We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

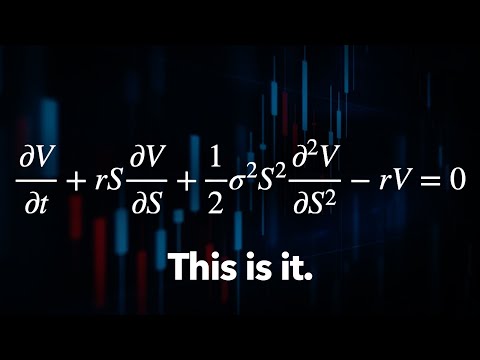

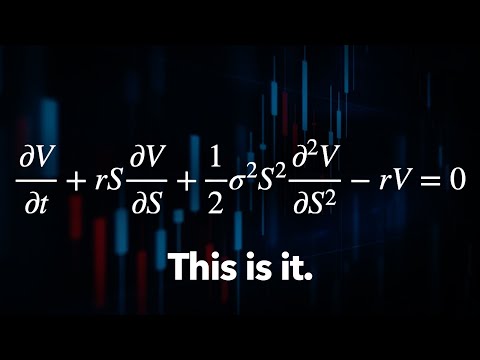

How to price options and beat the markets with 2nd order partial differential equations.

Bostonerimus1

Posts: 1,717 Forumite

It takes a lot of maths and computing power to find the inefficiencies of the markets...and an understanding of diffusion and String Theory doesn't hurt either. This is a very interesting little documentary.

https://www.youtube.com/watch?v=A5w-dEgIU1M

https://www.youtube.com/watch?v=A5w-dEgIU1M

https://www.youtube.com/watch?v=A5w-dEgIU1M

https://www.youtube.com/watch?v=A5w-dEgIU1MAnd so we beat on, boats against the current, borne back ceaselessly into the past.

0

Comments

-

Haven't watched it, but if they have to go into that level of maths, I get the same feel I get from many statistical equations. Good when first invented, but most of the people trying to use it subsequently won't understand the background requirements and will therefore generate unreliable results.If a good proportion of the population don't understand percentages, they won't get far with standard differential equations, never mind partial differentials.0

-

The documentary does a good job of explaining the concepts and the viewer does not need any specialized knowledge of maths. The second half of the show concentrates on Jim Simons, an MIT mathematician who started the Medallion hedge fund. The fact that his success hasn't been repeated makes me wonder about confirmation bias and there are some tax issues and questions as to why Medallion performed so much better than Simons' other funds.LHW99 said:Haven't watched it, but if they have to go into that level of maths, I get the same feel I get from many statistical equations. Good when first invented, but most of the people trying to use it subsequently won't understand the background requirements and will therefore generate unreliable results.If a good proportion of the population don't understand percentages, they won't get far with standard differential equations, never mind partial differentials.

Using maths to drag patterns out of large data sets is obviously topical because of AI, but being a child of the 60's and 70's I immediately think of Asimov's psychohistory in the Foundation Trilogy.And so we beat on, boats against the current, borne back ceaselessly into the past.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards