We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Sharia index tracker versus global (ethical) equity in workplace pension (USS)

Comments

-

And people have the habit of repeating their mistakes and thinking too short term.BlackKnightMonty said:

Dinosaurs were still walking the earth in tech 25 years ago.dunstonh said:

What about other weeks when the returns are the other way around?slenderkitten said:Yeah my fund went up £200 in one week when the 2040 fund did nothing, a waste of time, i'll keep an eye out for it and if i need to, i will switch to another one.

To get an idea of markets, you need to look at the last 25 years as a sensible period. Not one week in isolation.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

dunstonh said:If AI takes off, then tech may have reached a new level. If not, then tech will likely fall back to its previous state.No financial advice from me, but as an observation on the current state of play: I think both will be true. Folks are right to compare this to the dot.com bubble, it is very similar in terms of growth, promises, and opportunity.What a lot of folks forget is that what people thought during the bubble was the good times would never end, and what people thought after the crash was that it had all been smoke and mirrors.But at the end of the day the technological improvements that arose over that period changed the world more dramatically than anything twenty years either side of it, including even the rise of smartphones.A few companies will emerge victorious from the current situation, and the vast majority will fail. The world will be permanently and powerfully changed by the technology developing right now.Neither fact gives anyone (in my opinion) adequate predictive power in the world of investments.1

-

Ultimately it’s a choice. A choice of which NEST fund to chose. Most people probably don’t even look and stick with the default. That looked like a bad strategy 6 years ago when I joined NEST. I think I would still pick the Sharia fund today if faced with the same choice.1

-

The main business of both Google and Meta is not Tech but rather selling advertising space, about 80% of revenue for Google and 97% (IIRC) in the case of Meta. Their investment in tech is more for self promotion than profit.BlackKnightMonty said:

Dot.com was a very immature tech market. It’s very different today. Microsoft, Apple, Nvidia, Google, Meta aren’t a bunch of college grads any more.Udunstonh said:Is it a massive bubble or technology 5.0?Very true. However, the size of the tech bubble (if its one) is now comparable to the level before the original dot.com crash.

No one knows. I repeat, no one knows.

The original dot.com crash came along because anything tech-related had grown, and there was a realisation that most of the companies didn't have tech that was going to work and they had no assets and no market. A lot of wishes and promises that resulted in zero.

If AI takes off, then tech may have reached a new level. If not, then tech will likely fall back to its previous state.In my view, if AI takes off it will become a utility, not a gold mine. The technology is public. Anyone can set up an AI company. A comparator I have mentioned before is databases. They have changed the world in the past 50 years since they were first developed and every business beyond the smallest will probably use them. But very few people now could name even one specialist provider. The field is certainly not seen as an investment opportunity.

In the short term there will be large speculative gains and losses. Any investment in new tech needs to be balanced by growth investments in other sectors and in solid profitable companies.0 -

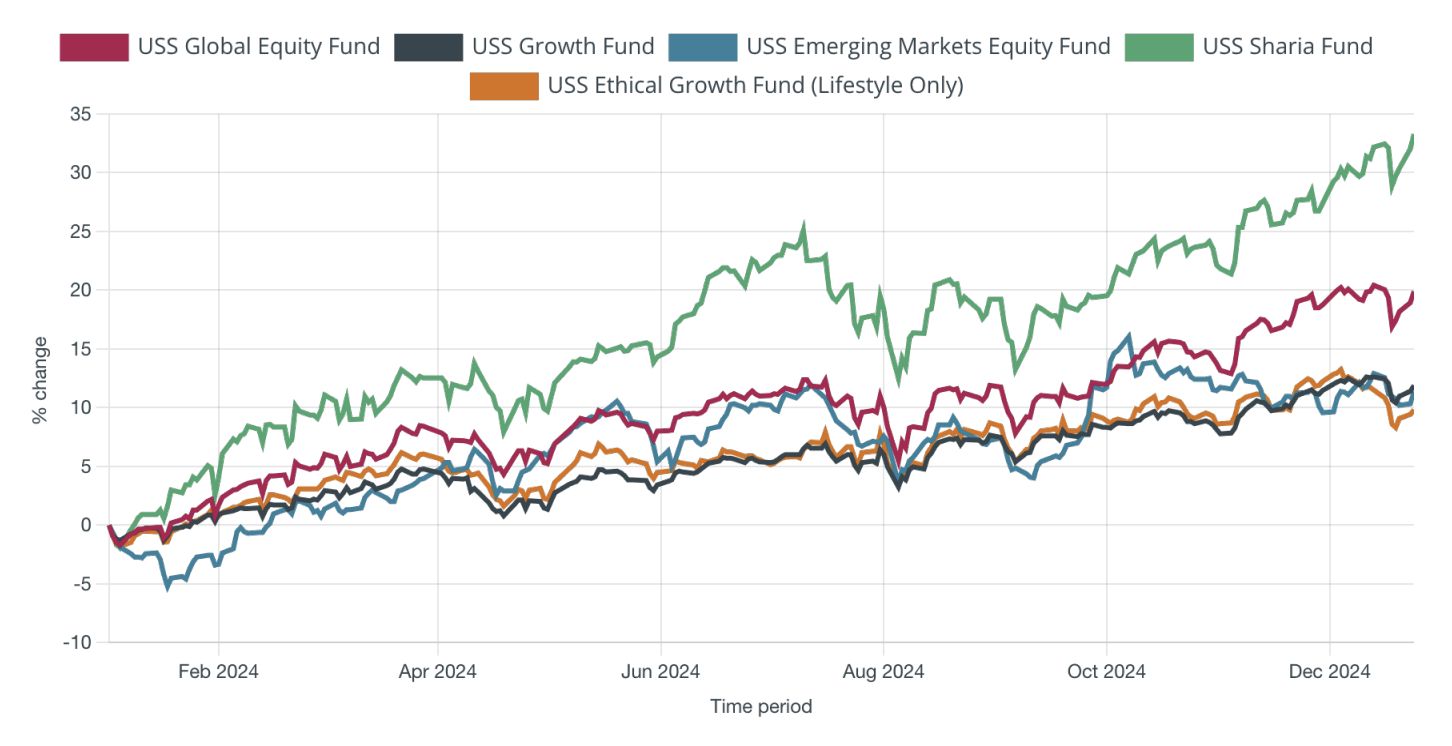

Thanks everyone for this thread. I came across it a couple of months ago when I was looking into my fund choices in USS and it was by far the most informative source I found on the contents of the Sharia Fund. I've been in the Sharia fund since the DC component of the pension kicked off, and wondered why it was outperforming. I decided to up my %age in it. Here's an updated graph of how the various growth funds have performed this year. The Sharia Fund has continued to outperform rather handily. Of course there are good reasons to think that US tech stocks might be a bit overpriced, so my strategy is to sit on my holding and keep a careful eye on it.JohnWinder said:A lot of nice background there; not always easy choices.The theory, with not much to counter it, based on the efficient market hypothesis, capital asset pricing model and later variants, suggest that your best 'return for risk' will come from the most diverse capitalisation weighted index fund tracking a reasonable index at low cost. And, you'll never have to say sorry to yourself for choosing unwisely. Small deviations from that wouldn't be worth fussing over, but take large variations and you really have to start thinking about your choices: why do this; can I ignore all the evidence suggesting passive is better than active; size of impact; alternatives; conviction to see it through to the end.

'trying not to just make this decision based on the Sharia line going higher in the performance graphs than all the others! 'I hope you've succeeded, because to use higher returns for a short period to compare similar type funds would do yourself a grave disservice if it suggests the future would be the same. Compared to a benchmark, go right ahead. And compared to a benchmark year by year, not matching its benchmark every 5 years, unless you can wait 5 years to get at your money and the 5 years is a reliable figure.

0

0 -

My USS DB is 100% in the Shariah fund. It was 50/50 Shariah/Ethical Equity, but observing the EE performance slippage I changed all to Shariah. No point in investing in some fat cat pension manager’s greenwashing fund if it grows substantially slower and with similar volatility. Would rather make more money and then choose to support green initiatives I know and trust.0

-

My USS DB is 100% in the Shariah fund. It was 50/50 Shariah/Ethical Equity, but observing the EE performance slippage I changed all to ShariahThey are not comparable for risk though. The Shariah fund can lose upto 80% of its value in 12 months.

Historically, ethical funds underperform conventional investing.No point in investing in some fat cat pension manager’s greenwashing fund if it grows substantially slower and with similar volatility.It wont be similar volatility and don't they have the same charges?Would rather make more money and then choose to support green initiatives I know and trust.Can you afford the losses that could occur on the shariah fund?

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

5 year annualised fund volatility is 14% for Sharia and 13.4% for ethical equity. 5 year total return is 120% for Sharia and 80% for Ethical Equity fund. Sharia funds is growing more with similar volatility to the ethical equity fund.0

-

5 year volatility is largely pointless. Its too short term to see what its really capable of in volatile times.Cafeanon said:5 year annualised fund volatility is 14% for Sharia and 13.4% for ethical equity. 5 year total return is 120% for Sharia and 80% for Ethical Equity fund. Sharia funds is growing more with similar volatility to the ethical equity fund.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards