We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Derivatives and other complexities in Man GLG Dynamic Income

Comments

-

Going back to credit spreads, this memo by Howard Marks is interesting https://www.oaktreecapital.com/docs/default-source/memos/gimme-credit.pdf?sfvrsn=e7de2b66_4.By the way, I think the reason my graphics are saying "Content not viewable in your region" is because I dropped them into and them out of Imgur, which as of last week no longer works in the UK.3

-

It's an interesting read, and clearly for someone holding a portfolio of higher risk credit long term, the spread needs to cover the actual level of defaults plus some margin for it to be a worthwhile investment. The market has made a judgement on what that level is based on what is known today. If a fund is turning over bonds that are de-rated (which will already have fallen in price by that point), then that will be a drag on returns. Perhaps active management can stem some of the drag by selling early, but in any case the spread will need to cover that too. If you have a fund that attempts to tactically allocate to different credit quality depending on where we are in the economic cycle, then they'll be seeking to harvest excess spread to boost returns. And those who are disinclined to take on credit risk when they can get a really quite good risk free rate of return may decide to sit out a period of tight spreads.Though I think it is perhaps a little misguided to consider the GFC and Covid crash as evidence that defaults will be better avoided by governments throwing money at the problem. This has not been without its price and perhaps difficult to repeat next time around.

I did think they were a little racey, and liable to cause all manner of excitement to the younger bond investor. The very thing the Online Safety Act was put in place to combat.aroominyork said:By the way, I think the reason my graphics are saying "Content not viewable in your region" is because I dropped them into and them out of Imgur, which as of last week no longer works in the UK. I all seriousness, Imgur is redundant on the forum. You can upload images direct to the forum.0

I all seriousness, Imgur is redundant on the forum. You can upload images direct to the forum.0 -

masonic said:It's an interesting read, and clearly for someone holding a portfolio of higher risk credit long term, the spread needs to cover the actual level of defaults plus some margin for it to be a worthwhile investment. The market has made a judgement on what that level is based on what is known today. If a fund is turning over bonds that are de-rated (which will already have fallen in price by that point), then that will be a drag on returns. Perhaps active management can stem some of the drag by selling early, but in any case the spread will need to cover that too. If you have a fund that attempts to tactically allocate to different credit quality depending on where we are in the economic cycle, then they'll be seeking to harvest excess spread to boost returns. And those who are disinclined to take on credit risk when they can get a really quite good risk free rate of return may decide to sit out a period of tight spreads.The market continuously makes a call on default risk and hence sets a spread. If it were correct, high yield and treasuries would track each other, but they don't. High yield seems an area where active management is important. The long-term returns of Jonathan Golan, Mike Scott, Eric Holt seem to show good bond picking can add considerable value.

Yup, it read a bit like a salesman looking for a justification, but he seems a credible fella so what do I know?masonic said:Though I think it is perhaps a little misguided to consider the GFC and Covid crash as evidence that defaults will be better avoided by governments throwing money at the problem. This has not been without its price and perhaps difficult to repeat next time around.

I can't work out how to post direct, but I posted this and Imgbb works for me.masonic said:Imgur is redundant on the forum. You can upload images direct to the forum.0 -

aroominyork said:masonic said:It's an interesting read, and clearly for someone holding a portfolio of higher risk credit long term, the spread needs to cover the actual level of defaults plus some margin for it to be a worthwhile investment. The market has made a judgement on what that level is based on what is known today. If a fund is turning over bonds that are de-rated (which will already have fallen in price by that point), then that will be a drag on returns. Perhaps active management can stem some of the drag by selling early, but in any case the spread will need to cover that too. If you have a fund that attempts to tactically allocate to different credit quality depending on where we are in the economic cycle, then they'll be seeking to harvest excess spread to boost returns. And those who are disinclined to take on credit risk when they can get a really quite good risk free rate of return may decide to sit out a period of tight spreads.The market continuously makes a call on default risk and hence sets a spread. If it were correct, high yield and treasuries would track each other, but they don't. High yield seems an area where active management is important. The long-term returns of Jonathan Golan, Mike Scott, Eric Holt seem to show good bond picking can add considerable value.I'm much more willing to buy into the active management case for bonds, where there are more constraints placed on price and the bet is simply on the company not failing. Though bond pickers can skilfully avoid one crash but be sucked into another (e.g. Richard Woolnough).

Select the image icon, then browse to add a file from your device.aroominyork said:

I can't work out how to post direct, but I posted this and Imgbb works for me.masonic said:Imgur is redundant on the forum. You can upload images direct to the forum. 1

1 -

Final (probably final) question abour Man Dynamic Income. Which months does it make its quarterly distributions of income? I cannot find the answer, and Man Group have (so far) not replied to my email asking.0

-

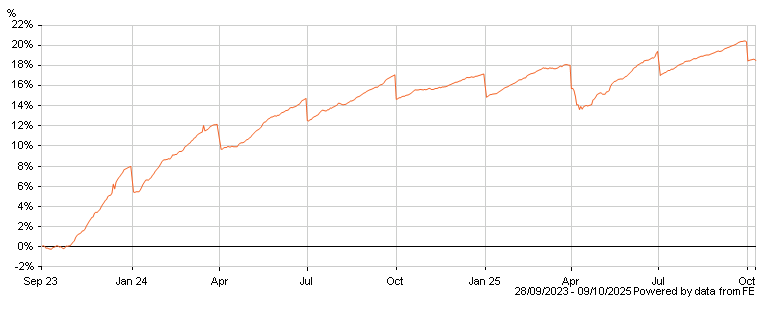

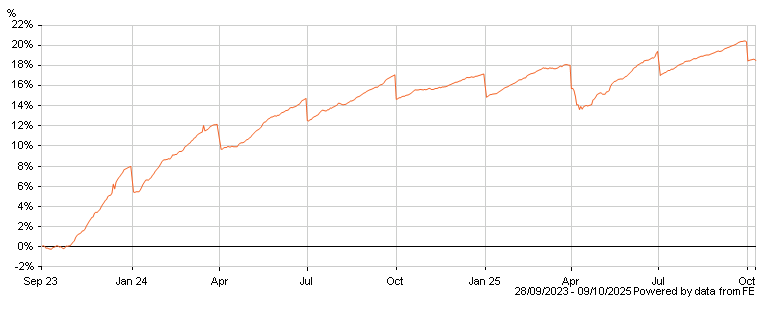

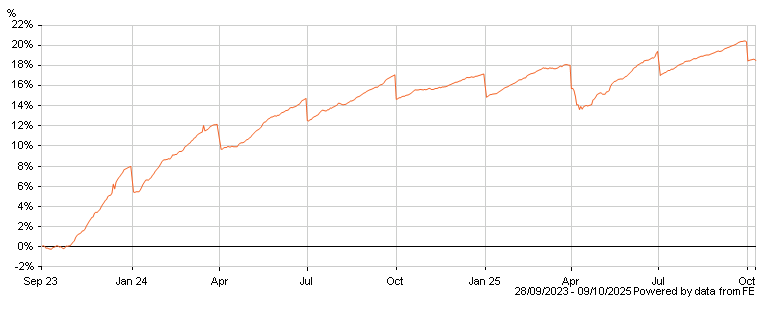

Good question. They don't share the data anywhere I'd normally look. It can be inferred from the price chart of the Inc unit class:

But without data feeding through to investment platforms, you probably won't end up with an accurate consolidated tax certificate if holding unwrapped.0

But without data feeding through to investment platforms, you probably won't end up with an accurate consolidated tax certificate if holding unwrapped.0 -

But the chart shows ex-div date, not distribution date.masonic said:Good question. They don't share the data anywhere I'd normally look. It can be inferred from the price chart of the Inc unit class: But without data feeding through to investment platforms, you probably won't end up with an accurate consolidated tax certificate if holding unwrapped.0

But without data feeding through to investment platforms, you probably won't end up with an accurate consolidated tax certificate if holding unwrapped.0 -

...and what does the prospectus say about when quarterly distributions are paid?aroominyork said:

But the chart shows ex-div date, not distribution date.masonic said:Good question. They don't share the data anywhere I'd normally look. It can be inferred from the price chart of the Inc unit class: But without data feeding through to investment platforms, you probably won't end up with an accurate consolidated tax certificate if holding unwrapped.0

But without data feeding through to investment platforms, you probably won't end up with an accurate consolidated tax certificate if holding unwrapped.0 -

There is only one quarterly option if you go by this:

... and the unit price on the website matches the retail price shown by HL. So presumably the answer is the end of Jan, Apr, Jul and Oct, yes?0

... and the unit price on the website matches the retail price shown by HL. So presumably the answer is the end of Jan, Apr, Jul and Oct, yes?0 -

Certainly before the end of those months, even if the exact date cannot be pinned down.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards