We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Port Skipton residential mortgage from remortgage?

Tali1989

Posts: 12 Forumite

I have a house on an owner occupier residential mortgage with Skipton. I would like to remortgage it to a buy to let mortgage (75%, maybe 80%) and port the residential mortgage to another property, so effectively a let to buy transaction.

Does anyone know if Skipton allows you to port from a remortgage?

thank you

Does anyone know if Skipton allows you to port from a remortgage?

thank you

0

Comments

-

Mortgage T&Cs change over time and everyone's situation is slightly different. I would suggest talking to Skipton.But what's your goal here? Are you wanting to rent out your existing property long term and buy another property to live in? What is the maximum deposit you can put down on your new place?0

-

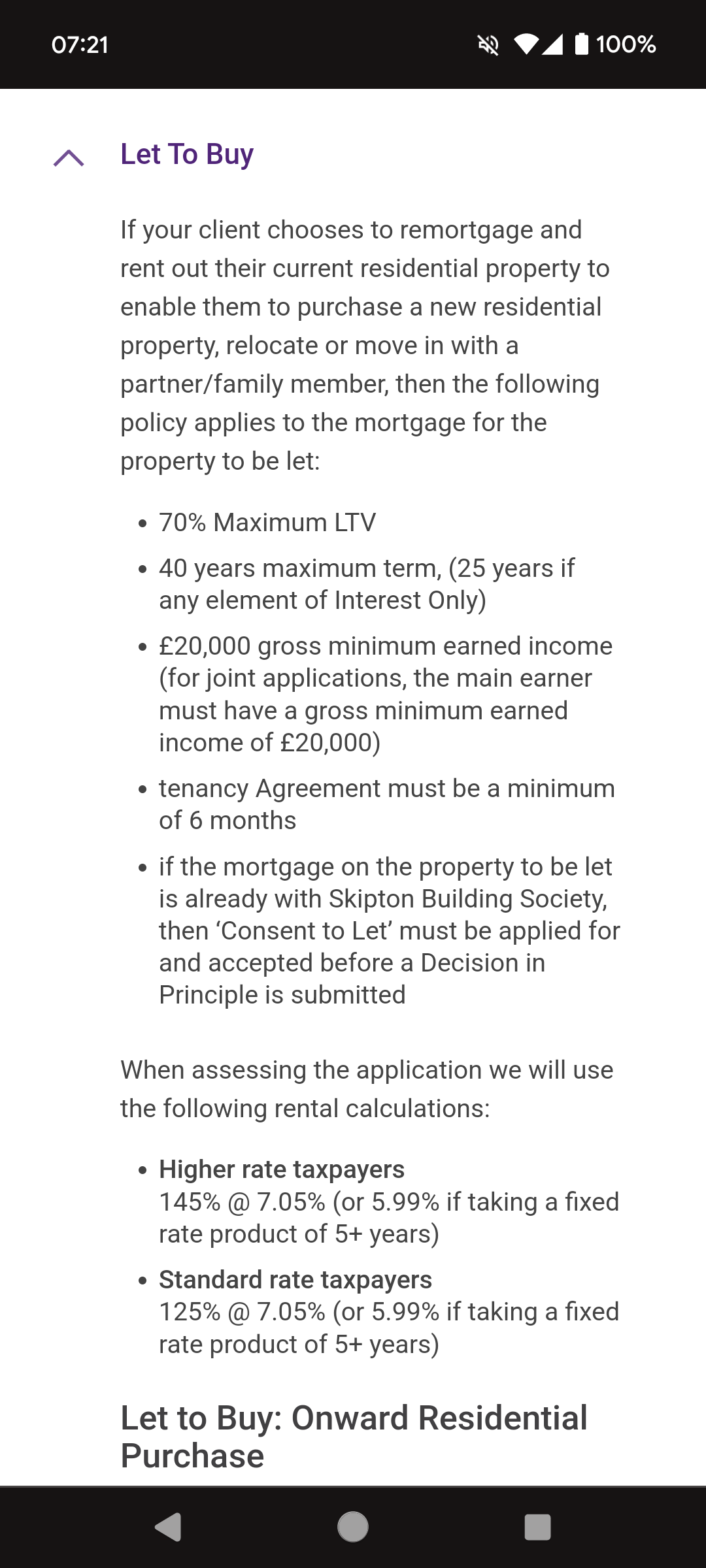

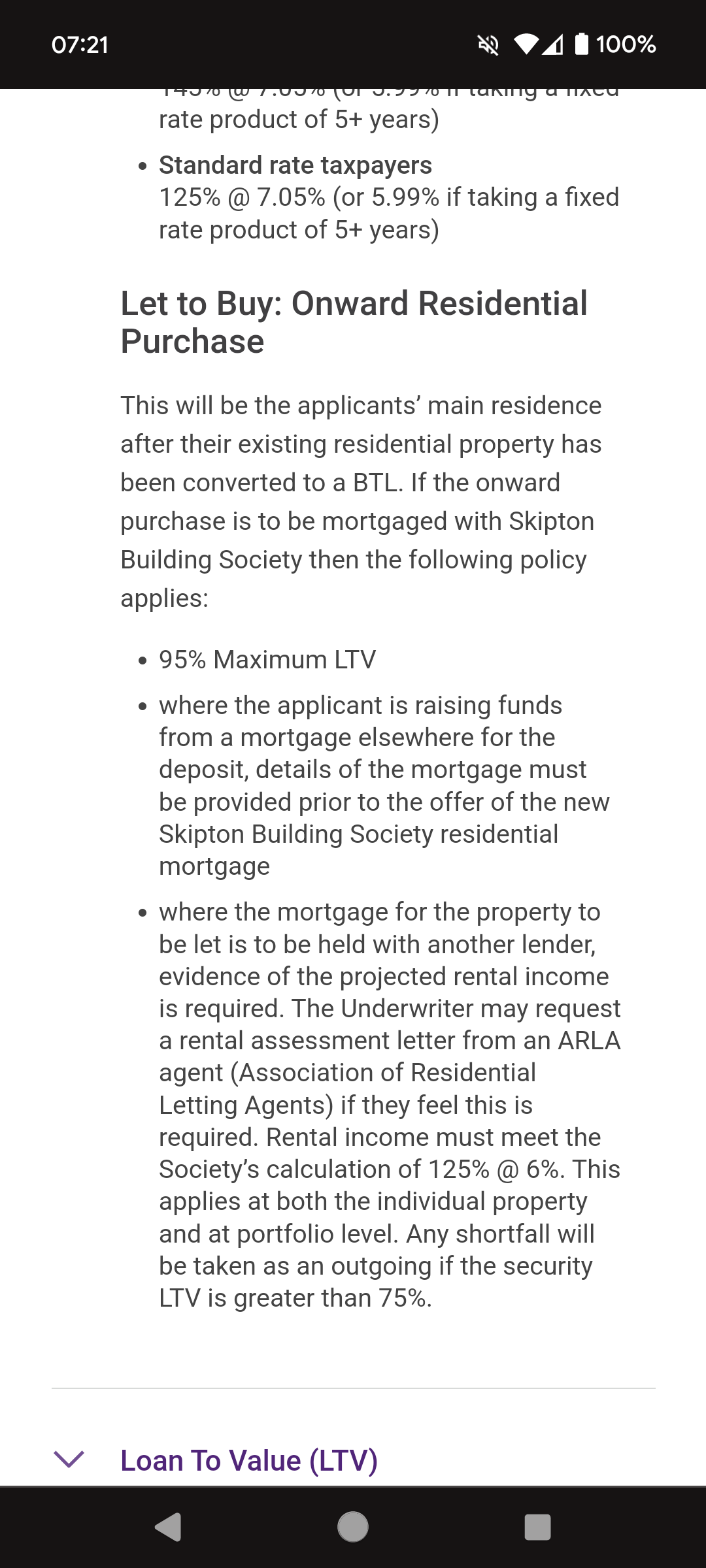

Here is the criteria. Whether or not you can actually port it to the new property is unclear though.

0 -

Mark_d said:Mortgage T&Cs change over time and everyone's situation is slightly different. I would suggest talking to Skipton.But what's your goal here? Are you wanting to rent out your existing property long term and buy another property to live in? What is the maximum deposit you can put down on your new place?My intention would be to live in the next house and rent out my current house (I did this before where my first house is let out and the mortgage was considered self-financing / in the background), though I didn’t port the existing mortgage the first time round. If I port the second residential mortgage then I can save a fair bit by not paying the early repayment charge, which will offset the total amount I need considering the additional property stamp duty rate, product fees for the new BTL mortgage, etc.housebuyer143 said:Here is the criteria. Whether or not you can actually port it to the new property is unclear though.

Yeah that looks ok with the onward purchase criteria, I think I’ll have to ask a mortgage broker as I couldn’t find anywhere on their criteria if you can port a resi from a remortgage0

Yeah that looks ok with the onward purchase criteria, I think I’ll have to ask a mortgage broker as I couldn’t find anywhere on their criteria if you can port a resi from a remortgage0 -

This should be possible with Skipton but you need to careful with a couple of things.

1. You say you want to raise 75% to 80% on the current property buy to let. Given current affordability calculations in this market that rarely possible.

2. Skipton will need to rent to cover the new BTL mortgage by some margin or it will impact on affordability for the new residential purchase.

For these reasons, and others, engage a good mortgage broker. Do not try to do this yourself or it will fall over.I am a Mortgage Broker

You should note that this site doesn't check my status as a Mortgage Broker, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.1 -

I should have enough equity for 75%-80%, the rent achieved should hold up to 125% stress tested at 6% (even 140%), the mortgage is fairly small at circa 90k. With regards to affordability calculations is there something I am missing?

I am a basic rate tax payer as well so would imagine the 125% stress rate will apply

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards