looked better than any cash ISA I could see.

There is a very small amount of savings left which I will leave in easy access as rainy day funds for now.

Really appreciate everyone's help and comments.

My global equity tracker of choice is HSBC All-world Index C Acc, which holds something around 65% in US stocks, many of which will be the same as those held in the S&P fund. I've significantly reduced my holding is the HSBC fund and sold various smaller holdings in S&P specific investments. This is however for a very specific reason, Ie I have more than enough on which to retire, as long as I don't loose a sizable chunk early into retirement and am happy to accept lower returns for peace of mind. As long as I can match inflation, then I'm more than happy at my stage in the journey and right now that's fairly easy with minimal risk.0 -

I don't understand your post, are you agreeing with me?Hoenir said:

How many people got burnt holding Scottish Mortgage Trust. The S&P 500 wasn't even on small investors radars 10 years ago. Perceptions very easily get skewed. With the benefit of hindsight.Cus said:

The past 10/15 years have seen an explosion of DIY investing, with many looking at huge paper gains especially with S&P investments. If I was an IFA, on the one hand I would be annoyed that this success means that so many people see paying for advice and having an IFA manage your investments and then to not make the same gains as pointless and a waste of money. On the other hand I would also see a lot of people having a shocker when it all turns again and would want to warn them.dunstonh said:

As usual, when I post risk warnings to people who do not understand the risks of what they are doing, another person who is equally uninformed often makes disparaging remarks.As usual whenever/wherever S&P 500 is mentioned on forum dunstonh chimes in with his dose of doom and gloom.

Nobody is unhappy when things are going well. Being aware of the potential negatives and being informed is a good thing as you can avoid silly mistakes.

[Quoted post removed by Forum Team]

0 -

dunstonh said:I am thinking of S&P 500 index via Vanguard.OK, that fills the US allocation but what about the rest of the world?

Or are you mistakenly looking at short term recent returns and making a bad investment selection on that basis?

So you're saying that the OP is fine with the S&P500 and needs a global fund too then. He's done that.1 -

Fair comment and I will keep diversification in mind once we have built up enough savings to invest again, compared to your portfolio, our investment is measley and any further spread will spread the money too thin.Roger175 said:

For me, that wouldn't be anything like well enough diversified, but as I've already said, I'm recently retired (at 60) and acutely aware of the need to minimise a sequence of returns risk.The_Palmist said:Thanks folks, I have opened a S&S Vanguard account in wife's (basic rate) name and made a small investment 50:50 between S &P 500 and FTSE All world. I have also opened a cash saver with Santander paying just over 5%, this is a bonus rate for 12 month and looked better than any cash ISA I could see.

There is a very small amount of savings left which I will leave in easy access as rainy day funds for now.

Really appreciate everyone's help and comments.

My global equity tracker of choice is HSBC All-world Index C Acc, which holds something around 65% in US stocks, many of which will be the same as those held in the S&P fund. I've significantly reduced my holding is the HSBC fund and sold various smaller holdings in S&P specific investments. This is however for a very specific reason, Ie I have more than enough on which to retire, as long as I don't loose a sizable chunk early into retirement and am happy to accept lower returns for peace of mind. As long as I can match inflation, then I'm more than happy at my stage in the journey and right now that's fairly easy with minimal risk.

Nothing is more damaging to the adventurous spirit within a man than a secure future. - Alex Supertramp1 -

At the time of this comment, I was going to go 💯 with S&P, this and other comments made me spread the available money to invest in S&P and FTSE global.Kotokos said:dunstonh said:I am thinking of S&P 500 index via Vanguard.OK, that fills the US allocation but what about the rest of the world?

Or are you mistakenly looking at short term recent returns and making a bad investment selection on that basis?

So you're saying that the OP is fine with the S&P500 and needs a global fund too then. He's done that.Nothing is more damaging to the adventurous spirit within a man than a secure future. - Alex Supertramp4 -

I'm not sure if you've said somewhere how much you were planning to put in but be aware that if it's a fairly small amount then the new Vanguard charges might be a lot more than you'd pay elsewhere.The_Palmist said:Thanks folks, I have opened a S&S Vanguard account in wife's (basic rate) name and made a small investment 50:50 between S &P 500 and FTSE All world.Remember the saying: if it looks too good to be true it almost certainly is.2 -

Do people make better informed decisions now that they can trade a click of a button. No they don't. ComplacencyCus said:

I don't understand your post, are you agreeing with me?Hoenir said:

How many people got burnt holding Scottish Mortgage Trust. The S&P 500 wasn't even on small investors radars 10 years ago. Perceptions very easily get skewed. With the benefit of hindsight.Cus said:

The past 10/15 years have seen an explosion of DIY investing, with many looking at huge paper gains especially with S&P investments. If I was an IFA, on the one hand I would be annoyed that this success means that so many people see paying for advice and having an IFA manage your investments and then to not make the same gains as pointless and a waste of money. On the other hand I would also see a lot of people having a shocker when it all turns again and would want to warn them.dunstonh said:

As usual, when I post risk warnings to people who do not understand the risks of what they are doing, another person who is equally uninformed often makes disparaging remarks.As usual whenever/wherever S&P 500 is mentioned on forum dunstonh chimes in with his dose of doom and gloom.

Nobody is unhappy when things are going well. Being aware of the potential negatives and being informed is a good thing as you can avoid silly mistakes.

[Quoted post removed by Forum Team]abounds. Thanks to the unique circumstances of the post GFC period. Spend long enough investng and you'll come to realise that investors who jump onto a current fad are the most likely to eventually get their fingers severely burnt.0 -

After reading this thread I think that is what I would have done. Now sit back for a decade and see which one does better.The_Palmist said:

At the time of this comment, I was going to go 💯 with S&P, this and other comments made me spread the available money to invest in S&P and FTSE global.Kotokos said:dunstonh said:I am thinking of S&P 500 index via Vanguard.OK, that fills the US allocation but what about the rest of the world?

Or are you mistakenly looking at short term recent returns and making a bad investment selection on that basis?

So you're saying that the OP is fine with the S&P500 and needs a global fund too then. He's done that.

You still got criticised for not diversifying enough. If you look at the holdings in the world fund you will find that is near 60% in the USA and nine of the top 10 holdings are the same as the S&P500 fund. If you add to this in the future then think about diversifying with the new money. I don't think you are investing enough at the moment to go splitting it further.1 -

Thanks, the comments have been very valid and those with bigger portfolios have a different vantage point. Point taken about top holdings being the same. I am looking to hold our position for at least 5 years and depending on this experience will add little amounts (£3K-£5K) in other holdings.DRS1 said:

After reading this thread I think that is what I would have done. Now sit back for a decade and see which one does better.The_Palmist said:

At the time of this comment, I was going to go 💯 with S&P, this and other comments made me spread the available money to invest in S&P and FTSE global.Kotokos said:dunstonh said:I am thinking of S&P 500 index via Vanguard.OK, that fills the US allocation but what about the rest of the world?

Or are you mistakenly looking at short term recent returns and making a bad investment selection on that basis?

So you're saying that the OP is fine with the S&P500 and needs a global fund too then. He's done that.

You still got criticised for not diversifying enough. If you look at the holdings in the world fund you will find that is near 60% in the USA and nine of the top 10 holdings are the same as the S&P500 fund. If you add to this in the future then think about diversifying with the new money. I don't think you are investing enough at the moment to go splitting it further.

Nothing is more damaging to the adventurous spirit within a man than a secure future. - Alex Supertramp0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards