We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Sharia index tracker versus global (ethical) equity in workplace pension (USS)

Comments

-

As I said, I would not switch all of my investments to this fund. So if I was in a pension that only allowed one fund I would choose something else.

If you want to attempt timing the market of course that's your choice. I replied because it doesn't sit well with me that someone has put all of their pension in this fund based on comments on a thread I started. I've said my piece now, best of luck.0 -

You can only choose one NEST fund.FIREmenow said:As I said, I would not switch all of my investments to this fund. So if I was in a pension that only allowed one fund I would choose something else.

If you want to attempt timing the market of course that's your choice. I replied because it doesn't sit well with me that someone has put all of their pension in this fund based on comments on a thread I started. I've said my piece now, best of luck.

Which other fund would you pick?

1 -

Is it a massive bubble or technology 5.0?Very true. However, the size of the tech bubble (if its one) is now comparable to the level before the original dot.com crash.

No one knows. I repeat, no one knows.

The original dot.com crash came along because anything tech-related had grown, and there was a realisation that most of the companies didn't have tech that was going to work and they had no assets and no market. A lot of wishes and promises that resulted in zero.

If AI takes off, then tech may have reached a new level. If not, then tech will likely fall back to its previous state.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

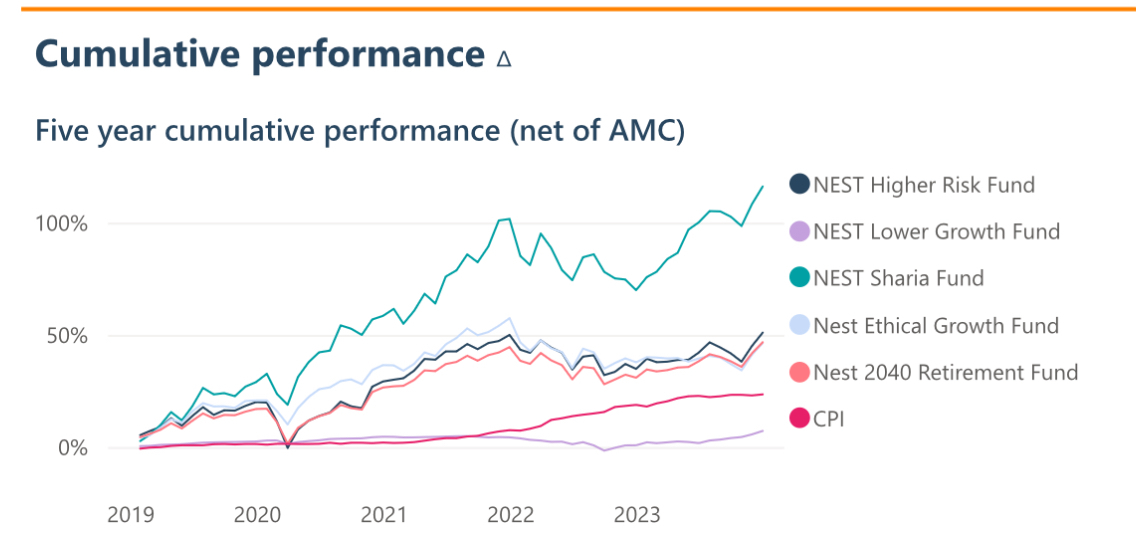

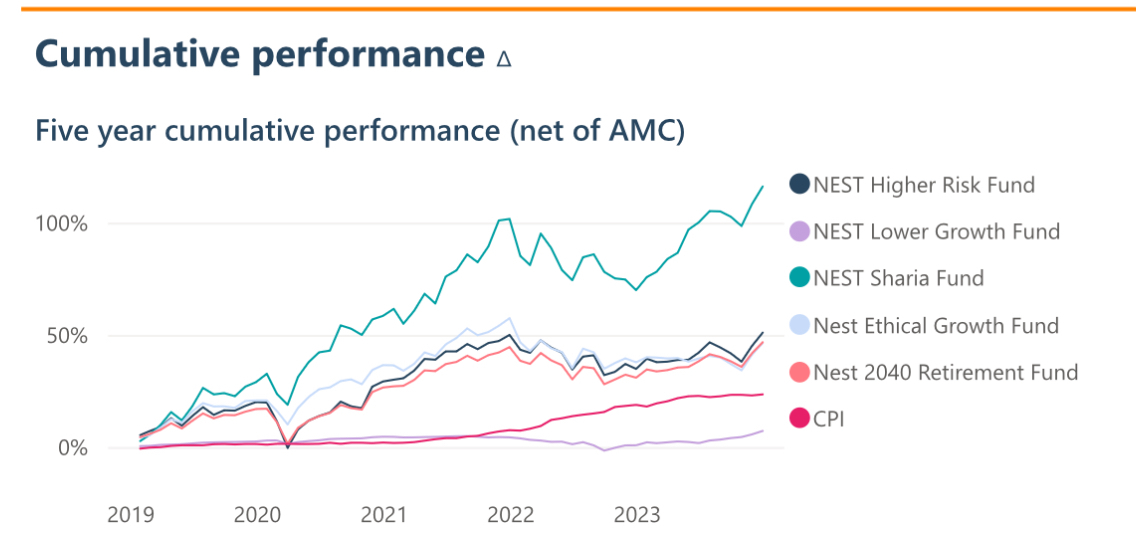

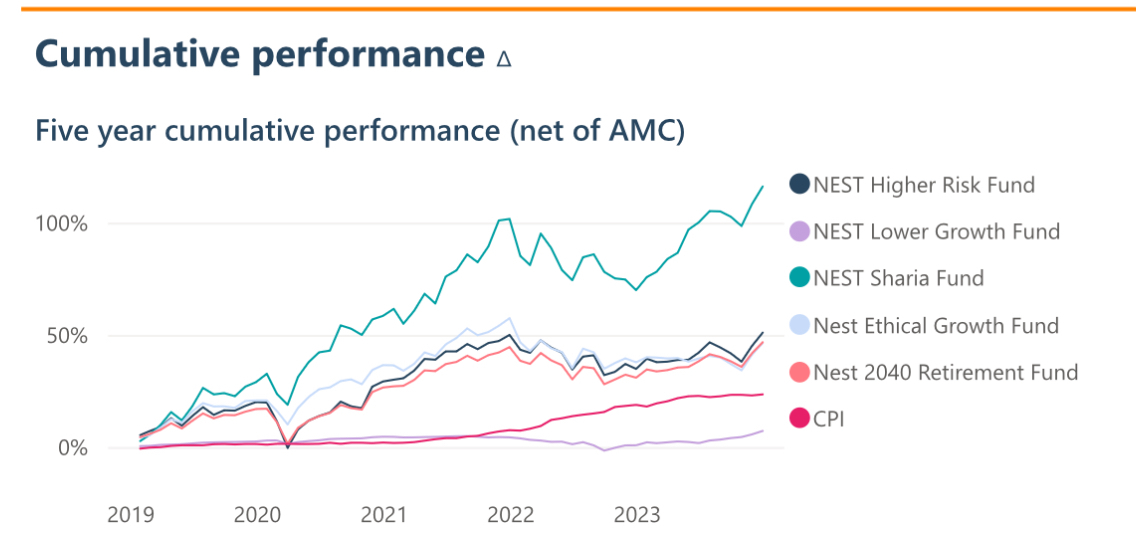

I would pick the higher-risk fund because it's lower risk than the Sharia fund. I went through the original dot.com crash and saw people lose 90% of their investments. Many never recovered as they didn't have the time before retirement, which left them financially hard up.BlackKnightMonty said:

You can only choose one NEST fund.FIREmenow said:As I said, I would not switch all of my investments to this fund. So if I was in a pension that only allowed one fund I would choose something else.

If you want to attempt timing the market of course that's your choice. I replied because it doesn't sit well with me that someone has put all of their pension in this fund based on comments on a thread I started. I've said my piece now, best of luck.

Which other fund would you pick?

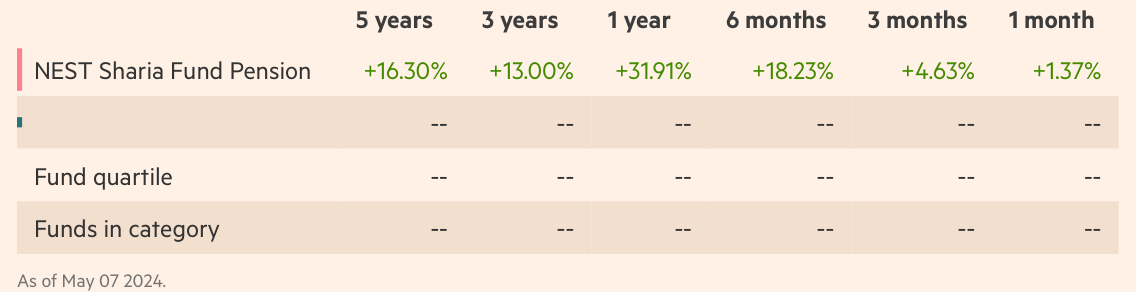

That past performance has already happened. If you were in it in 2019, then that would be fantastic for you. You have shaved off 5-6 years of what it would normally take to double. Now think about protecting it.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Dot.com was a very immature tech market. It’s very different today. Microsoft, Apple, Nvidia, Google, Meta aren’t a bunch of college grads any more.dunstonh said:Is it a massive bubble or technology 5.0?Very true. However, the size of the tech bubble (if its one) is now comparable to the level before the original dot.com crash.

No one knows. I repeat, no one knows.

The original dot.com crash came along because anything tech-related had grown, and there was a realisation that most of the companies didn't have tech that was going to work and they had no assets and no market. A lot of wishes and promises that resulted in zero.

If AI takes off, then tech may have reached a new level. If not, then tech will likely fall back to its previous state.1 -

I can switch funds for free within a week. So if/when I feel the need to do so; I will.dunstonh said:

I would pick the higher-risk fund because it's lower risk than the Sharia fund. I went through the original dot.com crash and saw people lose 90% of their investments. Many never recovered as they didn't have the time before retirement, which left them financially hard up.BlackKnightMonty said:

You can only choose one NEST fund.FIREmenow said:As I said, I would not switch all of my investments to this fund. So if I was in a pension that only allowed one fund I would choose something else.

If you want to attempt timing the market of course that's your choice. I replied because it doesn't sit well with me that someone has put all of their pension in this fund based on comments on a thread I started. I've said my piece now, best of luck.

Which other fund would you pick?

That past performance has already happened. If you were in it in 2019, then that would be fantastic for you. You have shaved off 5-6 years of what it would normally take to double. Now think about protecting it.

I don’t feel the need right now. There’s another 6 months of growth ahead, maybe more. That’s my read on it.1 -

Yeah my fund went up £200 in one week when the 2040 fund did nothing, a waste of time, i'll keep an eye out for it and if i need to, i will switch to another one.My Signature is MY OWN!!1

-

It will move both up and down; but it is still trending upwards. If I get uncomfortable I will let you know.slenderkitten said:Yeah my fund went up £200 in one week when the 2040 fund did nothing, a waste of time, i'll keep an eye out for it and if i need to, i will switch to another one.

0

0 -

What about other weeks when the returns are the other way around?slenderkitten said:Yeah my fund went up £200 in one week when the 2040 fund did nothing, a waste of time, i'll keep an eye out for it and if i need to, i will switch to another one.

To get an idea of markets, you need to look at the last 25 years as a sensible period. Not one week in isolation.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Dinosaurs were still walking the earth in tech 25 years ago.dunstonh said:

What about other weeks when the returns are the other way around?slenderkitten said:Yeah my fund went up £200 in one week when the 2040 fund did nothing, a waste of time, i'll keep an eye out for it and if i need to, i will switch to another one.

To get an idea of markets, you need to look at the last 25 years as a sensible period. Not one week in isolation.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards