We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Should the triple lock be scrapped in the 6 March Budget?

Comments

-

Yes it should be scrapped

Does that include all the other bits and bobs (winter fuel allowance, free travel etc)?Grumpy_chap said:

Another factor that comes into play here, with regard to the earnings element is availability of work for the working age group.Exodi said:

Even the double lock of CPI or average earnings can be problematic,

AIUI (and I may be incorrect, so happy to be advised), the earnings metric uses median annual earnings but does not take account of people with no earnings because of redundancy, general economic downturn, illness etc. Earnings can be taken away through events. You can't be made redundant from Retirement, or too ill to continue being Retired.

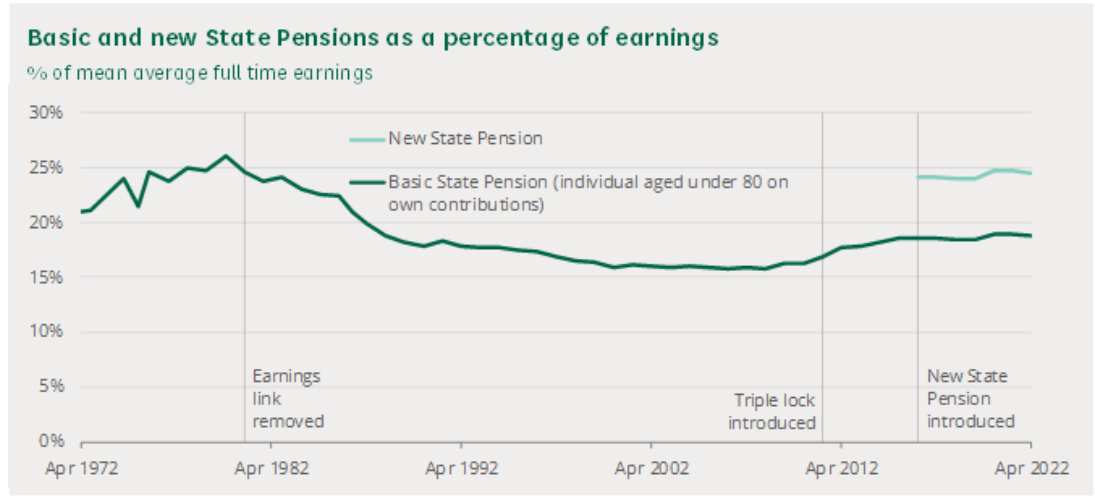

That chart shows the New State Pension is at the same level - only one year looks to be higher in history.The_Green_Hornet said:After 13 years of the triple lock, the State Pension, as a percentage of earnings, is still below the level it was in the 1970s.

That chart is incomplete as it ignores the Additional State Pension which adds to the Basic State Pension.

That chart is incomplete - what will the percentage be from this April's uplift?

Finally, don't forget that those above SP age who chose to continue working also get the benefit of no NI contributions which is quite a significant benefit.0 -

Yes it should be scrapped

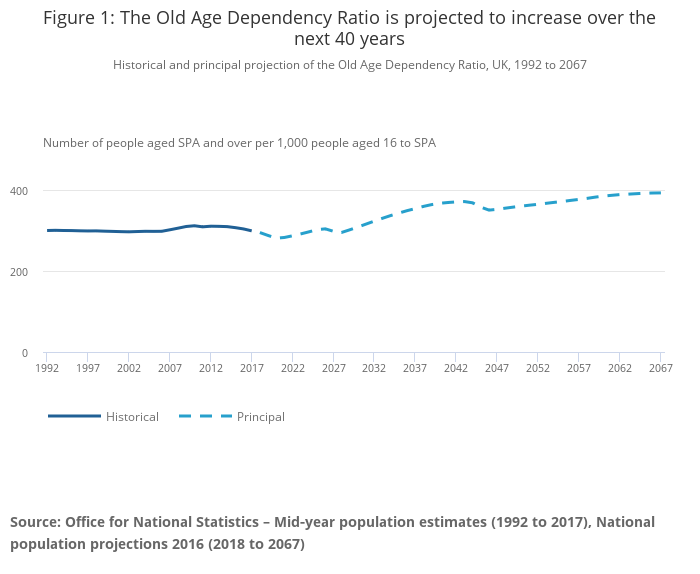

Chart added to further the discussion.The UK population is changing in both size and structure. By 2050, it is projected that one in four people in the UK will be aged 65 years and over – an increase from almost one in five in 2018. This is important since the ageing population has implications for a number of policy areas.

Chart added to further the discussion.The UK population is changing in both size and structure. By 2050, it is projected that one in four people in the UK will be aged 65 years and over – an increase from almost one in five in 2018. This is important since the ageing population has implications for a number of policy areas.

https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/ageing/articles/livinglongerandoldagedependencywhatdoesthefuturehold/2019-06-242 -

Thats more of an argument for increasing State Pension age, as opposed to reducing the amount paid.BlackKnightMonty said:Chart added to further the discussion.The UK population is changing in both size and structure. By 2050, it is projected that one in four people in the UK will be aged 65 years and over – an increase from almost one in five in 2018.

Speaking of which in 2050 the SP age will 68, so the comparison should really be the proportion of people 68 or over in 2050 vs proportion 65 or over in 2018.1 -

Never said they would honour it . Read back . It's under 20% of government spend , those are the figures. . It's been upgraded to help people in retirement survive using their own money. The second pension has also been encouraged to supplement this. DB pensions are fading fast so DC pots have taken their place. That doesn't mean everyone will be well off ? Maybe reduces the benefits paid out . All swings and roundabouts . Those in rental accommodation are rising fast together with BTL we are talking 30% plus of the housing stock. Millions. Plenty links out there to confirm this. Unfortunately a second pension won't help them as it'll be swallowed up in rent. Many might still be claiming benefits ? There's no real policy from any party just the same old tinkering . That's all they'll do play around with increases on the day.Grumpy_chap said:

The current Triple Lock ensures that SP increases relative to earnings and increases as a proportion of GDP, when taken over an economic cycle rather than individual year assessment.coastline said:

Why is it all unsustainable ?

If that is taken to the extreme, the SP would exceed GDP, which would clearly be unsustainable.

Sometime between now and exceeding GDP, the Triple Lock would have to end.

(We could accept the whole population living in poverty apart from State Pensioners, I suppose...)

In fact, we have had two scenarios where the vulnerability of the Triple Lock has been demonstrated in recent times:

- During COVID, earnings fell because a large chunk of the workforce was not working. SP still increased.

- Last year, SP rose by >10% (inflation rise greater than earnings rise) and this year SP will rise by 8.5% (earnings rise greater than inflation, showing typical lag). So, SP received an increase across two years of 19% which is far higher than employed people enjoyed.

Triple lock was introduced 2011 and if it's linked to GDP then there's hardly been any change either side of 5%. Blue on the chart. Maybe a blip during covid but that was an extreme case.

[img]https://i.postimg.cc/PxWZ6WkL/ukgs-chart-Sp42t.png[/img]

ukgs_chartSp42t.png (350×230) (ukpublicspending.co.uk)

Throw some average salaries to this but as I said it's been upgraded recently for a genuine reason . There again the retirement age continues to go up. Somebody mentioned perks earlier well the buss pass is now 66 yo from 60 yo.

Basic State Pension (Rate) - Royal London for advisers

0 -

Yes it should be scrapped

Even raising the age to 71 is probably inadequate to maintain the current triple plated system.Qyburn said:

Thats more of an argument for increasing State Pension age, as opposed to reducing the amount paid.BlackKnightMonty said:Chart added to further the discussion.The UK population is changing in both size and structure. By 2050, it is projected that one in four people in the UK will be aged 65 years and over – an increase from almost one in five in 2018.

Speaking of which in 2050 the SP age will 68, so the comparison should really be the proportion of people 68 or over in 2050 vs proportion 65 or over in 2018.1 -

Increasing State Pension age has a very different impact on people depending on where they live. Some areas have much lower life expectancy that others. So managing expenditure by increasing State Pension age results in redistributing the State Pension away from areas with low life expectancy and toward those areas with good life expectancy.Qyburn said:

Thats more of an argument for increasing State Pension age, as opposed to reducing the amount paid.BlackKnightMonty said:Chart added to further the discussion.The UK population is changing in both size and structure. By 2050, it is projected that one in four people in the UK will be aged 65 years and over – an increase from almost one in five in 2018.

Speaking of which in 2050 the SP age will 68, so the comparison should really be the proportion of people 68 or over in 2050 vs proportion 65 or over in 2018.

Remember the impact of increasing State Pension age. During this period State Pension rose from 60/65 to 66 for all. You see similar flat-lining or even reduction of spend for the years SPA is scheduled to increase (2026-28 and 2044-46). But in all other years expenditure steadily increases.coastline said:

Triple lock was introduced 2011 and if it's linked to GDP then there's hardly been any change either side of 5%. Blue on the chart. Maybe a blip during covid but that was an extreme case.3 -

That is a very difficult post to read.coastline said:Never said they would honour it . Read back . It's under 20% of government spend , those are the figures. . It's been upgraded to help people in retirement survive using their own money. The second pension has also been encouraged to supplement this. DB pensions are fading fast so DC pots have taken their place. That doesn't mean everyone will be well off ? Maybe reduces the benefits paid out . All swings and roundabouts . Those in rental accommodation are rising fast together with BTL we are talking 30% plus of the housing stock. Millions. Plenty links out there to confirm this. Unfortunately a second pension won't help them as it'll be swallowed up in rent. Many might still be claiming benefits ? There's no real policy from any party just the same old tinkering . That's all they'll do play around with increases on the day.

Triple lock was introduced 2011 and if it's linked to GDP then there's hardly been any change either side of 5%. Blue on the chart. Maybe a blip during covid but that was an extreme case.

[img]https://i.postimg.cc/PxWZ6WkL/ukgs-chart-Sp42t.png[/img]

ukgs_chartSp42t.png (350×230) (ukpublicspending.co.uk)

Throw some average salaries to this but as I said it's been upgraded recently for a genuine reason . There again the retirement age continues to go up. Somebody mentioned perks earlier well the buss pass is now 66 yo from 60 yo.

Basic State Pension (Rate) - Royal London for advisers

20% of Government spend is £1 in every £5. Quite a high proportion for any single line item.

The chart you shared for SP costs versus GDP shows 4% up to 2010 and then risen to 6% before falling back to 5%. Still an increase and, eventually, that increase against GDP will become unsustainable - a point that has been expressed by several posters and you have refused to acknowledge.

Average salaries were referenced further upthread:

What percentage of average salary do you think SP should cover?Grumpy_chap said:From April, NMW will be £11.44 (for the majority) so just under £24k for a full time employee.

Average (median) salary is £35k (https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/annualsurveyofhoursandearnings/2023)

1 -

I ain't refusing to acknowledge the triple lock . It's there for a purpose which can be altered anytime they like and it will be. Beats me why posters want something stopping when it benefits everyone. The next thread will be scrapping the 25% lump sum in the private pension or reducing the contribution perks to basic rate income tax. Just as well Mr JH isn't logged in on here at times. At the end of the day it's in one hand and out of the other. Income tax was 38% years ago and now 20% . VAT was 5% and now 20% . Central government withdrew funding for the council tax so the local authorities put it up. It just goes on and on. List is endless.Grumpy_chap said:

That is a very difficult post to read.coastline said:Never said they would honour it . Read back . It's under 20% of government spend , those are the figures. . It's been upgraded to help people in retirement survive using their own money. The second pension has also been encouraged to supplement this. DB pensions are fading fast so DC pots have taken their place. That doesn't mean everyone will be well off ? Maybe reduces the benefits paid out . All swings and roundabouts . Those in rental accommodation are rising fast together with BTL we are talking 30% plus of the housing stock. Millions. Plenty links out there to confirm this. Unfortunately a second pension won't help them as it'll be swallowed up in rent. Many might still be claiming benefits ? There's no real policy from any party just the same old tinkering . That's all they'll do play around with increases on the day.

Triple lock was introduced 2011 and if it's linked to GDP then there's hardly been any change either side of 5%. Blue on the chart. Maybe a blip during covid but that was an extreme case.

[img]https://i.postimg.cc/PxWZ6WkL/ukgs-chart-Sp42t.png[/img]

ukgs_chartSp42t.png (350×230) (ukpublicspending.co.uk)

Throw some average salaries to this but as I said it's been upgraded recently for a genuine reason . There again the retirement age continues to go up. Somebody mentioned perks earlier well the buss pass is now 66 yo from 60 yo.

Basic State Pension (Rate) - Royal London for advisers

20% of Government spend is £1 in every £5. Quite a high proportion for any single line item.

The chart you shared for SP costs versus GDP shows 4% up to 2010 and then risen to 6% before falling back to 5%. Still an increase and, eventually, that increase against GDP will become unsustainable - a point that has been expressed by several posters and you have refused to acknowledge.

Alter the time period anyway you want .

Public Spending Chart for United Kingdom 1950-2023 - Central Government Local Authorities (ukpublicspending.co.uk)

Public Spending Chart for United Kingdom 1950-2023 - Central Government Local Authorities (ukpublicspending.co.uk)

0 -

Spending that's on an unsustainable trend certainly does not benefit everyone. Pensions and health spending are going to be huge problems in the future.Beats me why posters want something stopping when it benefits everyone.

9 -

Yes it should be scrapped

You are making the incorrect assumption that lower taxes benefit everyone, or even the majority of people, in general it only benefits a very small group of people. Have a look at living standards and provision of public services in countries which charge higher taxes than the UK, France, Germany, Norway, Spain, Japan etc. Want to see your doctor? One gets an appointment within a day or two, often the same day. Want your children to go to school? One's children are taught by qualified teachers, in well maintained buildings, with adequate staffing levels. Want to drive your car? Drive on roads which are adequately maintained despite far worse seasonal weather. Are the victim of a crime? The police have enough resources to investigate further than just issuing a crime reference number. Want to have a career whilst having children? The state provides childcare, at a far lower cost overall for everyone. Need to go into a care home? No extra charges. Yes everyone pays slightly more tax, but overall society benefits far far more than individuals would from a few percentage points less paid in tax.coastline said:

I ain't refusing to acknowledge the triple lock . It's there for a purpose which can be altered anytime they like and it will be. Beats me why posters want something stopping when it benefits everyone.Grumpy_chap said:

That is a very difficult post to read.coastline said:Never said they would honour it . Read back . It's under 20% of government spend , those are the figures. . It's been upgraded to help people in retirement survive using their own money. The second pension has also been encouraged to supplement this. DB pensions are fading fast so DC pots have taken their place. That doesn't mean everyone will be well off ? Maybe reduces the benefits paid out . All swings and roundabouts . Those in rental accommodation are rising fast together with BTL we are talking 30% plus of the housing stock. Millions. Plenty links out there to confirm this. Unfortunately a second pension won't help them as it'll be swallowed up in rent. Many might still be claiming benefits ? There's no real policy from any party just the same old tinkering . That's all they'll do play around with increases on the day.

Triple lock was introduced 2011 and if it's linked to GDP then there's hardly been any change either side of 5%. Blue on the chart. Maybe a blip during covid but that was an extreme case.

[img]https://i.postimg.cc/PxWZ6WkL/ukgs-chart-Sp42t.png[/img]

ukgs_chartSp42t.png (350×230) (ukpublicspending.co.uk)

Throw some average salaries to this but as I said it's been upgraded recently for a genuine reason . There again the retirement age continues to go up. Somebody mentioned perks earlier well the buss pass is now 66 yo from 60 yo.

Basic State Pension (Rate) - Royal London for advisers

20% of Government spend is £1 in every £5. Quite a high proportion for any single line item.

The chart you shared for SP costs versus GDP shows 4% up to 2010 and then risen to 6% before falling back to 5%. Still an increase and, eventually, that increase against GDP will become unsustainable - a point that has been expressed by several posters and you have refused to acknowledge.

The first part is largely a bribe to retirees, yes it might benefit some (but far from even a majority), however it also costs the taxpayer and that money would be better invested. On the latter that is an argument that higher earners receive greater subsidy, as someone who directly benefits from that I still cannot argue for it's existence from a moral perspective.coastline said:

The next thread will be scrapping the 25% lump sum in the private pension or reducing the contribution perks to basic rate income tax.

Income tax has varied over time, combined with NI the rate for non-pensioners is 30% (20%IC + 10%NI) which is low by European standards and we also get a huge tax free allowance by European, or even global standards, the EU average is €1,800 tax free allowance and a starting rate of 38%, in many cases with compulsory health insurance on top.coastline said:

Income tax was 38% years ago and now 20% .

It was, but then on balance goods are still now cheap by historical standards, that VAT has also meant that other taxes have not needed to have been raised as much (fuel duty has not been raised for years).coastline said:

VAT was 5% and now 20%

Central government withdrew between 50% and 75% of council funding over two years, then further cut payments after that, councils have raised Council Tax at about 3% for the last decade, so they still have far less revenue than 14 years ago. My local council as an example has gets zero grant from central government, loses 40% of it's business rates (other councils get to keep 100%) and has below average council tax because they are limited by the percentage that they can raise it each year. Which is why social services are collapsing and the roads are disintegrating.coastline said:

Central government withdrew funding for the council tax so the local authorities put it up. It just goes on and on.

You can throw together an endless list of things, but if none of them are relevant in isolation, or they ignore fiscal reality then it is a pointless list.coastline said:

List is endless.4

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards