We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

mortgage term

Christine24

Posts: 17 Forumite

first time buyers and broker has based on 35 yr term, Any advice about shortening term but paying more per month? if we take 5yr deal can we change the term on next renewal? also can we ask broker about deals we have seen on moneysaving best deals?

0

Comments

-

Having a longer term means mean that by making no overpayments, your mortgage will be repaid automatically in 35 years time. Depending on the mortgage, you can repay it faster by making overpayments.Shortening the term of the mortgage effectively commits you to making a certain level of payment. There really is no advantage to doing this. It's an extra constraint on your cashflow2

-

Advantages of a shorter mortgage term are that (obvs) it will clear more quickly, and that you'll end up paying less interest over the course of the mortgage. So it's cheaper overall, even though the monthly payments will be higher.

1 -

Or you can save for 20 years into best savings account and then pay off your mortgage in full.

If savings % is greater than your mortgage % - it's better to save.0 -

"Unfortunately" to meet affordability and stress tests the lenders are now stretching loans to 30+ years whereas what we should be considering is offering less for houses rather than just continuing to pay ever increasing prices and commit to working for longer to pay it off.

Compound interest works on the way down as well as the way up. So going for a shorter mortgage or paying your mortgage off early can save you significant amounts of cash.

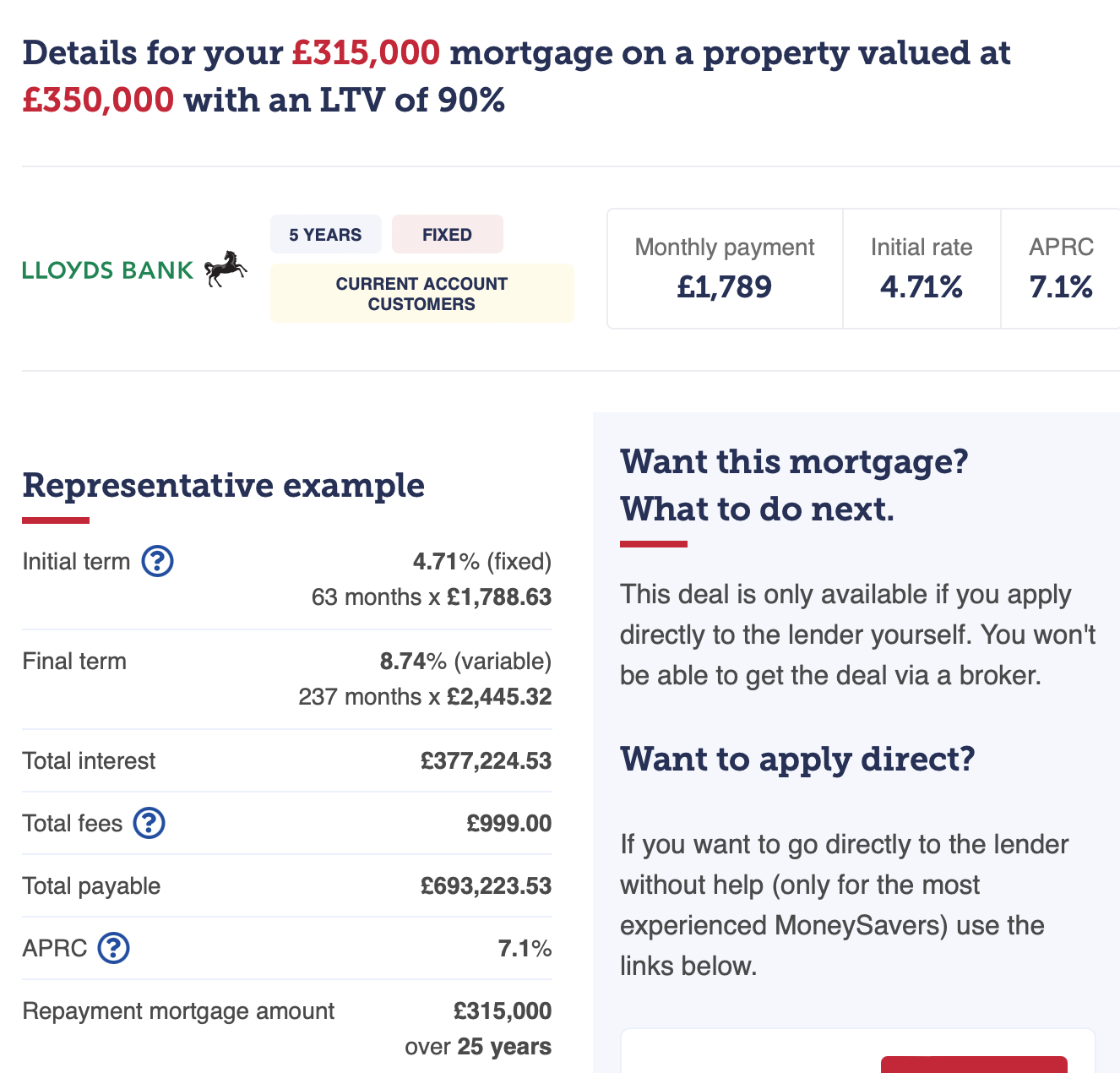

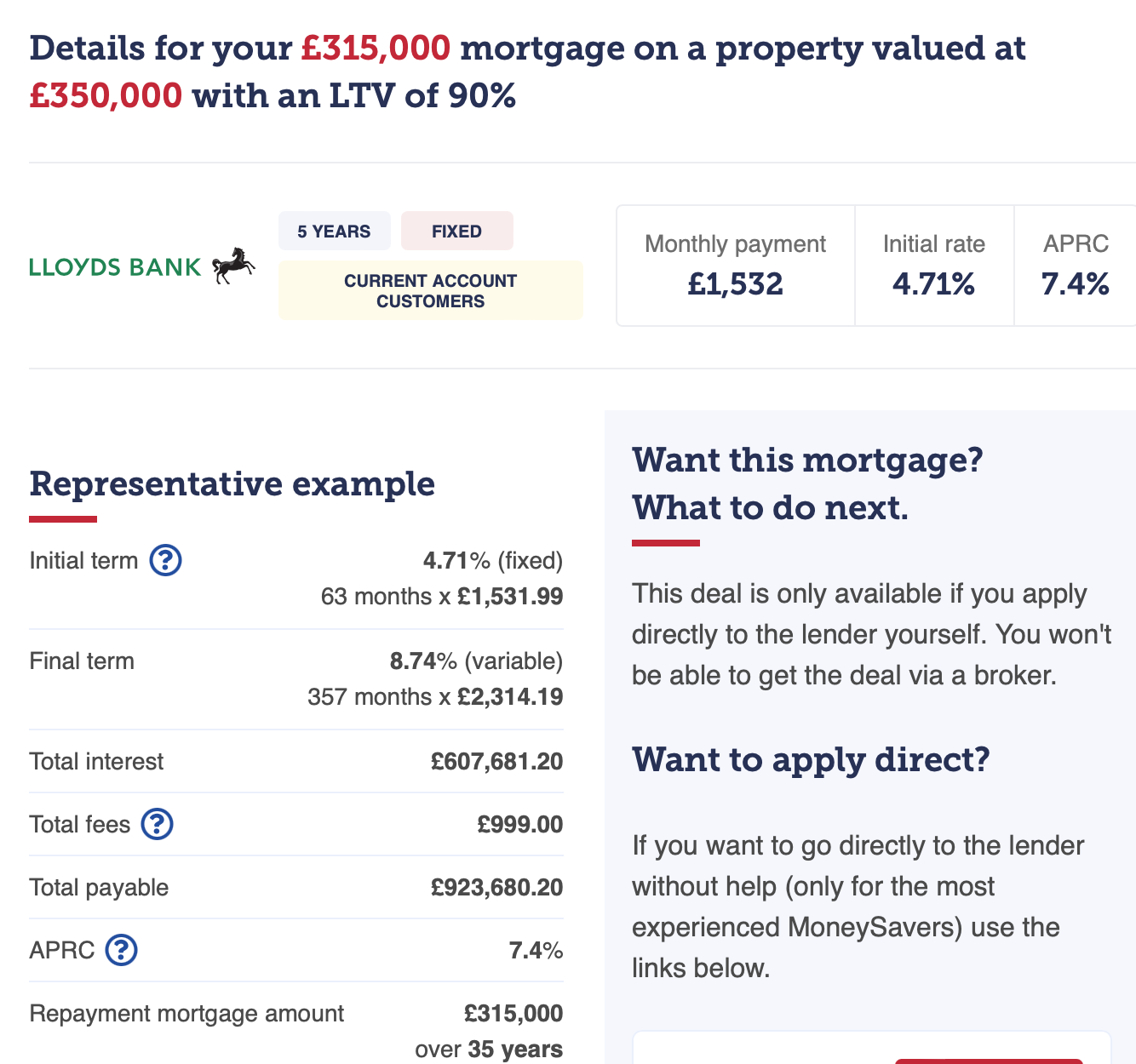

Try this site to see the difference: MSE Mortgage Best Buy Calc compare 25 years with 35 years and always consider the total amount payable see here:

and

Although the monthly figure is initially lower and people might say it saves you, it is in fact over £230k difference in interest for the extra 10 years! That could be in your pension pot rather than the banks profits.

Or you could use something like this spreadsheet to assess things for yourself

CAUTION

There are a number of differing lenders that are inhibiting overpayments and forcing customers to reduce the monthly payment rather than retaining the higher payment to reduce the term. I recommend you fully explore and understand how overpayments will be treated as any desire to save money may be curtailed by mortgage terms you may not have fully understood, especially if taking a product with a long life or long fixed fixed rate period.

Your life is too short to be unhappy 5 days a week in exchange for 2 days of freedom!1 -

Although, BB, you'll also pay less interest overall if the balance is reduced when overpaying rather than the term0

-

You can get mortgages which with over payments either reduce the term or reduce the amount to pay. Often re-calculated annually. As it is a contract, you have to agree all of this up front and it catches many out who automatically believe it will reduce the term.

Equally, you can re-contract on renewal to a different term and overpayment response.

Your mortgage advisor "should" explain this all to you, but going in with the view of what will best suit you will help make sure you get the right mortgage that suits what you want.0 -

BB has an odd thing in their head about overpayments being stolen somehow by lenders.Martico said:Although, BB, you'll also pay less interest overall if the balance is reduced when overpaying rather than the term

Their point is usually valid, just poorly explained with occasional incorrect assertions.0 -

You should simply speak to your Broker reference these issues.

You may be obliged to take a five year rate and 35 year term to make affordability.

Check price comparison sites tells you what you might get, not what you will get - that is what the Broker is for.I am a Mortgage Broker

You should note that this site doesn't check my status as a Mortgage Broker, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

BSAI has this habit of taking what I say and twisting it to meet their own different agenda. Where did I say stolen?BarelySentientAI said:

BB has an odd thing in their head about overpayments being stolen somehow by lenders.Martico said:Although, BB, you'll also pay less interest overall if the balance is reduced when overpaying rather than the term

Their point is usually valid, just poorly explained with occasional incorrect assertions.

Yes you will pay less interest as overpaying is reducing the capital. But changing what effect that has on payments going forward makes a difference. You could leave payments as they are and pay off earlier or you could reduce the future payments to leave the term the same.

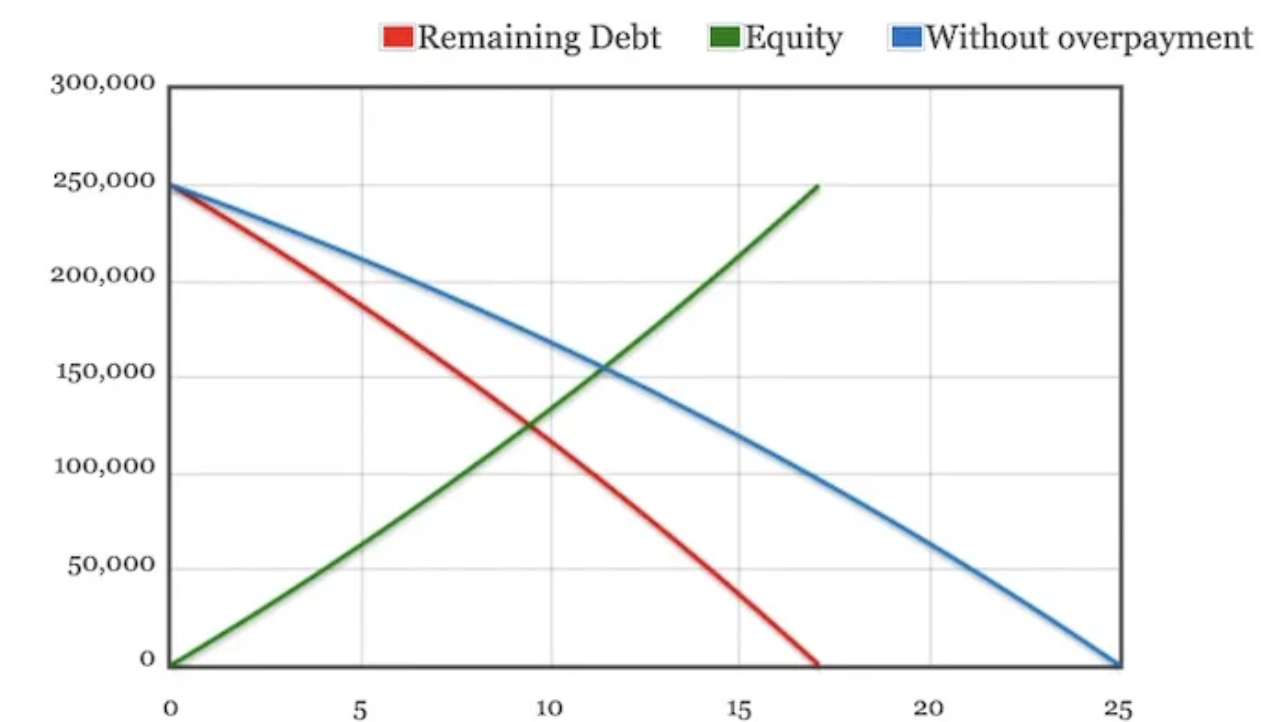

The red line is the payment that is being made as opposed to the blue line, what is agreed, in this example an additional sum per period reduces the debt with a micro line for i increasing equity. The area between the red and blue lines is the cash you can save by adjusting the end date from 25 years to ~17.5 years.

Whereas if you reduce your payments, to hit the same end point as the blue line the rate of the red line tapers off to meet the blue end point at 25 years and as you encroach into this area and your savings are lower.

In other words the rate of reduction of the debt is lower than sticking with the overpayment limit eg 10% per year. I have said, and this might be where my words have been skewed to stolen, that after borrowers overpay, often within agreed limits, lenders adjust repayments to fit the same term to ensure the lenders maximise their profits whereas leaving the payment at an already approved and agreed level and reducing the term will save the consumer more interest.

I have asserted what my mortgage allows me to do. It would appears others cannot, that is not incorrect its a fact and that is the warning I have added.

These are the facts in the same manner that the difference above in 25 v 35 yrs and £230k extra paid to the banks. But committing to a 35 year mortgage and not understanding or being able to exploit how you can reduce the £600k of interest, nearly double the value of the house, might lock you into a product that is not right for you but certainly suits the banks.

That's the evidence but as BSAI seem to come and continually try to rubbish the idea one must consider that they have a vested interest and are possible part of the lending system.

And on a money saving site as well!Your life is too short to be unhappy 5 days a week in exchange for 2 days of freedom!0 -

You say that, but I can think of a few.Mark_d said:Having a longer term means mean that by making no overpayments, your mortgage will be repaid automatically in 35 years time. Depending on the mortgage, you can repay it faster by making overpayments.Shortening the term of the mortgage effectively commits you to making a certain level of payment. There really is no advantage to doing this. It's an extra constraint on your cashflow

If your mortgage is 35 years, that is what your life becomes - new car? You can afford to spend a bit more each month on it. You want a new TV, a few more take aways or meals etc etc. Commit yourself to 25 years and you will get the cheaper car. In 12 years, the amount of people I met who said they would overpay (when rates were low) and didnt is ridiculous. Infact, I can only think of 3 who did.

In addition to that, last year I was having a lot of difficult conversations with people when interest rates were circa 6%. The ones who had originally done 25-30 years, were able to extend the term to lower the repayments, as were some of the younger applicants. The ones who did 35 years, now had 33 years after a 2 year deal - extending the term by 2 years helped and in fairness I dont know of any of our customers who had to sell up, but it was still a stretch for them.

I think you have to consider the fact that most people live to their means.

My mortgage was 35 years, but I am self employed my income is variable. When I can overpay, I do. But realistically I should have done a 30 year term, I would have brought my balance down quicker. But hindsight and all that.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards