We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Interactive Investors cashback offers

Comments

-

This is good to know. I had a pretty bad experience with HL -> II, but it was over a decade ago and I think things were generally slower back then (and my holdings were mostly open ended vs exchange traded unlike now).granta said:I have been affected by the slow Vanguard transfer processes, but in fairness, all other in specie transfers between ii, HL, and Fidelity have generally gone smoothly and quickly.

0 -

I have recently transferred an ISA from Fidelity to HL with three ETF's and one IT. It was completed in 6 days and another couple of days to fully settle. The cash back then arrived in less than a week.masonic said:

This is good to know. I had a pretty bad experience with HL -> II, but it was over a decade ago and I think things were generally slower back then (and my holdings were mostly open ended vs exchange traded unlike now).granta said:I have been affected by the slow Vanguard transfer processes, but in fairness, all other in specie transfers between ii, HL, and Fidelity have generally gone smoothly and quickly.1 -

That was an older thread, and II have increased their cashback a lot this time . Probably in response to HL, who significantly increased theirs last time around ( and have maintained for their new offer).vikkiew said:

Thanks for the link but that's rather poor form. II are giving £1250 not £300 as in your general thread.artyboy said:

To the OP, I do/did have a general thread on switching incentives,

https://forums.moneysavingexpert.com/discussion/6426220/pension-switching-incentives#latest

but it doesn't get a lot of activity - admittedly I didn't mention the most recent II because selfishly I'm not a new customer so can't take advantage.

There seems to be a battle for market share ( maybe pre some kind of market consolidation) as its not good business offering customers large cashbacks, and then in some cases at least, maybe only getting back a small fraction of that cashback in annual charges.

I couldn't find discussion of the cashback offers from ii. Is there no MSE interest or just the poor search functionality?

MSE tends to steer away from anything that might be seen as investment advice, even though that is not strictly the case here.

I can imagine if they did publicise it, and some people who did not really understand about pensions, moved their ex workplace pension invested in a middle of the road default fund, to a SIPP where they had to pick their own funds, it could lead to problems.

1 -

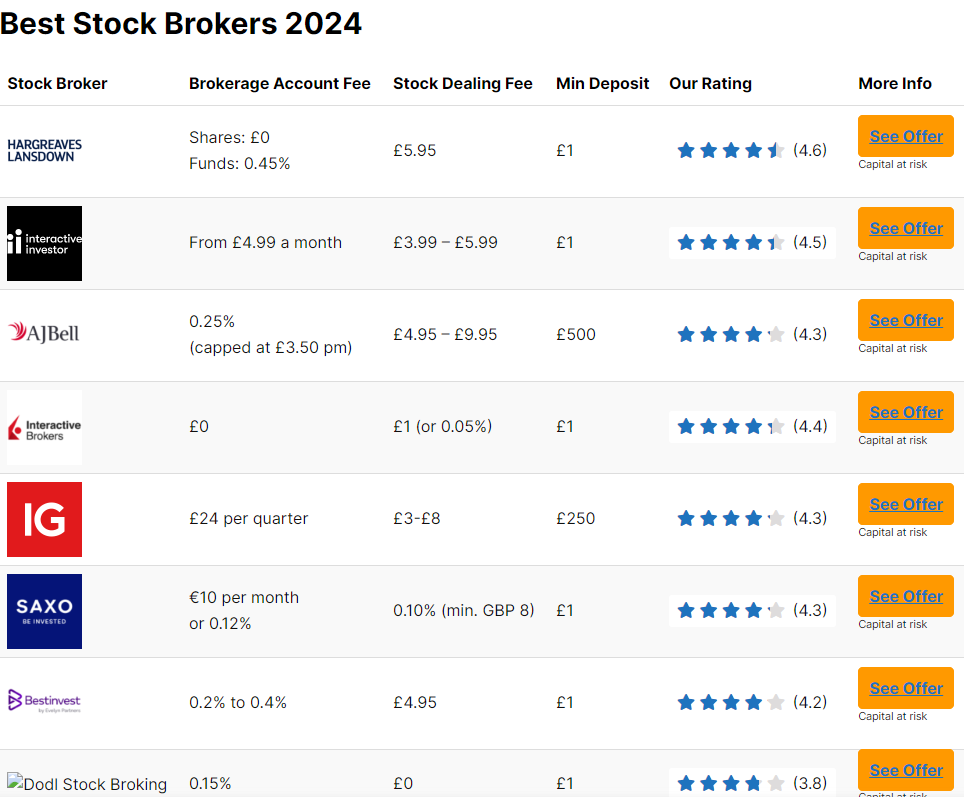

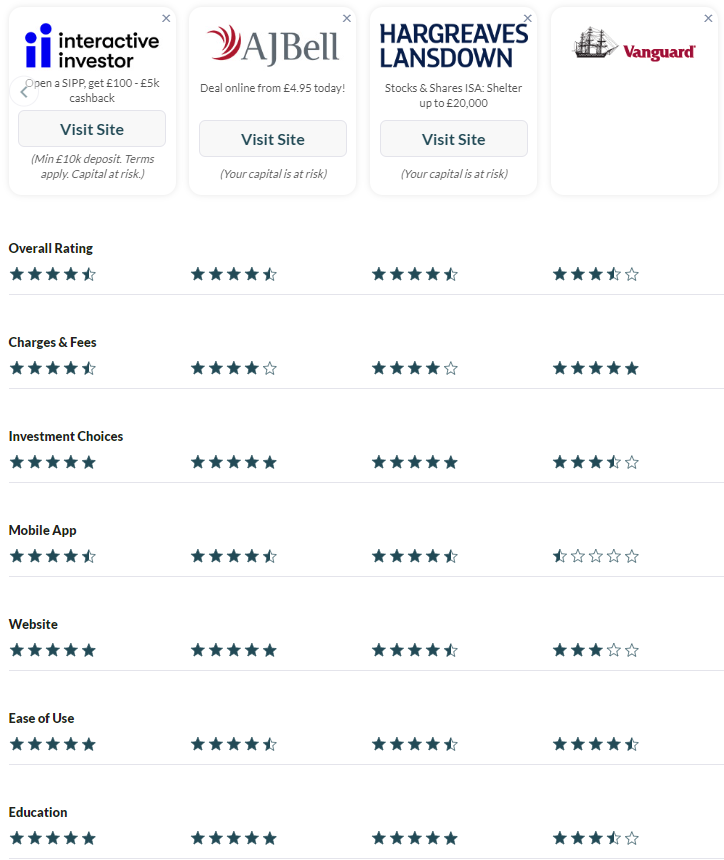

Presumably you have calculated the overall costs? If you deal in Funds, HL charge 0.45% for the first £250,000 which is more expensive than most brokers although it's probably cheaper for more frequent dealing.vikkiew said:

Are you not eligible for II or do you prefer HL over II? II gives at least as much and in many cases about double the cashback for both SIPP and ISA.masonic said:I'll be doing the HL one. Have registered for it and applied for 'more time' so I can do the ISA in the next tax year and the SIPP after the 18 month lock-in from previously taking up Fidelity's switching incentive. Transfers can be painful. There is another thread about Vanguard SIPPs taking over a year to transfer. It takes a large amount to tempt me to go through the hassle.

https://goodmoneyguide.com/investing/stock-brokers/

0 -

HL fee is capped at £45 per year for exchange traded investments in a S&S ISA, making it cheaper than II's £144 for S&S ISA only. For the SIPP the cost is capped at £200 for exchange traded investments vs £156 for SIPP only at II, or £264 for ISA + SIPP. Since the lock-in is only a year, these fee differences are not significant compared with the cashback on offer, but it would be unwise to hold Funds if you plan to switch around for cashback, since several providers make this an expensive choice.peter021072 said:

Presumably you have calculated the overall costs? If you deal in Funds, HL charge 0.45% for the first £250,000 which is more expensive than most brokers although it's probably cheaper for more frequent dealing.vikkiew said:

Are you not eligible for II or do you prefer HL over II? II gives at least as much and in many cases about double the cashback for both SIPP and ISA.masonic said:I'll be doing the HL one. Have registered for it and applied for 'more time' so I can do the ISA in the next tax year and the SIPP after the 18 month lock-in from previously taking up Fidelity's switching incentive. Transfers can be painful. There is another thread about Vanguard SIPPs taking over a year to transfer. It takes a large amount to tempt me to go through the hassle.

2 -

Think I’ll do HL’s transfer offer and leave II’s for another time, when I have a larger pot (hopefully they’ll have another campaign running in the future)

Is anyone doing Trading212s cashback offer for FY 2024/2025?0 -

I haven't looked recently, but is that new? I wasn't aware you can have SIPP without trading ac (and its fee) at II?masonic said:

HL fee is capped at £45 per year for exchange traded investments in a S&S ISA, making it cheaper than II's £144 for S&S ISA only. For the SIPP the cost is capped at £200 for exchange traded investments vs £156 for SIPP only at II, or £264 for ISA + SIPP. Since the lock-in is only a year, these fee differences are not significant compared with the cashback on offer, but it would be unwise to hold Funds if you plan to switch around for cashback, since several providers make this an expensive choice.peter021072 said:

Presumably you have calculated the overall costs? If you deal in Funds, HL charge 0.45% for the first £250,000 which is more expensive than most brokers although it's probably cheaper for more frequent dealing.vikkiew said:

Are you not eligible for II or do you prefer HL over II? II gives at least as much and in many cases about double the cashback for both SIPP and ISA.masonic said:I'll be doing the HL one. Have registered for it and applied for 'more time' so I can do the ISA in the next tax year and the SIPP after the 18 month lock-in from previously taking up Fidelity's switching incentive. Transfers can be painful. There is another thread about Vanguard SIPPs taking over a year to transfer. It takes a large amount to tempt me to go through the hassle.0 -

It's a couple of years old - their "Pension Builder" product:soulsaver said:

I haven't looked recently, but is that new? I wasn't aware you can have SIPP without trading ac (and its fee) at II?masonic said:

HL fee is capped at £45 per year for exchange traded investments in a S&S ISA, making it cheaper than II's £144 for S&S ISA only. For the SIPP the cost is capped at £200 for exchange traded investments vs £156 for SIPP only at II, or £264 for ISA + SIPP. Since the lock-in is only a year, these fee differences are not significant compared with the cashback on offer, but it would be unwise to hold Funds if you plan to switch around for cashback, since several providers make this an expensive choice.peter021072 said:

Presumably you have calculated the overall costs? If you deal in Funds, HL charge 0.45% for the first £250,000 which is more expensive than most brokers although it's probably cheaper for more frequent dealing.vikkiew said:

Are you not eligible for II or do you prefer HL over II? II gives at least as much and in many cases about double the cashback for both SIPP and ISA.masonic said:I'll be doing the HL one. Have registered for it and applied for 'more time' so I can do the ISA in the next tax year and the SIPP after the 18 month lock-in from previously taking up Fidelity's switching incentive. Transfers can be painful. There is another thread about Vanguard SIPPs taking over a year to transfer. It takes a large amount to tempt me to go through the hassle.

‘Pension Builder’ launched by interactive investor (ii.co.uk)

1 -

There's also a cheaper II account for balances < £50k, Pension Essentials, but since Pension Essentials only allows it's £5.99/m to be paid via direct debit, you miss the pension relief of having the charge taken from cash in the SIPP, which for a higher rate tax payer's relief only puts it £3/m less than Pension Builder with charge taken from cash in the SIPP.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards