We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Capital Gains Tax on crypto withdrawals

rundmc-k

Posts: 133 Forumite

in Cutting tax

Hello, I invested about 6k in crypto in

20/21, and made a profit of around 10k. I changed it all into Tether (cryptocurrency tied to the US dollar) back in 2021 and left it in the exchange/wallet.

I now want that money into my bank account. My question is about avoiding Capital gains tax. I know the profit limit is 3k before you start paying CGT, so can I...

- Withdraw ~9k without CGT (6k investment + 3k profit)

or

- Withdraw it all CGT-free as the profit was made in 20-21 when profit limit was about 12.5k

or

- Something else entirely

I would appreciate any help.

Many thanks

20/21, and made a profit of around 10k. I changed it all into Tether (cryptocurrency tied to the US dollar) back in 2021 and left it in the exchange/wallet.

I now want that money into my bank account. My question is about avoiding Capital gains tax. I know the profit limit is 3k before you start paying CGT, so can I...

- Withdraw ~9k without CGT (6k investment + 3k profit)

or

- Withdraw it all CGT-free as the profit was made in 20-21 when profit limit was about 12.5k

or

- Something else entirely

I would appreciate any help.

Many thanks

0

Comments

-

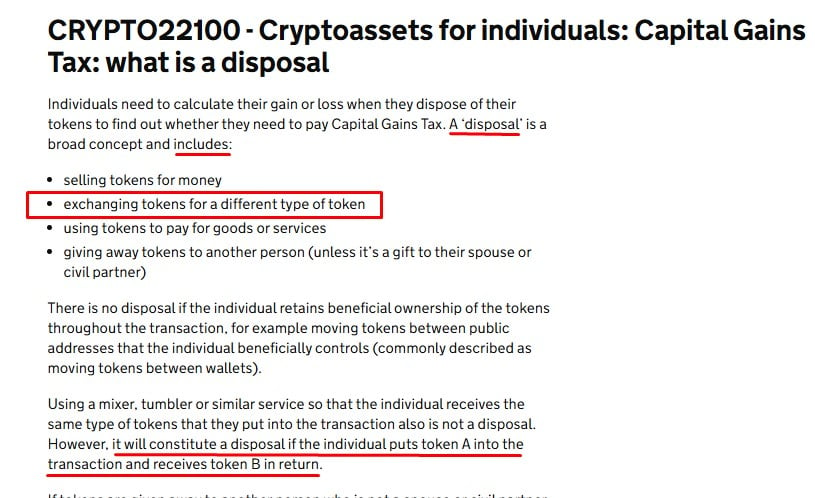

I could be wrong but... the CGT event was when you exchanged your crypto for USDT. You've missed your window to game the allowance and would have failed to report your gain to HMRC.

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual/crypto22100

The good news is the CGT annual exempt amount at that time was £12,300 so there should be no tax if your net gain was only £10k.3 -

Thankyou for your response. It's good to know the CGT event was the point that I changed crypto into USDT.

Missing my window to game the allowance... does this mean, for example, sending some to my wife to use her CGT allowance? So if I sent £3k USDT to an account set up in her name now it wouldn't count as a gift?0 -

gravel_2 said:

Forgive an entirely naïve question, why does exchanging crypto for Tether, another crypto currency/coin, become a withdrawal for CGT purposes? I thought the crypto (whatever flavour) had to be converted into Proper Money for this to happen.I could be wrong but... the CGT event was when you exchanged your crypto for USDT. You've missed your window to game the allowance and would have failed to report your gain to HMRC.

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual/crypto22100

The good news is the CGT annual exempt amount at that time was £12,300 so there should be no tax if your net gain was only £10k.

0 -

"Crypto" isn't a tax wrapper every time you exchange one token for another token you are exchanging one thing of value for another thing of value which triggers potential CGT liability. This will result in a capital gain or loss, even if the impact is not directly tied to GBP in your pocket until you eventually liquidate for fiat. The guidance makes this very clear.

@flaneurs_lobster2 -

explains it in that linkflaneurs_lobster said:gravel_2 said:

Forgive an entirely naïve question, why does exchanging crypto for Tether, another crypto currency/coin, become a withdrawal for CGT purposes? I thought the crypto (whatever flavour) had to be converted into Proper Money for this to happen.I could be wrong but... the CGT event was when you exchanged your crypto for USDT. You've missed your window to game the allowance and would have failed to report your gain to HMRC.

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual/crypto22100

The good news is the CGT annual exempt amount at that time was £12,300 so there should be no tax if your net gain was only £10k.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards