We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Bankruptcy questions

Comments

-

When you write you might include a brief summary of your health issues, as in heart disease, v high blood pressure, colitis, kidney disease and adverse reactions to necessary treatments and affected by stress? Not obligatory but helps them understand that you are not so much just unwell but likely to be adversely affected by their actions.If you've have not made a mistake, you've made nothing0

-

Update. I've made a start contacting debt collectors and creditors, advising that I am vulnerable and disabled. I also included details of my health issues and my financial circumstances explaining I am almost certainly not going to be able to work again and only have benefits to live on.

I have also received a letter from a debt collector that got a CCJ against me in May. Basically they have given me until 17 July to make arrangements to pay the debt or it says they MAY go to the court for a warrant of control.

I will be sending a letter to them this next week.

Is there anything else I need to do regards this, or is it a case of waiting to see what happens next after 17 July?

0 -

If it proceeds to a bailiff visit, doubtful but possible, do not allow them entry, they cannot force entry to private property, but can enter through an unlocked door.

If you don`t let them in, they can`t do anything, if you have a car, park it away from your property as it can be clamped if it belongs to you and is not on finance.

Bailiffs must give 7 days notice of attendance in writing, it will only be the county court bailiff, not the HCEO`s you see on the telly box, they are employees of the court and are usually reasonable to deal with.

Hopefully your letter will put a stop to further collection action.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

Thanks for the advice, it is appreciated.

To update a bit further, I have received a further email from the debt collector to remind me that I must pay in full by 17 July to avoid potential further action. Alternatively if I cant afford payment in full their client has agreed to accept payment terms of £30 a month if I accept and set up a DD by 6th July.

So it's gone from pay up in full or we go for a warrant of control, to you can pay £30 a month until the debt is repaid.

Am I now starting to understand that their threatening letters mean sod all (which is what you have all been saying to me) I think I am now starting to understand.2 -

I'd go back and argue for £20 or £25 if you can't afford more.

But you're getting it.If you've have not made a mistake, you've made nothing0 -

Basically in about 98% of cases yes, mostly bluff.

What payment did the court set? or was it a "pay in full judgement"?

Because you can apply to the court for an instalment order to pay whatever is affordable, and the creditor has to live with it, but you can accept their terms if they are acceptable.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

The judgement was a pay in full because I didn't respond to the court papers. At the time I was not opening any post I received as I just could not cope.0

-

I have continued my overall plan leading up to bankruptcy as I've been advised on here. I still haven't got my car sold unfortunately. I was already to go when I got appointments through for hospitals over 30 miles away. I've looked at public transport but it's a nightmare and doubtful I can get there in time. So I'm hanging on for now.

I have a couple of things I need some advice on though as to whether I can or can't do things.

1. My daughter needs a new car due to needing to travel for work every day, hers is 16 years old and needs some work on it. I was wondering if I sold mine could I buy hers and get the things done that it needs?

She will have the cash towards a newer car and I would essentially have a little run around for shopping, Drs and hospital etc. It would also help getting the amount I will have under 6k for UC.

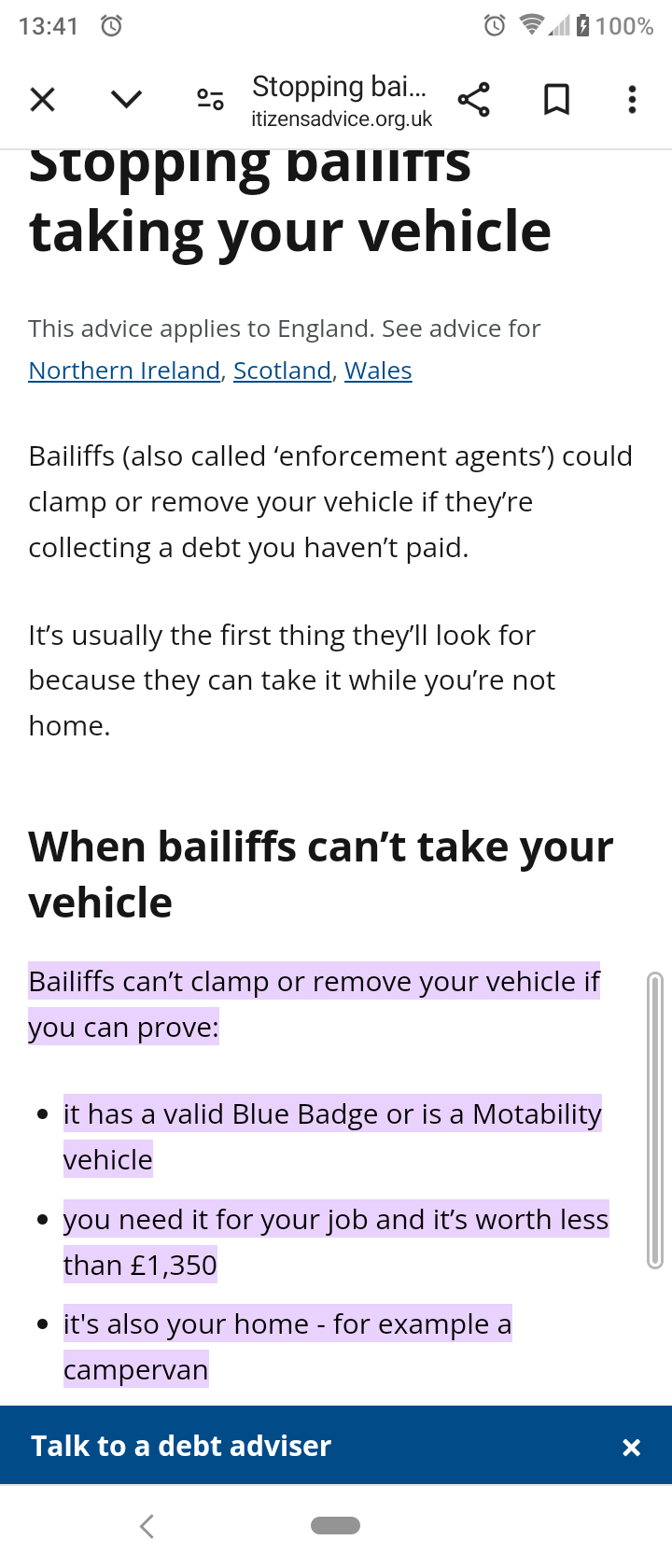

2. In the meantime, I have been reading through many websites and even Govt guidance on debt collection and bailiffs. I have read that if debt collectors or bailiffs come to my address and see my car they cannot take it if it is displaying my blue badge.

Is this correct or am I misunderstanding?0 -

I think as long as you sell your car to her for the going rate and get receipts between each other that's ok and court bailiffs only come

after cars if it is an unpaid court fine, or unpaid income tax or council tax, or an unpaid ccj

debt collectors have no power

and I think your car is fully exempt , see my link

https://www.citizensadvice.org.uk/debt-and-money/action-your-creditor-can-take/bailiffs/what-bailiffs-can-take/stopping-bailiffs-taking-your-vehicle/#:~:text=Bailiffs can't clamp or,home - for example a campervan

Christians Against Poverty solved my debt problem, when all other debt charities failed. Give them a call !! ( You don't have to be a Christian ! )

https://capuk.org/contact-us0 -

Debt collectors have no power to do anything, and I would not worry about bailiffs either, that stage is only reached after a lengthy legal process which can take many, many months, and has various stages to get through.

Add to that they are never normally used to collect consumer credit debt anyway, another fallacy.

Try and concentrate on your actual position and not drift off to worst case scenario extremes with every post.

The worst you will get are letters and calls, and they are easy to deal with, think no more about it than that.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards