We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Pension Investment Portfolios

Spivo46

Posts: 160 Forumite

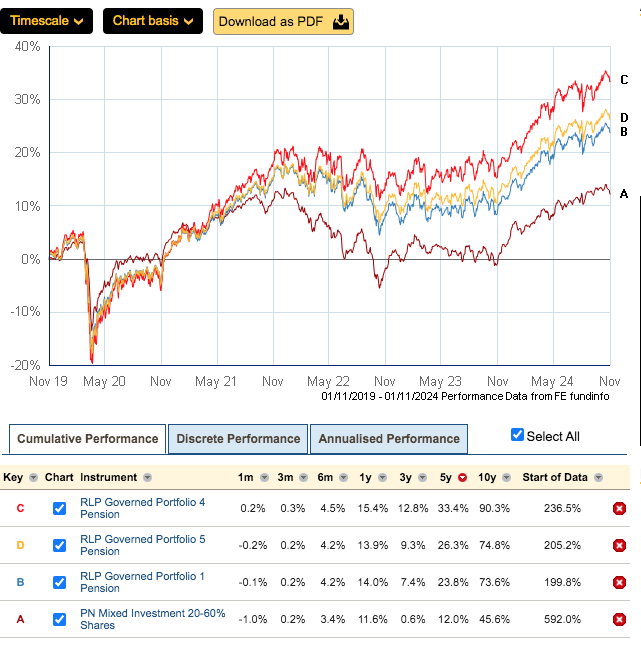

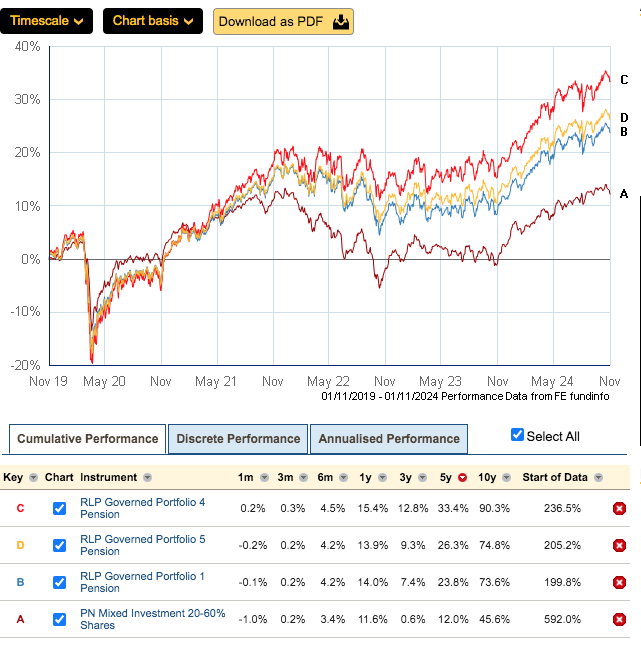

I was asking about RL pension portfolio performance and related risk scaling with a view to a balanced approach to investment in retirement. Below are some examples. Does anyone think that GP4 is a no brainer despite having 70% in stocks. Even at its worse during COVID 19, in comparison to the others, the fall was not significantly worse?

0

Comments

-

That chart certainly looks impressive. How does the performance of RL GP4 compare to a global tracker? It looks like it has kept up with growth more or less, but it also doesn't seem significantly less volatile. I'm a long way from retirement myself but I would have thought that minimising volatility would be a good idea when in drawdown.

Also the usual warning that past performance does not necessarily predict future performance.

Looking at the fund you mention it seems to be pretty overweight in UK equities. While that's not necessarily a bad thing I'm not a fan.

EDIT: I was reading the chart wrong. It has actually performed similarly to VLS60 (not a global tracker), though its value does seem to jump around more than VLS60. They both look more or less equivalent in terms of performance.

1 -

Who is this portfolio designed for?It is designed for someone who has a moderatelycautious or balanced attitude to risk and is a longtime away from retirement. With this time horizonand attitude to risk, a medium to high level ofinvestment risk is appropriate.Does it sound like you?Fashion on the Ration

2024 - 43/66 coupons used, carry forward 23

2025 - 62/891 -

Semi retired at 64. I am targeting above inflation growth and 12 months of living expenses set aside for any market crash. While i am in GP4 currently (70% equity) my sensible side is telling me to switch to GP5 (50% equity)Sarahspangles said:Who is this portfolio designed for?It is designed for someone who has a moderatelycautious or balanced attitude to risk and is a longtime away from retirement. With this time horizonand attitude to risk, a medium to high level ofinvestment risk is appropriate.Does it sound like you?0 -

The GP range is about to be modified and renamed to simplify it.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1

-

I do not think going for GP4 is a no brainier. The fund performed well because of perhaps the 2 most important investment events of the past few years, the rapid fall in interest rates severely hit bonds and the US megatechs significantly out performing other sectors in the global equity market.

GP4 has fewer bonds and more US megatechs than the other funds listed and hence performed better.The economic events are not permanent features of the investing landscape and the situation in the future could be very different. Basing investment choices on a small number of years performance figures is a seriously bad idea.

In my view you should base your portfolio on your objectives, not performance graphs.In retirement one has a need for secure income over the shorter term and inflation exceeding growth in the long term. Bonds provide for the first and equity for the second.

2 -

Thanks Linton - everything you have highlighted makes sense. However, is 10 years a sample that is too small?Linton said:I do not think going for GP4 is a no brainier. The fund performed well because of perhaps the 2 most important investment events of the past few years, the rapid fall in interest rates severely hit bonds and the US megatechs significantly out performing other sectors in the global equity market.

GP4 has fewer bonds and more US megatechs than the other funds listed and hence performed better.The economic events are not permanent features of the investing landscape and the situation in the future could be very different. Basing investment choices on a small number of years performance figures is a seriously bad idea.

In my view you should base your portfolio on your objectives, not performance graphs.In retirement one has a need for secure income over the shorter term and inflation exceeding growth in the long term. Bonds provide for the first and equity for the second.

Devils advocate - "Economic events are not a permanent" surely all advice is based on educated guessing. Is it impossible that GP4 out performs the other portfolios or the next 10 years?

0 -

Performance is the key factor that you cannot control. There is no point in chasing it because economic factors vary greatly over time. For example during the 2001-2010 decade US stocks went nowhere with the tech sector crashing at the start and once it had barely recovered the finance sector crashed. So yes 10 years is far too short to come to any useful conclusion as to where to invest for the future.Spivo46 said:

Thanks Linton - everything you have highlighted makes sense. However, is 10 years a sample that is too small?Linton said:I do not think going for GP4 is a no brainier. The fund performed well because of perhaps the 2 most important investment events of the past few years, the rapid fall in interest rates severely hit bonds and the US megatechs significantly out performing other sectors in the global equity market.

GP4 has fewer bonds and more US megatechs than the other funds listed and hence performed better.The economic events are not permanent features of the investing landscape and the situation in the future could be very different. Basing investment choices on a small number of years performance figures is a seriously bad idea.

In my view you should base your portfolio on your objectives, not performance graphs.In retirement one has a need for secure income over the shorter term and inflation exceeding growth in the long term. Bonds provide for the first and equity for the second.

Devils advocate - "Economic events are not a permanent" surely all advice is based on educated guessing. Is it impossible that GP4 out performs the other portfolios or the next 10 years?

40 years may be too short. Since around 1980 interest rates steadily declined and so bond returns were enhanced by increases in capital value due to older higher interest bonds being more valuable than newer lower interest ones. Clearly not sustainable, but it worked for a generation of investors. Then in 2022 it didn't.

So what can you do? Set up your portfolio appropriately based on your objectives knowing that the unknown future could derail you.

Firstly there is a choice of asset classes eg mainly global equity and bonds. But there are many others - eg property, loans, infrastructure etc. Each has different characteristics and so you chose the types of asset appropriate to your objectives.

The second important consideration is diversification. The more different countries, industries, company sizes, growth versus value etc you invest in the more likely you are to catch the stars of the future and the less likely you are to be wiped out by a localised crash.

Finally I will mention risk. This is not about whether you lose sleep over a major crash but rather how much the result matters. For something like investing for retirement you may be satisfied with sufficient return to retire when you are ready and not want to have to work longer because you looked for higher returns than you needed and failed.

Another risk occurs if you want income from your investments in retirement. Stability of sufficient income may be more important to you than maximising it and then finding that in a major crash you are selling core funds to meet your monthly bills.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards