We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Civil Service Classic Pension queries

Comments

-

Thank you!kjs31 said:

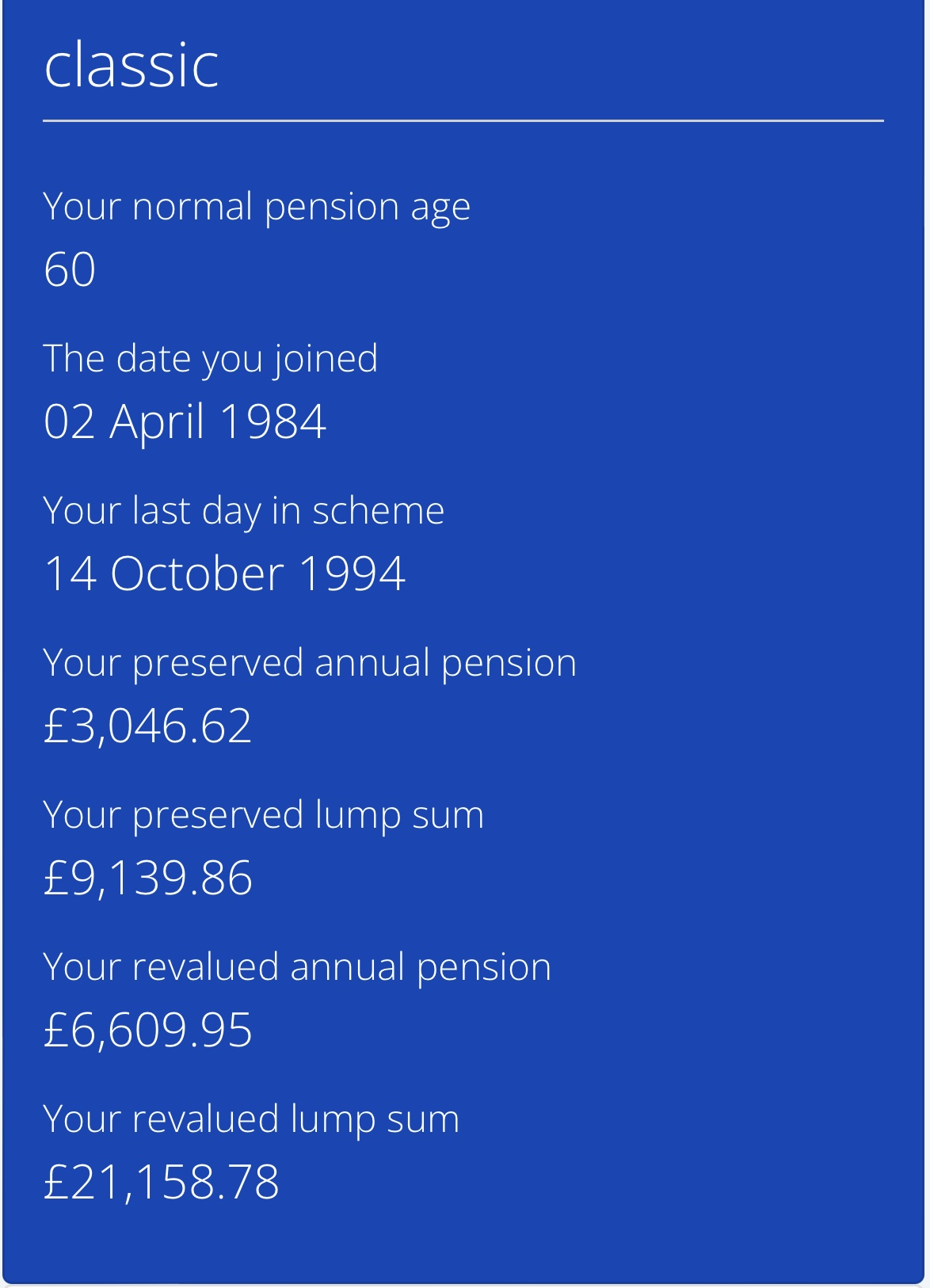

You need to register and log on here. Don’t bother with the app as it’s a waste of space if you have a deferred pension.bluelad1927 said:@kjs3 please can I ask what app you got that screenshot from. I am in a similar position with a frozen Classic pension. I did get a paper statement off CSP which took about 3 months to arrive.

It would be good to be able to log in and see it as frozen Classics previously weren't available to view on MyCSP.

Thanks0 -

I'm just going through a very similar query regarding the increase on deferred pensions about to be paid.Sorry for being a bit lengthy. My questions are;1. Am I correct in my thinking?2. Has anyone else experienced this and what was the outcome.I've been a deferred member since 2004. Normal pension age (NPA) of 60 in Feb 2025 for me but I've asked to take it early from 20/04/2024 with a small reduction.I've received a quote but this is based on the figures given in the April 2023 statement and makes no reference to the increase of 6.7% that should be applied in early Apr 2024. Note that my early retirement date is 20/04/2024 so is a short while after the date when the base pension should be revalued (along with the X3 lump sum).I called Civil Service Pensions yesterday and queried why the quote did not recognise the due increase although it was issued way after the 6.7% figure was known. Despite me trying to explain the implications of this several different ways the advisor didn't seem to click what I was asking and just kept saying the quote was correct. Eventually they consulted a higher power who apparently confirmed this & they are going to send me an explanation.I was told that my "finalisation statement" confirming the amounts would be issued by post on 15/04/2024! So only 5 days before I'm supposed to start receiving the pension. They confirmed this would be using the same figures as in the quotation i.e. no adjustment for the due increase.I'm sure this is wrong. If I had done nothing and left it to my NPA then in Apr 2024 the pension (& lump sum) would have been revalued to increase by 6.7% and this higher amount would be paid from NPA (Feb 2025).Any possible increase decided from Sept 2024 would be implemented on a pro rata basis in Apr 2025 and I understand that part of it.It would also be incorrect of them to apply the 6.7% increase after the pension came into payment as this would not increase the lump sum.I already have access to the web portal and can see the figures on there. They are as used in the quotation because of course the increase will not be applied until the start of April. It may well automatically apply the increase at that point and the finalisation statement may reflect this but it concerns me that they are unable to say if this is the case and are in fact stating the opposite.I may be needlessly concerned about this but based on the previous !!!!!!-ups I've to iron out with them I can't help feeling that I'll end up on the wrong side of them again.Any thoughts or experiences on this are gratefully received.0

-

I would not expect the scheme administrator to provide an official quotation incorporating the 2024 Pensions Increase before the Review Order has actually been issued, even if there is no real doubt about the percentage that will be confirmed. Normally this is March (https://www.legislation.gov.uk/uksi/2023/338/made), though admittedly the multiplier tables have already been issued, if less than a month ago (https://www.gov.uk/government/publications/public-service-pensions-increase-2024).ToneP said:I've been a deferred member since 2004. Normal pension age (NPA) of 60 in Feb 2025 for me but I've asked to take it early from 20/04/2024 with a small reduction.I've received a quote but this is based on the figures given in the April 2023 statement and makes no reference to the increase of 6.7% that should be applied in early Apr 2024. Note that my early retirement date is 20/04/2024 so is a short while after the date when the base pension should be revalued (along with the X3 lump sum).If I had done nothing and left it to my NPA then in Apr 2024 the pension (& lump sum) would have been revalued to increase by 6.7% and this higher amount would be paid from NPA (Feb 2025).

You would not have a pro-rata increase on the pension. That would just go up by the full increase whether in payment or deferred.

Any possible increase decided from Sept 2024 would be implemented on a pro rata basis in Apr 2025It would also be incorrect of them to apply the 6.7% increase after the pension came into payment as this would not increase the lump sum.

The pension will be increased on the increase date. If that is after you retire, and you retire at least 16 days after that increase date, then you will be due a 'second bite' on the lump sum/retirement grant - see Annex C in the multipliers spreadsheet I linked to above.2 -

Thanks hyubh that pretty much backs up what I was expecting. I.E. that the 'quote' would actually be uplifted once the increase had been officially sanctioned in March.It was the insistence of the advisor that this uplift would not be applied that had had me concerned. I had expected them to say that the quote was based on figures available at the time of issue but that there would be a re-calculatoin once it was officially implemented. But they very much didn't.....I guess I'll just have to wait until march and see what happens to my quoted figures hoping that it's correct.1

-

I think you have far too much faith in myCSP!ToneP said:Thanks hyubh that pretty much backs up what I was expecting. I.E. that the 'quote' would actually be uplifted once the increase had been officially sanctioned in March.It was the insistence of the advisor that this uplift would not be applied that had had me concerned. I had expected them to say that the quote was based on figures available at the time of issue but that there would be a re-calculatoin once it was officially implemented. But they very much didn't.....I guess I'll just have to wait until march and see what happens to my quoted figures hoping that it's correct.0 -

I may be completely wrong but I think generally the advisors on the phone are probably on minimum wage with very little training or genuine knowledge. Based on what you say they look for keywords and then find things on screen to read out to you. In my experience I have usually got a better service via email. Again only my assumption but I wonder whether the more experienced and knowledgeable staff tend to deal with the written enquiries.ToneP said:Thanks hyubh that pretty much backs up what I was expecting. I.E. that the 'quote' would actually be uplifted once the increase had been officially sanctioned in March.It was the insistence of the advisor that this uplift would not be applied that had had me concerned. I had expected them to say that the quote was based on figures available at the time of issue but that there would be a re-calculatoin once it was officially implemented. But they very much didn't.....I guess I'll just have to wait until march and see what happens to my quoted figures hoping that it's correct.0 -

It is worth remembering that each public service pension scheme has multiple schemes, and within each scheme different sections. In the case of the Civil Service, there is the Principal Civil Service Pension Scheme, consisting of the Classic (1972), Classic Plus (2002), Premium (2002) and Nuvos (2007) sections. There is also the Civil Servants and Others Scheme, consisting (so far!) only of alpha (2015). There is also the separate Partnership Defined Contribution scheme.german_keeper said:

I may be completely wrong but I think generally the advisors on the phone are probably on minimum wage with very little training or genuine knowledge. Based on what you say they look for keywords and then find things on screen to read out to you. In my experience I have usually got a better service via email. Again only my assumption but I wonder whether the more experienced and knowledgeable staff tend to deal with the written enquiries.ToneP said:Thanks hyubh that pretty much backs up what I was expecting. I.E. that the 'quote' would actually be uplifted once the increase had been officially sanctioned in March.It was the insistence of the advisor that this uplift would not be applied that had had me concerned. I had expected them to say that the quote was based on figures available at the time of issue but that there would be a re-calculatoin once it was officially implemented. But they very much didn't.....I guess I'll just have to wait until march and see what happens to my quoted figures hoping that it's correct.

On top of that, you have all the complications of 2015 Remedy (2023 rollback) and retained final salary links, retained legacy Added Pension, and retained Added Years contracts, which all means members are active in multiple schemes. There are even links between entirely separate sectors of the public sector, with service in one area counting toward qualifications towards thinks like transitional protection from 2015 scheme change and then toward the 2015 Remedy eligibility.

Each scheme and section is usually very different to the others, Classic Plus is broadly a combination of Classic and Premium, nuvos is very similar to alpha in many ways but aside from that everything is different.

If you have someone who has been around long enough to get a good knowledge and understanding of all the schemes and the sections, understands pension regulations, tax rules and so forth, you don't put them on the phones 1

1 -

I finally have a response to some of the queries that I raised with the scheme administrator. They have uplifted my lump sum to something that looks a bit more reasonable but haven’t answered why the uplift to my lump sum is larger than that of my annual pension, and why the start date shows (correctly) as April on the website but as August in the app. They are supposed to be sending me a new statement, so baby steps and I’ll wait for that to arrive before asking any further questions. I’ve got until December to get it all sorted (might take that long at this rate 😆)

0 -

MyCsp are in a mess at present, probably busy with the McCloud fallout, but still the ‘service’ leaves a lot to be desired. Don’t ever assume that they will get it right, because there have been lots of mistakes lately. The people on the phones just follow a script and are known to give wrong information.And now capita are taking over well, things can only get better 🙄2

-

The next two years could be quite chaotic when all the Mcloud remedy calculations are sent to potentially 1 million current and ex public sector employees. Let's hope the handover to Capita right in the middle of when the statements are being sent out goes well!1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards