We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

BEST WAY TO DO DRAWDOWN FOR A VERY SMALL POT

Comments

-

epsilon4900 said:Xylophone Just had a conversation with HL where they are saying that there is no way of avoiding triggering the MPAA eg by transferring the policy and splitting it into two sub funds as it were. The woman is very clear on this.

I am sure I had a different conversation a few weeks ago where it did seem to be possible. So I am more confused now than I ever was! Having said that I am unlikely ever to need to deposit more than 10k a year into a pension from this point so there is probably no advantage to be gained by delaying at this point and worrying further about the MPAA. Thanks.

Hargreaves will create a small pot (£10,000 or less, with 25% of it tax free, though technically not a PCLS) out of an existing SIPP up to three times - this does not invoke MPAA and does not use up any lump sum allowance.xylophone said:Xylophone Just had a conversation with HL where they are saying that there is no way of avoiding triggering the MPAAI am rather puzzled.

Was the idea not to create "small pots"?

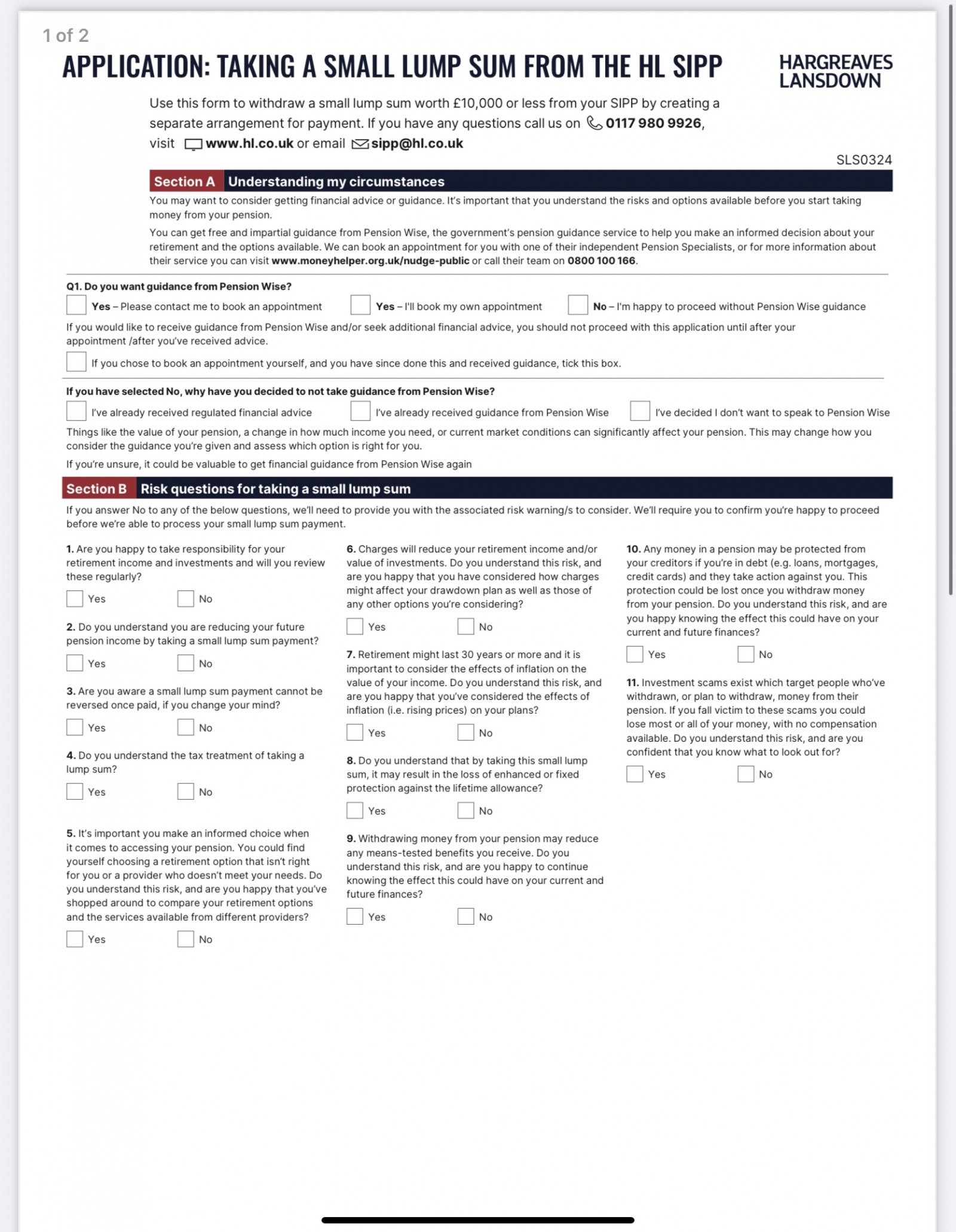

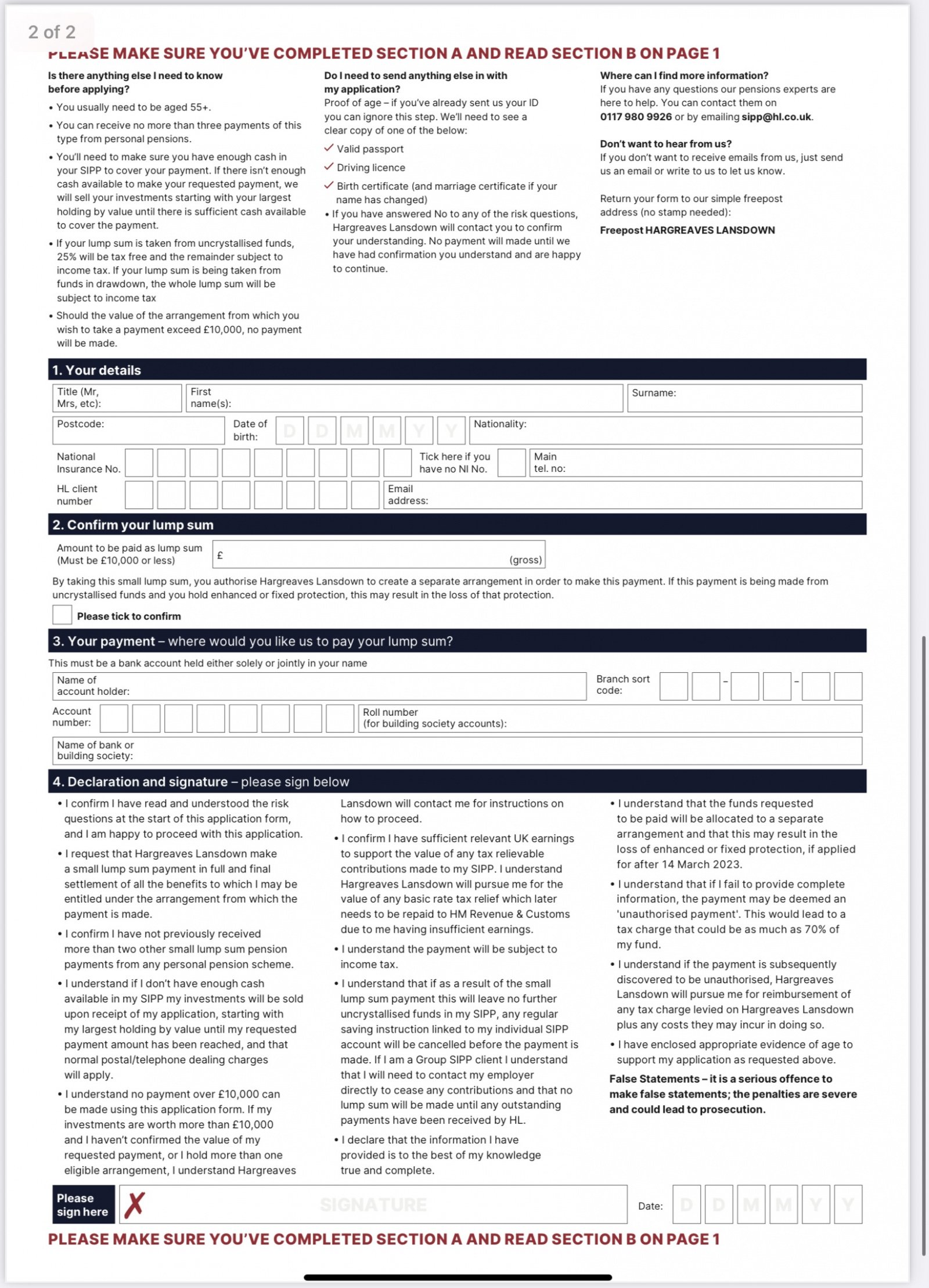

Just fill in this form and send it in.

https://www.hl.co.uk/__data/assets/pdf_file/0010/19864405/split-small-pots.pdf

The form looks like this …

0 -

Thanks Xylophone I am also puzzled! A few weeks ago HL person said something like this to avoid the MPAA was possible with my pension on transfer to them. ( Currently a pot of 10 to 11k ) We talked at length about it.

Today another person at HL said this was in fact not possible at all. So yes I am rather puzzled.

I think the trade off even if it is in fact possible is that I would have to take the whole amount eg 10k and be taxed on the non tax free bit of that. So it's clear to me that doing that although avoiding the MPAA has tax implications that probably outweigh it. I am frustrated to have one long conversation in early June saying one thing and then another long conversation today saying something completely different. Given that my current pot with Phoenix Life is

between 10 and 11 k eg over 10k how would it be possible to regard that as a small pot? Unless it's possible to portion off 10k of it and do something with that but then if so what happens to the remaining money? Does that just stay in the original product? I am unfortunately more confused than I was! Thanks though for your help. Maybe I am just a bear of very little brain after all!0 -

But £11000 could create three "small pots"?

For example, £3666 would give a tax free £916.50 with £2749.50 taxable income?

0 -

Thanks. So would the money need to be split somehow before leaving Phoenix Life? The HL person today was ruling out making my ( let's call it 11k ) into say two smaller funds and not triggering the MPAA when accessing either but just being fully taxed? In fact I could probably earn 2749 in your example as I never earn my tax allowance as I am self employed so that might actually work. Should I ask Phoenix Life about this? I am now wondering about making smaller pots eg below 10k from the fund they hold and transferring one at a time to make the tax work out and ideally leave the other/s in Phoenix still growing? Should that be possible?

0 -

Have you seen my post above?epsilon4900 said:Thanks. So would the money need to be split somehow before leaving Phoenix Life? The HL person today was ruling out making my ( let's call it 11k ) into say two smaller funds and not triggering the MPAA when accessing either but just being fully taxed? In fact I could probably earn 2749 in your example as I never earn my tax allowance as I am self employed so that might actually work. Should I ask Phoenix Life about this? I am now wondering about making smaller pots eg below 10k from the fund they hold and transferring one at a time to make the tax work out and ideally leave the other/s in Phoenix still growing? Should that be possible?0 -

Thanks FIREDreamer. No I haven't seen your post yet. Will have a good look when I finish work

after 6! Ta....0 -

It appears that Phoenix cannot offer the flexibility you seek from your approx £11000.

See Firedreamer's post.0 -

Thanks for this. So the idea would be to transfer the whole lot eg 10.5 to 11k pot I have with Phoenix Life to

HL into a SIPP there. Then I could remove small amounts as per the form above and 25 per cent would be tax free and the rest of that small amount would be fully taxed. So I would need to ensure that the taxable bit of the small amount did not take me over my tax allowance that year and claim the tax that would inevitably still be taken off once I have self assessed and hopefully shown I am still below the tax threshold as it were. And doing this up to three times to use up the fund would not trigger the MPAA? Pity the person today at HL seemed to know none of this sort of thing at all.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.4K Banking & Borrowing

- 253.3K Reduce Debt & Boost Income

- 453.8K Spending & Discounts

- 244.4K Work, Benefits & Business

- 599.7K Mortgages, Homes & Bills

- 177.2K Life & Family

- 258K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards