We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

regular saving accounts

Comments

-

Only if your earned income is less than your personal allowance. Any earned income above your personal allowance is taxable regardless of your total income including interestMiddle_of_the_Road said:

They will be more attractive to anyone with no/low earned income. If you earn less than £18,570 a year from income and savings interest, then all your savings interest will be tax-free thanks to tax-free savings and the starting savings rate.njkmr said:Im not sure i could manage all them accounts personally but my question is

Do you not end up paying a lot more tax on the interest earned on these rather than having the money in ISA,s ?

Im new to all this .

Tax-free savings: check if you're eligible - Money Saving Expert1 -

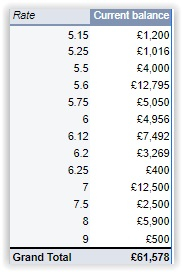

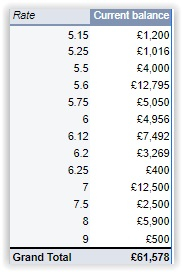

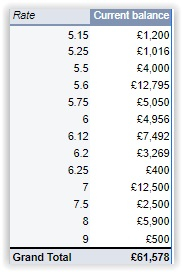

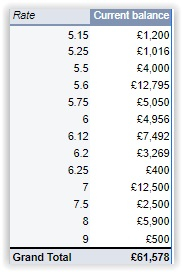

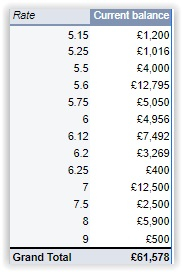

Do you mind me asking approx how much interest you will earn once each account matures, assuming maturity on all is 12months.friolento said:I currently have over £60k in 30 Regular Saver accounts, depositing over £7,000 a month, all at least 5.15% AER but some as high as 9%. It requires a moderate amount of time to set up and manage, a little discipline, and a spreadsheet. I find it rewarding. 0

0 -

Also, I realise this might be a personal question....but that £7k you deposit each month, I assume that's made up from a mix of savings and salary?friolento said:I currently have over £60k in 30 Regular Saver accounts, depositing over £7,000 a month, all at least 5.15% AER but some as high as 9%. It requires a moderate amount of time to set up and manage, a little discipline, and a spreadsheet. I find it rewarding. 0

0 -

I'm really sorry I should have put all of this in the one post...but how much better off are you after doing all that work than leaving it all in an easy access account with a decent rate (chip 4.84%)?friolento said:I currently have over £60k in 30 Regular Saver accounts, depositing over £7,000 a month, all at least 5.15% AER but some as high as 9%. It requires a moderate amount of time to set up and manage, a little discipline, and a spreadsheet. I find it rewarding.

I'm in the process of opening my first easy saver now and I'm definitely going to try and get a couple going!0 -

You need to realise that opening a regular saver is really very simple. If you set up a standing order for the regular payments there is minimal work/maintenance. It's no hassle at all and any regular saver paying more than you can get in an easy access account has to make perfect sense. I have 19 reg savers estimated to provide annual interest of £2800.0

-

This is a question that comes up often, and people have different opinions on whether the extra admin is worth it or not. Also many of the reg.savers are easy access, so there's no problems regarding having access to funds.jay_ftw said:

I'm really sorry I should have put all of this in the one post...but how much better off are you after doing all that work than leaving it all in an easy access account with a decent rate (chip 4.84%)?friolento said:I currently have over £60k in 30 Regular Saver accounts, depositing over £7,000 a month, all at least 5.15% AER but some as high as 9%. It requires a moderate amount of time to set up and manage, a little discipline, and a spreadsheet. I find it rewarding.

I'm in the process of opening my first easy saver now and I'm definitely going to try and get a couple going!

I have about 16 reg.savers and really don't knowhow much extra interest they will produce as I've not done the calculations for each one to get a total amount. All that matters to me is to get as much of my savings into accounts at rates above the best available easy access account rate.

Below is the MSE calculator which does the calculations-

The results shown in the example below, were for a total of 10 regular savers combined, assuming an interest rate of 6% and a monthly deposit of £250 in each.

£2,500 deposited into 10 accounts @6% fed from savings of £30,000 in a 5.2% easy access account, for1 year.

Regular Savings Calculator – MoneySavingExpertYour Results

Drip-feeding the regular saver

After drip-feeding the cash for 12 months, you'd have earned...

£1,688 in interest

£966 from the regular saver + £722 from the normal savings accountLeaving it in normal savings

If you'd kept the cash in normal savings without drip-feeding it, you'd have earned...

£1,525 in interest4 -

jay_ftw said:

I'm really sorry I should have put all of this in the one post...but how much better off are you after doing all that work than leaving it all in an easy access account with a decent rate (chip 4.84%)?friolento said:I currently have over £60k in 30 Regular Saver accounts, depositing over £7,000 a month, all at least 5.15% AER but some as high as 9%. It requires a moderate amount of time to set up and manage, a little discipline, and a spreadsheet. I find it rewarding.

I'm in the process of opening my first easy saver now and I'm definitely going to try and get a couple going!

It's in the region of an additional £1,500 after tax, over and above keeping the money in an easy access account, for me. I don't normally work out the actual profit account by account as it is good enough for me to just look at the AER. Any RS with 5.6% and above is currently of interest to me. The ones I have with lower than 5.6% are remnants from when their AERs looked good. I don't add much money to them now and they will mature shortly.

I don't find it much work to open a new Regular Saver though I do have any pre-req current accounts (e.g. First Direct, Club Lloyds, Natwest, RBS, COOP) and online/app access to various Building Societies in place.

You can use the MSE Regular Saver dripfeed calculator to work out how much more you can get by using Regular Savers.

3 -

Wow thanks for this, huge eye opener!Below is the MSE calculator which does the calculations-

The results shown in the example below, were for a total of 10 regular savers combined, assuming an interest rate of 6% and a monthly deposit of £250 in each.

£2,500 deposited into 10 accounts @6% fed from savings of £30,000 in a 5.2% easy access account, for1 year.

Regular Savings Calculator – MoneySavingExpertYour Results

Drip-feeding the regular saver

After drip-feeding the cash for 12 months, you'd have earned...

£1,688 in interest

£966 from the regular saver + £722 from the normal savings accountLeaving it in normal savings

If you'd kept the cash in normal savings without drip-feeding it, you'd have earned...

£1,525 in interest

Of course the percentages to each are gonna to-and-fro a little but I think these numbers are a great practical example. Therefore for the sake of £163 and opening 10 RS accounts I think I'll just keep the money in one easy access account.

1 -

Yes, it's not a huge amount, and some will see it as not worthwhile, this example was somewhat a generalisation.

I do question the results the calculator provided, but it does give you an idea how regular saving accounts operate.

Worth pointing out that each scheme has differing terms/conditions which can make them more/less attractive.

Some are fixed rate accounts, which will protect against rate drops. Others run without a fixed end date, and one of these was available with £1,000pm max deposit.

As others have said... I'd rather have the £163 than not, and find nothing arduous in opening multiple savings accounts.

4 -

Huge is an abstract definition. I cant be bothered to calculate the exact value of running my 30 RSs (I'm sure it is more than £163), it is rather irrelevant for me. All I know is - feeding them from my EAs maximises the return and the process is very easy to manage, easier and less time consuming than thinking about it and engaging in debates about whether it is worth using RSs or not. If one wants to maximise the return on their spare cash, well paying RSs is a good tool to use. If that's not the aim, then there is no point engaging with RS products and debating how many extra pence per day a Regular Saver might bring.Middle_of_the_Road said:Yes, it's not a huge amount, and some will see it as not worthwhile, this example was somewhat a generalisation.

I do question the results the calculator provided, but it does give you an idea how regular saving accounts operate.

Worth pointing out that each scheme has differing terms/conditions which can make them more/less attractive.

Some are fixed rate accounts, which will protect against rate drops. Others run without a fixed end date, and one of these was available with £1,000pm max deposit.

As others have said... I'd rather have the £163 than not, and find nothing arduous in opening multiple savings accounts.7

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards