We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Inheritance Tax on pensions - budget announcement and consultation

Comments

-

GunJack said:Doesn't this thread (and others similar) just go to prove that the entire tax system in the UK needs simplifying not making more complex???

If you're worried about your estate having to pay IHT then you're way too rich anyway 🤣🤣

If you don't have children, then you don't have to be "way too rich" to fall foul of the new pension IHT rules!!!

A joint estate allowance of 'only' £650,000 doesn't go very far, once it includes your house and your pension pots.

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)5 -

As an aside, we often hear planning tips about keeping enough in your pension to potentially cover residential care or nursing care costs. I wonder if people will be more or less inclined to do that with the IHT changes? If one doesn't go into a care home and instead drops down dead from a heart attack or a short battle against cancer - much of those set aside funds might simply be consumed by IHT now. It becomes more of a gamble, maybe? Clearly this won't be a consideration for many but some on here actively plan for care costs.4

-

Might be of interest to the discussion about IHT on pensions.Previously buying a guaranteed annuity had an extra IHT liability in most cases, which was a negative factor. I think the change in the budget may have turned this round into a slight positive - as the IHT liability for guaranteed annuities isn't quite as large as the funds needed to purchase them.Just did a quick Annuity IHT liability calculation for a £200k 30 yr Level Annuity I was already considering purchasing, (which would pay just under £12k a year) - and the "Estimated Open Market Value" and therefore IHT liability comes out at about £133k from day1 - and then gradually reduces - to around £60k 20 years in for example.

So from day 1, based on last weeks rates, buying a level, 30 year guaranteed annuity would bring around a 33% reduction in IHT exposure I think.

I used this calculator to work out the market value one month into the 30 year minimum term. https://www.gov.uk/government/publications/inheritance-tax-guaranteed-annuity-calculator2 -

Lorian said:How is an executor going to know there is an expression of wish let alone what was paid out based on it. There is no mention of it in the will....The executor contacts the pension scheme and they share information. Payment won't be made by the scheme to the nominated beneficiaries until after inheritance tax has been calculated. The pension scheme pays the pro-rated pension proportion of the inheritance tax out of the pension before paying out to the nominated beneficiaries and the executor pays the non-pension pro-rated amount of the inheritance tax out of the estate.All the executor initially needs to know is that the pension exists.I came, I saw, I melted0

-

Pretty muchJuno_Moneta said:Having thought about all this overnight - I would summarise my current thoughts as:

Previously I wanted to die with my riches squirrelled away in my 7 figure SIPP, which fortuitously for me currently yields 50k+ in dividends (not guaranteed), drawing down only what I needed to live on. Yes this was shameless estate planning using a retirement vehicle - I can’t apologise to HMRC enough.

Now I will maximise my drawings either up to either the lower rate limit of 50270 or upper rate limit of 100,000 a year - depending on how the gods of SIPP capital and dividend growth smile on my SIPP going forward.

And I will make large annual gifts (well beyond the £3k gift limit), with formal ‘given without reservation’ letters, to each of my 3 children every year in a rolling fashion so that at least some of them beat the 7 year rule hopefully.In summary then - from today my SIPP only needs to contain enough to live on, which is of course incredibly difficult to estimate over perhaps the 15 or 25 years I have left.

Higher rate tax payer dependants will now face a marginal tax rate of 64% on their inherited pensions (provided the deceased reached 75)

So previous approach of "use your ISAs and leave your SIPP" has become "spend the SIPP and gift more into kids LISAs and ISAs"

More work for IFAs

And presumably it's sensible to change your expression of wishes if the first parent to pass away was intending to leave part of their SIPP to the children? This would use part of a couples nil rate band and the SIPP benefit would be taxable for the dependant?

You can see why Reeves didn't need to bring back the lifetime allowance5 -

Sorry to be flippant but the complexity of the rules would compel me to blow as much of it as possible whilst I am alive.

No mention was made of the seven year PET rule.

1 -

Yes, they would be required to pay any IHT liability apportioned to the pension direct to HMRC, before paying out the rest to any beneficiaries. ( see Snowman's post above )artyboy said:

So would the trustees be required to withhold the appropriate amount to cover IHT on the estate? I don't see how an executor could be liable for reclaiming it off whoever the pension got paid out to - and there will doubtless be situations where the pension pot is sufficiently big that the resultant IHT liability will exceed the value of the rest of the estate...DRS1 said:

The will doesn't govern the pension pot's destination after death. That is still down to the discretion or the scheme trustees/administrators and the expression of wishes from the member. None of that is being changed only the tax law.Bolt1234 said:Yes. In the will the pension pot is left to the wife tax free. She then uses a deed of variation to give some of the proceeds to her son within 2 years

Who'd want to be an executor ever again?1 -

SnowMan said:zagfles said:

I think you'd pay more inheritance tax but usually less tax overall. But there could be cases where more tax overall is paid, an example may be where the TFLS hasn't been taken and the member died over 75.SnowMan said:[Deleted User] said:

Let's look at the numbers. Say you got basic rate tax relief on the money going into the pensions but you have more than £325,000 of assets (including what's left of your pension). A nice situation to be in. That top bit of your pension that causes you to go over the £325,000 threshold will be taxed at 40% and what's left taxed at 20% (if your kids are basic rate taxpayers). That's a 52% marginal tax rate (but could be more). So now we are at the stage of asking whether it is worth getting 20% tax relief to (i) pay 15% tax if you take the money out, or (ii) your family paying at 52% when you die old.

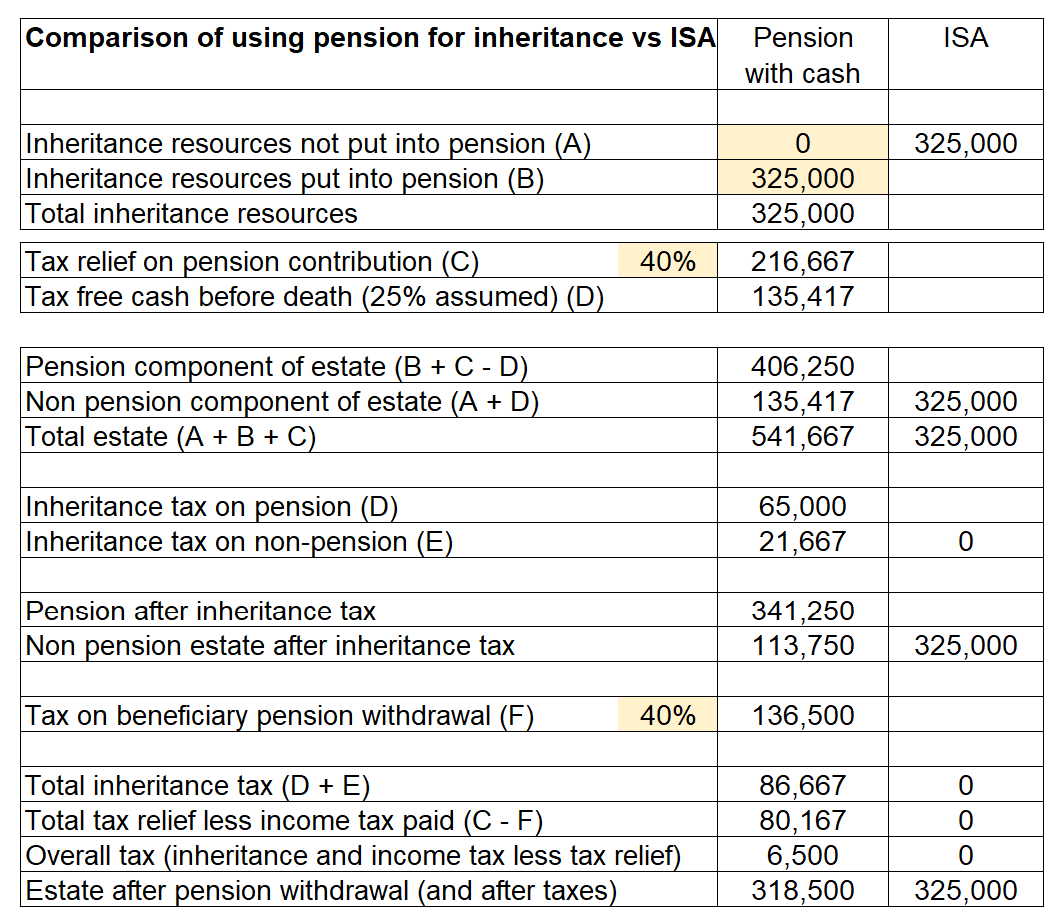

In the old fashioned times that wasn't an issue.You get tax relief on the pension as it goes in and usually if you take it out you incur a slightly lower rate of tax (allowing for tax free cash amongst other things). If you then die you pay inheritance tax on it. But the tax saving (= tax relief rate in less tax rate out) mitigates the estate inheritance tax bill.Alternatively you get tax relief as it goes into the pension. You leave it in the pension, you die, and your dependants take it out incurring a slightly lower rate of tax than the tax relief you got on the way in (or no income tax if you die before age 75). Your estate pays inheritance tax on the amount in the pension but the tax saving (= tax relief rate in less tax rate out) mitigates that.Either way you pay less inheritance tax than if the money hadn't gone into the pension and say had been put into an ISA until death, because of the tax saving.Numerically I've given an example above of how that works.Yes meant to say less overall tax after allowing for the income tax saving as well as the inheritance tax.The inheritance tax would be higher because of the inheritance tax on the income tax net gain, but that still leaves the majority of that income tax gain. Didn't want to overcomplicate the explanation. It's easier to see that where the tax rate in and out are identical then the inheritance tax must be equal and work from there.It is always possible to manufacture scenarios where a higher income tax rate is paid on the way out than the relief rate on the way into the pension. If someone hasn't taken any cash by 75 how likely is it they are using it for retirement provision? And in the very rare scenarios where there is a net income tax loss on the pension, it is likely we are talking about people with high income and high assets where any tax loss is not likely to be noticed by them financially.I had a play to create a scenario where someone putting money into their pension solely to pass it on to a beneficiary (rather than meet retirement needs) would pay more in overall tax relative to the ISA route, despite getting tax relief on their pension at the same rate their beneficiary pays tax on its withdrawal after death. I've assumed that the pension was put into drawdown before death, but with just the 25% tax free cash taken (no taxable income). Investment returns under ISA and pension assumed to be the same after charges etc. Assumed only the basic £325,000 IHT threshold applied. I've ignored difficulties such as getting the tax free cash into an ISA within ISA limits. I'm trying to be illustrate a concept rather than be technically completely accurate.The scenario I came up with was someone who put money into their pension, where their pension contributions (excluding tax relief) and after investment returns would have grown to £325,000 at death after age 75. I've assumed that the tax relief would have been at 40% throughout. The pension would have grown to £406,250 at death (adding in the tax relief and subtracting the 25% tax free cash). And I've assumed that the (non spouse) beneficiary withdraws money on the pension after death incurring the same 40% tax on the whole amount withdrawn. I've assumed that the deceased had no other assets at death, perhaps they were living off a state pension and a defined benefit pension that exactly covered their expenditure needsIn this scenario between them they pay £6,500 in overall tax going the pension route (inheritance tax plus income tax on withdrawal less income tax relief on contributions). However had they gone the ISA route they would have paid no tax at all because they would have been right on the threshold for inheritance tax.Quite instructive for understanding to try this. It's the fact that it's the grossed up value of pension that is being assessed for inheritance tax that pushes them into inheritance tax and even the tax free cash can't mitigate that effect of the extra inheritance tax.Assumes my logic/numbers are correct (which is the biggest assumption)

I came, I saw, I melted2 -

Albermarle said:

Yes, they would be required to pay any IHT liability apportioned to the pension direct to HMRC, before paying out the rest to any beneficiaries. ( see Snowman's post above )artyboy said:

So would the trustees be required to withhold the appropriate amount to cover IHT on the estate? I don't see how an executor could be liable for reclaiming it off whoever the pension got paid out to - and there will doubtless be situations where the pension pot is sufficiently big that the resultant IHT liability will exceed the value of the rest of the estate...DRS1 said:

The will doesn't govern the pension pot's destination after death. That is still down to the discretion or the scheme trustees/administrators and the expression of wishes from the member. None of that is being changed only the tax law.Bolt1234 said:Yes. In the will the pension pot is left to the wife tax free. She then uses a deed of variation to give some of the proceeds to her son within 2 years

Who'd want to be an executor ever again?

But doesn't that mean that (as HMRC would have been paid by the executor) that the pension co would not need to pay the apportioned IHT directly from the pension?

0 -

From part 3 of the consultationLHW99 said:

But doesn't that mean that (as HMRC would have been paid by the executor) that the pension co would not need to pay the apportioned IHT directly from the pension?PSAs [Pension Scheme administrators] will pay the Inheritance Tax charge to HMRC through the Accounting for Tax process (interest will accrue on this charge from the due date until it is paid and can be viewed on the pension scheme financial information)Any Inheritance Tax due from the non-pension elements of the estate (and any associated interest) is paid to HMRC by the PRs [Personal representatives]So if the non-pension assets for IHT purposes just happen to equal the pension death benefit value, and ignoring spouse exemption issues etc, they each pay half of the IHT to HMRC from my reading of it. But my reading could be wrong.I came, I saw, I melted1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards