We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Nationwide take over of Virgin Money

Comments

-

The Building Societies Act restricts how building societies operate and what they offer i.e. it has to be mostly residential mortgages and funded by, IIRC, 50%+ retail deposits plus mutuals have the perennial problem of how to raise capital given they have no shares to sell. Buying a bank opens up a world of new opportunities.WillPS said:

No, they won't. If the transaction proceeds they will be paid cash for their shares and will have no further part in the business - unless they happen to also be Nationwide members.Weakest_Link said:Virgin Money shareholders will be introduced to the dodgy, undemocratic and biased voting system used by the directors of this "modern mutual" (their term for bank). The purpose of building societies was and still is the provision of mortgages but Nationwide directors say its purpose is "Banking".

There's no stipulation preventing Nationwide or any other building society from offering whichever products they wish. They're not alone in having expanded their offer, although they are the only remaining player in the nationally-available current account market and I believe the only one to ever offer a credit card.

Nothing they are doing is in any way improper if that's your implication.1 -

The last building society they integrated with was The Derbyshire and that was over a decade ago. Their product selection was essentially savings and mortgages and their 'systems' were very basic... I'm not sure how much that playbook will help them here, presuming they have any of the talent still 10 years on.TheBanker said:

I think you're right - Clydesdale/Virgin have a hotch-potch of systems, nothing's properly integrated and doing so would be very expensive. I think Nationwide, whilst their systems are far from perfect, do at least have experience of integrating other Building Societies into their business.pafpcg said:Turning to the actual topic of this thread, I wonder if the proposed take-over of Clydesdale Bank PLC* has been initiated by Clydesdale seeking a saviour because it is facing bigger problems than it can cope with.

Readers of the MSE discussions about Virgin Money/Clydesdale elsewhere on MSE will be aware of the slowness of progress of the integration of the "old Virgin Money" products and systems (primarily savings) originating from Northern Rock with the banking systems from Clydesdale Bank & its sibling Yorkshire Bank. I'm speculating that Clydesdale has finally realized that the costs of building any sort of integrated system is greater than any potential benefits - it's now looking around for a partner with the resources to assist and crucially is willing to buy-out the shareholders whilst the Clydesdale business still has some value.

Take-over of Clydesdale by one of the High-Street banks probably wouldn't get regulatory approval but Nationwide might be a good match, and with the current Nationwide CEO being ex-Clydesdale, at least they'd get a sympathetic hearing! The other thought is that the Nationwide CEO would be well aware of Clydesdale's predicament and made the initial approach with the aim of getting it cheap and asset stripping it.

* "Virgin Money" is a trading name of Clydesdale Bank PLC. The "Virgin" branding is licenced from Virgin Enterprises.0 -

That restricts them in terms of how they must capitalise themselves. It doesn't in and of itself restrict them from offering products although I agree there are some which might make more sense for them inside a bank wrapper - investments, credit cards, business banking etc.wmb194 said:

The Building Societies Act restricts how building societies operate and what they offer i.e. it has to be mostly residential mortgages and funded by, IIRC, 50%+ retail deposits plus mutuals have the perennial problem of how to raise capital given they have no shares to sell. Buying a bank opens up a world of new opportunities.WillPS said:

No, they won't. If the transaction proceeds they will be paid cash for their shares and will have no further part in the business - unless they happen to also be Nationwide members.Weakest_Link said:Virgin Money shareholders will be introduced to the dodgy, undemocratic and biased voting system used by the directors of this "modern mutual" (their term for bank). The purpose of building societies was and still is the provision of mortgages but Nationwide directors say its purpose is "Banking".

There's no stipulation preventing Nationwide or any other building society from offering whichever products they wish. They're not alone in having expanded their offer, although they are the only remaining player in the nationally-available current account market and I believe the only one to ever offer a credit card.

Nothing they are doing is in any way improper if that's your implication.0 -

Coventry BS have no chance becoming the biggest BS now for decades to come.0

-

The reason for these takeover approaches by Nationwide (VM) and Coventry (co-op) is that with the higher interest rates they are making large profits. They have money they dont know what to do with, especially Nationwide.they made 2.2 Billion in profit last year. They could offer better rates but this would distort the market. They could return some of the profit to the customers. Nationwide did this last year at £100 per person with current accounts. (cost 350 Million). If mutuals were run for the benefits of customers this is what they would do, but instead they would rather burn the profits on aquisitions little benefit to existing customers.

0 -

I challenge your logic. Why do banks acquire other banks? In fact, why might any business take over a competitor? Among other reasons (good and bad) - the one which applies almost universally is to achieve better market share and economies of scale, to drive future profits.MA260 said:The reason for these takeover approaches by Nationwide (VM) and Coventry (co-op) is that with the higher interest rates they are making large profits. They have money they dont know what to do with, especially Nationwide.they made 2.2 Billion in profit last year. They could offer better rates but this would distort the market. They could return some of the profit to the customers. Nationwide did this last year at £100 per person with current accounts. (cost 350 Million). If mutuals were run for the benefits of customers this is what they would do, but instead they would rather burn the profits on aquisitions little benefit to existing customers.

Map that to a building society taking over a competitor - why does the same not apply?

Those future profits can then be invested in the way you describe. Alternatively, perhaps harder times will arrive and the additional scale will ensure sustainability at a time they may have otherwise struggled. In other words, they will have 'fixed the roof while the sun was shining'.

If we were talking about a bank who'd made a thumping profit, returned it all to shareholders via dividends and then a few years later hit hard times - there'd be no end of people decrying the opportunity missed because of those motivated by a short term payday; yet when it's a mutual all and sundry feel entitled to whatever would be best for themselves here and now.

Those seeking an explanation for why building societies should not compelled to put these type of decisions to a membership-wide vote, look no further than this thread.0 -

I have just done it with no issues ( older I phone XS- IOS 17.3.1) so something odd happening for you .friolento said:

Well done you. It won’t work for menoh said:

Works for me on iPhone Plus 15 iOS 17.3.1friolento said:Albermarle said:No ability to set up new payess, have to use the card reader

For info this has changed just in the last few days, if you register your photo with them the card reader will be redundant. So progress !They have managed to mess this up.I was invited to register, using a card reader, for the card-reader-less payments. I eagerly followed the instructions, just to be told there were system problems and I should try later. I tried later, with the same result. After multiple tries, I rang Nationwide CS who said there was nothing wrong with their systems and I should try again. Didn't work. They then said I didn't have the latest app version. Wrong again. Then they tried to tell me my phone (iPhone 15 Pro Max, on iOS 17.3 at the time) was not supported. When I asked where the list of supported phones was, they said I need to go into Branch as they could sort it for me.

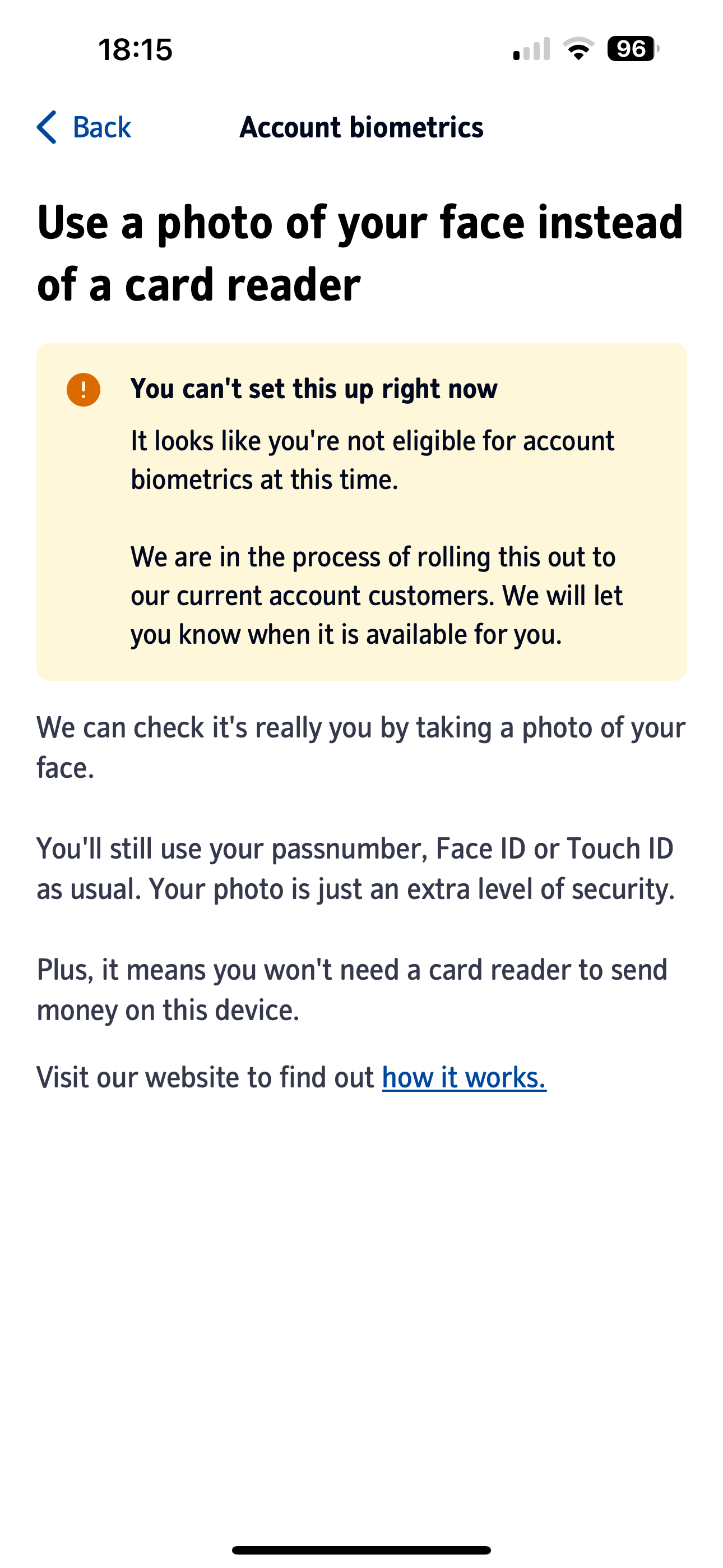

On my own initiative, I then uninstalled the Nationwide app and re-installed it. This newly installed version no longer has a splash screen inviting me to register for card-reader-less payments but I can change it in Settings. In theory. In practice, I am "not eligible for account biometrics at this time". I have used biometric login for the Nationwide app literally for years. I have been a Nationwide customer for 24 years. I am also less than impressed with Nationwide's app right now and won't be using them as my main current account anytime soon. I can imagine that it will get much worse when Nationwide acquire the hotchpotch of Virgin Money apps and systems

I had no problem registering my photo in the app

0

0 -

WillPS said:

There's no stipulation preventing Nationwide or any other building society from offering whichever products they wish. They're not alone in having expanded their offer, although they are the only remaining player in the nationally-available current account market and I believe the only one to ever offer a credit card.Weakest_Link said:Virgin Money shareholders will be introduced to the dodgy, undemocratic and biased voting system used by the directors of this "modern mutual" (their term for bank). The purpose of building societies was and still is the provision of mortgages but Nationwide directors say its purpose is "Banking".I recall the credit card offered by Leeds Building Society (aka Leeds & Holbeck BS) something like 20 years ago. But that may have been just a branding operation - it was dropped by Leeds BS within a couple of years and the accounts are now branded MBNA. (I've still got it!)Would the Co-op qualify? - it was still a mutual when I opened my Co-op Members credit card account.1 -

Given how old fashioned Nationwide are I wouldn't hold my breath. They have only just learnt what smartphones areNoodleDoodleMan said:Maybe Nationwide can "persuade" Virgin Money to allow online access to savings accounts which appears to be a 21st century concept too far for VM.0 -

I get them occasionally, maybe once a year, usually for just a few pounds because a final mobile phone bill was miscalculated or something. That's part of the reason why I have a Starling account as well as a Monzo. I did get a cheque for an interest refund from Nationwide on the back of as n unaffordable lending complaint. I did ask for a bank transfer instead but they refused, I think they are still living in the 1970s.adamp87 said:Are people really getting cheques that much in 2024? I remember banks used to always give you a cheque book on opening and now are more against doing so when you request, because they just aren’t used anywhere near as much as 20 years ago. Think in the past 5 years I’ve had 1 cheque. For a few pence funnily enough from a bank0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards