We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Capital Gains Tax changes in the October Budget

This is if CGT tax rates do not change in the budget! How likely is it that CGT rates are aligned with income tax rates, AND ALSO Business asset relief is abolished?

If that was the case I could end up paying not 10%, but 45% tax?

Any helpful comments would be really appreciated

Comments

-

The other day on Bloomberg the Prime Minister laughed off the idea of CGT being fully aligned with income tax rates as being wide of the mark so on that front it shouldn't be the worst case scenario.Taxingmatters2024 said:I am in the process of selling my business, which will act as my retirement fund. I can complete the deal at any stage over the next 6 months. If I complete now I will pay 20% CGT. If I can wait until April 2025 I will have been with my company for 2 years and be able to claim Business asset disposal relief and pay tax at 10%.

This is if CGT tax rates do not change in the budget! How likely is it that CGT rates are aligned with income tax rates, AND ALSO Business asset relief is abolished?

If that was the case I could end up paying not 10%, but 45% tax?

Any helpful comments would be really appreciated

"Starmer Signals UK Won’t Raise Capital Gains Tax to 39%"

https://www.bloomberg.com/news/articles/2024-10-14/starmer-signals-uk-won-t-raise-capital-gains-tax-as-high-as-39

1 -

True but actions vs words and all that:wmb194 said:

The other day on Bloomberg the Prime Minister laughed off the idea of CGT being fully aligned with income tax rates as being wide of the mark so on that front it shouldn't be the worst case scenario.Taxingmatters2024 said:I am in the process of selling my business, which will act as my retirement fund. I can complete the deal at any stage over the next 6 months. If I complete now I will pay 20% CGT. If I can wait until April 2025 I will have been with my company for 2 years and be able to claim Business asset disposal relief and pay tax at 10%.

This is if CGT tax rates do not change in the budget! How likely is it that CGT rates are aligned with income tax rates, AND ALSO Business asset relief is abolished?

If that was the case I could end up paying not 10%, but 45% tax?

Any helpful comments would be really appreciated

"Starmer Signals UK Won’t Raise Capital Gains Tax to 39%"

https://www.bloomberg.com/news/articles/2024-10-14/starmer-signals-uk-won-t-raise-capital-gains-tax-as-high-as-39Two years ago, Ms Reeves, when she was the shadow chancellor, said a plan by Rishi Sunak, the then-chancellor, to increase employers’ NI contributions was “the worst possible tax rise at the worst possible time” and would affect employees’ pay packets.

I definitely wouldn't rule out the possibility BADR is scrapped and CGT raised.

1 -

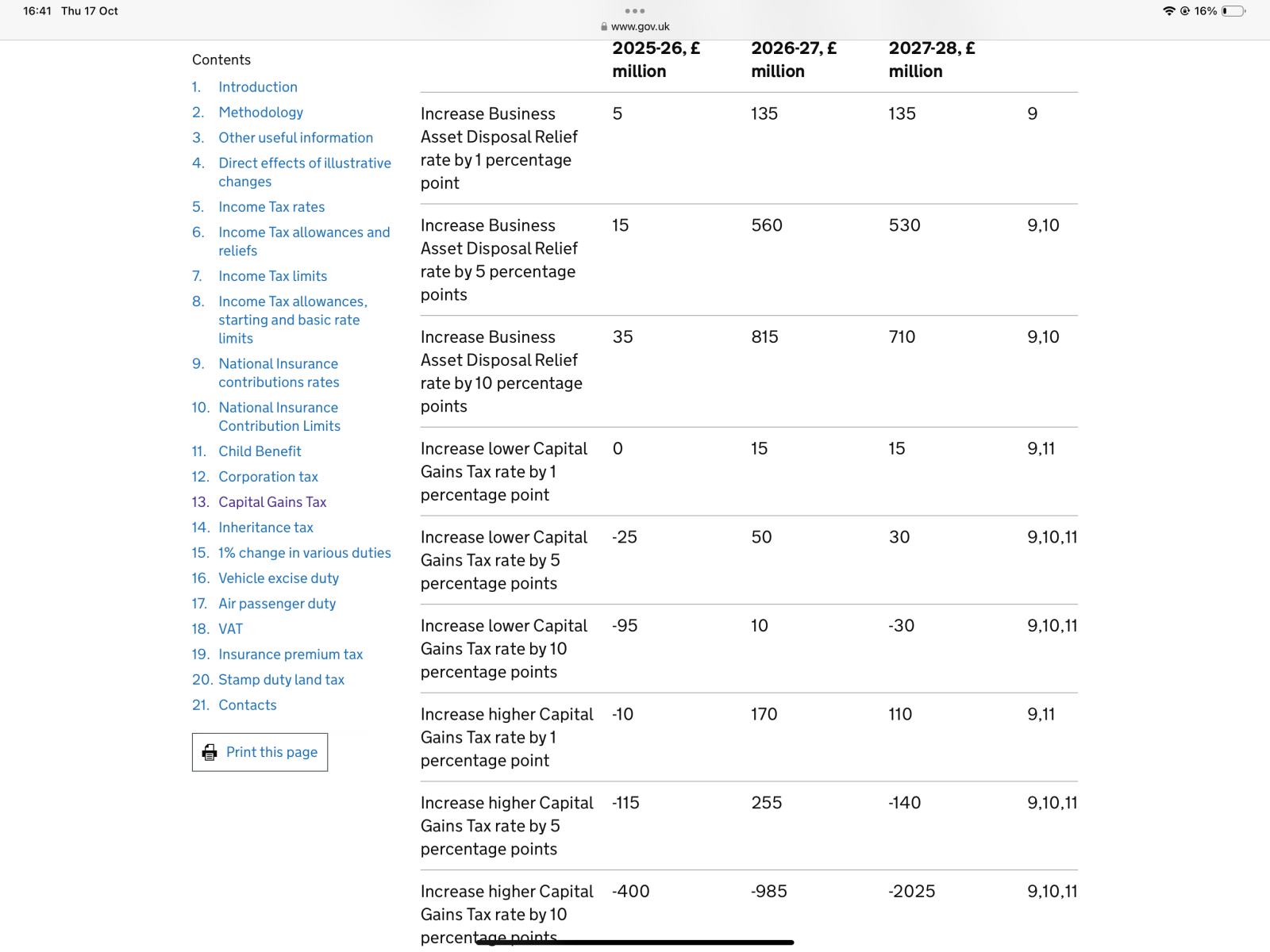

Unless they're insane, I'd expect the rate to be changed but not to be equalised with income tax. There's an HMRC report that says if it's equalised the tax take from CGT will fall, see the bottom row in the table below:hallmark said:

True but actions vs words and all that:wmb194 said:

The other day on Bloomberg the Prime Minister laughed off the idea of CGT being fully aligned with income tax rates as being wide of the mark so on that front it shouldn't be the worst case scenario.Taxingmatters2024 said:I am in the process of selling my business, which will act as my retirement fund. I can complete the deal at any stage over the next 6 months. If I complete now I will pay 20% CGT. If I can wait until April 2025 I will have been with my company for 2 years and be able to claim Business asset disposal relief and pay tax at 10%.

This is if CGT tax rates do not change in the budget! How likely is it that CGT rates are aligned with income tax rates, AND ALSO Business asset relief is abolished?

If that was the case I could end up paying not 10%, but 45% tax?

Any helpful comments would be really appreciated

"Starmer Signals UK Won’t Raise Capital Gains Tax to 39%"

https://www.bloomberg.com/news/articles/2024-10-14/starmer-signals-uk-won-t-raise-capital-gains-tax-as-high-as-39Two years ago, Ms Reeves, when she was the shadow chancellor, said a plan by Rishi Sunak, the then-chancellor, to increase employers’ NI contributions was “the worst possible tax rise at the worst possible time” and would affect employees’ pay packets.

I definitely wouldn't rule out the possibility BADR is scrapped and CGT raised.

https://www.gov.uk/government/statistics/direct-effects-of-illustrative-tax-changes/direct-effects-of-illustrative-tax-changes-bulletin-june-2024#capital-gains-tax

2 -

I sympathise. I have no knowledge of this area but just wondering can you hedge your bets, could you agree with the buyer to structure the sale of shares in 2 stages, e.g. sell 51% now so they control the business and you pay the tax rate now on that, and they buy the remaining 49% after the 2 years? Or does the legislation dictate that a business sale has to be 100% and in one transaction. Sometimes owners hold and sell less than 100% of shares.1

-

None of us know. We just have all the press speculation and rumours.Taxingmatters2024 said:How likely is it that CGT rates are aligned with income tax rates, AND ALSO Business asset relief is abolished?

And if they do make changes, none of us know whether they will come into force immediately or at a later date (although the latter might lead to a spurt of selling, which might not be ideal).

Personally, in your position I'd take the jam today and pay the 20% but that's just me.2 -

I've managed to pick up a crystal ball that shows the future of the Country from October 30. Very interesting it is to. Unfortunately, I can't tell any of you what it shows cos we can't discuss/debate politics. Never mind, you aint got long to wait.2

-

Here's one prediction I reckon you can take to the bank: holding the budget on October 30th has guaranteed a bunch of "halloween horror budget" type headlines the next day. Not sure they thought that part through.2

-

If governments were influenced by how excitable tabloids work, nothing would ever get done....hallmark said:Here's one prediction I reckon you can take to the bank: holding the budget on October 30th has guaranteed a bunch of "halloween horror budget" type headlines the next day. Not sure they thought that part through.0 -

I think you've just summed up the last 5 years.eskbanker said:

If governments were influenced by how excitable tabloids work, nothing would ever get done....hallmark said:Here's one prediction I reckon you can take to the bank: holding the budget on October 30th has guaranteed a bunch of "halloween horror budget" type headlines the next day. Not sure they thought that part through.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards