We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Default when I have arrangement set up prior

Georgepuddingandpie

Posts: 2 Newbie

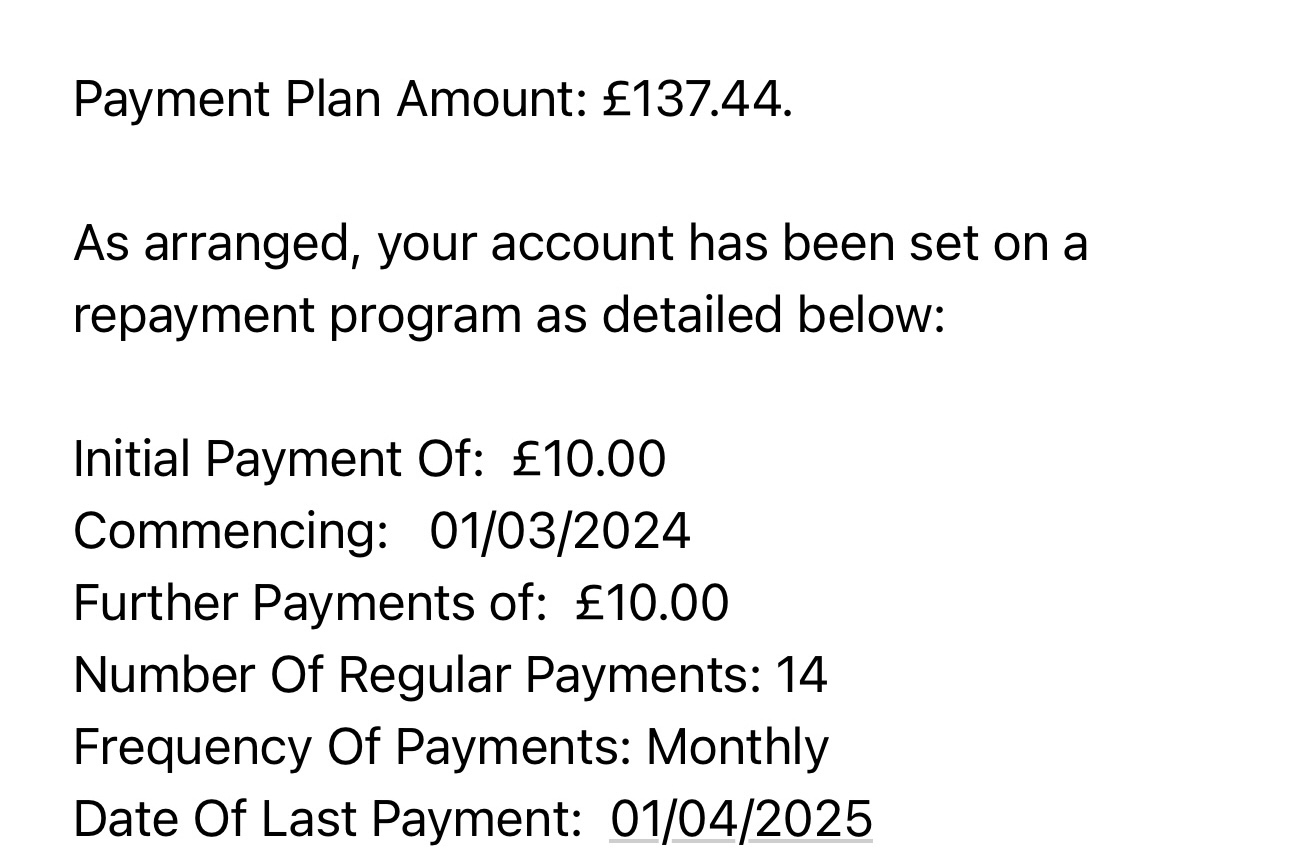

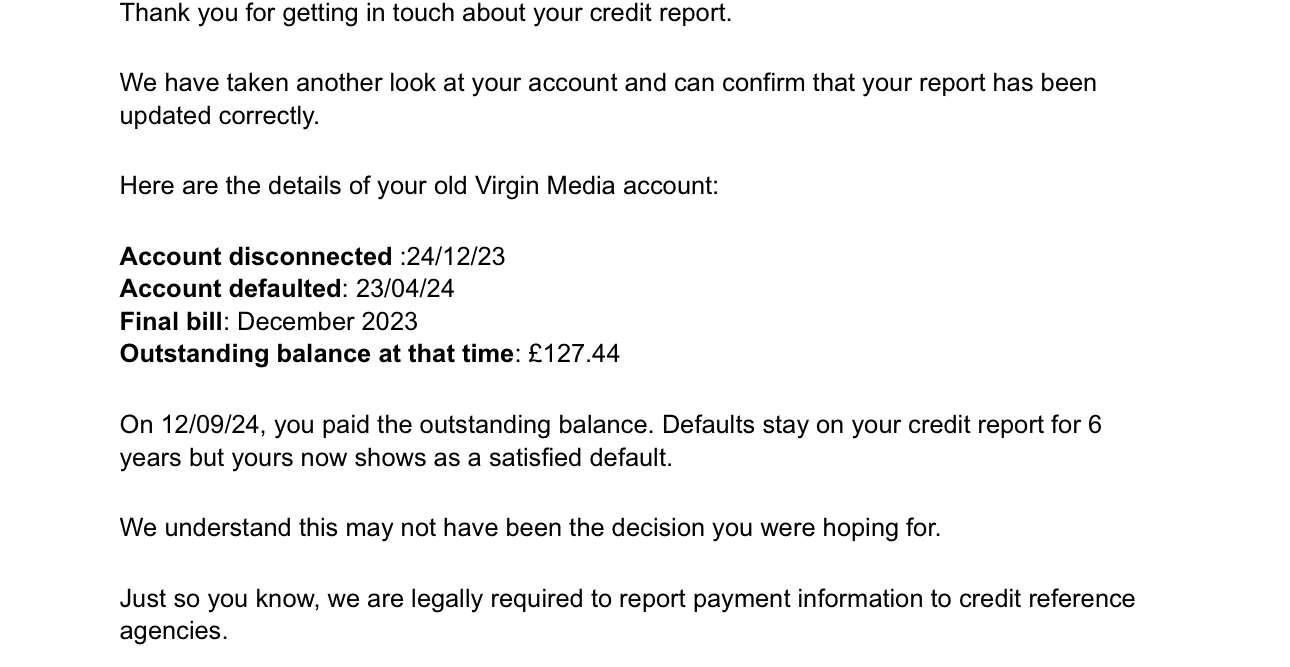

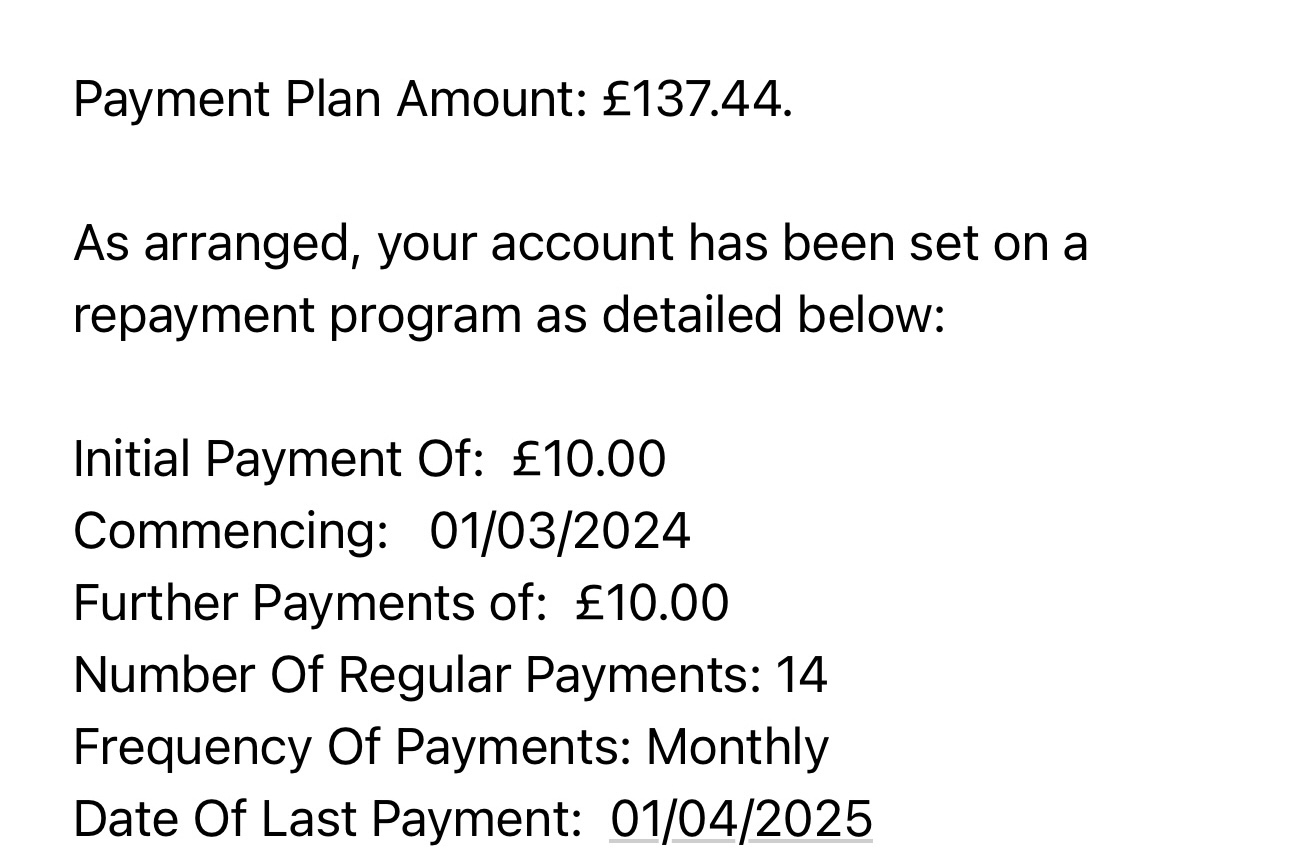

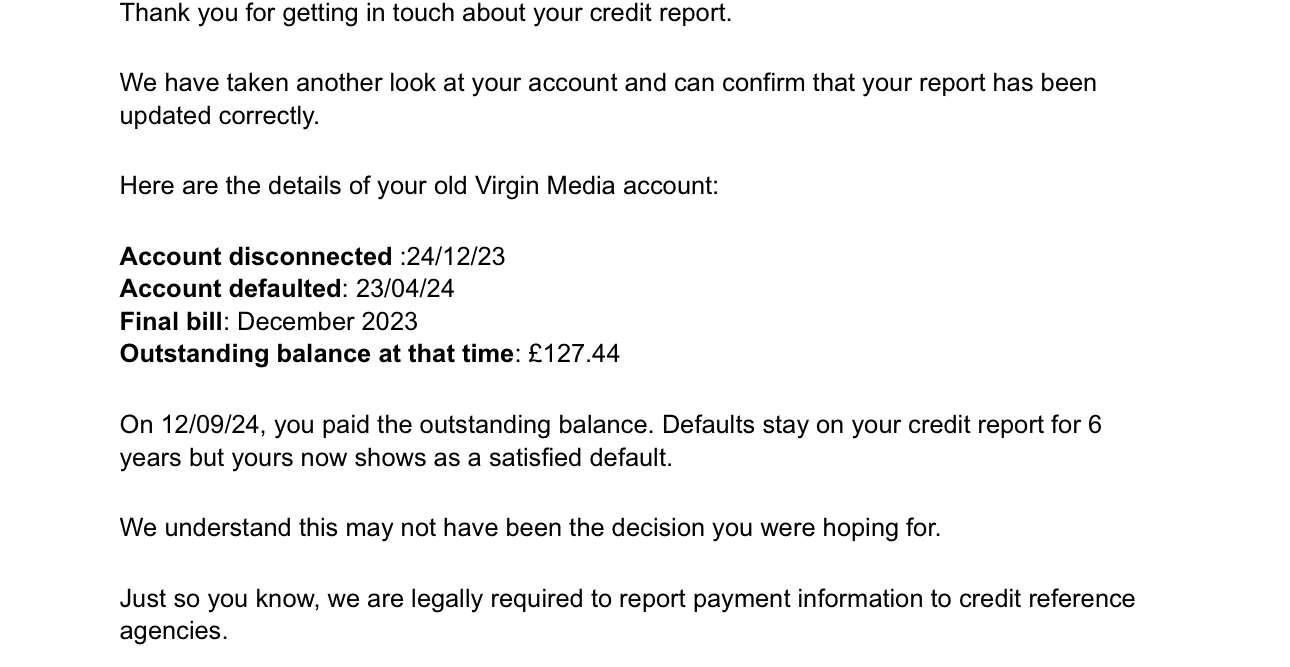

Hi, virgin media have added a default on my account. I was surprised as I’d already set up an arrangement to pay them. I left because they increased their prices and they produce a final bill in December. I hadn’t realised I’d have to pay a closing balance, when I got a notification in Feb, I agreed to set up and arrangement (of which I’ve not missed one payment). Then a few months later I checked Experian and there it was… a default dated April saying I missed four months payment? I had thought the arrangement would have prevented this. I’m super frustrated and emailed them numerous times and they will not remove it! I even spoke to an advisor on the phone who said if I paid it all off they would remove it and so I did thinking they would keep their word and left myself out of pocket. I just really wanted the default gone though. Now they won’t even honour their word and are saying they’re legal required to report to credit reference agencies.

0

Comments

-

So Virgin media increased their prices and you decided to leave them. At the end of your contract, you always have to pay for charges incurred during that final month. Why didn't Virgin media continue to take the money by direct debit like they had been doing?

0 -

It does not.Georgepuddingandpie said:Hi, virgin media have added a default on my account. I was surprised as I’d already set up an arrangement to pay them. I left because they increased their prices and they produce a final bill in December. I hadn’t realised I’d have to pay a closing balance, when I got a notification in Feb, I agreed to set up and arrangement (of which I’ve not missed one payment). Then a few months later I checked Experian and there it was… a default dated April saying I missed four months payment? I had thought the arrangement would have prevented this.

They will not as it is a factual statement.Georgepuddingandpie said:I’m super frustrated and emailed them numerous times and they will not remove it!

I think you might have possibly misunderstood. It would show as outstanding until paid, then up to date, but the default would still be correct on the date it happened.Georgepuddingandpie said:I even spoke to an advisor on the phone who said if I paid it all off they would remove it and so I did thinking they would keep their word and left myself out of pocket.

You cannot have the default "gone", it happened, it is factually recorded. They are legally required to report truthfully to the CRAs when they report data, so they cannot remove it.Georgepuddingandpie said:I just really wanted the default gone though. Now they won’t even honour their word and are saying they’re legal required to report to credit reference agencies.

Whilst it might be frustrating take it as a learning point and move on. It will have little impact in a few months, time heals all, even defaults.0 -

I would have thought they’d have to make me aware that I would still get a default even if an arrangement was set up. 0

I would have thought they’d have to make me aware that I would still get a default even if an arrangement was set up. 0 -

They can default after a period of non-payment, usually between three and six months, sometimes more, sometimes less. They do not need to make you aware and being in an arrangement to pay does not alter getting a default.Georgepuddingandpie said:

I would have thought they’d have to make me aware that I would still get a default even if an arrangement was set up. 1

I would have thought they’d have to make me aware that I would still get a default even if an arrangement was set up. 1 -

Unfortunately anything other than full contractual payment can, and likely will result in a default, it will be advised in the terms and conditions of any credit/service agreement.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.6K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.6K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards