We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Gilt Auction Treasury 4.375% 2028 - closes 12 November with HL

Comments

-

Given the BoE interest rate has just been cut (albeit bang on expectation), surely this will be priced above nominal?

Is there no option to specify the maximum price when bidding (e.g. on AJ Bell)? Or an option to commit/decline once the price is known?

Otherwise, how can it be an auction when it's almost a "blind" purchase?

EDIT: Asking as a newbie on Gilts, my funds are tax wrapped so no tax impact, but I like the idea of Gilts for their certainty (like a fixed rate ISA) hence trying to understand the likelihood of a premium price and whether there is a way to buy-in with a max price = nominal value.0 -

I suppose in reality the total return will be about the same as existing gilts.

If the return is less no one would touch them and if more there would be a stampede of switching from existing gilts, neither option helpful to DMO....

So not much to be excited about ?0 -

As an example, in the April 2024 auction I acquired £15,087 Treasury 4.125% 22/7/2029 at a cost of £14,999.65 so a small discount.gravel_2 said:

Price is driven by market participants. £100 is only the nominal value. If the market wants a higher % yield then a lower average bid will win, likewise if Government debt is in high demand the price might be above £100. You can see past auction results here: https://www.dmo.gov.uk/data/pdfdatareport?reportCode=D2.1ACiprico said:I read you're not guaranteed to pay £100 per gilt, so all the calculations above are speculative....?

"The price is determined during a competitive auction process managed by the Debt Management Office (DMO) on behalf of HM Treasury. You will receive the average accepted price which may be above £100 per gilt or £1 per unit"

At its current offer price of £99.83, the £15,087 nominal would cost £15,061 plus commission and accrued interest to date.

Small investors like ourselves who invest relative to prevailing B of E rates do not move the needle in the pricing of these auctions, as you say it is institutional market demand both domestic and overseas which will dictate initial auction prices and subsequent trading.0 -

Ciprico said:I suppose in reality the total return will be about the same as existing gilts.

If the return is less no one would touch them and if more there would be a stampede of switching from existing gilts, neither option helpful to DMO....

So not much to be excited about ?The return will depend on the results of the auction, but, yes it will be very similar to what comparable gilts are trading at on the secondary market. TR27 (matures 07/12/27, 4.5% coupon) currently has a redemption yield of 4.24% and TS28 (0706/28, 4.25%) has 4.36%. So somewhere between these two seems reasonable - although by the time the Weds auction closes these two could be trading either higher or lower.No, nothing much to be excited about. It's not like a share IPO where they are usually priced at a level below the anticipated market price to get some hype. As an auction, the price will be "fair" and reflect current market expectations of BoE rates, inflation, etc.But if you were thinking of purchasing a similar gilt in the near future then you in effect are able to do so without any spread or commission. When I've previously bought gilts the price has been very close to the middle of the quoted spread and the commission is only £4 with ii or £5 with AJB so there aren't any great savings here either, but every little helps!In my case, I have applied for some on behalf of my wife in her SIPP. But that's because I'm aiming to have a set amount of free cash every March to maximise withdrawals whilst keeping all her tax within the basic rate. A March maturity date works very well for this and fulfills the 2028 requirement.

2 -

intalex said:Given the BoE interest rate has just been cut (albeit bang on expectation), surely this will be priced above nominal?

Is there no option to specify the maximum price when bidding (e.g. on AJ Bell)? Or an option to commit/decline once the price is known?

Otherwise, how can it be an auction when it's almost a "blind" purchase?

EDIT: Asking as a newbie on Gilts, my funds are tax wrapped so no tax impact, but I like the idea of Gilts for their certainty (like a fixed rate ISA) hence trying to understand the likelihood of a premium price and whether there is a way to buy-in with a max price = nominal value.I'm anticipating a purchase price of approx 100.2p based on the market price of similar gilts which will give a redemption yield of about 4.3%. The actual price will depend on how the market moves before the auction deadline.The auction is among the big players (banks, funds, etc) and retail investors are basically piggybacking onto this - we will pay the average price of the successful bids without any bid/offer spread or commission.No, you cannot set a maximum price or decline once the price is known. It's a binding commitment. But you can be reasonably certain that the price paid will be a "fair" one reflecting the views of the auction participants at the time it takes place.

1 -

I assume the "fair" bids will be submitted according to how the markets close today?

Anyone know how to track/assess this? As an example, are the yields today better than on Friday?0 -

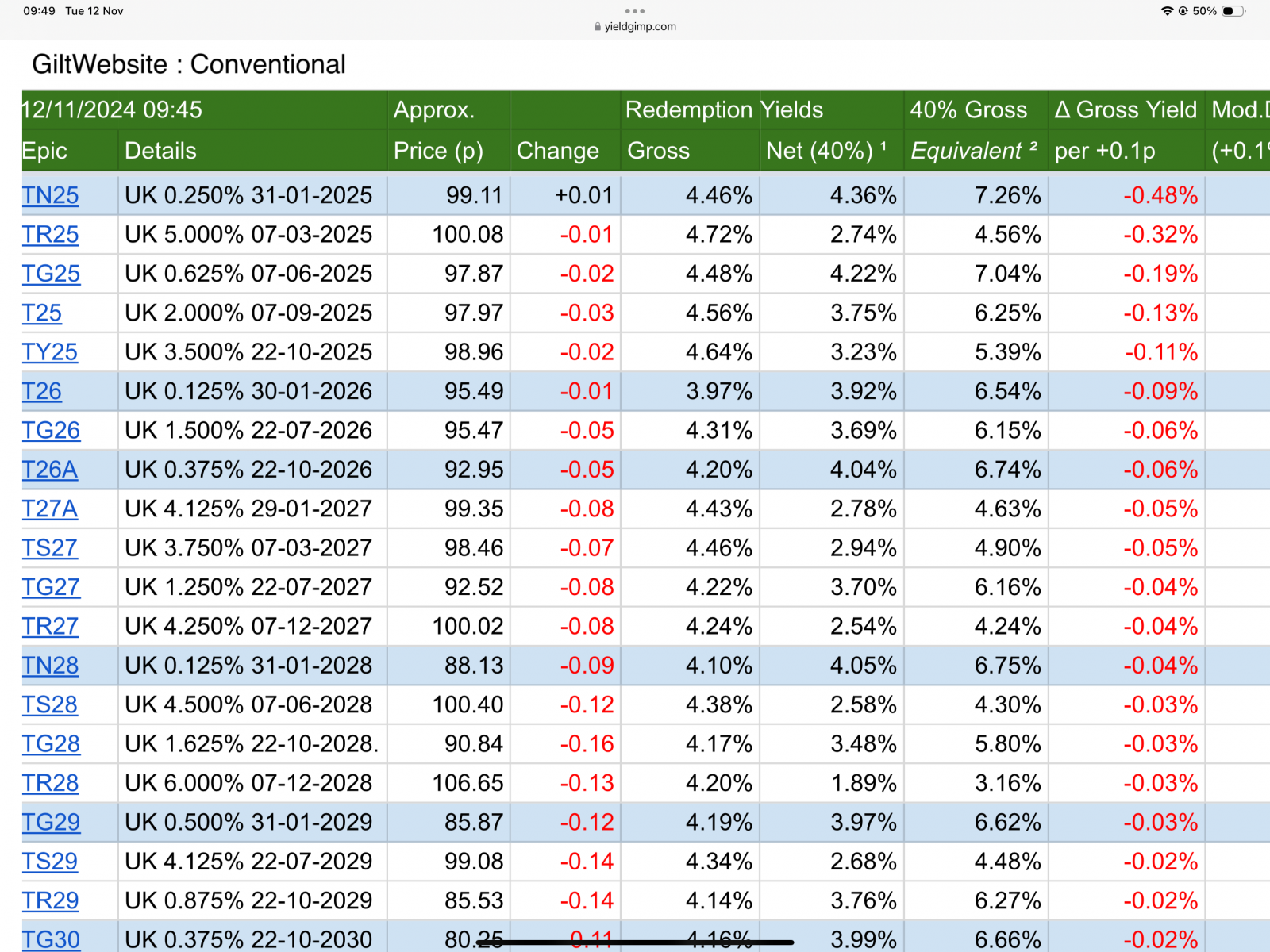

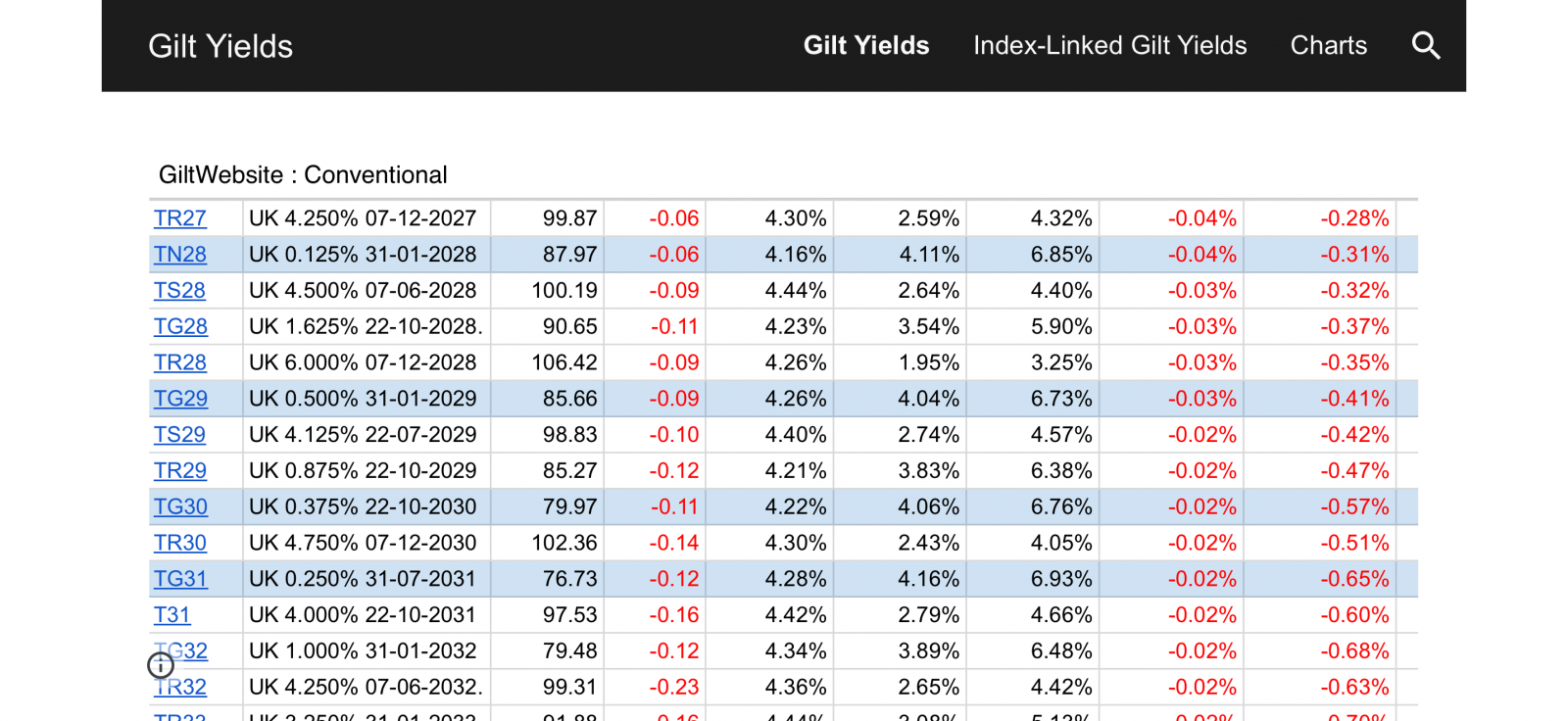

You just keep an eye on where the existing issues of about the same tenor are trading today/early tomorrow, so without some enormous drama today it'll probably price somewhere between 4.25% and 4.38%*. The closing time for bids is 10am tomorrow and we should know the result soon after that.intalex said:I assume the "fair" bids will be submitted according to how the markets close today?

Anyone know how to track/assess this? As an example, are the yields today better than on Friday?https://www.dmo.gov.uk/media/ddygkb2d/pr300824.pdfhttps://www.dmo.gov.uk/data/pdfdatareport?reportCode=D2.1PROF7*I'd ignore the low coupon gilts, they appear to have been bid up for their CGT advantages.

https://www.yieldgimp.com/1 -

Oof, 4.5% seems bad but I guess the market moved in the past day: looks about right compared to TS28.intalex said:Results out:

https://www.dmo.gov.uk/media/bylf5ie5/131124conventional.pdf

Doesn't state the final average price but assume it's between 99.600 and 99.647...

0 -

Results out, landed with a tiny discount at 99.629 and yield of 4.499% which is not bad for a ~3.5 year term...2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards