We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Bonds & Savings Platforms for an American national, British resident

Comments

-

Thanks for all the suggestions and help mentioned so far including the thread mentioned. To clarify, I was referring to new bonds for savings only. To date she has been able over the last year or so to open savings bonds with Hodge bank, Beehive (now Nottingham BS), MBNA with no issues.wmb194 said:

Take a look at this recent thread. Principality, Coventry and Lloyds appear to confirmed options. Plum is a possibility as well.londoner62 said:Can anyone provide a quick answer to which platforms such as HL, Raisin, etc. allow USA nationals, British residents (with an NI number) to open new bonds via their platforms? I am struggling to find any for my wife who has lived in the UK for thirty plus years!

Many thanks for any help offered.

https://forums.moneysavingexpert.com/discussion/6555741/best-savings-accounts-for-american-expats/p30 -

MBNA is a trading name of Lloyds so that tallies.londoner62 said:

Thanks for all the suggestions and help mentioned so far including the thread mentioned. To clarify, I was referring to new bonds for savings only. To date she has been able over the last year or so to open savings bonds with Hodge bank, Beehive (now Nottingham BS), MBNA with no issues.wmb194 said:

Take a look at this recent thread. Principality, Coventry and Lloyds appear to confirmed options. Plum is a possibility as well.londoner62 said:Can anyone provide a quick answer to which platforms such as HL, Raisin, etc. allow USA nationals, British residents (with an NI number) to open new bonds via their platforms? I am struggling to find any for my wife who has lived in the UK for thirty plus years!

Many thanks for any help offered.

https://forums.moneysavingexpert.com/discussion/6555741/best-savings-accounts-for-american-expats/p31 -

OP I would make sure your US spouse is up to date with their US tax filings and any joint accounts are declared.And so we beat on, boats against the current, borne back ceaselessly into the past.1

-

OP very surprised your spouse was able to open accounts with Hodge Bank.londoner62 said:

Thanks for all the suggestions and help mentioned so far including the thread mentioned. To clarify, I was referring to new bonds for savings only. To date she has been able over the last year or so to open savings bonds with Hodge bank, Beehive (now Nottingham BS), MBNA with no issues.wmb194 said:

Take a look at this recent thread. Principality, Coventry and Lloyds appear to confirmed options. Plum is a possibility as well.londoner62 said:Can anyone provide a quick answer to which platforms such as HL, Raisin, etc. allow USA nationals, British residents (with an NI number) to open new bonds via their platforms? I am struggling to find any for my wife who has lived in the UK for thirty plus years!

Many thanks for any help offered.

https://forums.moneysavingexpert.com/discussion/6555741/best-savings-accounts-for-american-expats/p3

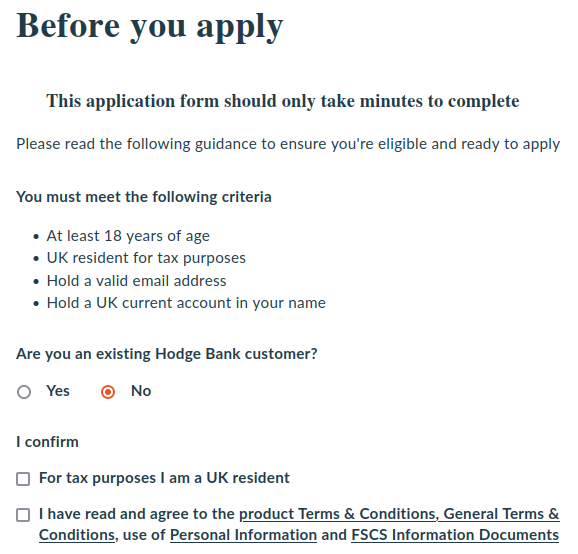

Once you get to the launch page for opening any account with them you encounter note 3 per link below.

https://mysavings.hodgebank.co.uk/registration/preApplication?productId=B1Y_A_221024

As for Beehive, any UK financial institution who knowingly accepts US citizens are supposed to obtain that person's Tax Identification Number ( TIN). If Beehive did not do this in the case of your spouse or make it clear they prohibit US citizens, then they are clearly not FATCA compliant. Not a problem for your wife, but Beehive maybe breaching their own HMRC compliance regs in this regard.

No issues with MBNA, they were owned by Bank of America prior to the Lloyds Bank 2017 acquisition of the business and have been FATCA compliant from outset. Needless to say Lloyds themselves welcome US persons subject to supplying their TIN.

stoneman's attitude and philosophy is an interesting one. One has to assume that if he is prepared to mislead uk financial institutions, he has a similar disregard for IRS annual FBAR reporting, where ISA income and gains are potentially taxable in the US.

0 -

Spouse opened her first bond in March with Hodge, third bond a fortnight ago. Maybe they changed the criteria since March and as she is already in their system, she was accepted again?

OP very surprised your spouse was able to open accounts with Hodge Bank.londoner62 said:

Thanks for all the suggestions and help mentioned so far including the thread mentioned. To clarify, I was referring to new bonds for savings only. To date she has been able over the last year or so to open savings bonds with Hodge bank, Beehive (now Nottingham BS), MBNA with no issues.wmb194 said:

Take a look at this recent thread. Principality, Coventry and Lloyds appear to confirmed options. Plum is a possibility as well.londoner62 said:Can anyone provide a quick answer to which platforms such as HL, Raisin, etc. allow USA nationals, British residents (with an NI number) to open new bonds via their platforms? I am struggling to find any for my wife who has lived in the UK for thirty plus years!

Many thanks for any help offered.

https://forums.moneysavingexpert.com/discussion/6555741/best-savings-accounts-for-american-expats/p3

Once you get to the launch page for opening any account with them you encounter note 3 per link below.

https://mysavings.hodgebank.co.uk/registration/preApplication?productId=B1Y_A_221024

As for Beehive, any UK financial institution who knowingly accepts US citizens are supposed to obtain that person's Tax Identification Number ( TIN). If Beehive did not do this in the case of your spouse or make it clear they prohibit US citizens, then they are clearly not FATCA compliant. Not a problem for your wife, but Beehive maybe breaching their own HMRC compliance regs in this regard.

No issues with MBNA, they were owned by Bank of America prior to the Lloyds Bank 2017 acquisition of the business and have been FATCA compliant from outset. Needless to say Lloyds themselves welcome US persons subject to supplying their TIN.

stoneman's attitude and philosophy is an interesting one. One has to assume that if he is prepared to mislead uk financial institutions, he has a similar disregard for IRS annual FBAR reporting, where ISA income and gains are potentially taxable in the US.0 -

Most unlikely Hodge were previously OK with US citizens but now aren't.londoner62 said:

Spouse opened her first bond in March with Hodge, third bond a fortnight ago. Maybe they changed the criteria since March and as she is already in their system, she was accepted again?

OP very surprised your spouse was able to open accounts with Hodge Bank.londoner62 said:

Thanks for all the suggestions and help mentioned so far including the thread mentioned. To clarify, I was referring to new bonds for savings only. To date she has been able over the last year or so to open savings bonds with Hodge bank, Beehive (now Nottingham BS), MBNA with no issues.wmb194 said:

Take a look at this recent thread. Principality, Coventry and Lloyds appear to confirmed options. Plum is a possibility as well.londoner62 said:Can anyone provide a quick answer to which platforms such as HL, Raisin, etc. allow USA nationals, British residents (with an NI number) to open new bonds via their platforms? I am struggling to find any for my wife who has lived in the UK for thirty plus years!

Many thanks for any help offered.

https://forums.moneysavingexpert.com/discussion/6555741/best-savings-accounts-for-american-expats/p3

Once you get to the launch page for opening any account with them you encounter note 3 per link below.

https://mysavings.hodgebank.co.uk/registration/preApplication?productId=B1Y_A_221024

As for Beehive, any UK financial institution who knowingly accepts US citizens are supposed to obtain that person's Tax Identification Number ( TIN). If Beehive did not do this in the case of your spouse or make it clear they prohibit US citizens, then they are clearly not FATCA compliant. Not a problem for your wife, but Beehive maybe breaching their own HMRC compliance regs in this regard.

No issues with MBNA, they were owned by Bank of America prior to the Lloyds Bank 2017 acquisition of the business and have been FATCA compliant from outset. Needless to say Lloyds themselves welcome US persons subject to supplying their TIN.

stoneman's attitude and philosophy is an interesting one. One has to assume that if he is prepared to mislead uk financial institutions, he has a similar disregard for IRS annual FBAR reporting, where ISA income and gains are potentially taxable in the US.

If so this would mean as a tiny UK bank with no US connections or likelihood of a significant US citizen client base, they had gone to the time, trouble and expense of voluntarily signing up with the IRS for a Global Intermediary Identification Number ( GIIN) with the intention of providing annual returns of income paid to US citizens.

Then having gone to all this effort, later had a change of heart, deregisterd with IRS and banned US citizens thereafter. Isnt it more likely your spouse missed the prohibition when she first signed up?

Question to ask her is whether Hodge or Beehive have ever asked her for a USA TIN, and has she ever supplied it to them? She will undoubtedly confirm that MBNA requested confirmation of her nationality, and whether she had tax residency elsewhere. Once she confirmed this, the application form would then have revealed a new box to enter her TIN. This is the standard system for any UK financial institution happy to accept US persons and towards that end, have put in place the appropriate systems to be FATCA compliant.0 -

poseidon1 said:

Most unlikely Hodge were previously OK with US citizens but now aren't.londoner62 said:

Spouse opened her first bond in March with Hodge, third bond a fortnight ago. Maybe they changed the criteria since March and as she is already in their system, she was accepted again?

OP very surprised your spouse was able to open accounts with Hodge Bank.londoner62 said:

Thanks for all the suggestions and help mentioned so far including the thread mentioned. To clarify, I was referring to new bonds for savings only. To date she has been able over the last year or so to open savings bonds with Hodge bank, Beehive (now Nottingham BS), MBNA with no issues.wmb194 said:

Take a look at this recent thread. Principality, Coventry and Lloyds appear to confirmed options. Plum is a possibility as well.londoner62 said:Can anyone provide a quick answer to which platforms such as HL, Raisin, etc. allow USA nationals, British residents (with an NI number) to open new bonds via their platforms? I am struggling to find any for my wife who has lived in the UK for thirty plus years!

Many thanks for any help offered.

https://forums.moneysavingexpert.com/discussion/6555741/best-savings-accounts-for-american-expats/p3

Once you get to the launch page for opening any account with them you encounter note 3 per link below.

https://mysavings.hodgebank.co.uk/registration/preApplication?productId=B1Y_A_221024

As for Beehive, any UK financial institution who knowingly accepts US citizens are supposed to obtain that person's Tax Identification Number ( TIN). If Beehive did not do this in the case of your spouse or make it clear they prohibit US citizens, then they are clearly not FATCA compliant. Not a problem for your wife, but Beehive maybe breaching their own HMRC compliance regs in this regard.

No issues with MBNA, they were owned by Bank of America prior to the Lloyds Bank 2017 acquisition of the business and have been FATCA compliant from outset. Needless to say Lloyds themselves welcome US persons subject to supplying their TIN.

stoneman's attitude and philosophy is an interesting one. One has to assume that if he is prepared to mislead uk financial institutions, he has a similar disregard for IRS annual FBAR reporting, where ISA income and gains are potentially taxable in the US.

If so this would mean as a tiny UK bank with no US connections or likelihood of a significant US citizen client base, they had gone to the time, trouble and expense of voluntarily signing up with the IRS for a Global Intermediary Identification Number ( GIIN) with the intention of providing annual returns of income paid to US citizens.

Then having gone to all this effort, later had a change of heart, deregisterd with IRS and banned US citizens thereafter. Isnt it more likely your spouse missed the prohibition when she first signed up?

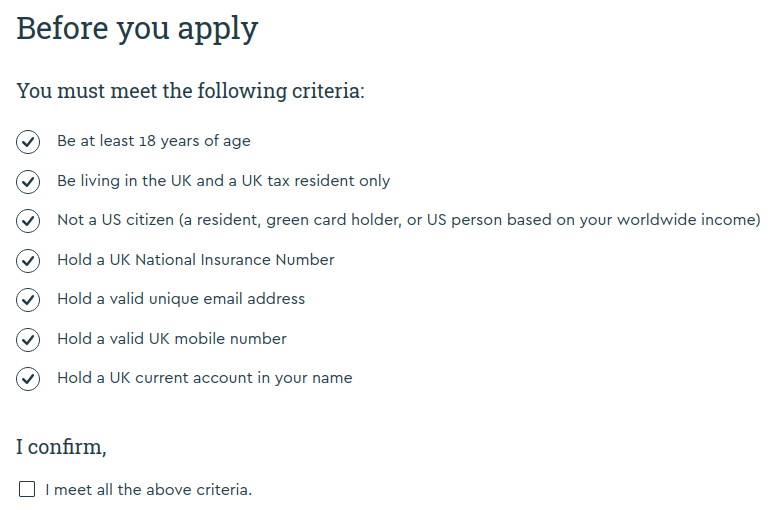

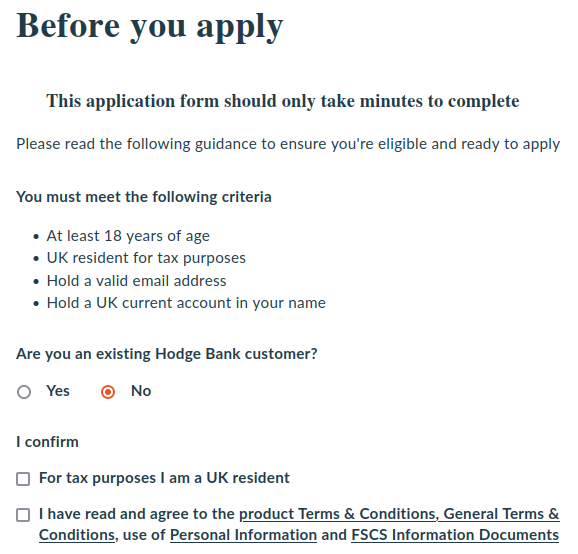

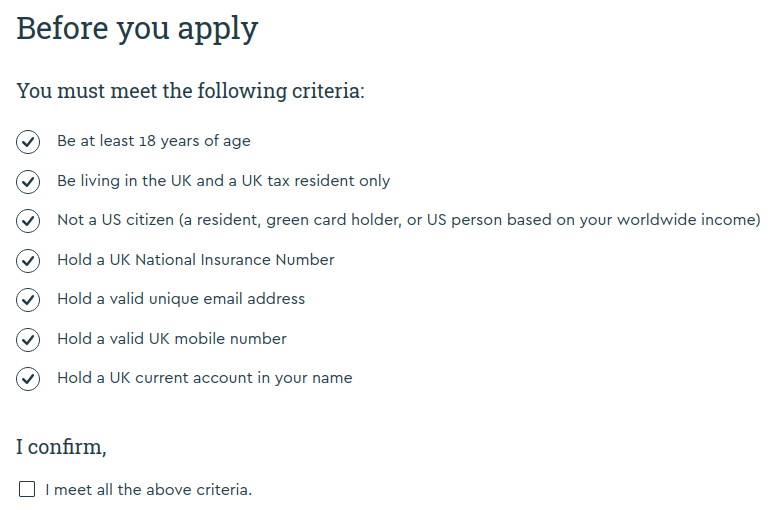

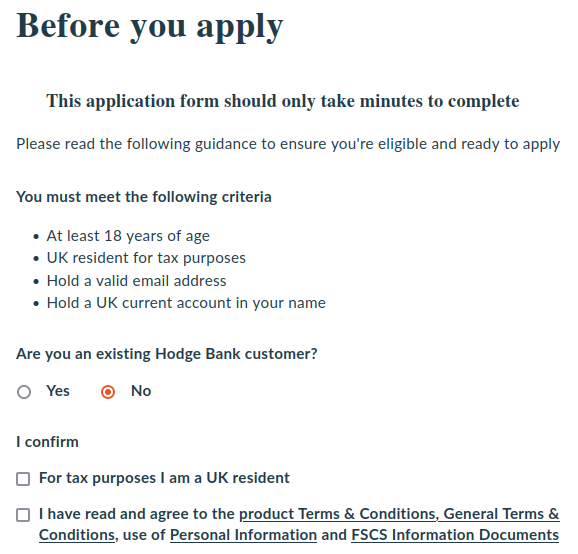

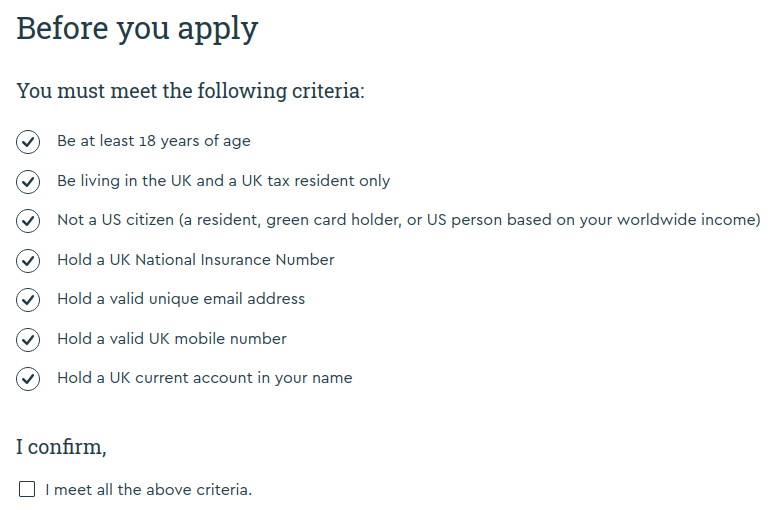

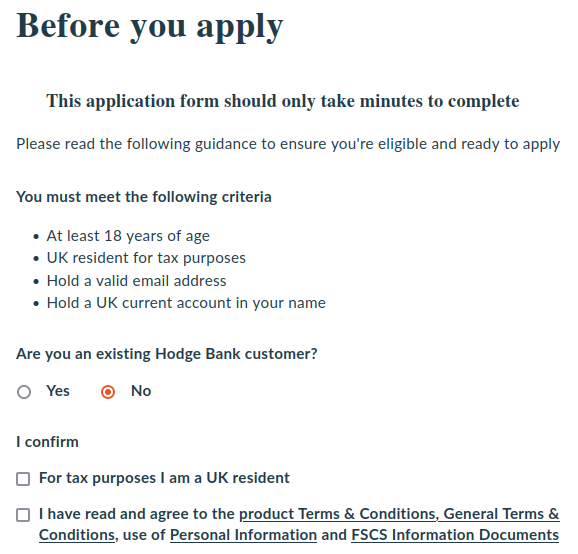

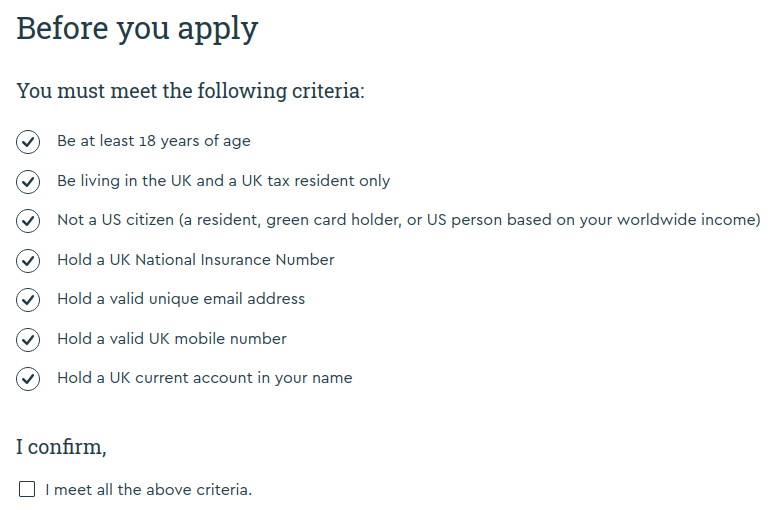

Question to ask her is whether Hodge or Beehive have ever asked her for a USA TIN, and has she ever supplied it to them? She will undoubtedly confirm that MBNA requested confirmation of her nationality, and whether she had tax residency elsewhere. Once she confirmed this, the application form would then have revealed a new box to enter her TIN. This is the standard system for any UK financial institution happy to accept US persons and towards that end, have put in place the appropriate systems to be FATCA compliant.To me it looks like their error. Here is the pre-Application information (courtesy of the wayback machine) from Apr 2022 (the most recent capture I could find): And here it is now:

And here it is now: So the OP's spouse probably would have been permitted to open an account by Hodge's stated criteria in the past, but not today as she could not tick the "I meet all the above criteria" box. There may be a faster means of applying to new products after logging in that bypasses this page, in which case that's another oopsie on the part of Hodge. It would therefore seem to be a problem of their own making, and if they don't want any US persons on their books, they should be putting that second "Before you apply" box in front of existing and new customers when they apply for any new product. I don't know whether or not they do, but if they do then nobody in the spouse's situation would be able to open new accounts, so it would only be a matter of time before they were weeded out of the system.3

So the OP's spouse probably would have been permitted to open an account by Hodge's stated criteria in the past, but not today as she could not tick the "I meet all the above criteria" box. There may be a faster means of applying to new products after logging in that bypasses this page, in which case that's another oopsie on the part of Hodge. It would therefore seem to be a problem of their own making, and if they don't want any US persons on their books, they should be putting that second "Before you apply" box in front of existing and new customers when they apply for any new product. I don't know whether or not they do, but if they do then nobody in the spouse's situation would be able to open new accounts, so it would only be a matter of time before they were weeded out of the system.3 -

Thank you for the payback link: indeed her indoors has opened her last two (Sept and Dec) bonds with Hodge as an existing customer and does not recall answering in a not truthful manner.masonic said:poseidon1 said:

Most unlikely Hodge were previously OK with US citizens but now aren't.londoner62 said:

Spouse opened her first bond in March with Hodge, third bond a fortnight ago. Maybe they changed the criteria since March and as she is already in their system, she was accepted again?

OP very surprised your spouse was able to open accounts with Hodge Bank.londoner62 said:

Thanks for all the suggestions and help mentioned so far including the thread mentioned. To clarify, I was referring to new bonds for savings only. To date she has been able over the last year or so to open savings bonds with Hodge bank, Beehive (now Nottingham BS), MBNA with no issues.wmb194 said:

Take a look at this recent thread. Principality, Coventry and Lloyds appear to confirmed options. Plum is a possibility as well.londoner62 said:Can anyone provide a quick answer to which platforms such as HL, Raisin, etc. allow USA nationals, British residents (with an NI number) to open new bonds via their platforms? I am struggling to find any for my wife who has lived in the UK for thirty plus years!

Many thanks for any help offered.

https://forums.moneysavingexpert.com/discussion/6555741/best-savings-accounts-for-american-expats/p3

Once you get to the launch page for opening any account with them you encounter note 3 per link below.

https://mysavings.hodgebank.co.uk/registration/preApplication?productId=B1Y_A_221024

As for Beehive, any UK financial institution who knowingly accepts US citizens are supposed to obtain that person's Tax Identification Number ( TIN). If Beehive did not do this in the case of your spouse or make it clear they prohibit US citizens, then they are clearly not FATCA compliant. Not a problem for your wife, but Beehive maybe breaching their own HMRC compliance regs in this regard.

No issues with MBNA, they were owned by Bank of America prior to the Lloyds Bank 2017 acquisition of the business and have been FATCA compliant from outset. Needless to say Lloyds themselves welcome US persons subject to supplying their TIN.

stoneman's attitude and philosophy is an interesting one. One has to assume that if he is prepared to mislead uk financial institutions, he has a similar disregard for IRS annual FBAR reporting, where ISA income and gains are potentially taxable in the US.

If so this would mean as a tiny UK bank with no US connections or likelihood of a significant US citizen client base, they had gone to the time, trouble and expense of voluntarily signing up with the IRS for a Global Intermediary Identification Number ( GIIN) with the intention of providing annual returns of income paid to US citizens.

Then having gone to all this effort, later had a change of heart, deregisterd with IRS and banned US citizens thereafter. Isnt it more likely your spouse missed the prohibition when she first signed up?

Question to ask her is whether Hodge or Beehive have ever asked her for a USA TIN, and has she ever supplied it to them? She will undoubtedly confirm that MBNA requested confirmation of her nationality, and whether she had tax residency elsewhere. Once she confirmed this, the application form would then have revealed a new box to enter her TIN. This is the standard system for any UK financial institution happy to accept US persons and towards that end, have put in place the appropriate systems to be FATCA compliant.To me it looks like their error. Here is the pre-Application information (courtesy of the wayback machine) from Apr 2022 (the most recent capture I could find): And here it is now:

And here it is now: So the OP's spouse probably would have been permitted to open an account by Hodge's stated criteria in the past, but not today as she could not tick the "I meet all the above criteria" box. There may be a faster means of applying to new products after logging in that bypasses this page, in which case that's another oopsie on the part of Hodge. It would therefore seem to be a problem of their own making, and if they don't want any US persons on their books, they should be putting that second "Before you apply" box in front of existing and new customers when they apply for any new product. I don't know whether or not they do, but if they do then nobody in the spouse's situation would be able to open new accounts, so it would only be a matter of time before they were weeded out of the system.

So the OP's spouse probably would have been permitted to open an account by Hodge's stated criteria in the past, but not today as she could not tick the "I meet all the above criteria" box. There may be a faster means of applying to new products after logging in that bypasses this page, in which case that's another oopsie on the part of Hodge. It would therefore seem to be a problem of their own making, and if they don't want any US persons on their books, they should be putting that second "Before you apply" box in front of existing and new customers when they apply for any new product. I don't know whether or not they do, but if they do then nobody in the spouse's situation would be able to open new accounts, so it would only be a matter of time before they were weeded out of the system.

Reference Beehive, again all answers have been answered honestly with respect to all four bonds. Only difference this time was she was an existing customer via a regular saver!

Ref Lloyds (MBNA), every year she gets sent a form clarifying her NI, TIN and status/residence etc.

The hardest part for the spouse was recalling her TIN when she first got asked about 60 years after leaving high school!!!0 -

Well done Masonic for going 'back to the future'! Agree with you regarding applying for new products once you are are already on boarded. All my institutions fast track additional product applications based on information they already hold on me.masonic said:poseidon1 said:

Most unlikely Hodge were previously OK with US citizens but now aren't.londoner62 said:

Spouse opened her first bond in March with Hodge, third bond a fortnight ago. Maybe they changed the criteria since March and as she is already in their system, she was accepted again?

OP very surprised your spouse was able to open accounts with Hodge Bank.londoner62 said:

Thanks for all the suggestions and help mentioned so far including the thread mentioned. To clarify, I was referring to new bonds for savings only. To date she has been able over the last year or so to open savings bonds with Hodge bank, Beehive (now Nottingham BS), MBNA with no issues.wmb194 said:

Take a look at this recent thread. Principality, Coventry and Lloyds appear to confirmed options. Plum is a possibility as well.londoner62 said:Can anyone provide a quick answer to which platforms such as HL, Raisin, etc. allow USA nationals, British residents (with an NI number) to open new bonds via their platforms? I am struggling to find any for my wife who has lived in the UK for thirty plus years!

Many thanks for any help offered.

https://forums.moneysavingexpert.com/discussion/6555741/best-savings-accounts-for-american-expats/p3

Once you get to the launch page for opening any account with them you encounter note 3 per link below.

https://mysavings.hodgebank.co.uk/registration/preApplication?productId=B1Y_A_221024

As for Beehive, any UK financial institution who knowingly accepts US citizens are supposed to obtain that person's Tax Identification Number ( TIN). If Beehive did not do this in the case of your spouse or make it clear they prohibit US citizens, then they are clearly not FATCA compliant. Not a problem for your wife, but Beehive maybe breaching their own HMRC compliance regs in this regard.

No issues with MBNA, they were owned by Bank of America prior to the Lloyds Bank 2017 acquisition of the business and have been FATCA compliant from outset. Needless to say Lloyds themselves welcome US persons subject to supplying their TIN.

stoneman's attitude and philosophy is an interesting one. One has to assume that if he is prepared to mislead uk financial institutions, he has a similar disregard for IRS annual FBAR reporting, where ISA income and gains are potentially taxable in the US.

If so this would mean as a tiny UK bank with no US connections or likelihood of a significant US citizen client base, they had gone to the time, trouble and expense of voluntarily signing up with the IRS for a Global Intermediary Identification Number ( GIIN) with the intention of providing annual returns of income paid to US citizens.

Then having gone to all this effort, later had a change of heart, deregisterd with IRS and banned US citizens thereafter. Isnt it more likely your spouse missed the prohibition when she first signed up?

Question to ask her is whether Hodge or Beehive have ever asked her for a USA TIN, and has she ever supplied it to them? She will undoubtedly confirm that MBNA requested confirmation of her nationality, and whether she had tax residency elsewhere. Once she confirmed this, the application form would then have revealed a new box to enter her TIN. This is the standard system for any UK financial institution happy to accept US persons and towards that end, have put in place the appropriate systems to be FATCA compliant.To me it looks like their error. Here is the pre-Application information (courtesy of the wayback machine) from Apr 2022 (the most recent capture I could find): And here it is now:

And here it is now: So the OP's spouse probably would have been permitted to open an account by Hodge's stated criteria in the past, but not today as she could not tick the "I meet all the above criteria" box. There may be a faster means of applying to new products after logging in that bypasses this page, in which case that's another oopsie on the part of Hodge. It would therefore seem to be a problem of their own making, and if they don't want any US persons on their books, they should be putting that second "Before you apply" box in front of existing and new customers when they apply for any new product. I don't know whether or not they do, but if they do then nobody in the spouse's situation would be able to open new accounts, so it would only be a matter of time before they were weeded out of the system.

So the OP's spouse probably would have been permitted to open an account by Hodge's stated criteria in the past, but not today as she could not tick the "I meet all the above criteria" box. There may be a faster means of applying to new products after logging in that bypasses this page, in which case that's another oopsie on the part of Hodge. It would therefore seem to be a problem of their own making, and if they don't want any US persons on their books, they should be putting that second "Before you apply" box in front of existing and new customers when they apply for any new product. I don't know whether or not they do, but if they do then nobody in the spouse's situation would be able to open new accounts, so it would only be a matter of time before they were weeded out of the system.

This apparent previous oversight by Hodge ( belatedly corrected) would now put them in an invidious position of having at least 1 US person on their roster they are unaware of , and on whose behalf they are unable to fulfil FATCA compliance ( no TIN on record ).

One does wonder how many other tiddler UK banks have put themselves in this position both now and in the past. Seems some of these banks may have been ignorant of an international tax avoidance agreement with the USA that was put in place in 2014 but heralded 4 years previously. Hodge finally came to their senses, but looks as if Beehive have still to see the light.

It is not for the US person to point out Fatca to the financial institutions with whom they deal, or to volunteer their TIN if never asked. However it does appear that as far as the UK is concerned, some parts of its banking system seem akin to ' Swiss cheese' vis a vis Fatca compliance.2 -

I don't know about the application form but the help section of the Beehive/Nottingham Building Society app does state:poseidon1 said:

Hodge finally came to their senses, but looks as if Beehive have still to see the light.masonic said:poseidon1 said:

Most unlikely Hodge were previously OK with US citizens but now aren't.londoner62 said:

Spouse opened her first bond in March with Hodge, third bond a fortnight ago. Maybe they changed the criteria since March and as she is already in their system, she was accepted again?

OP very surprised your spouse was able to open accounts with Hodge Bank.londoner62 said:

Thanks for all the suggestions and help mentioned so far including the thread mentioned. To clarify, I was referring to new bonds for savings only. To date she has been able over the last year or so to open savings bonds with Hodge bank, Beehive (now Nottingham BS), MBNA with no issues.wmb194 said:

Take a look at this recent thread. Principality, Coventry and Lloyds appear to confirmed options. Plum is a possibility as well.londoner62 said:Can anyone provide a quick answer to which platforms such as HL, Raisin, etc. allow USA nationals, British residents (with an NI number) to open new bonds via their platforms? I am struggling to find any for my wife who has lived in the UK for thirty plus years!

Many thanks for any help offered.

https://forums.moneysavingexpert.com/discussion/6555741/best-savings-accounts-for-american-expats/p3

Once you get to the launch page for opening any account with them you encounter note 3 per link below.

https://mysavings.hodgebank.co.uk/registration/preApplication?productId=B1Y_A_221024

As for Beehive, any UK financial institution who knowingly accepts US citizens are supposed to obtain that person's Tax Identification Number ( TIN). If Beehive did not do this in the case of your spouse or make it clear they prohibit US citizens, then they are clearly not FATCA compliant. Not a problem for your wife, but Beehive maybe breaching their own HMRC compliance regs in this regard.

No issues with MBNA, they were owned by Bank of America prior to the Lloyds Bank 2017 acquisition of the business and have been FATCA compliant from outset. Needless to say Lloyds themselves welcome US persons subject to supplying their TIN.

stoneman's attitude and philosophy is an interesting one. One has to assume that if he is prepared to mislead uk financial institutions, he has a similar disregard for IRS annual FBAR reporting, where ISA income and gains are potentially taxable in the US.

If so this would mean as a tiny UK bank with no US connections or likelihood of a significant US citizen client base, they had gone to the time, trouble and expense of voluntarily signing up with the IRS for a Global Intermediary Identification Number ( GIIN) with the intention of providing annual returns of income paid to US citizens.

Then having gone to all this effort, later had a change of heart, deregisterd with IRS and banned US citizens thereafter. Isnt it more likely your spouse missed the prohibition when she first signed up?

Question to ask her is whether Hodge or Beehive have ever asked her for a USA TIN, and has she ever supplied it to them? She will undoubtedly confirm that MBNA requested confirmation of her nationality, and whether she had tax residency elsewhere. Once she confirmed this, the application form would then have revealed a new box to enter her TIN. This is the standard system for any UK financial institution happy to accept US persons and towards that end, have put in place the appropriate systems to be FATCA compliant.To me it looks like their error. Here is the pre-Application information (courtesy of the wayback machine) from Apr 2022 (the most recent capture I could find): And here it is now:

And here it is now: So the OP's spouse probably would have been permitted to open an account by Hodge's stated criteria in the past, but not today as she could not tick the "I meet all the above criteria" box. There may be a faster means of applying to new products after logging in that bypasses this page, in which case that's another oopsie on the part of Hodge. It would therefore seem to be a problem of their own making, and if they don't want any US persons on their books, they should be putting that second "Before you apply" box in front of existing and new customers when they apply for any new product. I don't know whether or not they do, but if they do then nobody in the spouse's situation would be able to open new accounts, so it would only be a matter of time before they were weeded out of the system.For any type of account, you need to be a UK resident who’s only registered in the UK for tax purposes.2

So the OP's spouse probably would have been permitted to open an account by Hodge's stated criteria in the past, but not today as she could not tick the "I meet all the above criteria" box. There may be a faster means of applying to new products after logging in that bypasses this page, in which case that's another oopsie on the part of Hodge. It would therefore seem to be a problem of their own making, and if they don't want any US persons on their books, they should be putting that second "Before you apply" box in front of existing and new customers when they apply for any new product. I don't know whether or not they do, but if they do then nobody in the spouse's situation would be able to open new accounts, so it would only be a matter of time before they were weeded out of the system.For any type of account, you need to be a UK resident who’s only registered in the UK for tax purposes.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards