We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Target for Average Pension Pot growth

Comments

-

For sure i defo hope mines is not the default for most folk.MeteredOut said:

It may be your default L&G fund, but not the same for everyone. Here's the default fund for my employer scheme with L&G.bamgbost said:I had to go double check... and correction its 40% Equities not 25%, even still. The default fund sounds low on equities based on the advise given.

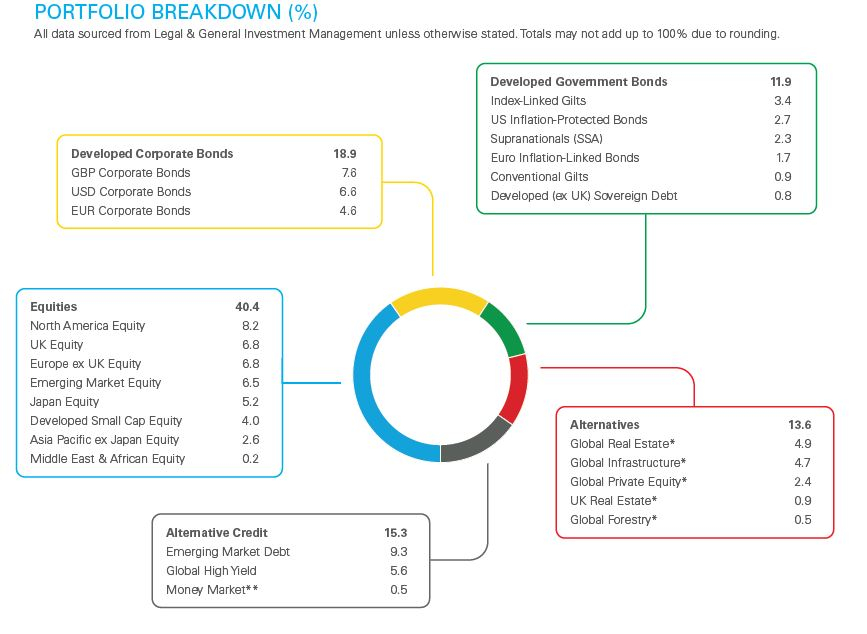

Its an L&G default fund... called. ...L&G PMC Multi-Asset Fund 3. Heres a snapshot of it....

im just glad I have asked the Q and looked into it now, and making steps to amend things....

The fund you have, I have seen. and that is defo looking more up my street.365 Day 1p challenge - £371.49 / 667.95

Emergency Fund £1000 / £1000 ( will enlarge once debts are cleared)

DFW - £TBC0 -

Interesting this. I only had a similar conversation with my advisor earlier this week……only by email though and we are meeting in a few weeks. I’m already taking my pension, so maybe a slightly different perspective but I’m in a position where I have taken a modest 10 year annuity (for stability) and the majority of what is a healthy pot in drawdown. I can draw what I need very easily and allow the pot to continue to increase (markets allowing). I don’t want it to drop as then it would have to work harder to support what I want to take out each month. Question is understanding the sweet spot to maximise my income, while allowing the pot to a5 least keep up with inflation.2

-

A sustainable withdrawal rate should be designed to survive the variable return of your pension pot, so even in years with negative returns you should be able to make your withdrawals. Realistically, you might reduce the amount you take out. The balancing act is to provide you with enough income (greater withdrawals usually require a higher percentage of equities) while also keeping the possibility of you running out of money to acceptable levels.jaypers said:Interesting this. I only had a similar conversation with my advisor earlier this week……only by email though and we are meeting in a few weeks. I’m already taking my pension, so maybe a slightly different perspective but I’m in a position where I have taken a modest 10 year annuity (for stability) and the majority of what is a healthy pot in drawdown. I can draw what I need very easily and allow the pot to continue to increase (markets allowing). I don’t want it to drop as then it would have to work harder to support what I want to take out each month. Question is understanding the sweet spot to maximise my income, while allowing the pot to a5 least keep up with inflation.And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

There was also the Great Dust Bowl between 1930 and 1936 in the Southern States. Creating tough economic times on an area highly dependent upon agriculture.Bostonerimus1 said:

Back in the 1930s no one was retiring with a DC pension and the US did not pass Federal Social Security laws until 1935. There was a reasonable safety net in New York, California and Massachusetts who all had state run benefits schemes, but the retirement landscape in the US in the 1930s depended on where you lived and who you worked for. Most people just tried to save something for hard times and expected to keep working, but that became difficult in the Great Depression.Hoenir said:

Gets overlooked that the US was still regrded as an emerging market back then. Europe was still overcoming the trauma of WW1. Likewise Japan was still a relatively unknown quantity only recently having exited self imposed exile. Charts unfortunately fail to paint the whole story.gm0 said:

Someone riding into town 1900-1930 retiring into the crash - would perhaps have not been quite as sanguine.0 -

That affected the "Great Plains" and lead to a lot of people moving westward to California. The Federal Government stepped in and so the Dust Bowl and The Great Depression did a lot to "socialize" the US at the Federal level.Hoenir said:

There was also the Great Dust Bowl between 1930 and 1936 in the Southern States. Creating tough economic times on an area highly dependent upon agriculture.Bostonerimus1 said:

Back in the 1930s no one was retiring with a DC pension and the US did not pass Federal Social Security laws until 1935. There was a reasonable safety net in New York, California and Massachusetts who all had state run benefits schemes, but the retirement landscape in the US in the 1930s depended on where you lived and who you worked for. Most people just tried to save something for hard times and expected to keep working, but that became difficult in the Great Depression.Hoenir said:

Gets overlooked that the US was still regrded as an emerging market back then. Europe was still overcoming the trauma of WW1. Likewise Japan was still a relatively unknown quantity only recently having exited self imposed exile. Charts unfortunately fail to paint the whole story.gm0 said:

Someone riding into town 1900-1930 retiring into the crash - would perhaps have not been quite as sanguine.And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

All these factors shape listed company profitability. That's what ultimately the markets reflect. Why equities carry a risk premium to cover the uncertainty of future events.Bostonerimus1 said:

That affected the "Great Plains" and lead to a lot of people moving westward to California. The Federal Government stepped in and so the Dust Bowl and The Great Depression did a lot to "socialize" the US at the Federal level.Hoenir said:

There was also the Great Dust Bowl between 1930 and 1936 in the Southern States. Creating tough economic times on an area highly dependent upon agriculture.Bostonerimus1 said:

Back in the 1930s no one was retiring with a DC pension and the US did not pass Federal Social Security laws until 1935. There was a reasonable safety net in New York, California and Massachusetts who all had state run benefits schemes, but the retirement landscape in the US in the 1930s depended on where you lived and who you worked for. Most people just tried to save something for hard times and expected to keep working, but that became difficult in the Great Depression.Hoenir said:

Gets overlooked that the US was still regrded as an emerging market back then. Europe was still overcoming the trauma of WW1. Likewise Japan was still a relatively unknown quantity only recently having exited self imposed exile. Charts unfortunately fail to paint the whole story.gm0 said:

Someone riding into town 1900-1930 retiring into the crash - would perhaps have not been quite as sanguine.0 -

Yes, economic and natural disasters will have an effect on investment markets. The difference today is that people have state pensions. Those with some resources and nous can secure more income with an annuity and follow a withdrawal plan that will survive all but the worst set of market returns. This is not complicated, but it can be difficult for many people to implement because it requires the extra income to invest and long term planning in both the accumulation and drawdown phases.Hoenir said:

All these factors shape listed company profitability. That's what ultimately the markets reflect. Why equities carry a risk premium to cover the uncertainty of future events.Bostonerimus1 said:

That affected the "Great Plains" and lead to a lot of people moving westward to California. The Federal Government stepped in and so the Dust Bowl and The Great Depression did a lot to "socialize" the US at the Federal level.Hoenir said:

There was also the Great Dust Bowl between 1930 and 1936 in the Southern States. Creating tough economic times on an area highly dependent upon agriculture.Bostonerimus1 said:

Back in the 1930s no one was retiring with a DC pension and the US did not pass Federal Social Security laws until 1935. There was a reasonable safety net in New York, California and Massachusetts who all had state run benefits schemes, but the retirement landscape in the US in the 1930s depended on where you lived and who you worked for. Most people just tried to save something for hard times and expected to keep working, but that became difficult in the Great Depression.Hoenir said:

Gets overlooked that the US was still regrded as an emerging market back then. Europe was still overcoming the trauma of WW1. Likewise Japan was still a relatively unknown quantity only recently having exited self imposed exile. Charts unfortunately fail to paint the whole story.gm0 said:

Someone riding into town 1900-1930 retiring into the crash - would perhaps have not been quite as sanguine.And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

Thanks for all the advice guys. I went through my portfolio in the summer, and made drastic changes. So that I am more in equities, with a higher risk, hoping for higher gains in the long run. The comments were very helpful.

One Q tho, that was still not answered clearly. Which is what is a reasonable % growth to expect on your pension on average each year. Does no-one have any guidance or advice along these lines?

I have been listening to Dave Ramsey, and he advises circa 8-10% growth, based on investment in the S&P500. Does this sound reasonable?365 Day 1p challenge - £371.49 / 667.95

Emergency Fund £1000 / £1000 ( will enlarge once debts are cleared)

DFW - £TBC1 -

100% S&P 500 is not for most people as it is too volatile. When/if it drops alarmingly at some point you need strong nerves just to sit tight, especially if it is your main fund.bamgbost said:Thanks for all the advice guys. I went through my portfolio in the summer, and made drastic changes. So that I am more in equities, with a higher risk, hoping for higher gains in the long run. The comments were very helpful.

One Q tho, that was still not answered clearly. Which is what is a reasonable % growth to expect on your pension on average each year. Does no-one have any guidance or advice along these lines?

I have been listening to Dave Ramsey, and he advises circa 8-10% growth, based on investment in the S&P500. Does this sound reasonable?

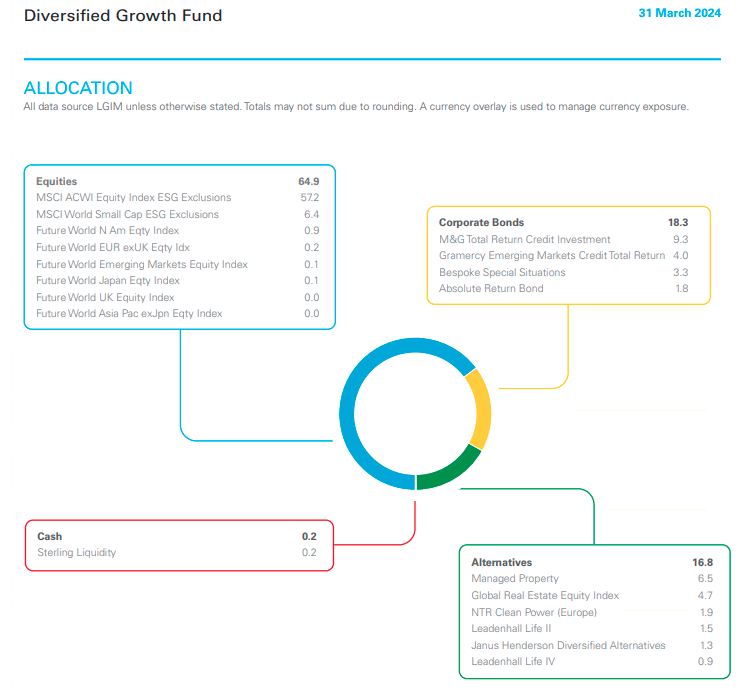

If you want a general guideline about typical pension fund growth, I would look at the one in a previous post - L&G Diversified growth, as a typical default fund. Perhaps add 1% pa for a fund with a higher % of equities ( say 75%)

Remember to take inflation into account, although looking forward you will have to guesstimate inflation- 2.5% ?0 -

Rather than expect an average growth for retirement planning I think it is far more sensible to assume a low one and then you should be reasonably safe no matter what happens. I used 3% inflation + 1%.bamgbost said:Thanks for all the advice guys. I went through my portfolio in the summer, and made drastic changes. So that I am more in equities, with a higher risk, hoping for higher gains in the long run. The comments were very helpful.

One Q tho, that was still not answered clearly. Which is what is a reasonable % growth to expect on your pension on average each year. Does no-one have any guidance or advice along these lines?

I have been listening to Dave Ramsey, and he advises circa 8-10% growth, based on investment in the S&P500. Does this sound reasonable?

8-10% for UK investors who would not naturally invest solely in the S&P 500 is very high and that would assume 100% equity. This is far riskier than many retirees would be prepared to accept. The real problem is that you will rarely get the average, some years you could greatly exceed it, some years you could lose money. It's a period of poor years during when you are continuing to drawdown to meet expenses that leads to running out of money before you die

Over the past 40 years the MSCI Global; index returned an average of 8.6%. But in the period 2001-2010 it returned an average of around 0%. Both figures are in £ terms. Feeling lucky?

https://curvo.eu/backtest/en/market-index/msci-world?currency=gbp0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards