We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Workplace DC I think employer is wrong

trevjl

Posts: 298 Forumite

Sorry for the bit of a waffle.

Today I received this months wage slip and my usual -£919 pension in the payments column is missing. This is in that column due to being taken from the gross (called smart pension ???). It appears this month in the deductions column. Also, the amount the employer pays has reduced this month from £299 to £183.

A bit of background, I went 3 days a week last August and this is the first month I have had a basic month (no overtime or overseas). I have questioned this and they say it is because of salary sac and minimum wage thing, which I am fully aware of, and this has come up this month for the first time due to the basic wage.

The issue is I have never been on salary sac, I didn't think the company offered it.

I was under the impression that up to what I earn I can do whatever % I like ( I do 20%, company 6.5%)

Am I correct or does smart pension amount to the same thing as salary sac under these circumstances?

Today I received this months wage slip and my usual -£919 pension in the payments column is missing. This is in that column due to being taken from the gross (called smart pension ???). It appears this month in the deductions column. Also, the amount the employer pays has reduced this month from £299 to £183.

A bit of background, I went 3 days a week last August and this is the first month I have had a basic month (no overtime or overseas). I have questioned this and they say it is because of salary sac and minimum wage thing, which I am fully aware of, and this has come up this month for the first time due to the basic wage.

The issue is I have never been on salary sac, I didn't think the company offered it.

I was under the impression that up to what I earn I can do whatever % I like ( I do 20%, company 6.5%)

Am I correct or does smart pension amount to the same thing as salary sac under these circumstances?

0

Comments

-

If you're in a smart pension arrangement, then yes, it's salary sacrifice. Good explanation here: https://www.bdo.co.uk/en-gb/insights/tax/global-employer-services/smart-pensions-the-factstrevjl said:Sorry for the bit of a waffle.

Today I received this months wage slip and my usual -£919 pension in the payments column is missing. This is in that column due to being taken from the gross (called smart pension ???). It appears this month in the deductions column. Also, the amount the employer pays has reduced this month from £299 to £183.

A bit of background, I went 3 days a week last August and this is the first month I have had a basic month (no overtime or overseas). I have questioned this and they say it is because of salary sac and minimum wage thing, which I am fully aware of, and this has come up this month for the first time due to the basic wage.

The issue is I have never been on salary sac, I didn't think the company offered it.

I was under the impression that up to what I earn I can do whatever % I like ( I do 20%, company 6.5%)

Am I correct or does smart pension amount to the same thing as salary sac under these circumstances?

If your contributions are paid by salary sacrifice, they are (technically) employer contributions. The salary you are actually receiving must meet minimum wage requirements.

If you want to contribute more, you can do so as a personal contribution (ie not by salary sacrifice). If this extra personal contribution reduces your pay below minimum wage, that's allowed because your employer is paying you the minimum wage; you are choosing how to 'spend' some of it.

Salary sacrifice gives you and the employer an NI saving, but the actual tax relief for you works out the same whichever method is used.Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!2 -

Sorry if I have terminology wrong.

I am in a net pay scheme, not sure if that's the same thing.

Couldn't get the link to work.0 -

The terminology is hopelessly confusing!trevjl said:Sorry if I have terminology wrong.

I am in a net pay scheme, not sure if that's the same thing.

Couldn't get the link to work.- Net pay actually means your personal contribution is taken from your gross salary before it is subject to income tax (NI is on your whole gross salary).

- Relief at source is where your contribution is paid from net pay (told you it was confusing!) and the pension provider claims basic rate tax on your behalf and adds it to your pension pot.

Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0 -

What the company pays has gone down because you have paid a contribution on this occasion.

If you pay by salary sacrifice then you don't pay any contributions. The company pays them for you in exchange for a lower salary.

A similar thing happened to me a couple of months ago (I'm part time too) when I had a flat month. Salary sacrifice would have put me below minimum wage so they couldn't do it. I t meant that I paid more NI than I otherwise would have done!0 -

Thanks for replies.

I understand that if SS is applicable then they are correct. What I can't get my head around is that I am most definitely Net Pay. If that is not the same then they have messed up, it wouldn't be the first time.

I was off for 3 months during covid and they tried to reduce my & their contributions even though they are based on last years earnings. I promptly told them they couldn't do that and they had to back down. Head office is frankly absolutely useless0 -

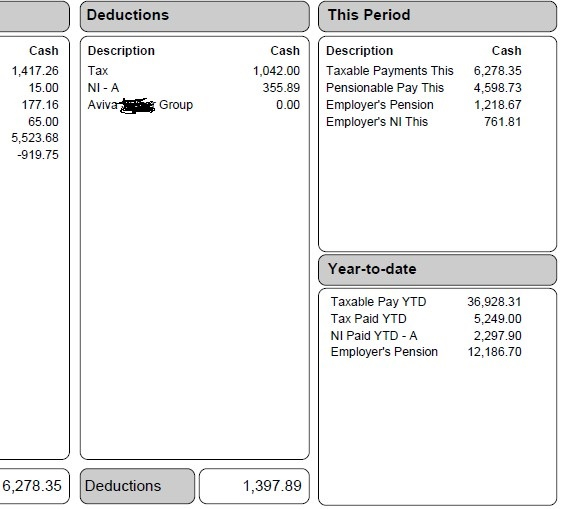

Could you give this month's gross salary as shown in your wage slip; tax deducted this month; and pension contributions for this month (yours/the employers - whatever is shown your payslip). Might be easiest to post a copy of your wage slip with all personal information such as name, NI etc redacted.trevjl said:Thanks for replies.

I understand that if SS is applicable then they are correct. What I can't get my head around is that I am most definitely Net Pay. If that is not the same then they have messed up, it wouldn't be the first time.

I was off for 3 months during covid and they tried to reduce my & their contributions even though they are based on last years earnings. I promptly told them they couldn't do that and they had to back down. Head office is frankly absolutely uselessGoogling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0 -

Although the NI information could be useful in distinguishing between salary sacrifice and net pay.Marcon said:

Could you give this month's gross salary as shown in your wage slip; tax deducted this month; and pension contributions for this month (yours/the employers - whatever is shown your payslip). Might be easiest to post a copy of your wage slip with all personal information such as name, NI etc redacted.trevjl said:Thanks for replies.

I understand that if SS is applicable then they are correct. What I can't get my head around is that I am most definitely Net Pay. If that is not the same then they have messed up, it wouldn't be the first time.

I was off for 3 months during covid and they tried to reduce my & their contributions even though they are based on last years earnings. I promptly told them they couldn't do that and they had to back down. Head office is frankly absolutely useless

But to be honest I've never heard of a "Smart" pension being anything other than salary sacrifice.0 -

January 24

February 24

0 -

Agree - I meant to put NI number!Dazed_and_C0nfused said:

Although the NI information could be useful in distinguishing between salary sacrifice and net pay.Marcon said:

Could you give this month's gross salary as shown in your wage slip; tax deducted this month; and pension contributions for this month (yours/the employers - whatever is shown your payslip). Might be easiest to post a copy of your wage slip with all personal information such as name, NI etc redacted.trevjl said:Thanks for replies.

I understand that if SS is applicable then they are correct. What I can't get my head around is that I am most definitely Net Pay. If that is not the same then they have messed up, it wouldn't be the first time.

I was off for 3 months during covid and they tried to reduce my & their contributions even though they are based on last years earnings. I promptly told them they couldn't do that and they had to back down. Head office is frankly absolutely useless

But to be honest I've never heard of a "Smart" pension being anything other than salary sacrifice.Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0 -

Looking at the available payslip info it looks like salary sacrifice to me, not net pay.Marcon said:

Agree - I meant to put NI number!Dazed_and_C0nfused said:

Although the NI information could be useful in distinguishing between salary sacrifice and net pay.Marcon said:

Could you give this month's gross salary as shown in your wage slip; tax deducted this month; and pension contributions for this month (yours/the employers - whatever is shown your payslip). Might be easiest to post a copy of your wage slip with all personal information such as name, NI etc redacted.trevjl said:Thanks for replies.

I understand that if SS is applicable then they are correct. What I can't get my head around is that I am most definitely Net Pay. If that is not the same then they have messed up, it wouldn't be the first time.

I was off for 3 months during covid and they tried to reduce my & their contributions even though they are based on last years earnings. I promptly told them they couldn't do that and they had to back down. Head office is frankly absolutely useless

But to be honest I've never heard of a "Smart" pension being anything other than salary sacrifice.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards