We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

MBNA (Lloyds) Savings Account

Relwod

Posts: 1 Newbie

Following this website's guidance, I have just opened a fixed term (1 year) savings account with MBNA . I have not made a a deposit just yet but just wanted to confirm that this account is managed on the phone only (not online) and the account name is listed as MBNA Savings (and not in my own name as I presumed)? Is this usual?

0

Comments

-

Everything you need to know is clearly explained on their website. You might be concerned about using them, but there's no need to as they are perfectly safe.

https://www.mbna.co.uk/savings/fixed-saver.html

1 -

Beddie's response may be correct but you do not even receive an acknowledgment email when you have signed up. Plus the application process is clunky, unwieldly and ill thought out.

More concerning is my wife's experience. She has banked with Lloyds for over 30 years. She applied to MBNA for the 1-year fix account and was accepted. You have 14 days to pay the money in electronically - no other option. Because of delays in getting funds together, and a £25,000 per day faster payment limit, she made a Chaps payment. MBNA, itself part of Lloyds, refused to accept it. The Lloyds branch advised that she could up her faster payment to £100,000. and this was confirmed when she called today. However, on starting the process, she was advised that because MBNA is owned by Lloyds - for security reasons - the higher figure does not apply and she can still only pay £25k daily. The reality is that while they invite applications for up to £750k, if you are a Lloyds customer, which owns MBNA, the absolute maximum you can put into the account is £300,000. If you are not a Lloyds customer, unless you can make larger faster payments, the same situation prevails. What a staggering waste of our time! Lloyds/MBNA - you need to get your act together!1 -

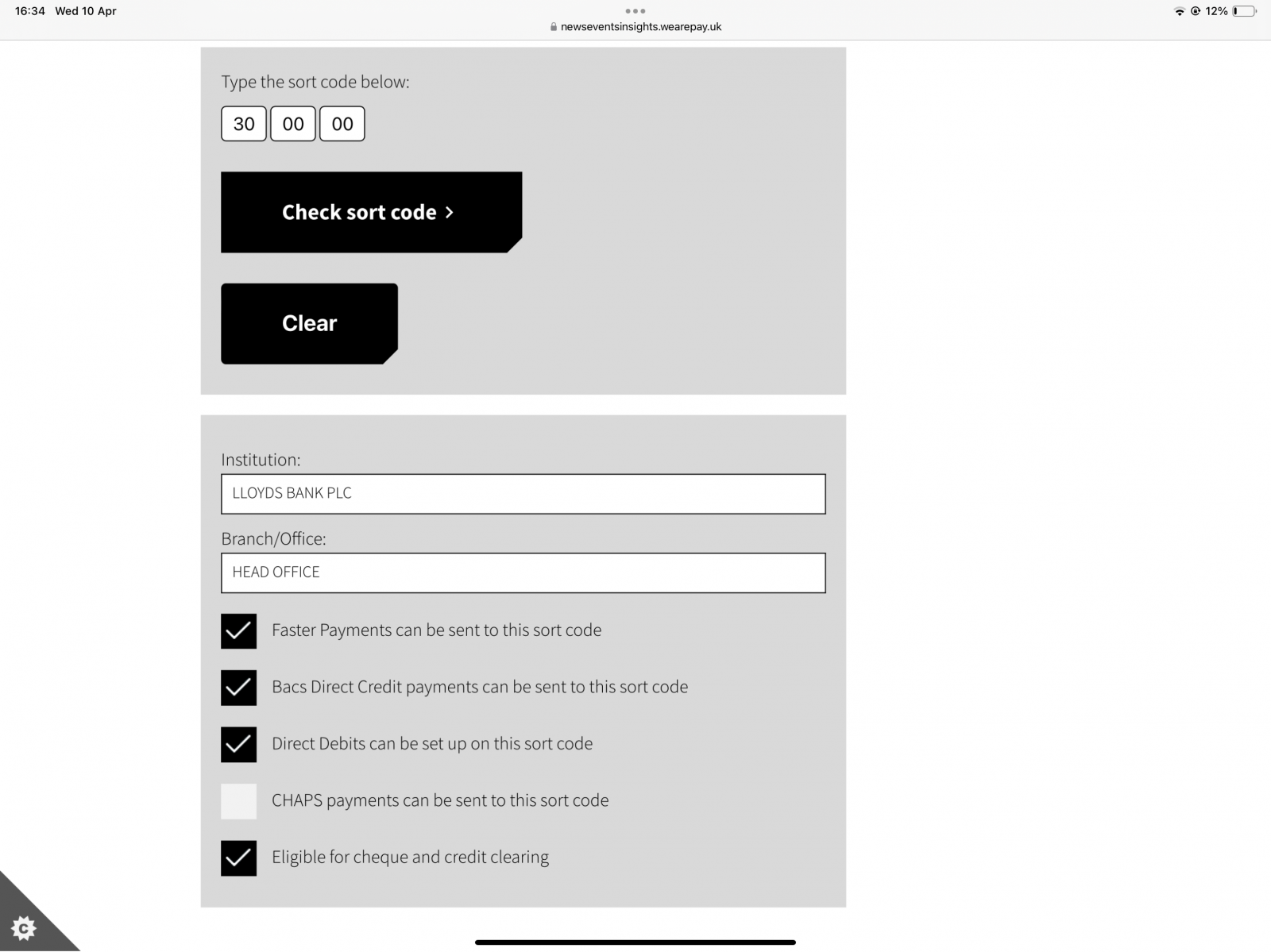

Its sort code, 30-00-00, doesn't accept Chaps payments. It's probably been disabled because it wants all deposits to come from a nominated current account. Only being able to deposit up to £350k if you can make payments on weekends is a bit of a niche problem.MPHILDIY said:Beddie's response may be correct but you do not even receive an acknowledgment email when you have signed up. Plus the application process is clunky, unwieldly and ill thought out.

More concerning is my wife's experience. She has banked with Lloyds for over 30 years. She applied to MBNA for the 1-year fix account and was accepted. You have 14 days to pay the money in electronically - no other option. Because of delays in getting funds together, and a £25,000 per day faster payment limit, she made a Chaps payment. MBNA, itself part of Lloyds, refused to accept it. The Lloyds branch advised that she could up her faster payment to £100,000. and this was confirmed when she called today. However, on starting the process, she was advised that because MBNA is owned by Lloyds - for security reasons - the higher figure does not apply and she can still only pay £25k daily. The reality is that while they invite applications for up to £750k, if you are a Lloyds customer, which owns MBNA, the absolute maximum you can put into the account is £300,000. If you are not a Lloyds customer, unless you can make larger faster payments, the same situation prevails. What a staggering waste of our time! Lloyds/MBNA - you need to get your act together!

It says it can accept cheques so I don't know whether this would be an option.

0 -

Hi, on the recommendation of this site, I opened a MBNA account last weekend and transferred some money across. I've become really nervous its a SCAM because you just cannot see where your money is. I have the confirmation email and text on transfer. I realise the website is comprehensive and the security measures seem to be in place. However, to not have evidence other than a text seems reckless in today's world. I've just called customer services before I transfer more money across and they've said that others have raised the same concerns and that there might be an online service at some point. I asked if I could withdraw my funds - standard 14 day cooling off period - and I cannot. I've decide to find another deal with the rest of my savings. Does anyone know anymore? Can anyone reassure me that everything is in order with this service and my money is safe? Thanks0

-

‘Recommendations’ on this site for savings accounts are only based on the interest rate and not the customer service or the user experience of the provider.

personally I wouldn’t use any provider that doesn’t provide at least online access, nor would I use a provider that’s not generally known for savings accounts but that’s just me.

did they email you the confirmation to say the account is set up with the account number and how much you’ve deposited and what your balance is ?

as long as your savings are fully protected upto 85k then I wouldn’t have thought you have anything to worry about and certainly wouldn’t class it as a scam as MBNA are a very well known company ( albeit for credit cards )0 -

MBNA is Lloyds Bank so you really don't need to worry.TheOutdoorSwimmer said:Hi, on the recommendation of this site, I opened a MBNA account last weekend and transferred some money across. I've become really nervous its a SCAM because you just cannot see where your money is. I have the confirmation email and text on transfer. I realise the website is comprehensive and the security measures seem to be in place. However, to not have evidence other than a text seems reckless in today's world. I've just called customer services before I transfer more money across and they've said that others have raised the same concerns and that there might be an online service at some point. I asked if I could withdraw my funds - standard 14 day cooling off period - and I cannot. I've decide to find another deal with the rest of my savings. Does anyone know anymore? Can anyone reassure me that everything is in order with this service and my money is safe? Thanks1 -

I was about to transfer my money in to mbna but the fact the account name I transfer to does not match my name does leave me a bit concerned. I get it must be a holding account, but is this normal for a savings account? I suppose premium bonds work similarly, but I can view my account there, whereas here, its only by phone, which seems a bit off.0

-

MsMoneyPennie said:I was about to transfer my money in to mbna but the fact the account name I transfer to does not match my name does leave me a bit concerned. I get it must be a holding account, but is this normal for a savings account?

It's not uncommon

I suppose premium bonds work similarly, but I can view my account there, whereas here, its only by phone, which seems a bit off.

Doesn't bother me. It's not as though there's anything much to see0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards