We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Any USS crew about?

bluebirdy

Posts: 78 Forumite

I’ve just found out my employer is about to launch a VS scheme. My latest plan was to retire fully in three years, possibly flexibly retiring before then. I don’t know if I’ll be eligible for VS or what the offer is yet but handily, I’d already asked for an updated pension quote because I wanted to compare the impact of the Apr 24 ERF change with it reverting back to Oct 24 on a possible full retirement this year.

It looks like a (positive) difference of about £2k pa in pension plus £14k of lump sum if I go now (compared to how much it would have been had the new ERFs already been in place)

If you were me, what kind of questions would you be asking of a VS sum to help you make the decision?

eg can it cover three years of full salary (of course not! but then I wouldn’t be working! 😆)

can it cover enough to bridge my ideal pension amount, the amount I would have liked to take at NPA?

can it bridge up to SPA?

can I invest it well enough to draw down x%?

It looks like a (positive) difference of about £2k pa in pension plus £14k of lump sum if I go now (compared to how much it would have been had the new ERFs already been in place)

If you were me, what kind of questions would you be asking of a VS sum to help you make the decision?

eg can it cover three years of full salary (of course not! but then I wouldn’t be working! 😆)

can it cover enough to bridge my ideal pension amount, the amount I would have liked to take at NPA?

can it bridge up to SPA?

can I invest it well enough to draw down x%?

Or would you just BITE THEIR HAND OFF AND GO?!

0

Comments

-

Maybe wait and find out before taking any sort of decision (or getting your hopes up!)?bluebirdy said:I’ve just found out my employer is about to launch a VS scheme. My latest plan was to retire fully in three years, possibly flexibly retiring before then. I don’t know if I’ll be eligible for VS or what the offer is yet but handily, I’d already asked for an updated pension quote because I wanted to compare the impact of the Apr 24 ERF change with it reverting back to Oct 24 on a possible full retirement this year.

It looks like a (positive) difference of about £2k pa in pension plus £14k of lump sum if I go now (compared to how much it would have been had the new ERFs already been in place)

If you were me, what kind of questions would you be asking of a VS sum to help you make the decision?

eg can it cover three years of full salary (of course not! but then I wouldn’t be working! 😆)

can it cover enough to bridge my ideal pension amount, the amount I would have liked to take at NPA?

can it bridge up to SPA?

can I invest it well enough to draw down x%?Or would you just BITE THEIR HAND OFF AND GO?!

Depends what x is - and how good you are at investing...and how much you're enjoying your job (or otherwise).bluebirdy said:

can I invest it well enough to draw down x%?Or would you just BITE THEIR HAND OFF AND GO?!Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!1 -

Where I worked used to offer enhanced rates for VS on "grounds of business efficiency" This would give over 55s access to pension without actuarial reduction.

So wait to see what the deal is seems good advice.1 -

I haven’t seen this at our place for a very long time but I’ll wait and see on that one because that would be amazing. I suspect v unlikely since it would mean (presumably?) the employer shelling out a lot of cash to USS to make up the shortfall?kempiejon said:Where I worked used to offer

enhanced rates for VS on "grounds of business efficiency" This would give over 55s access to pension without actuarial reduction.

So wait to see what the deal is seems good advice.

0 -

I suppose I’m trying to do all the thinking ahead of the numbers a bit, as will have to move quickly I think.Marcon said:

Maybe wait and find out before taking any sort of decision (or getting your hopes up!)?bluebirdy said:I’ve just found out my employer is about to launch a VS scheme. My latest plan was to retire fully in three years, possibly flexibly retiring before then. I don’t know if I’ll be eligible for VS or what the offer is yet but handily, I’d already asked for an updated pension quote because I wanted to compare the impact of the Apr 24 ERF change with it reverting back to Oct 24 on a possible full retirement this year.

It looks like a (positive) difference of about £2k pa in pension plus £14k of lump sum if I go now (compared to how much it would have been had the new ERFs already been in place)

If you were me, what kind of questions would you be asking of a VS sum to help you make the decision?

eg can it cover three years of full salary (of course not! but then I wouldn’t be working! 😆)

can it cover enough to bridge my ideal pension amount, the amount I would have liked to take at NPA?

can it bridge up to SPA?

can I invest it well enough to draw down x%?Or would you just BITE THEIR HAND OFF AND GO?!

Depends what x is - and how good you are at investing...and how much you're enjoying your job (or otherwise).bluebirdy said:

can I invest it well enough to draw down x%?Or would you just BITE THEIR HAND OFF AND GO?!I think I’m actually asking what sort of money I’d need to [get an IFA to] invest realistically to generate about £5-8k pa income over 6-7 years (until SP kicks in).On the enjoying the job bit: really not at all right now.0 -

@ussdave @MPLMPL and maybe @Universidad might have thoughts from a USS perspective?

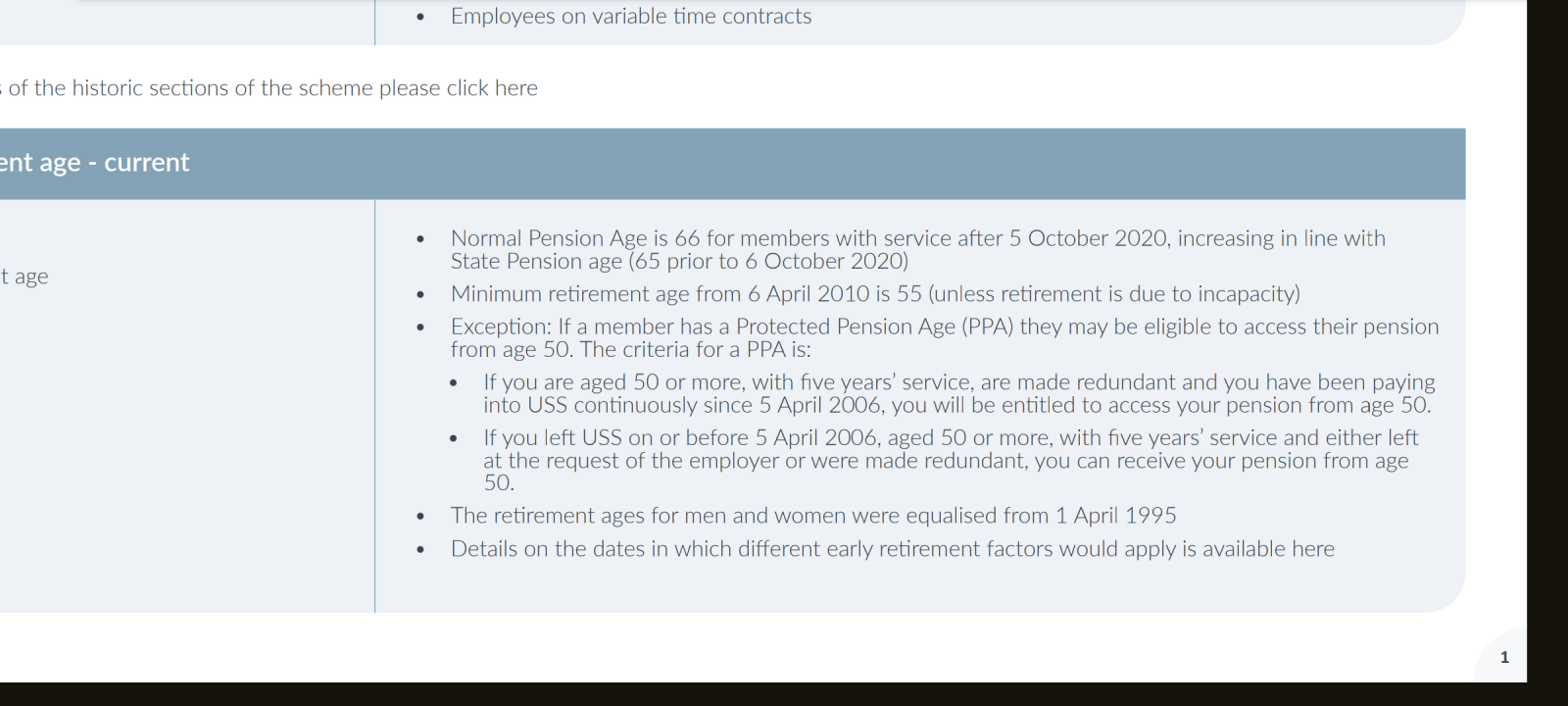

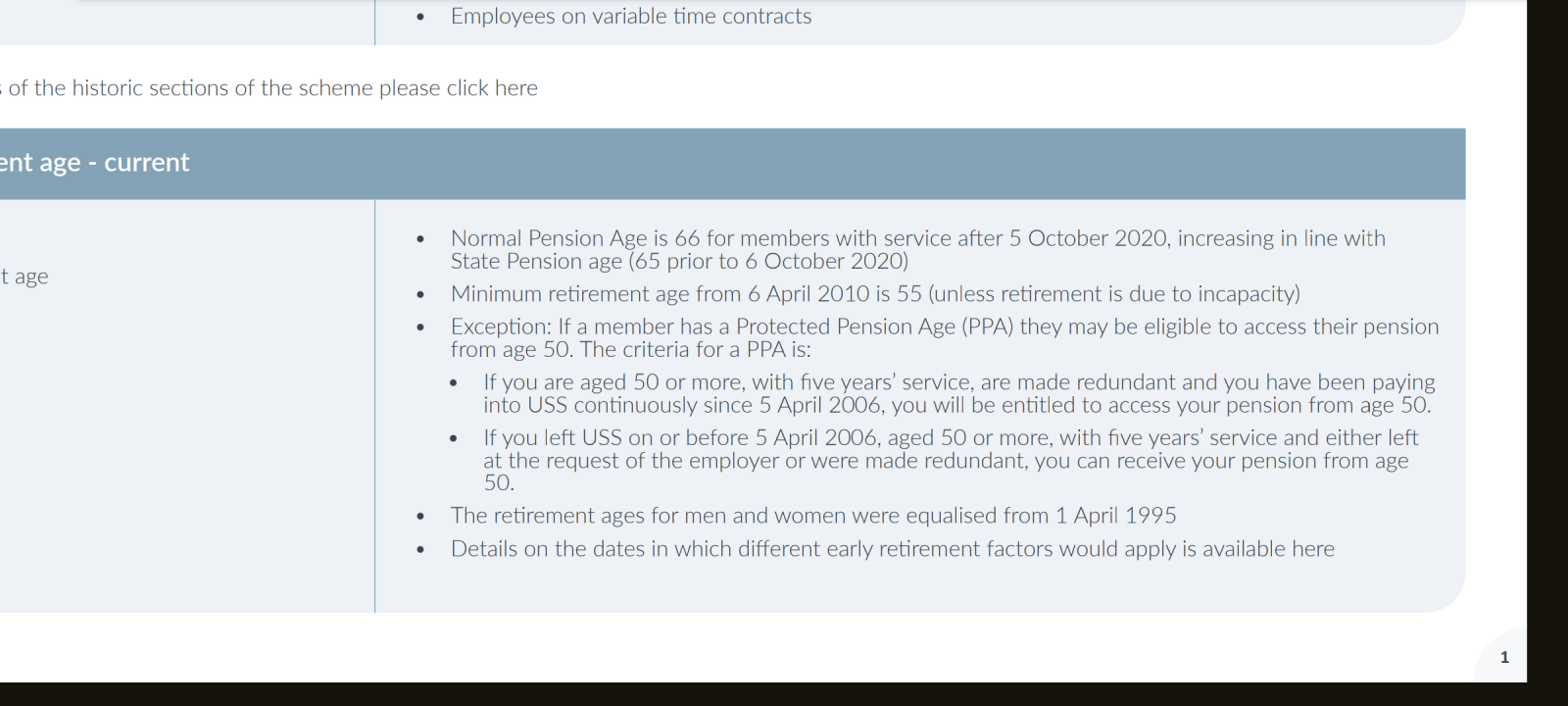

There is something in the guide for IFAs (and therefore probably the scheme rules about redundancy, if you fit the criteria:

I don't know whether employers also add their own options for early retirement through redundancy separate to this though.1 -

Thanks. I’m already over 55 so I know I’m eligible to take my pension. As I understand it, any enhancement comes from the employer not the pension scheme itself so I’m currently still expecting normal ERFs to apply, but we’ll see!There is something in the guide for IFAs (and therefore probably the scheme rules about redundancy, if you fit the criteria:

I don't know whether employers also add their own options for early retirement through redundancy separate to this though.0 -

Why would you want to invest if it's covering a known period? To get that sort of return, you'd be looking at a seriously hefty amount of capital (think £100K+) and you'd need to be willing to take risks with it.bluebirdy said:

I suppose I’m trying to do all the thinking ahead of the numbers a bit, as will have to move quickly I think.Marcon said:

Maybe wait and find out before taking any sort of decision (or getting your hopes up!)?bluebirdy said:I’ve just found out my employer is about to launch a VS scheme. My latest plan was to retire fully in three years, possibly flexibly retiring before then. I don’t know if I’ll be eligible for VS or what the offer is yet but handily, I’d already asked for an updated pension quote because I wanted to compare the impact of the Apr 24 ERF change with it reverting back to Oct 24 on a possible full retirement this year.

It looks like a (positive) difference of about £2k pa in pension plus £14k of lump sum if I go now (compared to how much it would have been had the new ERFs already been in place)

If you were me, what kind of questions would you be asking of a VS sum to help you make the decision?

eg can it cover three years of full salary (of course not! but then I wouldn’t be working! 😆)

can it cover enough to bridge my ideal pension amount, the amount I would have liked to take at NPA?

can it bridge up to SPA?

can I invest it well enough to draw down x%?Or would you just BITE THEIR HAND OFF AND GO?!

Depends what x is - and how good you are at investing...and how much you're enjoying your job (or otherwise).bluebirdy said:

can I invest it well enough to draw down x%?Or would you just BITE THEIR HAND OFF AND GO?!I think I’m actually asking what sort of money I’d need to [get an IFA to] invest realistically to generate about £5-8k pa income over 6-7 years (until SP kicks in).On the enjoying the job bit: really not at all right now.

A short term annuity would do the job - and if you are looking at £5K for 6 years, then £30K or thereabouts (up to £8K x 7 = £56K) - or simply put the capital somewhere 'safe' and withdraw a what you need each year.

Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!2 -

When my HEI offered a VR round last year, it was on same T&Cs as regular redundancy, no extra perks.1

-

I'm not going to be much help here...

I remember three rounds of VS over the years, and it was definitely the case in the early days that people in their 50s would, as part of the deal, get their pensions unreduced, and that the university would foot a large bill for this.

I also recall one round of VS in which it was made clear this was no longer the case, and there was much grumbling among colleagues who had initially hoped to punch their ticket.

What I don't know is if that was just an institutional decision, or precipitated by a change in legislation or scheme rules.1 -

Myself and my OH have recently left our HEI. I got statutory redundancy and OH got nothing. The VES offer at our HEI is for a full years salary if you have 10 full years of service. No enhancement to pension. The difficult part of VES is having a role than can be allowed to disappear. I’d moved to a fixed term role which allowed for redundancy albeit at miserable rates. We know many people who applied for VES and did not get accepted.

Life is too short and we are enjoying our early exit.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards