We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

HELP - CCA advice please

Comments

-

Hi fiveyearplan

Thanks for the pm.

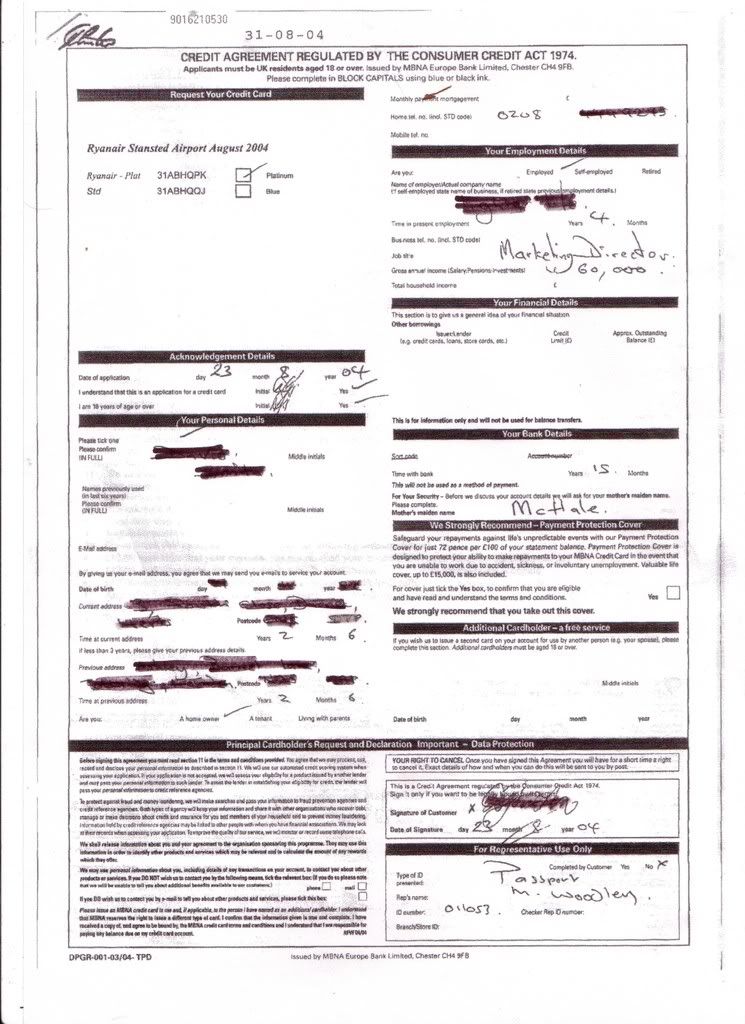

From reading loads of these threads it seems to me a bit hit and miss with no right and wrong way of going about it. I've also read too many government documents to remember were i've read things? One thing I did read was that the interest must be stated not implied, again my personal slant on this is if it is within the terms and conditions with a rider that says these figures do not take into consideration any changes in interest then how can it be the interest rate? re you cca on cag. Another point is your right to cancell - by getting you to complete the application on your way out of the country they are infact removing your rights to cancell 'knowing that it's for usually 14 days?'

As you have probably read I disagree with some but it's all about how you want to play it. I see it as a win win situation. I win and I don't pay them any more money, if I don't win then at least i've cost them time and a few pennies off their bottom line.

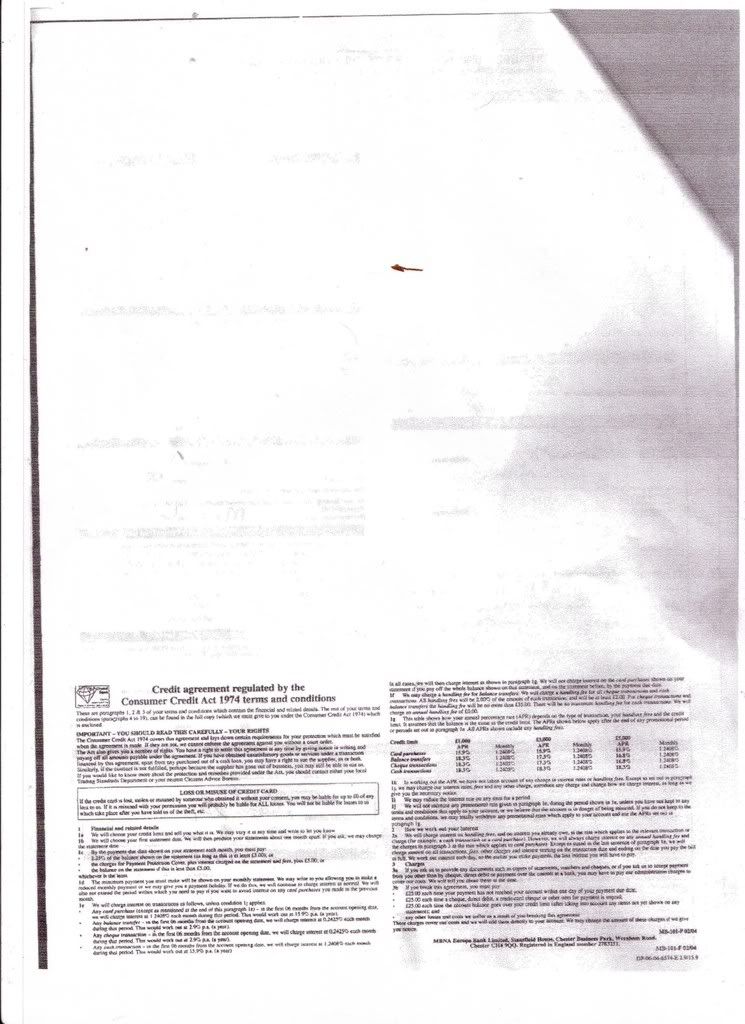

One think I have picked up on is that ALL are confused by the 2007 revision to the act and this is NOT backward looking. The 2004 revision did not alter the 1974 act so upto when the 2007 came into force all CCA's come under the 1974 act. (Here is the bit i'm unsure about) Reg 3 therefore does not apply pre 2007 and the blurb to do with not having to send a copy of the original true executed CCA is crap. I think some DCA's are trying to use this and the probability is that some 126 year old judge will fall for it.

KelJune 2005 = 48K of Debt

Sept 2006 Started dmp = 56k of Debt (inc fees and charges) DFD April 2030:eek:

May 2008 = <5k of Debt (CCA route -48K, paid off 3K) DFD April 2010

Nov 2008 Lloyds found CCA for 14K loan:mad: New DFD Jan 2016

Happy so far tomorrows another day 0

0 -

I agree that it all seems hit and miss, we will just go to court and hopefully a) they don't show up b) we get a good judge! I think we've got another 2 weeks til court so if you find out anything else, please post on here or pm me.

Thanks

:j :j

0 -

fiveyearplan wrote: »I agree that it all seems hit and miss, we will just go to court and hopefully a) they don't show up b) we get a good judge! I think we've got another 2 weeks til court so if you find out anything else, please post on here or pm me.

Thanks

Hi again, fyp - Posters on sites such as this one, and the Consumer Advice site, can only give their views, based on their own experience, and interpretation, of the law and how it should be applied to a particular problem - I hasten to add that I include myself, first and foremost, in this.

There are, of course, many conflicting areas within the application of the Consumer Credit Act, and the many amendments since the act came into force do not do much to make the reading of the act any easier for the 'layman'.

Whilst, as I said in my previous post, credit card application forms, which do not contain all of the required information, 'do not a consumer credit agreement make' it would, most certainly, be in your best interests to discuss the actual case with a qualified legal professional, in order to be absolutely certain of your defence.

You could start with a free phone call to National Debtline - 0808 808 4000 or CCCS - 0800 138 1111 or your local Citizen's Advice Bureau.

These charities are staffed with fully trained advisers and would have access to qualified legal experts who would be best suited to confirm whether or not the MBNA 'application form' does constitute a legally binding consumer credit agreement.

Good luckI am NOT, nor do I profess to be, a Qualified Debt Adviser. I have made MANY mistakes and have OFTEN been the unwitting victim of the the shamefull tactics of the Financial Industry.

If any of my experiences, or the knowledge that I have gained from those experiences, can help anyone who finds themselves in similar circumstances, then my experiences have not been in vain.

HMRC Bankruptcy Statistic - 26th October 2006 - 23rd April 2007 BCSC Member No. 7

DFW Nerd # 166 PROUD TO BE DEALING WITH MY DEBTS0 -

Thanks Rog2. I think I'm just looking for someone to tell me I'm right! I know no one can do that it's just a bit stressful.

:j :j

0 -

fiveyearplan wrote: »Thanks Rog2. I think I'm just looking for someone to tell me I'm right! I know no one can do that it's just a bit stressful.

From what you have posted I firmly believe that you are right, and that you will be covered by the protection that the Consumer Credit Act, 1974, affords to all consumers.

I fully understand how stressfull 'debt' can be, and it is certainly not helped by the behaviour of those 'scavengers' that feed on the misfortune of people like us.

I would just feel a bit happier if you did get legal confirmation - thanks.I am NOT, nor do I profess to be, a Qualified Debt Adviser. I have made MANY mistakes and have OFTEN been the unwitting victim of the the shamefull tactics of the Financial Industry.

If any of my experiences, or the knowledge that I have gained from those experiences, can help anyone who finds themselves in similar circumstances, then my experiences have not been in vain.

HMRC Bankruptcy Statistic - 26th October 2006 - 23rd April 2007 BCSC Member No. 7

DFW Nerd # 166 PROUD TO BE DEALING WITH MY DEBTS0 -

Hmmm................

Reading that thread, it was Curleyben who was of the opinion that the agreement was enforceable thought the courts. He is one of the CAG CCA specialists, and generally I would consider his advice to be more reliable than most. I must admit, I'm not quite sure how he read the fine print to see the prescribed terms.

The only one I can make out is the one that shows how the APR is set.

Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0 -

Yes, thats the one I'm referring to. Also I don't really know where this second page came from as the application form was on a clipboard and the MBNA rep filled it in, she never showed us the back of it, so as far as we knew it just had one page.

:j :j

0 -

If it did have a back page or page 2 don't you think we should have to initial it? Otherwise anything could be put in without our knowledge.

:j :j

0 -

fiveyearplan wrote: »If it did have a back page or page 2 don't you think we should have to initial it? Otherwise anything could be put in without our knowledge.

Most definitely, fyp.I am NOT, nor do I profess to be, a Qualified Debt Adviser. I have made MANY mistakes and have OFTEN been the unwitting victim of the the shamefull tactics of the Financial Industry.

If any of my experiences, or the knowledge that I have gained from those experiences, can help anyone who finds themselves in similar circumstances, then my experiences have not been in vain.

HMRC Bankruptcy Statistic - 26th October 2006 - 23rd April 2007 BCSC Member No. 7

DFW Nerd # 166 PROUD TO BE DEALING WITH MY DEBTS0 -

fiveyearplan wrote: »Yes, thats the one I'm referring to. Also I don't really know where this second page came from as the application form was on a clipboard and the MBNA rep filled it in, she never showed us the back of it, so as far as we knew it just had one page.

It certainly appears to be the back page of the same document. If you look on the first side under the bank details section you can see the "mother's maiden name" entry, which clearly shows though in reverse in the scan of the back page.

Is that as good an image of the small print that you can get?Free/impartial debt advice: National Debtline | StepChange Debt Charity | Find your local CAB

IVA & fee charging DMP companies: Profits from misery, motivated ONLY by greed0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards