We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Tax Credits finalisation for 2023/24 - Help!

FIREDreamer

Posts: 1,118 Forumite

I am having problems getting this closed off.

In April I was sent a statement giving my salary as S (say), other income as O (say, which is correct). I rang them up and, after being on hold for nearly an hour got through to someone to advise them of my personal pension contributions made from my bank account, P (gross) say, so they reduced my declared salary to S-P and my total income as S-P+O.

In April I was sent a statement giving my salary as S (say), other income as O (say, which is correct). I rang them up and, after being on hold for nearly an hour got through to someone to advise them of my personal pension contributions made from my bank account, P (gross) say, so they reduced my declared salary to S-P and my total income as S-P+O.

In June I received another statement giving my total income as S+O. They had ignored my personal pension contributions again.

Another long on hold phonecall ensued and again I advised the pension contributions. The lady said she will make another note on my tax credits file.

Today I received a final statement dated 23rd July for 2023/24. Guess what? My income is S+O and the pension contributions have been ignored yet again and not deducted. As my pension contributions were large (due to intended retirement in 2024/25) but within limits the difference is a significant alleged overpayment which is incorrect. Indeed with pension contributions of P we have been slightly underpaid. P was made to ensure no overpayment of tax credits would be made.

As I started taking an annuity (included with my DB pensions within O) I set my pension contributions such that P= S (pretty much) so my total income is O.

We all know that tax credits have pension contributions as allowable deductions with no cap mentioned. However what is the legislation that I need to quote in my complaint about the tax credits staff not deducting these contributions?

I have bank statements showing these coming from my bank account (not employer contributions) plus post sale summary showing these being added to my pension.

If someone can state the legislation/ reference that I need to quote in my complaint about the tax credits staff not deducting these contributions so that I can get 2023/24 ended properly with no liability for a non existent overpayment I would be very grateful.

Thanks

Another long on hold phonecall ensued and again I advised the pension contributions. The lady said she will make another note on my tax credits file.

Today I received a final statement dated 23rd July for 2023/24. Guess what? My income is S+O and the pension contributions have been ignored yet again and not deducted. As my pension contributions were large (due to intended retirement in 2024/25) but within limits the difference is a significant alleged overpayment which is incorrect. Indeed with pension contributions of P we have been slightly underpaid. P was made to ensure no overpayment of tax credits would be made.

As I started taking an annuity (included with my DB pensions within O) I set my pension contributions such that P= S (pretty much) so my total income is O.

We all know that tax credits have pension contributions as allowable deductions with no cap mentioned. However what is the legislation that I need to quote in my complaint about the tax credits staff not deducting these contributions?

I have bank statements showing these coming from my bank account (not employer contributions) plus post sale summary showing these being added to my pension.

If someone can state the legislation/ reference that I need to quote in my complaint about the tax credits staff not deducting these contributions so that I can get 2023/24 ended properly with no liability for a non existent overpayment I would be very grateful.

Thanks

0

Comments

-

Suggest you submit a complaint, if not already done.

Others will tell you what legislation to quote.The comments I post are personal opinion. Always refer to official information sources before relying on internet forums. If you have a problem with any organisation, enter into their official complaints process at the earliest opportunity, as sometimes complaints have to be started within a certain time frame.0 -

It's a while since I was involved with tax credits but this was always an ongoing problem. I think you need to submit a "mandatory reconsideration", looks like you can do this online now, and attach the completed TC825 working sheet plus proof of the pension contributions - a tax year contributions statement from the pension provider is probably better than bank statements.0

-

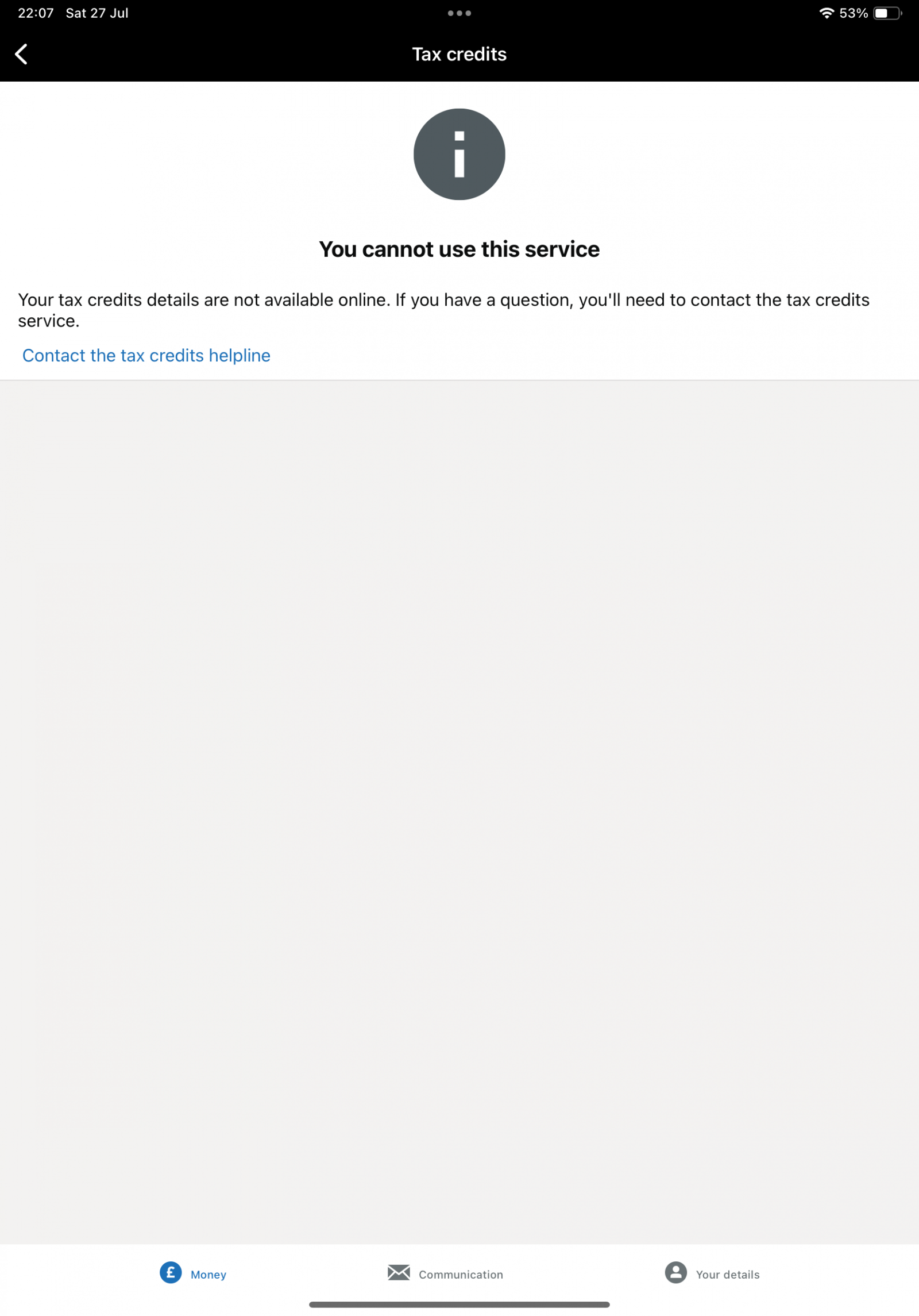

Online access to tax credits is no longer available.zagfles said:It's a while since I was involved with tax credits but this was always an ongoing problem. I think you need to submit a "mandatory reconsideration", looks like you can do this online now, and attach the completed TC825 working sheet plus proof of the pension contributions - a tax year contributions statement from the pension provider is probably better than bank statements.

Is there an email address I can send my complaint to instead of by post to tax credits?

0 -

Unusual for personal pension contributions to be paid gross. Normally tax relief is claimed on your behalf. As the money is paid by you from taxed earnings.FIREDreamer said:to advise them of my personal pension contributions made from my bank account, P (gross) say, so they reduced my declared salary to S-P and my total income as S-P+O.0 -

Hoenir said:

Unusual for personal pension contributions to be paid gross. Normally tax relief is claimed on your behalf. As the money is paid by you from taxed earnings.FIREDreamer said:to advise them of my personal pension contributions made from my bank account, P (gross) say, so they reduced my declared salary to S-P and my total income as S-P+O.

Tax credit calculations are based upon gross earnings so any pension contributions made from RAS pay need to be reported grossed up with income tax added back on.

1 -

I paid net 0.8 * P and the pension provider grossed up to P. I am a basic rate taxpayer.kaMelo said:Hoenir said:

Unusual for personal pension contributions to be paid gross. Normally tax relief is claimed on your behalf. As the money is paid by you from taxed earnings.FIREDreamer said:to advise them of my personal pension contributions made from my bank account, P (gross) say, so they reduced my declared salary to S-P and my total income as S-P+O.

Tax credit calculations are based upon gross earnings so any pension contributions made from RAS pay need to be reported grossed up with income tax added back on.0 -

Never had any issues with TC and pension. We either phoned them up or updated it via online gateway. Always put 100% of earning into pension. Just keep updating it with correct figures. Just keep updating them with correct figures.0

-

I am having similar. Told them twice, got a letter saying they were using income that did not take them into account, option of posting evidence if unhappy with calculation unless it was for personal pension in which case to just call them so called again, which I did. Waiting to see what happens. Also can't access claim online anymore.

Perhaps I will also send them evidence even though letter said to call. Will try an dig out paperwork to see where I was to send evidence to.I think....0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards