I am a Mortgage Adviser

You should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.

We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Birmingham Midshires Negative Equity

SingingElephant

Posts: 5 Forumite

Hello,

I was wondering if anyone had some advice please? Apologies for the length.

My Aunt purchased a property in late 2007 for £195,000 (with a 10 year residential interest only mortgage of £170,000 with Birmingham Midshires). A few months later, the 2008 crash happened and the property practically overnight, became valued at about £80,000. She held on, hoping that the value would increase by the time the mortgage came to full term, as the intention was to sell it. However, it never did by the time the mortgage ran out in 2017. She managed to get an extension granted to 2022. The property has been for sale since 2018, starting at £135,000 and then dropped to £120,000, with few viewings and no offers. Eventually an offer has recently been accepted for £110,000. However, Birmingham Midshires have now put a halt on the sale, as the shortfall is more than £50,000 (It is £64,000). They said that if it was less than £50,000 they would have let her make a shortfall agreement, to pay a reduced amount over a set number of years.

She hasn’t lived in the property since 2018 and had permission to let. The property is currently empty and she is still paying interest.

My Aunt purchased a property in late 2007 for £195,000 (with a 10 year residential interest only mortgage of £170,000 with Birmingham Midshires). A few months later, the 2008 crash happened and the property practically overnight, became valued at about £80,000. She held on, hoping that the value would increase by the time the mortgage came to full term, as the intention was to sell it. However, it never did by the time the mortgage ran out in 2017. She managed to get an extension granted to 2022. The property has been for sale since 2018, starting at £135,000 and then dropped to £120,000, with few viewings and no offers. Eventually an offer has recently been accepted for £110,000. However, Birmingham Midshires have now put a halt on the sale, as the shortfall is more than £50,000 (It is £64,000). They said that if it was less than £50,000 they would have let her make a shortfall agreement, to pay a reduced amount over a set number of years.

She hasn’t lived in the property since 2018 and had permission to let. The property is currently empty and she is still paying interest.

To complicate matters, her husband took early retirement and purchased them a modest property mortgage free. (Her share of the equity is about £75,000). They are in their seventies and are living on pension income. She is so worried that they will take her house off her and she will lose everything.

Has anyone any idea how to approach this please? She is making herself ill with this weighing over her. If the buyer pulls out, she is back to square one. The property had been for sale for over 5 years and she has no idea when another offer would come in. Meanwhile, she is still paying monthly interest, which is crippling her.

We can find plenty of forums with people negotiating settlement agreements with lots of lenders, but none with Birmingham Midshires.

Thank you in advance of any help or advice you can give. She is just desperate to not lose her home.

0

Comments

-

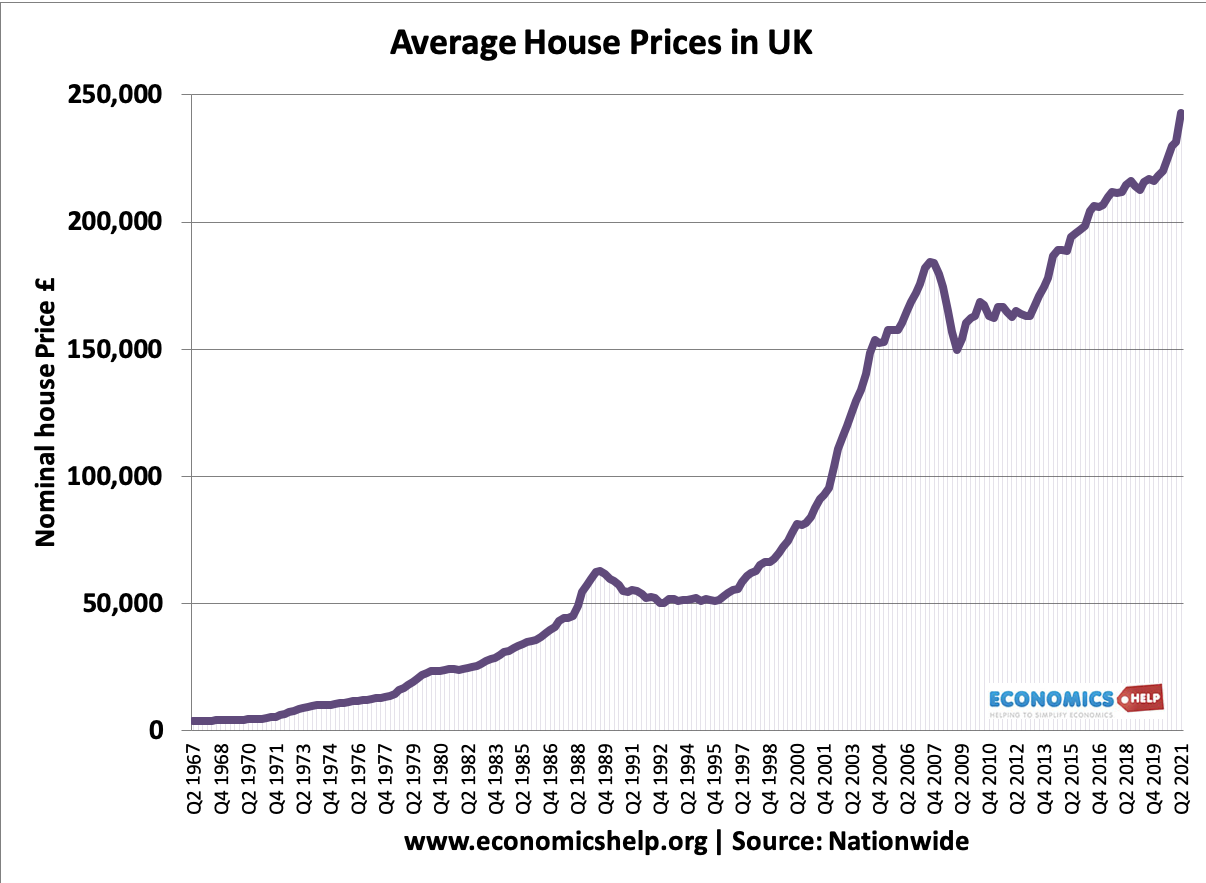

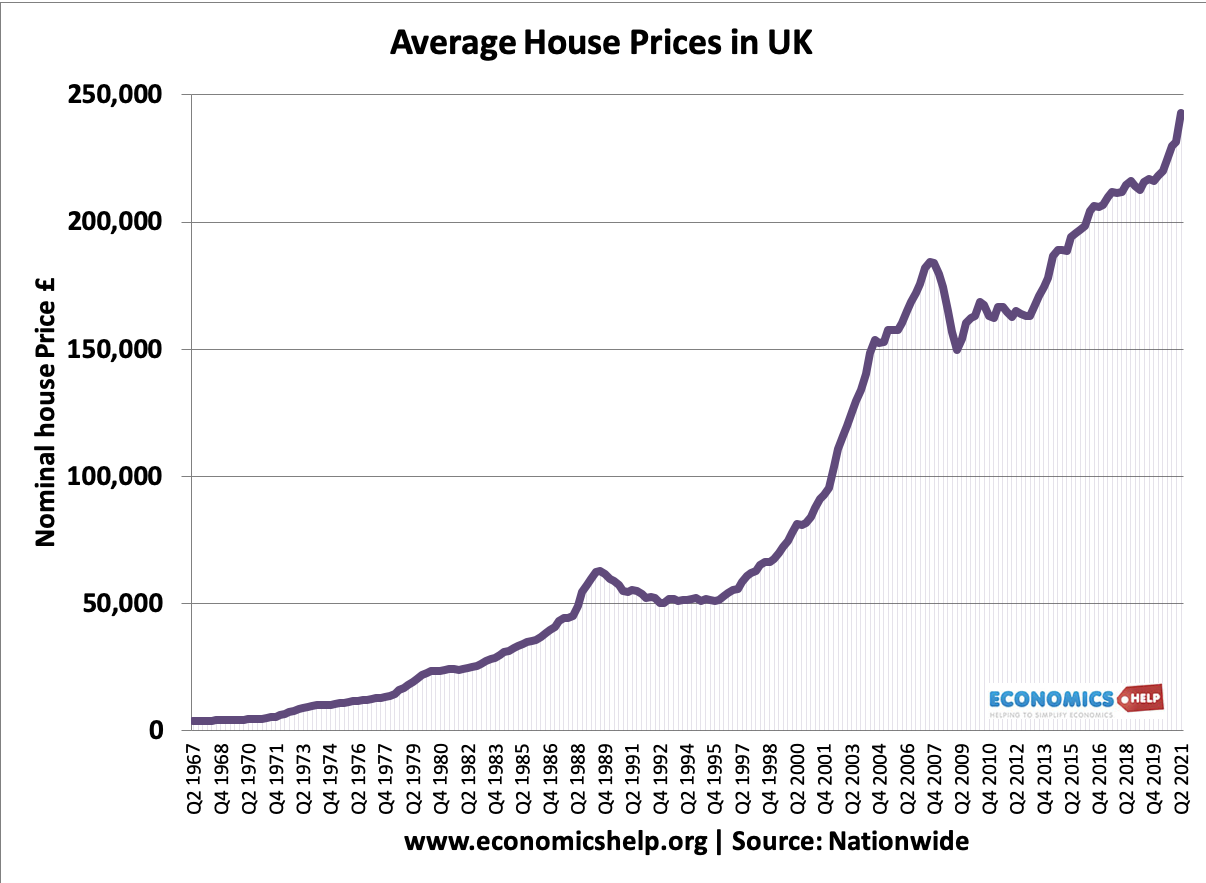

Something doesn't add up here....

It's really hard to believe that the price dropped from £170K to £80K and hasn't recovered since then.

https://www.economicshelp.org/blog/8733/housing/uk-house-prices-high/

1 -

grumbler said:

Thank you. I know it seems a lot, but it was the perfect mix of terrible circumstances. There are 3 other owners in the building in the same situation. They are younger however and have been allowed to extend longer with their mortgage companies.Something doesn't add up here....

It's really hard to believe that the price dropped from £170K to £80K and hasn't recovered since then.

Basically, it is a fairly impoverished area, but the building itself was to a very high/upmarket standard. The mortgage company had no problem valuing it at the time (this was during a property boom) but the most expensive (and largest flat) in the building has only sold for £125,000 since then. If I told you the area, you might understand more, but I need to keep this as private as possible.

0 -

Get a mortgage on the current place for £60k to pay the shortfall?

0 -

penners324 said:Get a mortgage on the current place for £60k to pay the shortfall?

Thank you, but they can’t do that, as they are in their seventies and nowhere will do it, as they have checked.She needs advice about the best way to get them to agree to the sale and come to a settlement arrangement with them.Thank you, but they can’t do that, as they are in their seventies and nowhere will do it.She needs advice about the best way to get them to agree to the sale and come to a settlement arrangement with them.0 -

Offer her share of the property she is living in as security. Presumably the BTL is generating an income that could be used to reduce the debt owed?0

-

The problem is that the mortgage actually ran out in 2022, so being sold is the only option. It also wasn’t a buy to let mortgage. It was a residential mortgage with a consent to let in the last few years.Hoenir said:Offer her share of the property she is living in as security. Presumably the BTL is generating an income that could be used to reduce the debt owed?

0 -

A few options:

a) find £14,000 to reduce the outstanding amount to £50,000. Sell up and accept a repayment schedule with the lender.

b) had the keys back to the lender - voluntary repossession. Let the lender deal with the sale, then they will come after her for the outstanding amount and she can agree a repayment schedule. Shifts the problem to the lender, but the outstanding amount will probably be greater than if she sold it herself.

c) the way you’ve written it suggests the problem property is in her name only, is the house in his name only?I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0 -

Thanks for your reply. Finding £14,000 will be extremely difficult for her. I don’t know where the arbitrary figure of £50,000 has come from. I’d be so scared of her getting into more debt, just for them them then change the £50,000 ‘rule’ and come after her house.silvercar said:A few options:

a) find £14,000 to reduce the outstanding amount to £50,000. Sell up and accept a repayment schedule with the lender.

b) had the keys back to the lender - voluntary repossession. Let the lender deal with the sale, then they will come after her for the outstanding amount and she can agree a repayment schedule. Shifts the problem to the lender, but the outstanding amount will probably be greater than if she sold it herself.

c) the way you’ve written it suggests the problem property is in her name only, is the house in his name only?I had suggested voluntary repossession to her, but I know that they will sell for a much lower price than the current offer (which has taken 5 years to get) and interest gets added on until it is sold. I wish they would realise it is in their best interests to allow the sale to go through before the buyer walks away.The problem property is in her sole name and the house is joint ownership with her husband.0 -

do either of them care about leaving their current property to anyone?

They could sell the BTL and then do equity release on the residential to pay the shortfall?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards