We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Building Insurance - malicious acts

Comments

-

Which policy do you have with them? They have three levels of coverSVts said:

So back to the original question, If a car crashes into my house am I insured?XRS200 said:

It's very clear. All in the policy wording.SVts said:

OK thanks. I was just looking for clarification on what I was insured for but I guess it is never as clear as that when it comes to insurance as each case/claim is unique. Fingers crossed then :-DXRS200 said:

There are three policy wordings on their website. The one I looked at covers collision/impact by vehicles.SVts said:I cannot find a detailed policy.

Only document I can find is this;

https://quote1.swinton.co.uk/swinton/default/hc/doc.download?documentId=8653554993

I think it would be rare for a buildings policy not to cover this.

Looking at their basic policy, if the home itself was damaged you'd be covered for all the damage covered up to the sums insured less the policy excess. If the car went through your fence but did not damage the house itself then you wouldn't be covered

If you have Legal Expenses cover you are likely to be covered for claiming any uninsured losses (eg the excess) from the driver of the vehicle assuming they were negligent.0 -

I would read that as you haven't taken out the optional cover which would include accidental damage to your buildings. So your policy wouldn't cover if a car crashes into your house unless you added the optional cover.SVts said:What is insured?

Damage to your buildings caused by things such as fire, storm, flood, theft, escape of water or domestic heating fuel, malicious acts and subsidence

Alternative Accommodation and loss of rent

Accidental Damage to underground services

Lost or stolen keys

Property owners liability

Finding the source of escaping water

Frost damage to inside pipes

Optional Cover • Accidental damage to your buildings Not included

Probably answers my original query If a car crashes into my house am I insured?

No I am not?

BUT if a car crashes into your house I suspect that that person's motor insurance would cover the damage. It's not a common thing so few of us will ever experience this (as opposed to losing keys or having frost damage etc). More common, and mentioned on MSE previously, was having a car crash into a fence/wall and the problems of getting the driver's insurance to cover the type of repairs the home owner wanted done. (returning to original condition rather than a mere repair). All of which suggests to me that it's good to have a sturdy barrier between the road and your house to, literally, lessen the impact.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅0 -

You're reading it wrong, for reasons already set out in the thread.Brie said:

I would read that as you haven't taken out the optional cover which would include accidental damage to your buildings. So your policy wouldn't cover if a car crashes into your house unless you added the optional cover.SVts said:What is insured?

Damage to your buildings caused by things such as fire, storm, flood, theft, escape of water or domestic heating fuel, malicious acts and subsidence

Alternative Accommodation and loss of rent

Accidental Damage to underground services

Lost or stolen keys

Property owners liability

Finding the source of escaping water

Frost damage to inside pipes

Optional Cover • Accidental damage to your buildings Not included

Probably answers my original query If a car crashes into my house am I insured?

No I am not?0 -

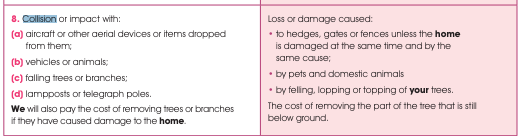

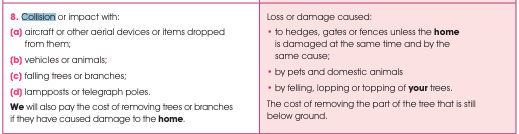

It doesn't come under AD but the discrete Collision Damage section, the only thing that wouldn't cover is if you were cutting down a tree and it fell onto your house... that would be an AD claim whereas if it came down in a storm or for reasons unknown then its Collision.Brie said:

I would read that as you haven't taken out the optional cover which would include accidental damage to your buildings. So your policy wouldn't cover if a car crashes into your house unless you added the optional cover.SVts said:What is insured?

Damage to your buildings caused by things such as fire, storm, flood, theft, escape of water or domestic heating fuel, malicious acts and subsidence

Alternative Accommodation and loss of rent

Accidental Damage to underground services

Lost or stolen keys

Property owners liability

Finding the source of escaping water

Frost damage to inside pipes

Optional Cover • Accidental damage to your buildings Not included

Probably answers my original query If a car crashes into my house am I insured?

No I am not?0 -

Which policy did you buy?SVts said:

So back to the original question, If a car crashes into my house am I insured?XRS200 said:

It's very clear. All in the policy wording.SVts said:

OK thanks. I was just looking for clarification on what I was insured for but I guess it is never as clear as that when it comes to insurance as each case/claim is unique. Fingers crossed then :-DXRS200 said:

There are three policy wordings on their website. The one I looked at covers collision/impact by vehicles.SVts said:I cannot find a detailed policy.

Only document I can find is this;

https://quote1.swinton.co.uk/swinton/default/hc/doc.download?documentId=8653554993

I think it would be rare for a buildings policy not to cover this.0 -

This is the problem with using a chat bot for things like this. Unless you create a very clear prompt and the chat bot has been trained you will get all sorts of hallucinogenic responses.

The risk isn't that AI will rise up and eliminate us, its that we will dumb down to the level the AI is trained to.

Accidental damage (for 1st party) is very different to 3rd party. So you throwing the TV down the stairs is a very different clause to someone else driving their car into your house. Former, unless you have taken accidental contents cover then no, latter with most buildings insurance would be yes, but check the policy itself as people have said.0 -

So back to the original answer - what does the policy book relevant to your insurance policy say?SVts said:

So back to the original question, If a car crashes into my house am I insured?XRS200 said:

It's very clear. All in the policy wording.SVts said:

OK thanks. I was just looking for clarification on what I was insured for but I guess it is never as clear as that when it comes to insurance as each case/claim is unique. Fingers crossed then :-DXRS200 said:

There are three policy wordings on their website. The one I looked at covers collision/impact by vehicles.SVts said:I cannot find a detailed policy.

Only document I can find is this;

https://quote1.swinton.co.uk/swinton/default/hc/doc.download?documentId=8653554993

I think it would be rare for a buildings policy not to cover this.

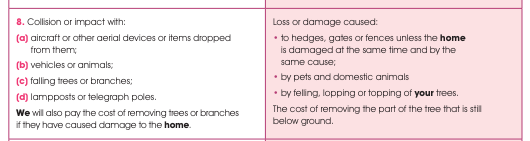

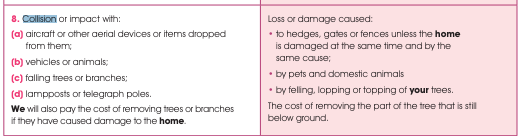

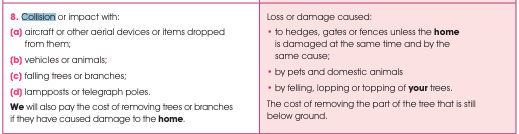

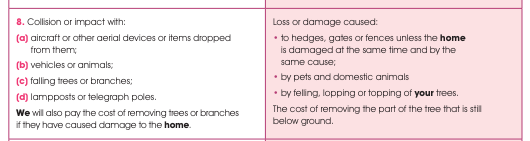

Swinton essentials:

Swinton classic:

Swinton premium:

I think I see consensus there.1 -

Thank you. I cannot find the policy book though :BarelySentientAI said:

So back to the original answer - what does the policy book relevant to your insurance policy say?SVts said:

So back to the original question, If a car crashes into my house am I insured?XRS200 said:

It's very clear. All in the policy wording.SVts said:

OK thanks. I was just looking for clarification on what I was insured for but I guess it is never as clear as that when it comes to insurance as each case/claim is unique. Fingers crossed then :-DXRS200 said:

There are three policy wordings on their website. The one I looked at covers collision/impact by vehicles.SVts said:I cannot find a detailed policy.

Only document I can find is this;

https://quote1.swinton.co.uk/swinton/default/hc/doc.download?documentId=8653554993

I think it would be rare for a buildings policy not to cover this.

Swinton essentials:

Swinton classic:

Swinton premium:

I think I see consensus there.0 -

Link to a page with all three has been provided to you earlier1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards